Investments by Private Firms in Space Exploration Missions

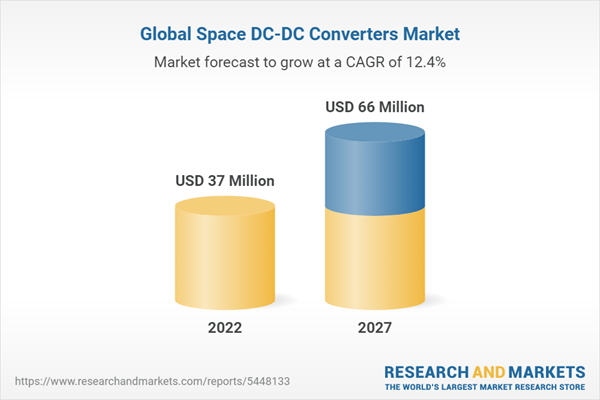

The Space DC-DC Converter market is projected to grow from USD 37 million in 2022 to USD 66 million by 2027, at a CAGR of 12.4%.

In recent years, DC-DC converters designed for space applications have evolved in terms of radiation resistance, compactness in size, etc. This evolution results from advancements in the space sector, which include new and improved satellites, spacecraft, etc. Recent developments, such as the Moon landers, have created a huge requirement for space standard radiation-hardened (rad-hard) DC-DC converters.

Texas Instruments (US), Vicor Corporation (US), and Infineon Technologies AG (Germany) are some of the key players operating in the space DC-DC converter market. These companies have been functioning in the domain for several years and have strong global distribution networks. Constant innovation and the development of technologically advanced products have been the standout features of these key players. One such feature is Vicor Corporation’s Factorized Power Architecture (FPA) technology used to develop space-standard products.

Based on platform, Interplanetary Spacecraft & Probes segment is estimated to be the fastest growing market

Interplanetary spacecraft and probes or interplanetary travel is the travel between stars and planets, usually within a single planetary system. In practice, spaceflights of this type are confined to travel between the planets of the solar system. Many astronomers, geologists, and biologists believe that exploring the solar system will provide knowledge that could not be gained by observations from Earth's surface or orbit around Earth. A probe is a spacecraft that travels through space to collect scientific information. Probes do not have astronauts onboard; they send data back to Earth for scientists to study.

The Indian Space Research Organisation (ISRO) is planning to deploy Aditya-L1, the first dedicated mission of the country to study the Sun, into space in the first few months of 2023

In October 2022, China sent the country's Advanced Space-based Solar Observatory (ASO-S) - a satellite specially designed to carry out a comprehensive probe of the Sun - into pre-set orbit via a Long March 2D carrier rocket. The satellite, also known as Kuafu-1, was jointly developed by the Innovation Academy for Microsatellites of the Chinese Academy of Sciences (CAS,) CAS National Astronomical Observatory, the CAS Changchun Institute of Optics, Fine Mechanics and Physics, and the CAS Purple Mountain Observatory. Kuafu-1 will conduct continuous solar observations for at least four years. Its primary scientific goals include forming the solar magnetic field, solar flares, and titanic blasts known as coronal mass ejections.

Based on form factor, enclosed segment is estimated to be the fastest growing market

Enclosed converters are designed to operate at higher temperatures. DC-DC converters with enclosed form factors can provide up to the 10:1 input range. Rad-Hard POL converter from STMicroelectronics (Switzerland) is an enclosed DC-DC converter used in the attitude and orbit control subsystem (AOCS).

US to lead North America Space DC-DC Converter market

The growth of the market in the US can be attributed to the presence of key manufacturers of space DC-DC converters in the US. The rise in space launches from NASA is also anticipated to drive the US space DC-DC converter market for planetary exploration during the forecast period. The SLS is being designed to be the launch platform that sends humans to the moon and deeper into the solar system using the Orion spacecraft as well as the ground operation and launch facilities of its Kennedy Space Center in Florida. In July 2022, the US witnessed 39 successful launches out of 41 launches, against 51 in 2021.

The use of space DC-DC converters is expected to grow due to the increasing development of radiation-hardened DC-DC converters and miniaturization of DC-DC converters for satellites, capsules\cargos, interplanetary spacecraft & probes, rovers/spacecraft landers, launch vehicles, and space stations.

Some key US-based space DC-DC converters are Texas Instruments Incorporated (US), Astronics Corporation (US), AJ's Power Source (US), Vicor Corporation (US), and Synqor Inc. (US).

In February 2021, Microchip Technology Inc. (US) launched SA50-120 radiation-hardened DC-to-DC power converters. It is the only non-hybrid space-grade DC-DC power converter that provides flexibility and customization that fits specific requirements and applications.

The break-up of the profile of primary participants in the space DC-DC converter market:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C Level - 35%, Director Level - 25%, and Others - 40%

- By Region: North America - 40%, Europe - 30%, Asia Pacific - 20%, Rest of the World - 10%.

Key Market Players

The major players are Texas Instruments Incorporated (US), STMicroelectronics (Switzerland), Crane Co. (US), Infineon Technologies AG (Germany), and Vicor Corporation (US). These companies have well-equipped manufacturing and distribution networks across North America, Europe, Asia Pacific, Middle East, and Rest of the World.

Research Coverage:

This market study covers Space DC-DC Converter market across various segments and subsegments. It aims at estimating the size and growth potential of this market across different segments based on solutions, application, investment, type, operation and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their product and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall Space DC-DC Converter market. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on Space DC-DC Converter offered by the top players in the market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the Space DC-DC Converter market

- Market Development: Comprehensive information about lucrative markets - the report analyses the Space DC-DC Converter market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the Space DC-DC Converter market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, products, and service providing capabilities of leading players in the Space DC-DC Converter market.

Table of Contents

1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

Figure 1 Space Dc-Dc Converter Market Segmentation

1.3.2 Regional Scope

1.3.3 Years Considered

1.4 Currency Considered

Table 1 USD Exchange Rates

1.5 Inclusions and Exclusions

Table 2 Inclusions and Exclusions

1.6 Limitations

1.7 Stakeholders

1.8 Summary of Changes

Figure 2 Space Dc-Dc Converter Market to Grow at Higher Rate Than Previous Estimates

2 Research Methodology

2.1 Research Data

Figure 3 Report Process Flow

Figure 4 Space Dc-Dc Converter Market: Research Design

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Primary Respondents

2.1.2.3 Breakdown of Primary Interviews

Figure 5 Breakdown of Primary Interviews: by Company Type, Designation, and Region

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Indicators

2.3 Market Size Estimation & Methodology

2.3.1 Bottom-Up Approach

Figure 6 Bottom-Up Approach

2.3.2 Top-Down Approach

Figure 7 Top-Down Approach

2.4 Recession Impact on Market Analysis

Figure 8 Satellite Manufacturers Quarterly Revenue

2.5 Data Triangulation

Figure 9 Data Triangulation

2.6 Research Assumptions

Figure 10 Assumptions for Research Study on Space Dc-Dc Converter Market

2.7 Risks

3 Executive Summary

Figure 11 Satellites Segment to Lead Space Dc-Dc Converter Market During Forecast Period

Figure 12 Chassis Mount Segment to Lead Space Dc-Dc Converter Market During Forecast Period

Figure 13 Non-Isolated Segment to Lead Space Dc-Dc Converter Market During Forecast Period

Figure 14 North America Estimated to Dominate Space Dc-Dc Converter Market in 2022

4 Premium Insights

4.1 Attractive Growth Opportunities for Players in Space Dc-Dc Converter Market

Figure 15 Increasing Mars and Moon Exploration Missions to Drive Market from 2022 to 2027

4.2 Space Dc-Dc Converter Market, by Output Voltage

Figure 16 12V Segment Projected to Lead Market from 2022 to 2027

4.3 Space Dc-Dc Converter Market, by Application

Figure 17 Command & Data Handling Segment to Dominate Market from 2022 to 2027

4.4 Space Dc-Dc Converter Market, by Platform

Figure 18 Satellites Segment to Lead Market from 2022 to 2027

4.5 Space Dc-Dc Converter Market, by Country

Figure 19 Canada Projected to be Fastest-Growing Market from 2022 to 2027

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 20 Space Dc-Dc Converter Market Dynamics

5.2.1 Drivers

5.2.1.1 Investments by Private Firms in Space Exploration Missions

5.2.1.2 Emergence of Digital Power Management and Control

5.2.1.3 Increased Demand for High-Performance and Cost-Effective Systems

5.2.1.4 Development of Thick-Film Hybrid Dc-Dc Converters

5.2.1.5 Increasing Number of Space Exploration Missions

Table 3 Space Missions from 2022 to 2026

5.2.2 Restraints

5.2.2.1 Functionality of Dc-Dc Converters in No-Load Situation

5.2.2.2 Product Manufacturing Challenges

5.2.2.3 Export Restrictions for Us Manufacturers

5.2.2.4 Issues with Commercially Available Dc-Dc Converters

5.2.3 Opportunities

5.2.3.1 Miniaturization of Space Dc-Dc Converters

5.2.3.2 Development of Dc-Dc Converters with High Switching Frequency

5.2.3.3 Increasing Demand for Radiation-Hardened Isolated Dc-Dc Converters

5.2.3.4 Extending Operating Temperature of Dc-Dc Converter Components

Table 4 Operating Temperature of Dc-Dc Converters Offered by Market Players

5.2.4 Challenges

5.2.4.1 Global Shortage of Semiconductors

5.2.4.2 Maintaining High Performance with Compact Size

5.2.4.3 Development of Dc-Dc Converters with Low-Noise Performance

5.2.4.4 Power Density and Efficiency

5.3 Value Chain Analysis

Figure 21 Value Chain Analysis: Space Dc-Dc Converter Market

5.4 Recession Impact Analysis

Figure 22 Recession Impact Analysis

5.5 Operational Data

Table 5 Global Satellite Launch Volume, by Satellite Type, 2018-2021

5.6 Trade Analysis

Table 6 Import Value of Spacecraft, Including Satellites and Suborbital and Spacecraft Launch Vehicles (Product Harmonized System Code: 880260, USD Million (2017-2021)

Table 7 Exported Value of Spacecraft, Including Satellites and Suborbital and Spacecraft Launch Vehicles (Product Harmonized System Code: 880260, USD Million (2017-2021)

5.7 Disruptions Impacting Customer Business

5.7.1 Revenue Shift and New Revenue Pockets for Space Dc-Dc Converter Market

Figure 23 Revenue Shift in Space Dc-Dc Converter Market

5.8 Market Ecosystem

5.8.1 Prominent Companies

5.8.2 Private and Small Enterprises

5.8.3 End-users

Figure 24 Space Dc-Dc Converters Ecosystem

Table 8 Space Dc-Dc Converter Market Ecosystem

5.9 Pricing Analysis

5.9.1 Average Selling Price

Table 9 Average Selling Price: Space Dc-Dc Converter (USD)

5.10 Technology Analysis

5.10.1 Satellites for Earth Observation Imagery and Analytics

5.11 Porter's Five Forces Analysis

Table 10 Space Dc-Dc Converter Market: Porter's Five Forces Analysis

Figure 25 Space Dc-Dc Converter Market: Porter's Five Forces Analysis

5.11.1 Threat of New Entrants

5.11.2 Threat of Substitutes

5.11.3 Bargaining Power of Suppliers

5.11.4 Bargaining Power of Buyers

5.11.5 Intensity of Competitive Rivalry

5.12 Tariff and Regulatory Landscape

5.12.1 North America

5.12.2 Europe

5.12.3 Asia-Pacific

5.12.4 Middle East

5.13 Key Conferences & Events in 2023

Table 11 Space Dc-Dc Converter Market: Conferences & Events, 2023

5.14 Key Stakeholders & Buying Criteria

5.14.1 Key Stakeholders in Buying Process

Figure 26 Influence of Stakeholders on Buying Process for Top Three Platforms

Table 12 Influence of Stakeholders on Buying Process for Top Three Platforms (%)

5.14.2 Key Buying Criteria

Figure 27 Key Buying Criteria for Top Three Platform

Table 13 Key Buying Criteria for Top Three Platform

6 Industry Trends

6.1 Introduction

6.2 Technology Trends

6.2.1 Compact, High-Density, and High-Efficiency Dc-Dc Converters for New Space Applications

6.2.2 Low Power Devices

6.2.3 Miniaturization of Space Dc-Dc Converters

6.2.4 New Architectures in Space Dc-Dc Converters

6.2.5 Use of Gallium Nitride Technology for Increased Efficiency of Dc-Dc Converters

6.2.6 Emergence of New Power Architectures

6.3 Use Cases: Space Dc-Dc Converters

6.3.1 Dc-Dc Converters for Space Stations and Orion Program Platforms

6.4 Space Dc-Dc Converter Market: Patent Analysis, 2012-2021

Table 14 Patent Analysis

6.5 Impact of Megatrend

6.5.1 Upper-Stage and Spacecraft Orbit-Raising Technologies

6.5.2 Development of Small Satellites Using Additive Manufacturing Process

6.5.3 Deployment of Earth Observation Satellites

7 Space Dc-Dc Converter Market, by Platform

7.1 Introduction

Figure 28 Satellites Segment to Command Largest Market Share During Forecast Period

Table 15 Space Dc-Dc Converter Market, by Platform, 2018-2021 (USD Million)

Table 16 Space Dc-Dc Converter Market, by Platform, 2022-2027 (USD Million)

7.2 Satellites

Table 17 Satellites: Space Dc-Dc Converter Market, by Type, 2018-2021 (USD Million)

Table 18 Satellites: Space Dc-Dc Converter Market, by Type, 2022-2027 (USD Million)

7.2.1 Cubesats

7.2.1.1 Increasing Launch of Cubesats for Earth Observation

7.2.2 Small Satellites

Table 19 Small Satellites: Space Dc-Dc Converter Market, by Type, 2018-2021 (USD Million)

Table 20 Small Satellites: Space Dc-Dc Converter Market, by Type, 2022-2027 (USD Million)

7.2.2.1 Nanosatellites

7.2.2.1.1 Increasing Demand from Commercial and Government Sectors for Nanosatellite Services

7.2.2.2 Microsatellites

7.2.2.2.1 More Feasible for Commercial Purposes

7.2.2.3 Minisatellites

7.2.2.3.1 Advancements in Miniaturization of Electronic Components Enhance Capabilities of Minisatellites

7.2.3 Medium Satellites

7.2.3.1 Used in Climate & Environment Monitoring, Earth Observation, and Meteorology

7.2.4 Large Satellites

7.2.4.1 Commonly Launched in Geo and for Scientific Missions in Deep-Space Exploration

7.3 Capsules/Cargos

7.3.1 Ability to Survive Reentry and Return Payload to Surface of Earth from Orbit

7.4 Interplanetary Spacecraft & Probes

7.4.1 Countries Like India and China Launching Missions to Sun

7.5 Rovers/Spacecraft Landers

7.5.1 Growing Number of Commercial Lunar Missions

7.6 Launch Vehicles

7.6.1 Increasing Use of Reusable Launch Vehicles

8 Space Dc-Dc Converter Market, by Application

8.1 Introduction

Figure 29 Command & Data Handling Systems Expected to Lead Market During Forecast Period

Table 21 Space Dc-Dc Converter Market, by Application, 2018-2021 (USD Million)

Table 22 Space Dc-Dc Converter Market, by Application, 2022-2027 (USD Million)

8.2 Altitude & Orbital Control Systems

8.2.1 Required for Space Missions and Contains Tested Dc-Dc Converters

8.3 Surface Mobility and Navigation Systems

8.3.1 Increasing Use of Spacecraft/Rovers for Deep Space Exploration

8.4 Command & Data Handling Systems

8.4.1 Growing Launch of Mars Rovers and Small Satellites

8.5 Environmental Monitoring Systems

8.5.1 Need to Track Quality of Environment

8.6 Satellite Thermal Power Box

8.6.1 Need to Maintain Temperature Within Range in Spacecraft and Instruments

8.7 Electric Power Subsystems

8.7.1 Need to Provide Required Secondary Voltages for Payloads and Bus Subsystems

8.8 Power Conditioning Unit (Pcu)

8.8.1 Managing Energy Coming from Several Power Sources

8.9 Others

9 Space Dc-Dc Converter Market, by Type

9.1 Introduction

Figure 30 Isolated Segment to Command Larger Market Size During Forecast Period

Table 23 Space Dc-Dc Converter Market, by Type, 2018-2021 (USD Million)

Table 24 Space Dc-Dc Converter Market, by Type, 2022-2027 (USD Million)

9.2 Isolated

9.2.1 Designed for High-Power Rugged Scenarios

9.3 Non-Isolated

9.3.1 Smaller and Can Fit in Compact Spaces

10 Space Dc-Dc Converter Market, by Form Factor

10.1 Introduction

Figure 31 Enclosed Segment is Expected to Grow at Highest CAGR During Forecast Period

Table 25 Space Dc-Dc Converter Market, by Form Factor, 2018-2021 (USD Million)

Table 26 Space Dc-Dc Converter Market, by Form Factor, 2022-2027 (USD Million)

10.2 Chassis Mount

10.2.1 Better Thermal Efficiency Than Form Factors

10.3 Enclosed

10.3.1 Designed to Operate at Higher Temperatures

10.4 Brick

10.4.1 High Power Density with Lower Operational Noise

10.5 Discrete

10.5.1 Provide Higher Isolation Voltage, Reliability, and Efficiency Than Integrated Modules

11 Space Dc-Dc Converter Market, by Input Voltage

11.1 Introduction

Figure 32 12-40V Segment to Command Largest Market Size During Forecast Period

Table 27 Space Dc-Dc Converter Market, by Input Voltage, 2018-2021 (USD Million)

Table 28 Space Dc-Dc Converter Market, by Input Voltage, 2022-2027 (USD Million)

11.2 <12V

11.2.1 Compact and Provide Single Output

11.3 12-40V

11.3.1 Used for Tracking Subsystems and Memory of Satellites

11.4 42-75V

11.4.1 Employed by Bus in Satellites and Spacecraft

11.5 >75

11.5.1 Generated by Solar Panels of Larger Satellites Such as Geostationary Satellites

12 Space Dc-Dc Converter Market, by Output Voltage

12.1 Introduction

Figure 33 3.3V Segment to Command Market During Forecast Period

Table 29 Space Dc-Dc Converter Market, by Output Voltage, 2018-2021 (USD Million)

Table 30 Space Dc-Dc Converter Market, by Output Voltage, 2022-2027 (USD Million)

12.2 3.3V

12.2.1 Multi-Output Converters with Various Output Levels

12.3 5V

12.3.1 Required in Various Satellite Subsystems

12.4 12V

12.4.1 Used Between Cubesat Power Distribution and 12 Volts Bus

12.5 15V

12.5.1 Required in Active Control Driver Circuit of Satellites

12.6 28V

12.6.1 Used in Power Distribution Units (Pdus) of Larger Satellites

13 Space Dc-Dc Converter Market, by Output Power

13.1 Introduction

Figure 34 >500W Segment to Command Largest Market Size During Forecast Period

Table 31 Space Dc-Dc Converter Market, by Output Power, 2018-2021 (USD Million)

Table 32 Space Dc-Dc Converter Market, by Output Power, 2022-2027 (USD Million)

13.2 10W

13.2.1 Suitable for Converting Power in Compact Board Space

13.3 10-29W

13.3.1 Suitable for Space Applications

13.4 30-99W

13.4.1 Works Efficiently Under Interrupted Power Supply

13.5 100-250W

13.5.1 Suitable for Military and Aerospace Applications

13.6 251-500W

13.6.1 Used in Wide Range of Space Applications

13.7 501-1000W

13.7.1 Available in Brick and Encapsulated Forms

13.8 >1000W

13.8.1 Suitable for Working in Higher Temperatures

14 Space Dc-Dc Converter Market, by Region

14.1 Introduction

Figure 35 Space Dc-Dc Converter Market in North America Projected to Lead During Forecast Period

Table 33 Space Dc-Dc Converter Market, by Region, 2018-2021 (USD Million)

Table 34 Space Dc-Dc Converter Market, by Region, 2022-2027 (USD Million)

14.2 Regional Recession Impact Analysis

Figure 36 Global Pessimistic and Realistic View due to Recession Impact

Figure 37 Regional Recession Impact Analysis

14.3 North America

14.3.1 PESTLE Analysis: North America

Figure 38 North America: Space Dc-Dc Converter Market Snapshot

Table 35 North America: Space Dc-Dc Converter Market, by Country, 2018-2021 (USD Million)

Table 36 North America: Space Dc-Dc Converter Market, by Country, 2022-2027 (USD Million)

Table 37 North America: Space Dc-Dc Converter Market, by Application, 2018-2021 (USD Million)

Table 38 North America: Space Dc-Dc Converter Market, by Application, 2022-2027 (USD Million)

Table 39 North America: Space Dc-Dc Converter Market, by Type, 2018-2021 (USD Million)

Table 40 North America: Space Dc-Dc Converter Market, by Type, 2022-2027 (USD Million)

Table 41 North America: Space Dc-Dc Converter Market, by Platform, 2018-2021 (USD Million)

Table 42 North America: Space Dc-Dc Converter Market, by Platform, 2022-2027 (USD Million)

Table 43 North America: Space Dc-Dc Converter Market in Satellites, by Type, 2018-2021 (USD Million)

Table 44 North America: Space Dc-Dc Converter Market in Satellites, by Type, 2022-2027 (USD Million)

Table 45 North America: Space Dc-Dc Converter Market in Small Satellites, by Type, 2018-2021 (USD Million)

Table 46 North America: Space Dc-Dc Converter Market in Small Satellites, by Type, 2022-2027 (USD Million)

14.3.2 US

14.3.2.1 Increasing Starlink Satellite Launches by Spacex

Table 47 US: Space Dc-Dc Converter Market, by Application, 2018-2021 (USD Million)

Table 48 US: Space Dc-Dc Converter Market, by Application, 2022-2027 (USD Million)

Table 49 US: Space Dc-Dc Converter Market, by Type, 2018-2021 (USD Million)

Table 50 US: Space Dc-Dc Converter Market, by Type, 2022-2027 (USD Million)

Table 51 US: Space Dc-Dc Converter Market, by Platform, 2018-2021 (USD Million)

Table 52 US: Space Dc-Dc Converter Market, by Platform, 2022-2027 (USD Million)

14.3.3 Canada

14.3.3.1 Ongoing Developments in Planetary Exploration

Table 53 Canada: Space Dc-Dc Converter Market, by Application, 2018-2021 (USD Million)

Table 54 Canada: Space Dc-Dc Converter Market, by Application, 2022-2027 (USD Million)

Table 55 Canada: Space Dc-Dc Converter Market, by Type, 2018-2021 (USD Million)

Table 56 Canada: Space Dc-Dc Converter Market, by Type, 2022-2027 (USD Million)

Table 57 Canada: Space Dc-Dc Converter Market, by Platform, 2018-2021 (USD Million)

Table 58 Canada: Space Dc-Dc Converter Market, by Platform, 2022-2027 (USD Million)

14.4 Europe

14.4.1 PESTLE Analysis: Europe

Figure 39 Europe: Space Dc-Dc Converter Market Snapshot

Table 59 Europe: Space Dc-Dc Converter Market, by Country, 2018-2021 (USD Million)

Table 60 Europe: Space Dc-Dc Converter Market, by Country, 2022-2027 (USD Million)

Table 61 Europe: Space Dc-Dc Converter Market, by Application, 2018-2021 (USD Million)

Table 62 Europe: Space Dc-Dc Converter Market, by Application, 2022-2027 (USD Million)

Table 63 Europe: Space Dc-Dc Converter Market, by Type, 2018-2021 (USD Million)

Table 64 Europe: Space Dc-Dc Converter Market, by Type, 2022-2027 (USD Million)

Table 65 Europe: Space Dc-Dc Converter Market, by Platform, 2018-2021 (USD Million)

Table 66 Europe: Space Dc-Dc Converter Market, by Platform, 2022-2027 (USD Million)

Table 67 Europe: Space Dc-Dc Converter Market in Satellites, by Type, 2018-2021 (USD Million)

Table 68 Europe: Space Dc-Dc Converter Market in Satellites, by Type, 2022-2027 (USD Million)

Table 69 Europe: Space Dc-Dc Converter Market in Small Satellites, by Type, 2018-2021 (USD Million)

Table 70 Europe: Space Dc-Dc Converter Market in Small Satellites, by Type, 2022-2027 (USD Million)

14.4.2 Russia

14.4.2.1 Growing Reliability of Indigenous Space Systems

Table 71 Russia: Space Dc-Dc Converter Market, by Application, 2018-2021 (USD Million)

Table 72 Russia: Space Dc-Dc Converter Market, by Application, 2022-2027 (USD Million)

Table 73 Russia: Space Dc-Dc Converter Market, by Type, 2018-2021 (USD Million)

Table 74 Russia: Space Dc-Dc Converter Market, by Type, 2022-2027 (USD Million)

Table 75 Russia: Space Dc-Dc Converter Market, by Platform, 2018-2021 (USD Million)

Table 76 Russia: Space Dc-Dc Converter Market, by Platform, 2022-2027 (USD Million)

14.4.3 UK

14.4.3.1 Development of Small Satellite Configurations and Component Miniaturization

Table 77 UK: Space Dc-Dc Converter Market, by Application, 2018-2021 (USD Million)

Table 78 UK: Space Dc-Dc Converter Market, by Application, 2022-2027 (USD Million)

Table 79 UK: Space Dc-Dc Converter Market, by Type, 2018-2021 (USD Million)

Table 80 UK: Space Dc-Dc Converter Market, by Type, 2022-2027 (USD Million)

Table 81 UK: Space Dc-Dc Converter Market, by Platform, 2018-2021 (USD Million)

Table 82 UK: Space Dc-Dc Converter Market, by Platform, 2022-2027 (USD Million)

14.4.4 Germany

14.4.4.1 Increase in Demand for Cubesats

Table 83 Germany: Space Dc-Dc Converter Market, by Application, 2018-2021 (USD Million)

Table 84 Germany: Space Dc-Dc Converter Market, by Application, 2022-2027 (USD Million)

Table 85 Germany: Space Dc-Dc Converter Market, by Type, 2018-2021 (USD Million)

Table 86 Germany: Space Dc-Dc Converter Market, by Type, 2022-2027 (USD Million)

Table 87 Germany: Space Dc-Dc Converter Market, by Platform, 2018-2021 (USD Million)

Table 88 Germany: Space Dc-Dc Converter Market, by Platform, 2022-2027 (USD Million)

14.4.5 France

14.4.5.1 Growing Partnerships Among Local Companies

Table 89 France: Space Dc-Dc Converter Market, by Application, 2018-2021 (USD Million)

Table 90 France: Space Dc-Dc Converter Market, by Application, 2022-2027 (USD Million)

Table 91 France: Space Dc-Dc Converter Market, by Type, 2018-2021 (USD Million)

Table 92 France: Space Dc-Dc Converter Market, by Type, 2022-2027 (USD Million)

Table 93 France: Space Dc-Dc Converter Market, by Platform, 2018-2021 (USD Million)

Table 94 France: Space Dc-Dc Converter Market, by Platform, 2022-2027 (USD Million)

14.4.6 Italy

14.4.6.1 Rising Focus on Cubesats for Earth Observation and Science Missions

Table 95 Italy: Space Dc-Dc Converter Market, by Application, 2018-2021 (USD Million)

Table 96 Italy: Space Dc-Dc Converter Market, by Application, 2022-2027 (USD Million)

Table 97 Italy: Space Dc-Dc Converter Market, by Type, 2018-2021 (USD Million)

Table 98 Italy: Space Dc-Dc Converter Market, by Type, 2022-2027 (USD Million)

Table 99 Italy: Space Dc-Dc Converter Market, by Platform, 2018-2021 (USD Million)

Table 100 Italy: Space Dc-Dc Converter Market, by Platform, 2022-2027 (USD Million)

14.4.7 Rest of Europe

Table 101 Rest of Europe: Space Dc-Dc Converter Market, by Application, 2018-2021 (USD Million)

Table 102 Rest of Europe: Space Dc-Dc Converter Market, by Application, 2022-2027 (USD Million)

Table 103 Rest of Europe: Space Dc-Dc Converter Market, by Type, 2018-2021 (USD Million)

Table 104 Rest of Europe: Space Dc-Dc Converter Market, by Type, 2022-2027 (USD Million)

Table 105 Rest of Europe: Space Dc-Dc Converter Market, by Platform, 2018-2021 (USD Million)

Table 106 Rest of Europe: Space Dc-Dc Converter Market, by Platform, 2022-2027 (USD Million)

14.5 Asia-Pacific

14.5.1 PESTLE Analysis: Asia-Pacific

Figure 40 Asia-Pacific: Space Dc-Dc Converter Market Snapshot

Table 107 Asia-Pacific: Space Dc-Dc Converter Market, by Country, 2018-2021 (USD Million)

Table 108 Asia-Pacific: Space Dc-Dc Converter Market, by Country, 2022-2027 (USD Million)

Table 109 Asia-Pacific: Space Dc-Dc Converter Market, by Application, 2018-2021 (USD Million)

Table 110 Asia-Pacific: Space Dc-Dc Converter Market, by Application, 2022-2027 (USD Million)

Table 111 Asia-Pacific: Space Dc-Dc Converter Market, by Type, 2018-2021 (USD Million)

Table 112 Asia-Pacific: Space Dc-Dc Converter Market, by Type, 2022-2027 (USD Million)

Table 113 Asia-Pacific: Space Dc-Dc Converter Market, by Platform, 2018-2021 (USD Million)

Table 114 Asia-Pacific: Space Dc-Dc Converter Market, by Platform, 2022-2027 (USD Million)

Table 115 Asia-Pacific: Space Dc-Dc Converter Market in Satellites, by Type, 2018-2021 (USD Million)

Table 116 Asia-Pacific: Space Dc-Dc Converter Market in Satellites, by Type, 2022-2027 (USD Million)

Table 117 Asia-Pacific: Space Dc-Dc Converter Market in Small Satellites, by Type, 2018-2021 (USD Million)

Table 118 Asia-Pacific: Space Dc-Dc Converter Market in Small Satellites, by Type, 2022-2027 (USD Million)

14.5.2 China

14.5.2.1 Rapid Expansion of Commercial Space Sector

Table 119 China: Space Dc-Dc Converter Market, by Application, 2018-2021 (USD Million)

Table 120 China: Space Dc-Dc Converter Market, by Application, 2022-2027 (USD Million)

Table 121 China: Space Dc-Dc Converter Market, by Type, 2018-2021 (USD Million)

Table 122 China: Space Dc-Dc Converter Market, by Type, 2022-2027 (USD Million)

Table 123 China: Space Dc-Dc Converter Market, by Platform, 2018-2021 (USD Million)

Table 124 China: Space Dc-Dc Converter Market, by Platform, 2022-2027 (USD Million)

14.5.3 India

14.5.3.1 Increase in Funding for Space Startups

Table 125 India: Space Dc-Dc Converter Market, by Application, 2018-2021 (USD Million)

Table 126 India: Space Dc-Dc Converter Market, by Application, 2022-2027 (USD Million)

Table 127 India: Space Dc-Dc Converter Market, by Type, 2018-2021 (USD Million)

Table 128 India: Space Dc-Dc Converter Market, by Type, 2022-2027 (USD Million)

Table 129 India: Space Dc-Dc Converter Market, by Platform, 2018-2021 (USD Million)

Table 130 India: Space Dc-Dc Converter Market, by Platform, 2022-2027 (USD Million)

14.5.4 Japan

14.5.4.1 High Number of Planned Missions of Private and Public Space Players

Table 131 Japan: Space Dc-Dc Converter Market, by Application, 2018-2021 (USD Million)

Table 132 Japan: Space Dc-Dc Converter Market, by Application, 2022-2027 (USD Million)

Table 133 Japan: Space Dc-Dc Converter Market, by Type, 2018-2021 (USD Million)

Table 134 Japan: Space Dc-Dc Converter Market, by Type, 2022-2027 (USD Million)

Table 135 Japan: Space Dc-Dc Converter Market, by Platform, 2018-2021 (USD Million)

Table 136 Japan: Space Dc-Dc Converter Market, by Platform, 2022-2027 (USD Million)

14.5.5 South Korea

14.5.5.1 Excavation of Space Minerals for Future Economic Growth

Table 137 South Korea: Space Dc-Dc Converter Market, by Application, 2018-2021 (USD Million)

Table 138 South Korea: Space Dc-Dc Converter Market, by Application, 2022-2027 (USD Million)

Table 139 South Korea: Space Dc-Dc Converter Market, by Type, 2018-2021 (USD Million)

Table 140 South Korea: Space Dc-Dc Converter Market, by Type, 2022-2027 (USD Million)

Table 141 South Korea: Space Dc-Dc Converter Market, by Platform, 2018-2021 (USD Million)

Table 142 South Korea: Space Dc-Dc Converter Market, by Platform, 2022-2027 (USD Million)

14.5.6 Australia

14.5.6.1 Growing Involvement in National and International Space Activities

Table 143 Australia: Space Dc-Dc Converter Market, by Application, 2018-2021 (USD Million)

Table 144 Australia: Space Dc-Dc Converter Market, by Application, 2022-2027 (USD Million)

Table 145 Australia: Space Dc-Dc Converter Market, by Type, 2018-2021 (USD Million)

Table 146 Australia: Space Dc-Dc Converter Market, by Type, 2022-2027 (USD Million)

Table 147 Australia: Space Dc-Dc Converter Market, by Platform, 2018-2021 (USD Million)

Table 148 Australia: Space Dc-Dc Converter Market, by Platform, 2022-2027 (USD Million)

14.6 Rest of World

Table 149 Rest of World: Space Dc-Dc Converter Market, by Country, 2018-2021 (USD Million)

Table 150 Rest of World: Space Dc-Dc Converter Market, by Country, 2022-2027 (USD Million)

Table 151 Rest of World: Space Dc-Dc Converter Market, by Application, 2018-2021 (USD Million)

Table 152 Rest of World: Space Dc-Dc Converter Market, by Application, 2022-2027 (USD Million)

Table 153 Rest of World: Space Dc-Dc Converter Market, by Type, 2018-2021 (USD Million)

Table 154 Rest of World: Space Dc-Dc Converter Market, by Type, 2022-2027 (USD Million)

Table 155 Rest of World: Space Dc-Dc Converter Market, by Platform, 2018-2021 (USD Million)

Table 156 Rest of World: Space Dc-Dc Converter Market, by Platform, 2022-2027 (USD Million)

Table 157 Rest of World: Space Dc-Dc Converter Market in Satellites, by Type, 2018-2021 (USD Million)

Table 158 Rest of World: Space Dc-Dc Converter Market in Satellites, by Type, 2022-2027 (USD Million)

Table 159 Rest of World: Space Dc-Dc Converter Market in Small Satellites, by Type, 2018-2021 (USD Million)

Table 160 Rest of World: Space Dc-Dc Converter Market in Small Satellites, by Type, 2022-2027 (USD Million)

14.6.1 Middle East & Africa

Table 161 Middle East & Africa: Space Dc-Dc Converter Market, by Application, 2018-2021 (USD Million)

Table 162 Middle East & Africa: Space Dc-Dc Converter Market, by Application, 2022-2027 (USD Million)

Table 163 Middle East & Africa: Space Dc-Dc Converter Market, by Type, 2018-2021 (USD Million)

Table 164 Middle East & Africa: Space Dc-Dc Converter Market, by Type, 2022-2027 (USD Million)

Table 165 Middle East & Africa: Space Dc-Dc Converter Market, by Platform, 2018-2021 (USD Million)

Table 166 Middle East & Africa: Space Dc-Dc Converter Market, by Platform, 2022-2027 (USD Million)

14.6.2 Latin America

Table 167 Latin America: Space Dc-Dc Converter Market, by Application, 2018-2021 (USD Million)

Table 168 Latin America: Space Dc-Dc Converter Market, by Application, 2022-2027 (USD Million)

Table 169 Latin America: Space Dc-Dc Converter Market, by Type, 2018-2021 (USD Million)

Table 170 Latin America: Space Dc-Dc Converter Market, by Type, 2022-2027 (USD Million)

Table 171 Latin America: Space Dc-Dc Converter Market, by Platform, 2018-2021 (USD Million)

Table 172 Latin America: Space Dc-Dc Converter Market, by Platform, 2022-2027 (USD Million)

15 Competitive Landscape

15.1 Introduction

15.2 Competitive Overview

15.2.1 Key Developments of Leading Players in Space Dc-Dc Converter Market (2018-2021)

Table 173 Key Developments of Leading Players: Space Dc-Dc Converter Market

15.3 Ranking Analysis of Key Market Players, 2021

Figure 41 Ranking Analysis of Top Five Players, 2021

15.4 Market Share Analysis of Leading Players, 2021

Figure 42 Market Share Analysis of Key Companies

Table 174 Degree of Competition

15.5 Revenue Analysis 2019-2021

Figure 43 Collective Revenue Share of Top Five Players

15.6 Company Evaluation Quadrant

15.6.1 Stars

15.6.2 Emerging Leaders

15.6.3 Pervasive Players

15.6.4 Participants

Figure 44 Space Dc-Dc Converter Market: Company Evaluation Quadrant, 2021

15.6.5 Competitive Benchmarking

Table 175 Company Footprint

Table 176 Company Platform Footprint

Table 177 Company Product Type Footprint

Table 178 Company Region Footprint

15.7 Startup/Sme Evaluation Quadrant

15.7.1 Progressive Companies

15.7.2 Responsive Companies

15.7.3 Starting Blocks

15.7.4 Dynamic Companies

Figure 45 (Startup/Sme) Competitive Leadership Mapping, 2022

15.8 Competitive Scenario

15.8.1 Acquisitions

Table 179 Acquisitions, 2018-2021

15.8.2 Product Development

Table 180 Product Development, 2018-2021

15.8.3 Deals

Table 181 Deals, 2018-2021

16 Company Profiles

16.1 Introduction

(Business Overview, Products Offered, Recent Developments & Analyst's View)*

16.2 Key Players

16.2.1 Texas Instruments Incorporated

Table 182 Texas Instruments Incorporated: Business Overview

Figure 46 Texas Instruments Incorporated: Company Snapshot

Table 183 Texas Instruments Incorporated: Products Offered

16.2.2 Stmicroelectronics

Table 184 Stmicroelectronics: Business Overview

Figure 47 Stmicroelectronics: Company Snapshot

Table 185 Stmicroelectronics: Products

16.2.3 Crane Co.

Table 186 Crane Co.: Business Overview

Figure 48 Crane Co.: Company Snapshot

Table 187 Crane Co.: Products Offered

16.2.4 Astronics Corporation

Table 188 Astronics Corporation: Business Overview

Figure 49 Astronics Corporation: Company Snapshot

Table 189 Astronics Corporation: Products

16.2.5 Infineon Technologies Ag

Table 190 Infineon Technologies Ag: Business Overview

Figure 50 Infineon Technologies Ag: Company Snapshot

Table 191 Infineon Technologies Ag: Products Offered

16.2.6 Vicor Corporation

Table 192 Vicor Corporation: Business Overview

Figure 51 Vicor Corporation: Company Snapshot

Table 193 Vicor Corporation: Products Offered

Table 194 Vicor Corporation: Deals

16.2.7 Advanced Energy Industries Inc.

Table 195 Advanced Energy Industries Inc.: Business Overview

Figure 52 Advanced Energy Industries Inc.: Company Snapshot

Table 196 Advanced Energy Industries Inc.: Products Offered

16.2.8 Modular Devices Inc.

Table 197 Modular Devices Inc.: Business Overview

Table 198 Modular Devices Inc.: Products Offered

Table 199 Modular Devices Inc.: Product Launches

16.2.9 Thales Group

Table 200 Thales Group: Business Overview

Figure 53 Thales Group: Company Snapshot

Table 201 Thales Group: Products Offered

16.2.10 Airbus Group Se

Table 202 Airbus Group Se: Business Overview

Figure 54 Airbus Group Se: Company Snapshot

Table 203 Airbus Group Se: Products Offered

16.2.11 Microsemi Corporation

Table 204 Microsemi Corporation: Business Overview

Table 205 Microsemi Corporation: Products Offered

Table 206 Microsemi Corporation: Acquisitions

16.2.12 Synqor Inc.

Table 207 Synqor Inc.: Business Overview

Table 208 Synqor Inc.: Products Offered

16.2.13 Vpt

Table 209 Vpt: Business Overview

Table 210 Vpt: Products Offered

16.2.14 Epc Space

Table 211 Epc Space: Business Overview

Table 212 Epc Space: Products Offered

16.2.15 Renesas Electronics Corporation

Table 213 Renesas Electronics Corporation: Business Overview

Figure 55 Renesas Electronics Corporation: Company Snapshot

Table 214 Renesas Electronics Corporation: Products Offered

16.3 Other Players

16.3.1 Asp-Equipment GmbH

Table 215 Asp-Equipment GmbH: Business Overview

Table 216 Asp-Equipment GmbH: Products Offered

16.3.2 Analog Devices, Inc.

Table 217 Analog Devices, Inc.: Business Overview

Table 218 Analog Devices, Inc.: Products Offered

16.3.3 Ttm Technologies Inc.

Table 219 Ttm Technologies Inc.: Business Overview

Figure 56 Ttm Technologies Inc.: Company Snapshot

Table 220 Ttm Technologies Inc.: Products Offered

16.3.4 Isocom Limited

Table 221 Isocom Limited: Business Overview

Table 222 Isocom Limited: Products Offered

16.3.5 Cissoid

Table 223 Cissoid: Business Overview

Table 224 Cissoid: Products Offered

16.3.6 Nippon Avionics Co., Ltd.

Table 225 Nippon Avionics Co., Ltd.: Business Overview

Table 226 Nippon Avionics Co., Ltd.: Products Offered

16.3.7 3D Plus

Table 227 3D Plus: Business Overview

Table 228 3D Plus: Products Offered

16.3.8 Sitael S.P.A.

Table 229 Sitael S.P.A.: Business Overview

Table 230 Sitael S.P.A.: Products Offered

16.3.9 Tame Power

Table 231 Tame Power: Business Overview

Table 232 Tame Power: Products Offered

16.3.10 Aj's Power Source

Table 233 Aj's Power Source: Business Overview

Table 234 Aj's Power Source: Products Offered

*Details on Business Overview, Products Offered, Recent Developments & Analyst's View Might Not be Captured in Case of Unlisted Companies.

17 Appendix

17.1 Discussion Guide

17.2 Knowledgestore: The Subscription Portal

17.3 Customizations Options

Executive Summary

Companies Mentioned

- 3D Plus

- Advanced Energy Industries Inc.

- Airbus Group Se

- Aj's Power Source

- Analog Devices, Inc.

- Asp-Equipment GmbH

- Astronics Corporation

- Cissoid

- Crane Co.

- Epc Space

- Infineon Technologies Ag

- Isocom Limited

- Microsemi Corporation

- Modular Devices Inc.

- Nippon Avionics Co., Ltd.

- Renesas Electronics Corporation

- Sitael S.P.A.

- Stmicroelectronics

- Synqor Inc.

- Tame Power

- Texas Instruments Incorporated

- Thales Group

- Ttm Technologies Inc.

- Vicor Corporation

- Vpt

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 221 |

| Published | February 2023 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 37 Million |

| Forecasted Market Value ( USD | $ 66 Million |

| Compound Annual Growth Rate | 12.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |