This report provides an in depth analysis of China cosmetics market by value, by category, by retail channel, by product, etc. The report also provides a detailed analysis of the COVID-19 impact on the China cosmetics market.

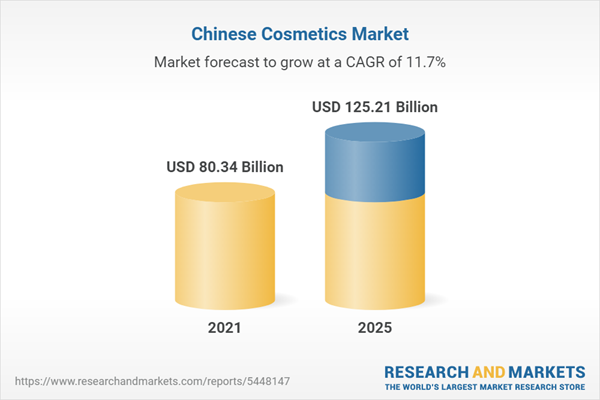

The report also assesses the key opportunities in the market and outlines the factors that are and would be driving the growth of the industry. Growth of the overall China cosmetics market has also been forecasted for the period 2021-2025, taking into consideration the previous growth patterns, the growth drivers and the current and future trends.

China cosmetics market is fragmented with many major market players operating in China. China’s market has mostly been dominated by foreign firms. The premium cosmetics market is fairly concentrated as global leaders have a strong presence and the mass cosmetics market is more fragmented. The key players of the China cosmetics market are L’Oréal SA, Shiseido Co. Ltd., The Procter & Gamble Company, and The Estée Lauder Companies Inc. are also profiled with their respective business strategies.

The report also assesses the key opportunities in the market and outlines the factors that are and would be driving the growth of the industry. Growth of the overall China cosmetics market has also been forecasted for the period 2021-2025, taking into consideration the previous growth patterns, the growth drivers and the current and future trends.

China cosmetics market is fragmented with many major market players operating in China. China’s market has mostly been dominated by foreign firms. The premium cosmetics market is fairly concentrated as global leaders have a strong presence and the mass cosmetics market is more fragmented. The key players of the China cosmetics market are L’Oréal SA, Shiseido Co. Ltd., The Procter & Gamble Company, and The Estée Lauder Companies Inc. are also profiled with their respective business strategies.

Country Coverage

- China

Company Coverage

- L’Oréal SA

- Shiseido Co. Ltd.

- The Procter & Gamble Company

- The Estée Lauder Companies Inc.

Table of Contents

1. Executive Summary

2. Introduction

3. China Market Analysis

4. Impact of COVID-19

5. Market Dynamics

6. Competitive Landscape

7. Company Profiles

List of Figures

Executive Summary

China cosmetics market can be segmented based on category (Skincare, Color Cosmetics, Fragrances, Other Categories); retail channel (E-commerce, Departmental Store, Beauty Specialist Retailers and Others); and product (Mass and Premium).The China cosmetics market has increased at a significant CAGR during the years 2016-2020 and projections are made that the market would rise in the next four years i.e. 2021-2025.

The China cosmetics market is expected to increase, due to escalating influence of social media, rapid urbanization, rising pollution due to industrialization, dominating cosmetics consumption by millennial and gen z generations, increasing per capita expenditure on personal appearance, escalating female population, rising online penetration of cosmetics, surging occurrence of cosmetic fairs & exhibitions, standardized regulation, tax cuts for premium cosmetics, increasing number of beauty salons, strong brand awareness among consumers, etc. yet the market faces some challenges such as skin allergies/counterfeit products, environmental issues, etc.

Companies Mentioned

- L’Oréal SA

- Shiseido Co. Ltd.

- The Procter & Gamble Company

- The Estée Lauder Companies Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 104 |

| Published | September 2021 |

| Forecast Period | 2021 - 2025 |

| Estimated Market Value ( USD | $ 80.34 Billion |

| Forecasted Market Value ( USD | $ 125.21 Billion |

| Compound Annual Growth Rate | 11.7% |

| Regions Covered | China |

| No. of Companies Mentioned | 4 |