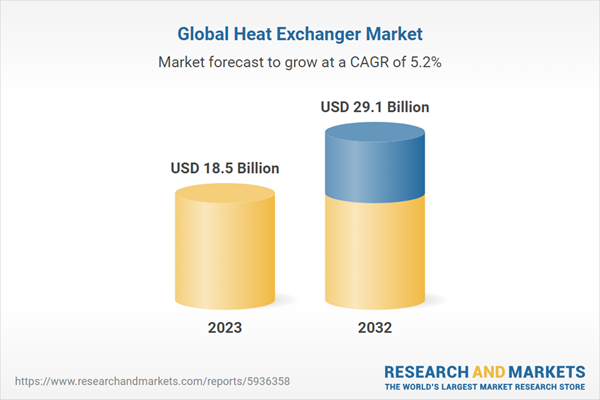

The global heat exchanger market size reached US$ 18.5 billion in 2023. The market is projected to reach US$ 29.1 billion by 2032, exhibiting a growth rate (CAGR) of 5.18% during 2023-2032. The increasing use of renewable energy sources, rising reliance on data centers for cloud computing, and the growing interest in thermal energy storage solutions for load balancing are some of the major factors propelling the market.

A heat exchanger is a device developed to transfer heat between two or more fluids without allowing them to mix. It consists of streams of hot and cold fluids that are split by a solid wall of the thermally conductive tube or plate, which helps remove direct contact between the two mediums. It works by having a hot fluid flow on one side and a cooler fluid on the other, separated by a solid barrier like metal plates or tubes. It assists in improving energy efficiency and operational effectiveness in many systems.

The increasing use of renewable energy sources like wind, solar, and geothermal power that necessitates efficient heat exchange systems to optimize energy output is strengthening the growth of the market around the world. Moreover, the rising reliance on data centers for cloud computing and data storage that requires efficient cooling systems is driving the demand for heat exchangers to help maintain optimal temperatures and ensure the longevity and efficiency of data center operations. In addition, the growing need for heat exchangers in ships for engine cooling and climate control is influencing the market positively. Apart from this, the increasing interest in thermal energy storage solutions for load balancing and energy optimization is contributing to the market growth. Furthermore, the rising installation of heating, ventilation, and air conditioning (HVAC) systems in residential and commercial spaces is bolstering the growth of the market.

In a plate and frame heat exchanger, corrugated metal plates are stacked together, which forms channels for the fluids to pass through. The plates are usually separated by gaskets to prevent mixing. These exchangers are known for their high efficiency and are ideal for low to medium pressure fluids. They are commonly used in HVAC systems, food processing, and pharmaceutical industries. Their compact size allows for easy installation and maintenance, although they are generally not suited for very high-temperature or high-pressure applications.

Carbon steel is often used in heat exchangers due to its cost-effectiveness and high thermal conductivity. It is particularly suitable for applications involving water, oil, and gas. This material is generally recommended for low to moderate temperature and pressure conditions. Proper protective measures like coatings can be needed for corrosive environments.

Heat exchangers in the petrochemical and oil and gas industries are critical for processes like refining, liquefaction, and gas treatment. They are used in cracking towers, reboilers, and condensing units, among other applications. The focus here is on durability, efficiency, and the ability to handle large volumes of fluids. Proper maintenance is crucial, as fouling and corrosion can lead to inefficiencies and even catastrophic failures.

The increasing investment in wind, solar, and geothermal energy projects that necessitates efficient heat exchangers to optimize performance represents one of the primary factors bolstering the market growth in Europe. Moreover, rising number of data centers are favoring the growth of the market in the region. Besides this, the growing production of luxury vehicles is influencing the market positively.

In 2023, Kelvion Holding GmbH launched its ‘Heat Exchange as a Service’ business model, under which heat exchangers can be billed on a pay-per-use basis based on a fixed hourly rate.

In 2020, Danfoss developed a comprehensive portfolio with its new Z-design technology-based microplate heat exchangers that reduce the refrigerant charge along with design changes to minimize weight.

2. What is the expected growth rate of the global heat exchanger market during 2024-2032?

3. What are the key factors driving the global heat exchanger market?

4. What has been the impact of COVID-19 on the global heat exchanger market?

5. What is the breakup of the global heat exchanger market based on the type?

6. What is the breakup of the global heat exchanger market based on the material?

7. What is the breakup of the global heat exchanger market based on the end-use industry?

8. What are the key regions in the global heat exchanger market?

9. Who are the key players/companies in the global heat exchanger market?

A heat exchanger is a device developed to transfer heat between two or more fluids without allowing them to mix. It consists of streams of hot and cold fluids that are split by a solid wall of the thermally conductive tube or plate, which helps remove direct contact between the two mediums. It works by having a hot fluid flow on one side and a cooler fluid on the other, separated by a solid barrier like metal plates or tubes. It assists in improving energy efficiency and operational effectiveness in many systems.

The increasing use of renewable energy sources like wind, solar, and geothermal power that necessitates efficient heat exchange systems to optimize energy output is strengthening the growth of the market around the world. Moreover, the rising reliance on data centers for cloud computing and data storage that requires efficient cooling systems is driving the demand for heat exchangers to help maintain optimal temperatures and ensure the longevity and efficiency of data center operations. In addition, the growing need for heat exchangers in ships for engine cooling and climate control is influencing the market positively. Apart from this, the increasing interest in thermal energy storage solutions for load balancing and energy optimization is contributing to the market growth. Furthermore, the rising installation of heating, ventilation, and air conditioning (HVAC) systems in residential and commercial spaces is bolstering the growth of the market.

Heat Exchanger Market Trends/Drivers

Increasing need for energy efficiency

One of the primary factors driving the demand for heat exchangers is the increasing emphasis on energy efficiency. As industries aim to minimize their environmental footprint, heat exchangers have become crucial in optimizing energy consumption. These devices allow heat from a fluid to pass to another fluid without the two fluids having to come into direct contact, thereby avoiding wastage of heat and conserving energy. This process helps in reducing operational costs and adhering to stringent energy regulations. Industries, such as HVAC, chemical, and oil and gas have increasingly adopted heat exchangers for their energy-efficient attributes, thus boosting market demand.Rise in regulatory compliance

Increasingly stringent regulations related to emissions and environmental sustainability are driving demand for heat exchangers. Governments and international bodies are focusing on reducing the carbon footprint and promoting environment friendly industrial practices. Heat exchangers assist in meeting these regulations by optimizing heat transfer processes, thus reducing energy consumption and lowering greenhouse gas emissions. Companies are investing in heat exchanger technology to stay compliant and avoid potential penalties, thereby adding to the market demand.Growing industrial growth

The rapid expansion of various industries, including pharmaceuticals, food and beverage (F&B), and petrochemicals, has also fueled the demand for heat exchangers. These sectors require precise temperature control for quality assurance, safety, and efficiency in production processes. Heat exchangers offer a reliable solution for temperature regulation, contributing to streamlined operations. Their essential role in various industrial applications ensures a sustained level of demand, which is likely to grow in parallel with industrial advancements.Heat Exchanger Industry Segmentation:

The report provides an analysis of the key trends in each segment of the global heat exchanger market report, along with forecasts at the global, regional, and country levels for 2023-2032. The report has categorized the market based on type, material, and end-use industry.Breakup by Type:

- Shell & Tube

- Plate & Frame

- Air Cooled

- Others

Shell and tube dominate the market

The report has provided a detailed breakup and analysis of the market based on the Type. This includes shell and tube, plate and frame, air cooled, and others. According to the report, shell and tube represented the largest segment. The shell and tube heat exchanger consist of a shell that houses a bundle of tubes. The tube material often has high thermal conductivity, allowing efficient heat transfer. This design is incredibly versatile, making it suitable for high-pressure and high-temperature applications.In a plate and frame heat exchanger, corrugated metal plates are stacked together, which forms channels for the fluids to pass through. The plates are usually separated by gaskets to prevent mixing. These exchangers are known for their high efficiency and are ideal for low to medium pressure fluids. They are commonly used in HVAC systems, food processing, and pharmaceutical industries. Their compact size allows for easy installation and maintenance, although they are generally not suited for very high-temperature or high-pressure applications.

Breakup by Material:

- Carbon Steel

- Stainless Steel

- Nickel

- Others

Stainless steel holds the largest share in the market

A detailed breakup and analysis of the market based on the material has also been provided in the report. This includes carbon steel, stainless steel, nickel, and others. According to the report, stainless steel accounted for the largest market share. Stainless steel is favored for its corrosion resistance and strength, which makes it ideal for more aggressive fluids and higher temperature applications. It is commonly used in pharmaceutical, F&B, and chemical industries wherein cleanliness and corrosion resistance are paramount.Carbon steel is often used in heat exchangers due to its cost-effectiveness and high thermal conductivity. It is particularly suitable for applications involving water, oil, and gas. This material is generally recommended for low to moderate temperature and pressure conditions. Proper protective measures like coatings can be needed for corrosive environments.

Breakup by End-Use Industry:

- Chemical

- Petrochemical and Oil & Gas

- HVAC and Refrigeration

- Food & Beverage

- Power Generation

- Paper & Pulp

- Others

Chemical dominate the market

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes chemical, petrochemical and oil and gas, HVAC and refrigeration, food and beverage, power generation, paper and pulp, and others. According to the report, chemical represented the largest segment. In the chemical industry, heat exchangers are commonly used for controlling temperature during chemical reactions and in separation processes. Precise temperature control is often essential for reaction yield and quality. Heat exchangers in this industry must be designed to resist corrosion from a variety of aggressive chemicals, often requiring the use of specialized materials like stainless steel or nickel alloys. Typical applications include distillation columns, evaporators, and condensers. Ensuring efficient heat transfer is critical for optimizing energy consumption and reducing operational costs.Heat exchangers in the petrochemical and oil and gas industries are critical for processes like refining, liquefaction, and gas treatment. They are used in cracking towers, reboilers, and condensing units, among other applications. The focus here is on durability, efficiency, and the ability to handle large volumes of fluids. Proper maintenance is crucial, as fouling and corrosion can lead to inefficiencies and even catastrophic failures.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

Europe exhibits a clear dominance, accounting for the largest heat exchanger market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others);Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others), and Middle East and Africa (Turkey, Saudi Arabia, Iran, the United Arab Emirates, and others). According to the report, Europe accounted for the largest market share.The increasing investment in wind, solar, and geothermal energy projects that necessitates efficient heat exchangers to optimize performance represents one of the primary factors bolstering the market growth in Europe. Moreover, rising number of data centers are favoring the growth of the market in the region. Besides this, the growing production of luxury vehicles is influencing the market positively.

Competitive Landscape

The leading companies are incorporating sensors and real time monitoring systems that allow for proactive monitoring of performance metrics and early detection of issues like fouling or leaks, thereby improving efficiency and reducing downtime. They are also developing new materials, such as graphene and ceramic composites that offer higher thermal conductivity and greater resistance to corrosion, which enables heat exchangers to operate under more demanding conditions. Moreover, key players are incorporating computational fluid dynamics (CFD) software that allows for precise modeling of fluid flow and heat transfer characteristics and enables engineers to optimize heat exchanger design before physical prototypes are built, which saves time and resources.Competition Analysis

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:- Alfa Laval

- API Heat Transfer Inc.

- Danfoss

- General Electric Company

- Hisaka Works, Ltd.

- IHI Corporation

- Johnson Controls

- Kelvion Holding GmbH

- Koch Industries, Inc.

- Lytron Inc.

- Mersen Corporate Services SAS

- Modine Manufacturing Company

- Royal Hydraulics

- Sondex A/S

- Xylem Inc.

Recent Developments:

In 2021, Alfa Laval partnered with Stena Recycling to incorporate a sustainable business model for increasing circularity in the heat exchanger supply chain.In 2023, Kelvion Holding GmbH launched its ‘Heat Exchange as a Service’ business model, under which heat exchangers can be billed on a pay-per-use basis based on a fixed hourly rate.

In 2020, Danfoss developed a comprehensive portfolio with its new Z-design technology-based microplate heat exchangers that reduce the refrigerant charge along with design changes to minimize weight.

Key Questions Answered in This Report

1. What was the size of the global heat exchanger market in 2023?2. What is the expected growth rate of the global heat exchanger market during 2024-2032?

3. What are the key factors driving the global heat exchanger market?

4. What has been the impact of COVID-19 on the global heat exchanger market?

5. What is the breakup of the global heat exchanger market based on the type?

6. What is the breakup of the global heat exchanger market based on the material?

7. What is the breakup of the global heat exchanger market based on the end-use industry?

8. What are the key regions in the global heat exchanger market?

9. Who are the key players/companies in the global heat exchanger market?

Table of Contents

1 Preface3 Executive Summary11 Value Chain Analysis13 Price Indicators

2 Scope and Methodology

4 Introduction

5 Global Heat Exchanger Market

6 Market Breakup by Type

7 Market Breakup by Material

8 Market Breakup by End-Use Industry

9 Market Breakup by Region

10 SWOT Analysis

12 Porters Five Forces Analysis

14 Competitive Landscape

List of Figures

List of Tables

Companies Mentioned

- Alfa Laval

- API Heat Transfer Inc.

- Danfoss

- General Electric Company

- Hisaka Works

- IHI Corporation

- Johnson Controls

- Kelvion Holding GmbH

- Koch Industries

- Lytron Inc.

- Mersen

- Modine Manufacturing

- Royal Hydraulics

- Sondex A/S and Xylem Inc.

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | January 2024 |

| Forecast Period | 2023 - 2032 |

| Estimated Market Value ( USD | $ 18.5 Billion |

| Forecasted Market Value ( USD | $ 29.1 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |