The Jet Fuel Market size is estimated at USD 175.76 billion in 2024, and is expected to reach USD 297.10 billion by 2029, growing at a CAGR of 11.07% during the forecast period (2024-2029).

This product will be delivered within 2 business days.

Key Highlights

- Over the medium period, the increasing number of air passengers, based on the cheaper airfare in recent times, improving economic conditions, and increasing disposable income, are expected to drive the market during the forecast period.

- On the other hand, the market can face hurdles in the coming years due to the high share of fossil-fuel-based jet fuels in many countries. They are responsible for the degradation of the environment.

- Nevertheless, the increasing concerns over emissions from the aviation industry led several governments worldwide to implement mandates that require a blending of renewable aviation fuel with conventional fuel types. It is expected to create significant opportunities for the companies involved in the market.

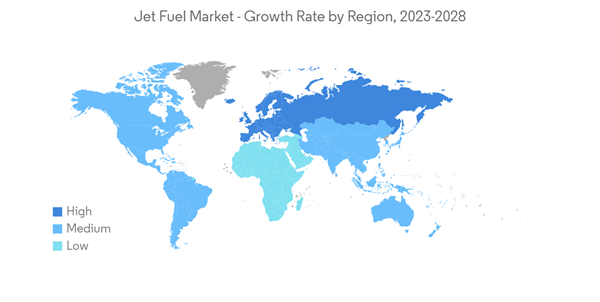

- Asia-Pacific dominated the market globally, as the region witnessed increasing passenger traffic, especially from emerging economies.

Jet Fuel Market Trends

The Commercial Segment to Dominate the Market

- Commercial aviation includes operating scheduled and non-scheduled aircraft, which involves commercial air transportation of passengers or cargo. The commercial segment is one of the largest consumers of aviation fuel, accounting for a quarter of the total operating expenditure for an airline operator.

- Air travel became more accessible than ever. In 2022, airfares, in real terms, averaged less than half of what they were in 1995. The airline network expanded to exceed 20,000 unique city pairs as per International Air Transport Association (IATA). Therefore, commercial airlines' growth is underpinned by the direct connection between cities, enabling the flow of goods and people.

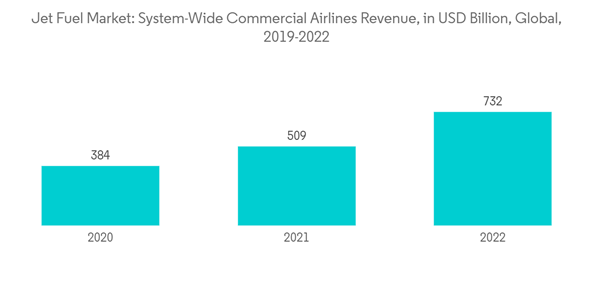

- As per International Air Transport Association (IATA)'s World Air Transport Statistics 2022, in 2022, the global airline industry's passenger air traffic revenue amounted to USD 732 billion, a 43.81% increase compared to the previous year. Hence, as the number of passengers is increasing on commercial flights, the demand for aviation fuel is expected to increase, driving the market studied during the forecast period.

- Domestic aviation markets are more resilient than international ones, as control measures are typically less stringent within a country. However, As of 2022, international traffic started to catch up with domestic traffic, increasing from 24.6% of pre-pandemic levels in 2021 to 62.1% in 2022.

- Therefore, factors like ease of travel restrictions for domestic and international travelers will build a positive trend in air passenger traffic. These are expected to boost the demand for jet fuel in commercial applications over the forecast period.

Asia-Pacific to Dominate the Market

- China is one of the largest aviation fuel markets globally and one of the largest in terms of air passengers carried. As of 2022, domestic passengers in China were the second-largest in the aviation market after the United States (IATA).

- Routes to, from, and within Asia-Pacific are expected to witness an extra 2.35 billion annual passengers by 2037, for a total market size of 3.9 billion passengers. On a global level, the number of trips per person is expected to increase by 4-8% per year for many emerging countries. But it can be as high as 10-11% annually in China and India.

- In the coming years, China is expected to surpass the United States as the world's largest aviation market (defined as traffic to, from, and within the country). The re-balancing of the country's economy toward consumption is expected to support strong passenger demand over the long term.

- India is expected to take third place after the United States, surpassing the United Kingdom around 2024. Indonesia is expected to stand out, climbing from the world's 10th-largest aviation market in 2017 to the 4th-largest by 2030.

- Because of inconsistencies in virus management and outbreaks, regions had varying degrees of traffic growth in 2022 and early 2023. Notably, in the Asia-Pacific region, International travel lagged behind other regions and only began to pick up steam in March 2022, when fears over the Omicron variant abated.

- Therefore, with the increasing air passenger and air freight traffic in the region, especially from emerging economies such as India, Indonesia, and Thailand, the jet fuel market in Asia-Pacific is expected to witness huge growth over the forecast period.

Jet Fuel Industry Overview

The jet fuel market is moderately consolidated. The key players in the market (in no particular order) include Exxon Mobil Corp., Shell PLC, TotalEnergies SE, Chevron Corporation, and BP PLC., among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION

4 MARKET OVERVIEW

5 MARKET SEGMENTATION

6 COMPETITIVE LANDSCAPE

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Exxon Mobil Corp.

- Shell PLC

- TotalEnergies SE

- Chevron Corporation

- BP PLC

- Qatar Jet Fuel Company

- Allied Aviation Services Inc.

- Bharat Petroleum Corp. Ltd

- Gazprom Neft PJSC

Methodology

LOADING...