As people become less inclined to spend long periods of time cooking at home, delivery offerings and processed ingredients have become famous options. Younger generations are showing a more interest in processed meat because of evolving buyer options and changing nutritional habits. Western food culture has performed a tremendous role in expanding younger consumer' palates and making them more accepting of processed meat products.

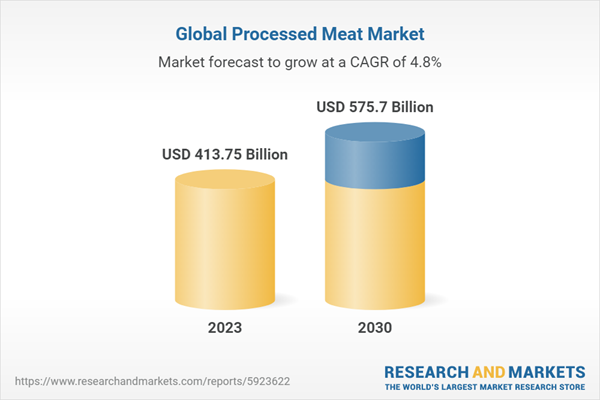

Global Processed meat market has been developing at a CAGR of 4.83% from 2024 to 2030

While food processing could make meats flavor better and last longer, it additionally changes them from their natural state. Many manufacturers are turning to natural curing agents like cherry celery powder to deal with these concerns and replace dangerous nitrates. This is becoming famous among customers who want to eat healthier and decrease their hazard of fitness issues. Many agencies are making an investment closely in research and development to find safer options to the chemical compounds utilized in meat maintenance. There is a developing demand for organic processed meat free from antibiotics and chemical residues. To meet this demand, businesses are sourcing meat from natural-licensed farms. They are also the use of natural preservatives rather than artificial ones, supporting the market growth.Fast food chains like KFC, McDonald's, Subway, Burger King, and Taco Bell have led to a rise in processed meat consumption. Affordable meal packages and discounts supplied through these chains have contributed to the growth of the processed meat market globally. According to the U.S. Center for Disease and Control Prevention, around 37% of Americans consume fast food every day, which has fostered market increase in developed regions. The global processed meat market is surging because of increased demand for ready up-to-cook and ready to eat food. The convenience and time-saving benefits of those food’types drive this demand. The upward thrust in the wide number of employees and their busy life has led to multiplied intake of those products. Processed Meat Market was valued at US$ 413.75 Billion in 2023.

Poultry Processed meat segment dominates due toincreasing consumption worldwide

By Meat Types, Processed Meat Market is segmented into Poultry, Beef, Pork and Others. The Processed Meat market witnessed a noteworthy dominance through the poultry sector, underscored by a surge in worldwide consumption. Poultry products, such as chicken and turkey, have won prominence because of their versatility, affordability, and general recognition among customers globally.Factors including converting dietary choices, comfort, and a growing population have fueled the demand for processed chicken meat. This dominance inside the market is reflective of the evolving culinary landscape and the poultry industry's capability to fulfill the numerous wishes of buyers in search of convenient and flavorful protein sources. The chicken sectors dominance keeps to form the trajectory of the processed meat market.

Frozen Processed meat holds sizable market sales within the worldwide Processed Meat Market

By Processed Types, Processed Meat Market is divided into Frozen, Chilled and Canned. Frozen processed meat commands a huge proportion of the worldwide processed meat marketplace, contributing extensively to its global revenue. This market segment's popularity may be attributed to the benefit it offers customers, making sure longer shelf existence and smooth storage. With busy existence and the need for quick meal solutions, frozen processed meat products meet the demand for each comfort and flavor. The worldwide enchantment of these products underscores their massive recognition, making them a key participant in the processed meat industry. As customer possibilities evolve, frozen processed meat maintains to play a pivotal role in shaping the market panorama.Online Retail Stores will capture larger percent in upcoming years

By Distribution Channels, Processed Meat Market is classified into Hypermarkets and Supermarket, Convenience Stores, Online Retail Stores and Others. Online retail shops are poised to capture an increasing market percentage inside the worldwide processed meat market. The comfort and accessibility supplied through online platforms cater to the evolving customer choices for hassle free shopping experiences. As digitalization transforms the retail panorama, an increasing number of customers turns to online channels for their processed meat purchases. The comfort of doorstep delivery, an extensive type of options, and the capacity to compare products contribute to the appeal of online retail in the processed meat sector. This shift displays a growing trend, signaling a substantial presence and impact of e commerce in the future of processed meat sales.Due to growing demand for instant food and a booming processed meat production area, the China market is anticipated to grow in the coming years

By Country, Processed Meat Market is split into North America (United States, Canada), Europe (Germany, United Kingdom, France, Italy, Spain, Switzerland), Asia Pacific (Japan,China, India, Australia, South Korea, Indonesia), South America (Mexico, Brazil, Argentina), Middle East & Africa (South Africa, Saudi Arabia, United Arab Emirates) and Rest of world. China emerges as a substantial worldwide consumer of processed meat, exerting huge influence on the market dynamics. The nation's huge populace, coupled with moving nutritional styles and urbanization, propels the demand for processed meat products. China's impact on global intake is sizable, as its culinary landscape adapts to trendy choices. This trend indicates the mixing of processed meats into the everyday food diet of millions, showcasing China's pivotal role in shaping global market trends. As a main player, China no longer only drives consumption however additionally serves as a trademark of evolving culinary options on a global scale.Key Players

Hormel foods, Tyson Foods, Conagra Brands Inc., General Mills, Nestle, Cargill Incorporated, WH Group and BRF SA are the prominent player inside the global Processed Meat Market.Meat Type - Market have been covered from 4 viewpoints

- Poultry

- Beef

- Pork

- Others

Processing Type - Market have been covered from 3 viewpoints

- Frozen

- Chilled

- Canned

Distribution Channel - Market have been covered from 4 viewpoints

- Hypermarkets and Supermarket

- Convenience Stores

- Online Retail Stores

- Others

Countries - Market have been covered from 21 country Processed Meat industry viewpoints

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Switzerland

Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Australia

Latin America

- Mexico

- Brazil

- Argentina

Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

Rest of the World

All companies have been covered from 3 viewpoints:

- Overview

- Recent Development

- Revenue Analysis

Company Analysis

- Hormel foods

- Tyson Foods

- Conagra Brands Inc.

- General Mills

- Nestle

- Cargill Incorporated

- WH Group

- BRF SA

Table of Contents

Companies Mentioned

- Hormel foods

- Tyson Foods

- Conagra Brands Inc.

- General Mills

- Nestle

- Cargill Incorporated

- WH Group

- BRF SA

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2024 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 413.75 Billion |

| Forecasted Market Value ( USD | $ 575.7 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |