Speak directly to the analyst to clarify any post sales queries you may have.

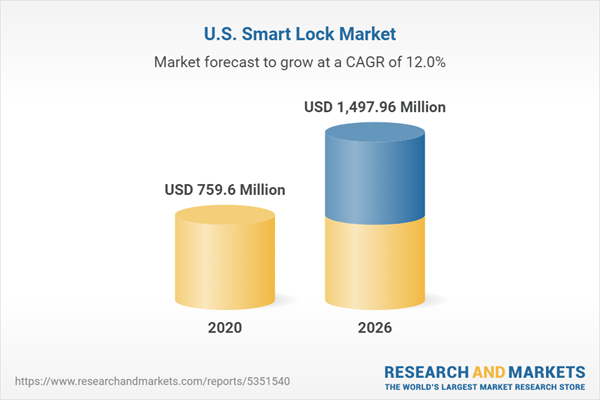

The U.S. smart lock market by revenue is expected to grow at a CAGR of approx. 12% during the period 2020-2026.

Increasing safety concerns, growing home automation, rising awareness of IoT, and growing industrial and commercial sectors will boost the U.S. smart lock market growth. Millennials in the United States are highly inclined toward home automation and are willing to pay a premium for advanced products. With the increased internet and smartphone penetration, the smart lock market is likely to observe considerable growth during the forecast period due to the high adoption of these intelligent technologies in several end-users such as educational institutions, hospitals, government offices. Moreover, to prevent invasion and unauthorized access, the market is likely to observe a substantial expansion in demand from households. Smart city initiatives by the US government and the growing focus on adopting intelligent technology for better living standards, provide huge growth potential to innovative lock vendors.

The following factors are likely to contribute to the growth of the U.S. smart lock market during the forecast period:

- Rise in Number of Smart Homes

- Growth in Commercial and Industrial Sector

- The emergence of New Technologies (IoT, AI/ML)

- Adoption of 5G And Smartphone Penetration

The study considers the U.S. smart lock market's present scenario and its market dynamics for the period 2020-2026. It covers a detailed overview of several market growth enablers, restraints, and trends.

The report offers both the demand and supply aspects of the market. It profiles and examines leading companies and other prominent ones operating in the market.

U.S. SMART LOCK MARKET SEGMENTATION

The U.S. smart lock market research report includes a detailed segmentation by lock type, communication technology, authentication method, component, end-user. Due to the high convenience, the deadbolt segment expects to emerge as the leading revenue contributor in the U.S. smart lock market. It is likely to grow significantly during the forecast period. However, lever handle locks expect to grow at a CAGR of 10.76% due to the growth of the commercial sector and the growing adoption of inner doors in hotels and residential houses. The market expects to face certain hindrances as they are comparatively challenging to install, thereby hampering its share in the market. Growing concerns over safety and security due to the rising number of theft and burglary cases in both residential and industrial sectors lead to the demand for smart padlocks. The US padlock market expects to reach USD 376.46 million by 2026.

Bluetooth intelligent locks, holding a share of over 36%, leading the US smart lock market, followed by Wi-Fi smart locks with a share of approx. 30%. The high revenue share of Bluetooth technology is attributed to the longer battery life than Wi-Fi and high-energy efficiency. The market for Wi-Fi-controlled locking systems expects to grow faster than others. High smartphone penetration, increased adoption of new technology, increasing technological advancement such as the Internet of Things (IoT), machine learning, and other benefits are likely to lead to the demand for Bluetooth locking systems in the US.

The U.S. smart lock market by component can be segregated into hardware, software, and services. Hardware is the physical component of smart locks and consists of microcontroller units, Bluetooth transmitters, and smartphones. The increased application of smart devices in new construction projects and the growing penetration of smartphones are likely to drive the growth of the hardware segment. Exponential growth observed in intelligent machines with the advent of IoT is likely to disrupt the software intelligent lock market. Smart devices show a strong inclination toward interconnected software solutions to increase convenience and adoption in the population.

In terms of authentication methods, PIN/Code smart locks are leading the market in the US, holding a share of over 47%. The high demand for biometric, PIN/Code and RFID-based locking systems comes from the residential sector and followed by the commercial sector. The RFID card is the fastest-growing segment and is expected to grow at the CARG of over 14% during the forecast period 2021-2026. The high adoption of IoT, machine learning, and artificial intelligence technology in the US and continuous innovations for unlocking the door generate better opportunities for the market's growth. Most of the US population is working professionals and mostly stay in the office, leading to the rising demand for smart keyless locks. All intelligent lock functions subject to substantial risks. A certain number of people are doubtful with respect to the reliability of smart door locks. Privacy and hacking challenges associated with these systems are likely to pose challenges to the growth of the market, thereby hampering the overall smart lock market.

Continuous growth in the residential sector in several US states is pushing the demand for smart locks. The growing real estate sector is adding to the demand for smart locks. The demand for single-family homes is growing, leading to rapid growth in the construction of a new single-family home in the US. The demand for Wi-Fi locking systems is growing rapidly in the residential sector due to their convenience in terms of accessibility.

Lock Type

- Deadbolt

- Lever Handle

- Padlock

- Others

Communication Technology

- Bluetooth

- Wi-Fi

- Zigbee & Z-Wave

- Others

Authentication Method

- Biometric

- Fingerprint sensor

- Face recognition

- Iris scanner

- PIN/Code

- RFID Cards

Components

- Hardware

- Software

- Services

End-user

- Residential

- Commercial

- Institution & Government

- Industrial

INSIGHTS BY GEOGRAPHY

The adoption of smart technology in the US remains high. The increasing safety concern regarding home leads to the rise in demand for intelligent locks as they help prevent unauthorized access. The hospitality industry provides promising growth opportunities to smart lock vendors as most premium hotels deploy intelligent locks to provide convenience and safety to customers. Government initiatives toward smart cities influence and drive people toward technology-driven products, thereby leading to the high demand for internet-based solutions. WI-FI-enabled locking systems are popular in the US population as they offer several benefits, including convenience. Hence, the demand for Wi-Fi systems expects to grow during the forecast period. Premium hotels are the primary users of these systems to provide safety and security to their guests. The increasing number of hotels in the US offers high growth opportunities to vendors in the market. The COVID-19 pandemic has a major impact on the market as most smart lock technology companies are situated in the US.

Geography

- US

- South

- West

- Northeast

- Midwest

INSIGHTS BY VENDORS

The US has a moderate number of large players and several small players operating in the smart lock market. Honeywell, Latch, and Master Lock are a few major players in the market. The players are increasingly focusing on developing innovative products and expanding their product portfolios by making huge investments in R&D. Although established players dominate the market, growth opportunities for other new entrants also exist as they target the developing end-markets or cities by producing low-cost products. The competitive intensity of the market is higher in Western and Southern parts of the US due to the large number of smart homes boosting the demand for smart locks.

Prominent Vendors

- Honeywell

- Latch

- Master Lock

- Onity

Other Prominent Vendors

- Altro Smart

- Baldwin Hardware

- Gate Labs

- Hampton

- Level

- Lockly

- SimpliSafe

- U-tec

KEY QUESTIONS ANSWERED:

1. How big is the U.S. smart lock market?

2. Which smart lock type holds the highest share in the US?

3. Which end-user segment expects to account for the highest revenue for smart lock vendors?

4. What are the factors enabling the digital locks market growth?

5. Who are the key players in the U.S. smart door lock market?

Table of Contents

Companies Mentioned

- Honeywell

- Latch

- Master Lock

- Onity

- Altro Smart

- Baldwin Hardware

- Gate Labs

- Hampton

- Level

- Lockly

- SimpliSafe

- U-tec

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 206 |

| Published | June 2021 |

| Forecast Period | 2020 - 2026 |

| Estimated Market Value ( USD | $ 759.6 Million |

| Forecasted Market Value ( USD | $ 1497.96 Million |

| Compound Annual Growth Rate | 12.0% |

| Regions Covered | United States |

| No. of Companies Mentioned | 12 |