This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

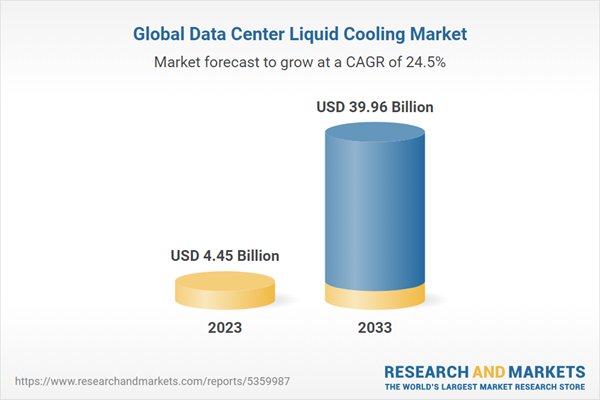

The global data center liquid cooling market, valued at $4,457.2 million in 2023, is expected to reach $39,961.3 million by 2033, exhibiting a robust CAGR of 24.53% during the forecast period 2023-2033. The growth in the global data center liquid cooling market is expected to be driven by increased data center spending and reduction in operational costs for data centers.

Introduction to Data Center Liquid Cooling Market

In today's digitally driven world, data centers are the backbone of the global economy, powering everything from cloud computing to online services. However, the exponential growth of data processing and storage demands has led to an unprecedented challenge: heat management. To address this, the data center liquid cooling market has emerged as a dynamic and essential sector within the technology industry.

In a data center, the heat generated by the IT equipment is absorbed by the liquid coolant, which then circulates through a cooling system, where it releases the heat to the outside environment.

Liquid cooling solutions are revolutionizing data centers by efficiently dissipating heat generated by high-performance servers and equipment. This market is driven by a compelling need for energy-efficient and sustainable cooling methods to optimize data center operations. As the demand for data continues to surge, businesses and data center operators are turning to innovative liquid cooling technologies to enhance performance, reduce operating costs, and minimize environmental impact.

The market's expansion is influenced by a multitude of significant factors. These include the escalating worldwide need for energy-efficient and robust data center cooling solutions, increasing penetration of the internet, cloud computing, and technologies such as AI, IoT, and big data. As a cumulative effect, these factors are projected to drive the increased adoption of data center liquid cooling.

Market Segmentation:

Segmentation 1: by End Use Industry

- IT and Telecom

- Banking, Financial Services, and Insurance (BFSI)

- Government and Public Sector

- Healthcare

- Manufacturing

- Retail

- Others

IT and Telecom Industry to Dominate the Global Data Center Liquid Cooling Market (by End Use Industry)

During the forecast period 2023-2033, the IT and Telecom segment is expected to dominate the market. With the introduction of new technologies such as 5G, IoT, virtual and augmented reality, and artificial intelligence, the IT and telecommunications industry is evolving to cater to huge data processing. As a result, telecom data centers are also transforming to handle high data volume and low latency needs. The banking, financial services, and insurance (BFSI) segment is expected to anticipate the highest growth rate due to being digitized, which involves utilizing the most cutting-edge technology, which will boost the data center usage, thereby augmenting the data center liquid cooling market.

Segmentation 2: by Data Center Type

- Hyperscale Data Center

- Enterprise Data Center

- Colocation Data Center

- Others

Segmentation 3: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, France, Switzerland, Netherlands, Italy, Spain, and Rest-of Europe

- China

- U.K.

- Asia-Pacific - Japan, India, Australia, Singapore, Malaysia, and Rest-of-Asia-Pacific

- Rest-of-the-World

During the forecast period, Europe, North America, and Asia-Pacific are projected to witness substantial demand for data center liquid cooling. The increasing government regulations and the consequent expansion of the data center industry are expected to create favorable conditions for the adoption of liquid cooling.

The utilization of liquid cooling is witnessing a notable expansion in Europe, North America, Asia-Pacific, and China. This growth can be attributed to heightened research and development activities, alongside a competitive environment that fosters innovation, infrastructure modernization projects, climate challenges, energy efficiency mandates, AI and HPC expansion, digital economy development, and strict data privacy and security requirements are all contributing to the growth of data caused by smartphones and the Internet of Things is driving the adoption of data center liquid cooling, consequently stimulating market growth.

Recent Developments in the Global Data Center Liquid Cooling Market

Recently, the global data center liquid cooling market has seen significant developments, reflecting a shift towards more efficient and sustainable cooling solutions. Major players like Vertiv Group Corp. and Asetek have introduced advanced liquid cooling technologies, catering to the increasing power densities in modern data centers. For instance, IBM's adoption of liquid-cooled servers for enhanced energy efficiency sets a benchmark in the industry. Furthermore, collaborations between cooling solution providers and cloud service giants, like the partnership between COOLIT SYSTEMS and Dell, are driving innovation. These developments underscore a growing trend towards eco-friendly and cost-effective cooling methods, essential for meeting the escalating demands of large-scale data processing.

Demand - Drivers, Challenges, and Opportunities

Market Drivers: Increasing Data Center Spending

The exponential growth in data generation and utilization across diverse sectors has significantly boosted the demand for data servers and data centers. CloudScene data reveals that as of January 2021, almost 8,000 data centers were operational in 110 countries. The United States leads with 33% of these centers, followed by the United Kingdom (5.7%), Germany (5.5%), China (5.2%), Canada (3.3%), and the Netherlands (3.4%). Approximately 77% of these data centers are in countries that are members of the Organization for Economic Co-operation and Development (OECD), such as France, Greece, Hungary, Iceland, and Ireland. Additionally, about 64% are situated in North Atlantic Treaty Organization (NATO) countries, including Denmark, Croatia, and the Czech Republic.

The U.S. market experienced a substantial increase in data center capacity, with a record absorption of 493.4 megawatts (MW) in 2021, as reported by Coldwell Banker Richard Ellis (CBRE). This marks a 31% increase from the previous high in 2019 and a 50% rise from 2020. Jones Lang LaSalle Inc. (JLL) also noted a significant uptick in data center absorption, which reached 885.7 MW across 14 domestic markets in 2021, driven largely by expansions of major cloud and technology firms. This represents a 44.3% year-on-year increase.

The future outlook for data centers remains positive, fueled by the surge in data usage. Factors such as the continued popularity of streaming services, virtual collaboration tools, and remote working have led to unprecedented demand for data centers in 2020 and 2021. This demand resurgence is particularly notable among top global data center operators, who are witnessing increased enterprise-level demand from sectors such as technology, finance, and healthcare.

Market Challenges: High Investment Costs

Investing in liquid cooling technologies for data centers presents a significant financial challenge, often hindering their adoption by operators who currently rely on traditional cooling methods. The substantial initial investment required for liquid cooling systems, including the need for specialized infrastructure and equipment, serves as a major barrier for many businesses considering an upgrade to their data center cooling systems.

In terms of cost implications:

- Electricity expenses can make up more than half of the operating costs in conventional data centers.

- Cooling operations alone can represent up to 43% of a data center's total power usage.

- Transitioning to more efficient cooling solutions like liquid cooling entails high upfront costs (capital expenditure or CAPEX) and could lead to increased operational costs (operational expenditure or OPEX), particularly due to the use of costly coolants such as dielectric fluids and fluorocarbons.

Market Opportunities: Increasing Efficiency of Existing Data Centers

The typical lifespan of a data center is around 9-10 years, after which it tends to become outdated, though upgrades can extend its usability. Many older data centers may not be fully compatible with modern liquid cooling technologies. However, the opportunity to retrofit these older infrastructures presents a significant market for liquid cooling solutions in data centers.

The key drivers for retrofitting data centers include increasing IT densities, new technological developments, aging hardware, the need for improved cooling systems, and the demand for energy-efficient and power-saving solutions. Even recently built cloud or hyper-scale data centers are undergoing retrofits to meet these needs. The process of updating operational data centers is highly complex, often more so than designing and constructing new facilities. Consequently, retrofitting has become an increasingly attractive option for data center operators in the forecast period.

Many data centers constructed in the last decade are now undergoing modernization to enhance efficiency and adapt to technological innovations driven by AI, IoT, and other digital advancements. For retrofitting, upgrading electrical components is often more feasible than server virtualization, which can be costly and labour-intensive. Switching to liquid cooling systems in data centers offers immediate benefits, including reduced electrical failures and heat emissions. Efficiency gains, often achieved through relatively simple modifications, can lead to a decrease of up to 40% in cooling costs and electricity consumption.

How Can This Report Add Value to an Organization?

Product/Innovation Strategy: The product segment helps the reader understand the different application and product segments of data center liquid cooling and their potential globally. Moreover, the study gives the reader a detailed understanding of the different regulations, consortiums and associations, and government programs impacting the liquid cooling manufacturers for various purposes, including data centers.

Growth/Marketing Strategy: The global data center liquid cooling market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint venture. The favored strategy for the companies has been partnership, collaboration, and joint venture activities to strengthen their position in the global data center liquid cooling market.

Competitive Strategy: Key players in the global data center liquid cooling market analyzed and profiled in the study involve liquid cooling providers, including market segments covered by distinct product kinds, applications served, and regional presence, as well as the influence of important market tactics employed. Moreover, a detailed competitive benchmarking of the players operating in the global data center liquid cooling market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Methodology

Primary Data Sources

The primary sources involve industry experts from the data center industry and various stakeholders such as cooling solution providers, system integrators, immersion liquid cooling suppliers, data server operators, and data center developers. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

The key data points taken from primary sources Include:

- validation and triangulation of all the numbers and graphs

- validation of reports segmentation and key qualitative findings

- understanding the competitive landscape

- validation of the numbers of various markets for market type

- percentage split of individual markets for regional analysis

Secondary Data Sources

This research study involves the usage of extensive secondary research, directories, company websites, and annual reports. It also makes use of databases, such as ITU, Hoovers, Bloomberg, Businessweek, and Factiva, to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global market. In addition to the aforementioned data sources, the study has been undertaken with the help of other data sources and websites, such as Data Center Dynamics and Data Center Knowledge.

Secondary research was done in order to obtain crucial information about the industry’s value chain, revenue models, the market’s monetary chain, the total pool of key players, and the current and potential use cases and applications.

The key data points taken from secondary research include:

- segmentations and percentage shares

- data for market value

- key industry trends of the top players of the market

- qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- quantitative data for mathematical and statistical calculations

Data Triangulation

This research study involves the usage of extensive secondary sources, such as certified publications, articles from recognized authors, white papers, annual reports of companies, directories, and major databases to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global data center liquid cooling market.

The process of market engineering involves the calculation of the market statistics, market size estimation, market forecast, market crackdown, and data triangulation (the methodology for such quantitative data processes is explained in further sections). The primary research study has been undertaken to gather information and validate the market numbers for segmentation types and industry trends of the key players in the market.

Key Market Players and Competition Synopsis

The global data center liquid cooling market is a dynamic and rapidly evolving market, characterized by a blend of established companies and emerging innovators, each bringing unique technologies and strategies to meet the escalating demand for energy-efficient, high-performance cooling solutions in data centers worldwide. Driven predominantly by technological innovation, these companies are continuously developing new and improved cooling systems to enhance efficiency and minimize environmental impact. The companies are putting emphasis on delivering customizable and scalable solutions to accommodate the varying requirements of data centers, from modest operations to large, intricate facilities. Moreover, the market is witnessing a trend of strategic partnerships and collaborations, as companies seek to expand their market presence and leverage collective technological expertise, further intensifying the competition and fostering growth in this sector.

A recent instance of COOLIT SYSTEMS’s collaboration with a major cloud service provider. This partnership involved the deployment of company’s direct-to-chip liquid cooling solutions in several of the provider's data centers, resulting in significant improvements in cooling efficiency and energy savings. This move not only reinforced company’s position in the market but also set a benchmark for eco-friendly and efficient data center cooling practices, influencing other players in the industry to follow suit.

Major players in the market include liquid cooling providers such as Vertiv Group Corp., Asetek Inc., Asperitas, COOLIT SYSTEMS, and DCX Inc.

Some of the prominent companies in this market are:

- Vertiv Group Corp.

- GRC, Inc.

- Iceotope

- LiquidStack Holding B.V.

- Submer

- Coolcentric

- Motivair Corporation

- PEZY Computing Inc.

- DCX Inc.

- Asetek, Inc.

- Chilldyne, Inc.

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Asetek, Inc.

- Asperitas

- Chilldyne, Inc.

- COOLIT SYSTEMS

- DCX INC.

- GRC, Inc.

- Iceotope

- LiquidStack Holding B.V.

- Submer

- Vertiv Group Corp.

- ZutaCore, Inc.

- Coolcentric

- Midas Immersion Cooling

- Motivair Corporation

- PEZY Computing Inc.

- Mikros Technologies

- Nortek Air Solutions, LLC

- TMGcore, Inc.

- Koolance, Inc.

- Firmus Technologies Pty Ltd

- Shenzhen MicroBT Electronics Technology Co., Ltd

- Super Micro Computer, Inc.

- LiquidCool Solutions

- Schneider Electric

- Rittal GmbH & Co. KG

- Accelsius

- Legrand

- STULZ GMBH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 187 |

| Published | March 2024 |

| Forecast Period | 2023 - 2033 |

| Estimated Market Value ( USD | $ 4.45 Billion |

| Forecasted Market Value ( USD | $ 39.96 Billion |

| Compound Annual Growth Rate | 24.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |