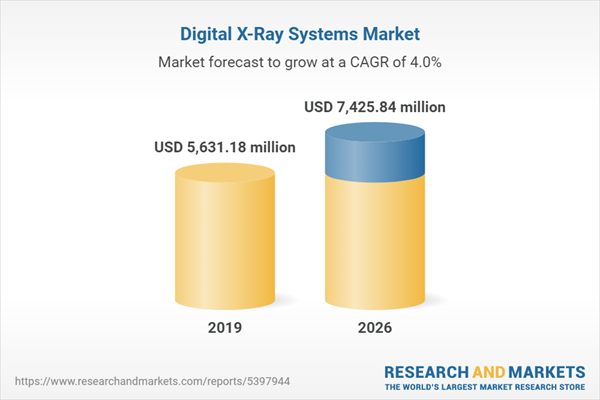

The global digital x-ray systems market is evaluated at US$5,631.180 million for the year 2019 and is projected to grow at a CAGR of 4.03% to reach a market size of US$7,425.844 million by the year 2026. Digital radiography utilizes X-ray imaging, through a digital image capture device where digital X-ray sensors are used instead of traditional photographic film. Digital X-ray systems produce diagnostic images by interacting with human tissues. The generated images can be obtained, modified, deleted, and shared over a network of computers. The primary factor driving the digital X-ray system market is growing incidents of cardiovascular, orthopedic, and dental disorders around the globe. Advancement in technologies, efforts to provide better healthcare facilities, and an aging population is also fuelling the demand for digital X-ray systems. However, expensive diagnostic tools have curtailed market growth to some extent. Geographically, the APAC region will drive the global market for Digital X-Ray equipment on account of heavy investments in healthcare infrastructure whereas America will also be driven by the growth in digital X-ray systems on account of rising incidents of injuries and accidents coupled with growing awareness of these systems among the target population about its uses in the region.

Furthermore, some of the key factors responsible for the market growth include, such as the increasing occurrence of orthopedic diseases and cancers, the increasing number of serious injuries, the advantages of digital X-ray systems over conventional X-rays, technological advancements, and product development. Digital X-ray devices use digital x-ray sensors instead of films to capture images. This results in an immediate preview of the images that ultimately improves time efficiency and capacity to digitally transfer images.

The major advantages of digital imaging are cost-effectiveness and easy accessibility. The hospitals can cut the cost by lowering the film price, reducing the requirement of storage space, and decreasing the number of people required to run the services and archive sections. The images are also instantly available for distribution to the clinical services without the time and physical effort needed to retrieve film packets and reviewing previous imaging on a patient is much easier. This factor majorly impacts the positive growth of the digital X-ray devices market. Digital X-rays expose approximately 70-80% less radiation than conventional X-rays. This is hugely beneficial for the long-term health of patients, especially pregnant women or patients who are already suffering from illness, thus ensuring safety. With the help of digital X-rays, dentists can now easily recognize oral issues, which is leading to a declining need for an invasive investigation at the diagnosis stage. Additionally, digital radiography safely stores patient X-rays, resulting in no loss from the holders.

The market has been significantly driven by the increasing health expenditures done by several governments in order to enhance the technological advancements in the sector.

The advent of COVID-19 had a positive impact on the digital x-ray systems market given the rise in the cases from the disease which increased the demand for digital x-rays during the period. The COVID-19 pandemic has turned on the spotlight on diagnostic imaging, particularly on digital X-ray devices. Digital imaging plays a key role in the diagnosis of COVID-19 and indicates the affected lung tissue in infected patients. In Dec 2020 Agfa HealthCare launched its new SmartXR for X-ray Artificial Intelligence (AI) for Digital Radiography portfolio to assist with the radiology routine, which has proven important during the COVID-19 crisis. Thus, because of the ongoing pandemic, the digital X-rays devices market is expected to be positively impacted by COVID-19 accurate diagnosis and treatment.

Rising dental disorders and cardiac problems are expected to fuel the market during the forecast period.

Due to the increase in the number of dental disorders, cardiac disorders, cancers especially breast cancer, there is an increased demand for digital X-ray devices globally. As per American Heart Association in 2017, approximately 17.8 million death occurred due to cardiovascular diseases in the United States, and this number is expected to grow to more than 22.2 million deaths by 2030 in the United States. The increasing incidence of cardiovascular diseases surges the demand for imaging devices with precise diagnosis and hence Digital X-ray devices acquire their importance in this context.

Increasing technological innovations in the sector are expected to be a tailwind to the market in the coming years.

The advancements in technology and increasing product approvals, along with partnerships and collaborations by key players are helping in the market growth. For instance, in June 2020, Nanoxand SK Telcom entered into a partnership agreement to deploy 2,500 Nanoxdigital X-ray Systems into South Korea and Vietnam. Also, in Nov 2020, Hologic, Inc., received a CE mark for its Genius Digital Diagnostics System, which consists of a digital imager for image acquisition, an AI algorithm for analyzing images, an image management server for storing images for Cervical Cancer Screening. Thus, all the aforementioned factors are currently augmenting the growth of the digital X-ray devices market.

Furthermore, some of the key factors responsible for the market growth include, such as the increasing occurrence of orthopedic diseases and cancers, the increasing number of serious injuries, the advantages of digital X-ray systems over conventional X-rays, technological advancements, and product development. Digital X-ray devices use digital x-ray sensors instead of films to capture images. This results in an immediate preview of the images that ultimately improves time efficiency and capacity to digitally transfer images.

The major advantages of digital imaging are cost-effectiveness and easy accessibility. The hospitals can cut the cost by lowering the film price, reducing the requirement of storage space, and decreasing the number of people required to run the services and archive sections. The images are also instantly available for distribution to the clinical services without the time and physical effort needed to retrieve film packets and reviewing previous imaging on a patient is much easier. This factor majorly impacts the positive growth of the digital X-ray devices market. Digital X-rays expose approximately 70-80% less radiation than conventional X-rays. This is hugely beneficial for the long-term health of patients, especially pregnant women or patients who are already suffering from illness, thus ensuring safety. With the help of digital X-rays, dentists can now easily recognize oral issues, which is leading to a declining need for an invasive investigation at the diagnosis stage. Additionally, digital radiography safely stores patient X-rays, resulting in no loss from the holders.

The market has been significantly driven by the increasing health expenditures done by several governments in order to enhance the technological advancements in the sector.

The advent of COVID-19 had a positive impact on the digital x-ray systems market given the rise in the cases from the disease which increased the demand for digital x-rays during the period. The COVID-19 pandemic has turned on the spotlight on diagnostic imaging, particularly on digital X-ray devices. Digital imaging plays a key role in the diagnosis of COVID-19 and indicates the affected lung tissue in infected patients. In Dec 2020 Agfa HealthCare launched its new SmartXR for X-ray Artificial Intelligence (AI) for Digital Radiography portfolio to assist with the radiology routine, which has proven important during the COVID-19 crisis. Thus, because of the ongoing pandemic, the digital X-rays devices market is expected to be positively impacted by COVID-19 accurate diagnosis and treatment.

Rising dental disorders and cardiac problems are expected to fuel the market during the forecast period.

Due to the increase in the number of dental disorders, cardiac disorders, cancers especially breast cancer, there is an increased demand for digital X-ray devices globally. As per American Heart Association in 2017, approximately 17.8 million death occurred due to cardiovascular diseases in the United States, and this number is expected to grow to more than 22.2 million deaths by 2030 in the United States. The increasing incidence of cardiovascular diseases surges the demand for imaging devices with precise diagnosis and hence Digital X-ray devices acquire their importance in this context.

Increasing technological innovations in the sector are expected to be a tailwind to the market in the coming years.

The advancements in technology and increasing product approvals, along with partnerships and collaborations by key players are helping in the market growth. For instance, in June 2020, Nanoxand SK Telcom entered into a partnership agreement to deploy 2,500 Nanoxdigital X-ray Systems into South Korea and Vietnam. Also, in Nov 2020, Hologic, Inc., received a CE mark for its Genius Digital Diagnostics System, which consists of a digital imager for image acquisition, an AI algorithm for analyzing images, an image management server for storing images for Cervical Cancer Screening. Thus, all the aforementioned factors are currently augmenting the growth of the digital X-ray devices market.

Market Segmentation:

By Technology

- Direct Radiography

- Computed Radiography

By Portability

- Handheld Systems

- Portable X-Ray Systems

- Mobile X-Ray Systems

- Floor-to-ceiling Mounted Systems

- Ceiling Mounted Systems

- Fixed Digital X-Ray Systems

By End Users

- Hospitals

- Diagnostic Centres

By Application

- Cardiovascular Imaging

- Chest Imaging

- General Radiography

- Dental

- Mammography

- Orthopaedic

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

Table of Contents

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

5. Digital X-Ray Systems Market Analysis, by Technology

6. Digital X-Ray Systems Market Analysis, by Portability

7. Digital X-Ray Systems Market Analysis, by End user

8. Digital X-Ray Systems Market Analysis, by Application

9. Digital X-Ray Systems Market Analysis, by Geography

10. Competitive Environment and Analysis

11. Company Profiles

Companies Mentioned

- Carestream Health

- Fujifilm Holdings Corporation (Fujifilm Medical Systems)

- GE Company (GE Healthcare)

- Hitachi, Ltd.

- Hologic, Inc

- Koninklinje Philips NV (Philips Healthcare)

- Shimadzu Corporation

- Siemens Healthineers

- Canon Medical Systems Corporation (Toshiba Corporation)

- Samsung Electronics Co. Ltd (Samsung Healthcare)

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 111 |

| Published | July 2021 |

| Forecast Period | 2019 - 2026 |

| Estimated Market Value ( USD | $ 5631.18 million |

| Forecasted Market Value ( USD | $ 7425.84 million |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |

![Digital X-ray Systems Market by Product (Fixed [Ceiling, Floor], Portable, Detectors, Software & Services) Technology (Computed, Direct) Application (Orthopedic & Trauma, Breast, Chest & Lung) End User (Hospital, Imaging Center) - Global Forecast to 2030 - Product Image](http://www.researchandmarkets.com/product_images/12541/12541972_60px_jpg/digital_xray_systems_market.jpg)