Geopolitical Instabilities Leading to Procurement of Advanced Missile Systems

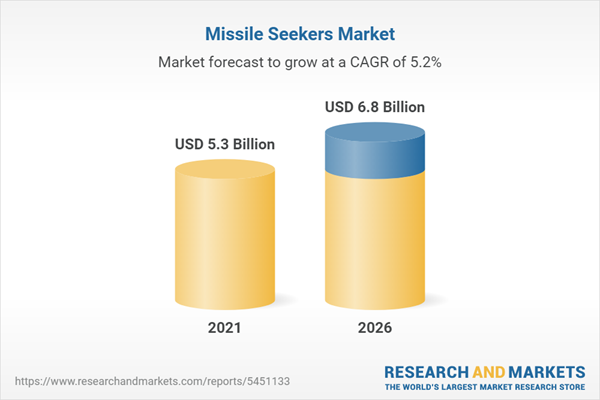

The global missile seekers market size is projected to grow from USD 5.3 billion in 2021 to USD 6.8 billion by 2026, at a CAGR of 5.2% from 2021 to 2026. The market is driven by various factors, such as geopolitical instabilities, changing nature of warfare, increasing defense expenditure of emerging economies, and technological advancements in missile seekers.

The missile seekers market will majorly be driven by the changing nature of warfare in the forecasted year. The advancements in technology have led to the development of new and advanced defense systems, including air defense systems and guided missiles for hitting moving targets. The changing nature of warfare across the globe has led to the acquisition of advanced missile firing and defending capabilities by militaries of various countries. These militaries are increasingly engaged in low-intensity battles. One example of the changing nature of warfare was the Indian military’s reply to the Pulwama attack, where the Indian Air Force fighter planes destroyed a terrorist camp in Balakot (Pakistan) using guided missiles.

Advanced missile defense capabilities help countries in defending themselves against rocket and missile attacks. For instance, Israel’s Iron Dome air defense system prevented more than 2,500 missile and mortar attacks with a success rate greater than 90%. The missile seeker in such a system plays the most important role of making sure the missiles fired by the defense system hit the targets accurately. This fueled the development of more advanced air defense systems, which use ground-to-air missiles with guided seekers, with a success rate greater than 90%. Thus, the changing nature of warfare has resulted in the increased demand for highly advanced seekers for missiles from militaries across the globe.

The missile seekers market includes major players BAE Systems (UK), Boeing (US), Leonardo S.p.A. (Italy), Raytheon Technologies (US), Safran Group (France), Thales (France), and Northrop Grumman Corporation (US). These players have spread their business across various countries includes North America, Europe, Asia Pacific, Middle East, and the Rest of the World. COVID-19 has impacted their businesses as well. Industry experts believe that COVID-19 has affected missile seekers production and services globally in 2020.

Infrared Technology: The largest segment of the Missile Seekers market, by Technology.

The infrared technology is projected to dominate the missile seekers market during the forecast period. Infrared technology is capable of tracking the heat generated by an object. In missile guidance systems, infrared tracks the target based on the heat generated by it. Infrared is a passive type of homing technology which is effective in anti-aircraft missiles as it detects the heat generated by the jet engines of aircraft. Cross-array seekers and rosette seekers make use of infrared technology to guide missiles.

Interceptor: The fastest-growing segment of the missile seekers market, by Missile Type.

Based on the missile type, interceptor missiles is projected to grow at the highest CAGR for the missile seekers market during the forecast period. Interceptor missiles are anti-ballistic missiles used to counter ballistic missiles like intercontinental and intermediate-range ballistic missiles launched from any enemy country and to counter aircraft and other missiles. S400, Arrow 2, Arrow 3, THAAD, Patriot missile defense system, and Barak 8 are interceptor missiles used to defend against any kind of airborne threats, such as helicopters, aircraft, UAVs, anti-ship missiles, and ballistic missiles.

Air-to-Air: The fastest-growing segment of the missile seekers market, by Launch Mode.

Based on the launch mode, the air-to-air segment is projected to grow at the highest CAGR rate for the missile seekers market during the forecast period. Air-to-air missiles are launched from aircraft, helicopters, or unmanned combat aerial vehicles (UCAVs) to destroy enemy aircraft. The warhead types of air-to-air missiles are fragmentation warheads or continuous rod warheads. These missiles detect their targets using radars or infrared guidance systems and can fly at a very high speed. These missiles are long and have narrow cross-sections to reduce drag.

North America: The largest contributing region in the missile seekers market.

North America is projected to be the largest regional share of the global missile seekers market during the forecast period. Major companies, such as Raytheon Technologies, Northrop Grumman Corporation, and SemiConductor Devices, and small-scale private companies, such as Excelitas Technologies Corp, Marotta Controls, and KODA Technologies Inc., are based in the US. These players continuously invest in the R&D of new & improved missile seeker designs.

The missile seekers market in North America is driven by the increasing need for advanced defense systems from the US military. Missile seekers are the systems used in missiles to guide them on the right trajectory to accurately hit the desired targets. Recent technological developments in defense systems, including guided missiles, have led to the increased demand for more efficient missile seekers.

Canada has shown no interest in developing its own missile systems; the country relies on the US for its defense systems, including missile systems.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1-35%; Tier 2-45%; and Tier 3-20%

- By Designation: C Level-35%; Directors-25%; and Others-40%

- By Region: North America-40%; Europe-20%; Asia Pacific-30%; Middle East & Africa-5%; and South America-5%

BAE Systems (UK), Boeing (US), Leonardo S.p.A. (Italy), Raytheon Technologies (US), Safran Group (France), Thales (France), and Northrop Grumman Corporation (US) are some of the leading players operating in the missile seekers market report.

Research Coverage

The study covers the missile seekers market across various segments and subsegments. It aims at estimating the size and growth potential of this market across different segments based on technology, missile type, launch mode, and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their product and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Reasons to Buy this Report

This report is expected to help market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall missile seekers market and its segments. This study is also expected to provide region-wise information about the end-use, and wherein missile seekers are used. This report aims at helping the stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. This report is also expected to help them understand the pulse of the market and provide them with information on key drivers, restraints, challenges, and opportunities influencing the growth of the market.

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Inclusions & Exclusions

1.5 Currency & Pricing

1.6 USD Exchange Rates

1.7 Limitations

1.8 Stakeholders

2 Research Methodology

2.1 Research Data

Figure 1 Report Process Flow

Figure 2 Research Design

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Primary Sources

2.2 Market Size Estimation

2.2.1 Segments and Subsegments

2.3 Research Approach & Methodology

2.3.1 Bottom-Up Approach

2.3.2 Missile Seekers Market for Verticals

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

2.3.3 Top-Down Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

2.4 Data Triangulation

Figure 5 Data Triangulation

2.4.1 Triangulation Through Primary and Secondary Research

2.5 Growth Rate Assumptions

2.6 Assumptions for the Research Study

2.7 Risks

3 Executive Summary

Figure 6 by Technology, Multi-Mode Segment Projected to Register Highest CAGR During Forecast Period

Figure 7 by Missile Type, Interceptor Segment Estimated to Lead Missile Seekers Market During Forecast Period

Figure 8 North America Estimated to Lead Missile Seekers Market in 2021

4 Premium Insights

4.1 Attractive Growth Opportunities in Missile Seekers Market

Figure 9 Changing Nature of Warfare to Drive Missile Seekers Market Growth

4.2 Missile Seekers Market, By Launch Mode

Figure 10 Surface-To-Air Segment Estimated to Lead Missile Seekers Market from 2021 to 2026

4.3 North America Missile Seekers Market, by Technology

Figure 11 Infrared Segment to Lead Missile Seekers Market from 2021 to 2026

4.4 Missile Seekers Market, by Country

Figure 12 India Projected to be Fastest-Growing Market from 2021 to 2026

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 13 Missile Seekers Market Dynamics

5.2.1 Drivers

5.2.1.1 Geopolitical Instabilities Leading to Procurement of Advanced Missile Systems

Table 1 List of Ongoing Geopolitical Issues and Conflicts

5.2.1.2 Changing Nature of Warfare

5.2.1.3 Increasing Defense Expenditure of Emerging Economies

Table 2 Defense Budget of India & China, 2015-2020 (USD Billion)

5.2.1.4 Technological Advancements in Missile Seekers

5.2.2 Restraints

5.2.2.1 Procurement of Conventional Warfare Systems Rather Than Advanced Precision-Guided Munition by Many Countries

5.2.2.2 High Manufacturing Cost

Table 3 Manufacturing Cost of Missiles Developed for US Military

5.2.3 Opportunities

5.2.3.1 Miniaturization of Missiles and Their Components

5.2.3.2 Support for Researchers and Manufacturers for Developing Missile Seeker Solutions

5.2.3.3 Depleting Stock of Precision-Guided Missiles

5.2.4 Challenges

5.2.4.1 Delivering Products of Highest Standards Every Time

5.2.4.2 Regulations on the Use of Missiles

5.3 COVID-19 Impact Scenarios

5.4 COVID-19 Impact on Missile Seekers Market

Figure 14 COVID-19 Impact on Missile Seekers Market

5.4.1 Demand-Side Impact

5.4.1.1 Key Developments from January 2020 to August 2021

Table 4 Key Developments in Missile Seekers Market 2020-2021

5.4.2 Supply-Side Impact

5.5 Trends/Disruptions Impacting Customers’ Business

5.5.1 Development of Highly Accurate Missiles Capable of Hitting Moving Targets (Stormbreaker)

5.5.2 Development of Akash Surface-To-Air Missile Systems from Bel

5.5.3 3-D Printed Missiles

Figure 15 Trends and Disruptions Impacting Customers

5.6 Market Ecosystem

5.6.1 Prominent Companies

5.6.2 Private and Small Enterprises

5.6.3 End-users

Figure 16 Missile Seekers Ecosystem

Table 5 Missile Seekers Market Ecosystem

5.7 Pricing Analysis

5.7.1 Average Selling Price Analysis of Missile Seekers in 2020

5.8 Tariff Regulatory Landscape for Defense Industry

5.9 Trade Data

5.9.1 Trade Analysis

Table 6 Country-Wise Exports, 2019-2020 (USD Thousand)

Table 7 Country-Wise Imports, 2019-2020 (USD Thousand)

5.10 Value Chain Analysis of Missile Seekers Market

Figure 17 Value Chain Analysis

5.11 Porter's Five Forces Model

5.11.1 Missile Seekers Market: Porter's Five Forces Analysis

5.11.2 Threat of New Entrants

5.11.3 Threat of Substitutes

5.11.4 Bargaining Power of Suppliers

5.11.5 Bargaining Power of Buyers

5.11.6 Competition in the Industry

5.12 Technology Analysis

5.12.1 Development of Precision-Guidance Seekers

5.13 Use Cases

5.13.1 Missile Seekers Developed by Tata Advanced Systems Ltd.

6 Industry Trends

6.1 Introduction

6.2 Supply Chain Analysis

Figure 18 Supply Chain Analysis

6.2.1 Major Companies

6.2.2 Small and Medium Enterprises

6.2.3 End-users/Customers

6.3 Emerging Industry Trends

6.3.1 Reduction in Size

6.3.2 Imaging Infrared(I2R) Technology

6.3.3 Precision Guided Missile Seeker

6.3.4 Fiber-Optic Guidance Systems

6.3.5 Automatic Target Recognition (Atr)

6.3.6 Use of Synthetic Aperture Radar (Sar) in Missile Seekers

6.4 Innovations and Patents Registrations, 2012-2021

6.5 Impact of Megatrend

6.5.1 Use of Ai in Defense

6.5.2 Constant Innovation in the Defense Sector

7 Missile Seekers Market, by Technology

7.1 Introduction

Figure 19 Infrared Segment to Command Largest Market Size During Forecast Period

Table 8 by Technology, Missile Seekers Market Size, 2018-2026 (USD Million)

7.2 Radar

7.2.1 Active Radar

7.2.1.1 High Accuracy Makes Active Radar An Attractive Technology

Table 9 Missiles Using Active Radar Seekers

7.2.2 Semi-Active Radar

7.2.2.1 Demand for Anti-Aircraft Systems Will Drive the Market

Table 10 Missiles Using Semi-Active Radar Seekers

7.2.3 Passive Radar

7.2.3.1 Simple Design to Drive Demand

Table 11 Missiles Using Passive Radar Seekers

7.3 Infrared

7.3.1 Imaging Infrared Technology to Drive Demand

Table 12 Missiles Using Infrared Seekers

7.4 Laser

7.4.1 Short-Range Missiles to Drive Demand

Table 13 Missiles Using Laser-Based Seekers

7.5 Multi-Mode

7.5.1 Need for High Accuracy in Unknown Terrain Will Drive Demand

Table 14 Missiles Using Multi-Mode Seekers

8 Missile Seekers Market, by Missile Type

8.1 Introduction

Figure 20 Interceptor Segment to Command Largest Market Size During Forecast Period

Table 15 by Missile Type, Missile Seekers Market Size, 2018-2026 (USD Million)

8.2 Cruise

8.2.1 Need for Missiles to Travel Undetected Will Drive the Demand

8.3 Ballistic

8.3.1 Rising Border Disputes Will Fuel Growth

8.4 Conventional Guided

8.4.1 Growth in Combat UAVs Will Drive the Market

8.5 Interceptor

8.5.1 Border Tension Between Countries Will Fuel the Market

9 Missile Seekers Market, By Launch Mode

9.1 Introduction

Figure 21 Surface-To-Air Segment to Command Largest Market Size During Forecast Period

Table 16 by Launch Mode, Missile Seekers Market Size, 2018-2026 (USD Million)

9.2 Surface-To-Surface

9.2.1 Investment by Homegrown Companies Will Drive the Market

9.3 Surface-To-Air

9.3.1 Increase in Missile Defense System Will Drive the Market

9.4 Air-To-Air

9.4.1 Border Disputes Will Fuel the Market

9.5 Air-To-Surface

9.5.1 Increase in Overseas Combat Operations by Nato Countries Will Drive the Market

10 Regional Analysis

10.1 Introduction

Figure 22 Missile Seekers Market: Regional Snapshot

10.2 Impact of COVID-19

Figure 23 COVID-19 Impact on Missile Seekers Market

Table 17 Missile Seekers Market Size, by Region, 2018-2026 (USD Million)

Table 18 Missile Seekers Market Size, by Technology, 2018-2026 (USD Million)

Table 19 Missile Seekers Market Size, by Missile Type, 2018-2026 (USD Million)

Table 20 Missile Seekers Market Size, by Launch Mode, 2018-2026 (USD Million)

10.3 North America

10.3.1 Impact of COVID-19

10.3.2 PESTLE Analysis: North America

Figure 24 North America: Missile Seekers Market Snapshot

Table 21 North America: Missile Seekers Market Size, by Country, 2018-2026(USD Million)

Table 22 North America: Missile Seekers Market Size, by Technology, 2018-2026 (USD Million)

Table 23 North America: Missile Seekers Market Size, by Missile Type, 2018-2026 (USD Million)

Table 24 North America: Missile Seekers Market Size, by Launch Mode, 2018-2026 (USD Million)

10.3.3 US

10.3.3.1 Presence of Key Manufacturers to Drive the Missile Seekers Market in the US

Figure 25 US: Military Spending, 2010-2020 (USD Billion)

Table 25 US: Missile Seekers Market Size, by Technology, 2018-2026 (USD Million)

Table 26 US: Missile Seekers Market Size, by Missile Type, 2018-2026 (USD Million)

Table 27 US: Missile Seekers Market Size, by Launch Mode, 2018-2026 (USD Million)

10.3.4 Canada

10.3.4.1 Increasing Demand for Small Satellites Leading to Expansion of Manufacturing Facilities

Figure 26 Canada: Military Spending, 2010-2020 (USD Billion)

Table 28 Canada: Missile Seekers Market Size, by Technology, 2018-2026 (USD Million)

Table 29 Canada: Missile Seekers Market Size, by Missile Type, 2018-2026 (USD Million)

Table 30 Canada: Missile Seekers Market Size, by Launch Mode, 2018-2026 (USD Million)

10.4 Europe

10.4.1 Impact of COVID-19

10.4.2 PESTLE Analysis: Europe

Figure 27 Europe: Missile Seekers Market Snapshot

Table 31 Europe: Missile Seekers Market Size, by Country, 2018-2026(USD Million)

Table 32 Europe: Missile Seekers Market Size, by Technology, 2018-2026 (USD Million)

Table 33 Europe: Missile Seekers Market Size, by Missile Type, 2018-2026 (USD Million)

Table 34 Europe: Missile Seekers Market Size, by Launch Mode, 2018-2026 (USD Million)

10.4.3 Russia

10.4.3.1 Development of Advanced Missiles by the Russian Army is Driving the Market Growth in the Country

Figure 28 Russia: Military Spending, 2010-2020 (USD Billion)

Table 35 Russia: Missile Seekers Market Size, by Technology, 2018-2026 (USD Million)

Table 36 Russia: Missile Seekers Market Size, by Missile Type, 2018-2026 (USD Million)

Table 37 Russia: Missile Seekers Market Size, by Launch Mode, 2018-2026 (USD Million)

10.4.4 UK

10.4.4.1 The Presence of Missile Manufacturers to Drive Demand

Figure 29 UK: Military Spending, 2010-2020 (USD Billion)

Table 38 UK: Missile Seekers Market Size, by Technology, 2018-2026 (USD Million)

Table 39 UK: Missile Seekers Market Size, by Missile Type, 2018-2026 (USD Million)

Table 40 UK: Missile Seekers Market Size, by Launch Mode, 2018-2026 (USD Million)

10.4.5 France

10.4.5.1 The Presence of Key Defense Manufacturers to Drive Demand for Missile Seekers

Figure 30 France: Military Spending, 2010-2020 (USD Billion)

Table 41 France: Missile Seekers Market Size, by Technology, 2018-2026 (USD Million)

Table 42 France: Missile Seekers Market Size, by Missile Type, 2018-2026 (USD Million)

Table 43 France: Missile Seekers Market Size, by Launch Mode, 2018-2026 (USD Million)

10.4.6 Norway

10.4.6.1 The Use of Advanced Missiles by Norway's Military to Drive the Market for Missile Seekers

Table 44 Norway: Missile Seekers Market Size, by Technology, 2018-2026 (USD Million)

Table 45 Norway: Missile Seekers Market Size, by Missile Type, 2018-2026 (USD Million)

Table 46 Norway: Missile Seekers Market Size, by Launch Mode, 2018-2026 (USD Million)

10.4.7 Rest of Europe

10.4.7.1 The Development of New Missiles to Drive the Demand

Table 47 Rest of Europe: Missile Seekers Market Size, by Technology, 2018-2026 (USD Million)

Table 48 Rest of Europe: Missile Seekers Market Size, by Missile Type, 2018-2026 (USD Million)

Table 49 Rest of Europe: Missile Seekers Market Size, by Launch Mode, 2018-2026 (USD Million)

10.5 Asia-Pacific

10.5.1 COVID-19 Impact on Asia-Pacific

10.5.2 PESTLE Analysis: Asia-Pacific

Figure 31 Asia-Pacific: Missile Seekers Market Snapshot

Table 50 Asia-Pacific: Missile Seekers Market Size, by Country, 2018-2026 (USD Million)

Table 51 Asia-Pacific: Missile Seekers Market Size, by Technology, 2018-2026 (USD Million)

Table 52 Asia-Pacific: Missile Seekers Market Size, by Missile Type, 2018-2026 (USD Million)

Table 53 Asia-Pacific: Missile Seekers Market Size, by Launch Mode, 2018-2026 (USD Million)

10.5.3 China

10.5.3.1 High Defense Expenditure to Drive the Market for Missile Seekers in China

Figure 32 China: Military Spending, 2010-2020 (USD Billion)

Table 54 China: Missile Seekers Market Size, by Technology, 2018-2026 (USD Million)

Table 55 China: Missile Seekers Market Size, by Missile Type, 2018-2026 (USD Million)

Table 56 China: Missile Seekers Market Size, by Launch Mode, 2018-2026 (USD Million)

10.5.4 India

10.5.4.1 Modernization of Armed Forces to Drive the Market for Missile Seekers in India

Figure 33 India: Military Spending, 2010-2020 (USD Billion)

Table 57 India: Missile Seekers Market Size, by Technology, 2018-2026 (USD Million)

Table 58 India: Missile Seekers Market Size, by Missile Type, 2018-2026 (USD Million)

Table 59 India: Missile Seekers Market Size, by Launch Mode, 2018-2026 (USD Million)

10.5.5 South Korea

10.5.5.1 Increasing Development of Advanced Surface-To-Surface Ballistic Missiles by the Country to Drive the Demand

Figure 34 South Korea: Military Spending, 2010-2020 (USD Billion)

Table 60 South Korea: Missile Seekers Market Size, by Technology, 2018-2026 (USD Million)

Table 61 South Korea: Missile Seekers Market Size, by Missile Type, 2018-2026 (USD Million)

Table 62 South Korea: Missile Seekers Market Size, by Launch Mode, 2018-2026 (USD Million)

10.5.6 Australia

10.5.6.1 The Presence of Prominent Missile Seeker Manufacturers to Drive the Demand for Missile Seekers in the Country

Figure 35 Australia: Military Spending, 2010-2020 (USD Billion)

Table 63 Australia: Missile Seekers Market Size, by Technology, 2018-2026 (USD Million)

Table 64 Australia: Missile Seekers Market Size, by Missile Type, 2018-2026 (USD Million)

Table 65 Australia: Missile Seekers Market Size, by Launch Mode, 2018-2026 (USD Million)

10.5.7 Rest of Asia-Pacific

10.5.7.1 Procurement of Advanced Missiles by Japan to Drive the Market

Table 66 Rest of Asia-Pacific: Missile Seekers Market Size, by Technology, 2018-2026 (USD Million)

Table 67 Rest of Asia-Pacific: Missile Seekers Market Size, by Missile Type, 2018-2026 (USD Million)

Table 68 Rest of Asia-Pacific: Missile Seekers Market Size, by Launch Mode, 2018-2026 (USD Million)

10.6 Middle East

10.6.1 COVID-19 Impact on Middle East

10.6.2 PESTLE Analysis: Middle East

Figure 36 Middle East: Missile Seekers Market Snapshot

Table 69 Middle East: Missile Seekers Market Size, by Country, 2018-2026 (USD Million)

Table 70 Middle East: Missile Seekers Market Size, by Technology, 2018-2026 (USD Million)

Table 71 Middle East: Missile Seekers Market Size, by Missile Type, 2018-2026 (USD Million)

Table 72 Middle East: Missile Seekers Market Size, by Launch Mode, 2018-2026 (USD Million)

10.6.3 Israel

10.6.3.1 Presence of Major Defense Players Resulted in Growth of Missile Seekers Market in Israel

Figure 37 Israel: Military Spending, 2010-2020 (USD Billion)

Table 73 Israel: Missile Seekers Market Size, by Technology, 2018-2026 (USD Million)

Table 74 Israel: Missile Seekers Market Size, by Missile Type, 2018-2026 (USD Million)

Table 75 Israel: Missile Seekers Market Size, by Launch Mode, 2018-2026 (USD Million)

10.6.4 Turkey

10.6.4.1 Increasing Procurement of Advanced Intercepting Missiles, Such as S-400, is Driving the Missile Seekers Market in the Country

Figure 38 Turkey: Military Spending, 2010-2020 (USD Billion)

Table 76 Turkey: Missile Seekers Market Size, by Technology, 2018-2026 (USD Million)

Table 77 Turkey: Missile Seekers Market Size, by Missile Type, 2018-2026 (USD Million)

Table 78 Turkey: Missile Seekers Market Size, by Launch Mode, 2018-2026 (USD Million)

10.6.5 Rest of Middle East

10.6.5.1 Increasing Procurement of Missile Launching Platforms by the Uae is Driving the Growth of the Missile Seekers Market

Table 79 Rest of Middle East: Missile Seekers Market Size, by Technology, 2018-2026 (USD Million)

Table 80 Rest of Middle East: Missile Seekers Market Size, by Missile Type, 2018-2026 (USD Million)

Table 81 Rest of Middle East: Missile Seekers Market Size, by Launch Mode, 2018-2026 (USD Million)

10.7 Rest of the World

10.7.1 COVID-19 Impact on Rest of the World

10.7.2 PESTLE Analysis: Rest of the World

Figure 39 Rest of the World: Missile Seekers Market Snapshot

Table 82 Rest of the World: Missile Seekers Market Size, by Country, 2018-2026 (USD Million)

Table 83 Rest of the World: Missile Seekers Market Size, by Technology, 2018-2026 (USD Million)

Table 84 Rest of the World: Missile Seekers Market Size, by Missile Type, 2018-2026 (USD Million)

Table 85 Rest of the World: Missile Seekers Market Size, by Launch Mode, 2018-2026 (USD Million)

10.7.3 Latin America

10.7.3.1 Strengthening of the Naval Warfare by Countries Such as Brazil to Drive the Market

Figure 40 Brazil: Military Spending, 2010-2020 (USD Billion)

Table 86 Latin America: Missile Seekers Market Size, by Technology, 2018-2026 (USD Million)

Table 87 Latin America: Missile Seekers Market Size, by Missile Type, 2018-2026 (USD Million)

Table 88 Latin America: Missile Seekers Market Size, by Launch Mode, 2018-2026 (USD Million)

10.7.4 Africa

10.7.4.1 Increasing Territorial Conflicts in the Country to Drive the Demand

Figure 41 South Africa: Military Spending, 2010-2020 (USD Billion)

Table 89 Africa: Missile Seekers Market Size, by Technology, 2018-2026 (USD Million)

Table 90 Africa: Missile Seekers Market Size, by Missile Type, 2018-2026 (USD Million)

Table 91 Africa: Missile Seekers Market Size, by Launch Mode, 2018-2026 (USD Million)

11 Competitive Landscape

11.1 Introduction

Table 92 Key Developments by Leading Players in Missile Seekers Market Between 2018 and 2021

11.2 Market Share Analysis of Leading Players 2020

Table 93 Degree of Competition

Figure 42 Collective Revenue Share of Top 5 Players

11.3 Rank Analysis, 2020

Figure 43 Revenue Generated by Major Players in Missile Seekers Market, 2020

Table 94 Company Region Footprint

Table 95 Company Product Footprint

Table 96 Company Application Footprint

11.4 Competitive Evaluation Quadrant

11.4.1 Missile Seekers Market Competitive Leadership Mapping

11.4.1.1 Star

11.4.1.2 Pervasive

11.4.1.3 Emerging Leader

11.4.1.4 Participant

Figure 44 Missile Seekers Market Competitive Leadership Mapping, 2021

11.4.2 Missile Seekers Market Competitive Leadership Mapping (SME)

11.4.2.1 Progressive Companies

11.4.2.2 Responsive Companies

11.4.2.3 Starting Blocks

11.4.2.4 Dynamic Companies

Figure 45 Missile Seekers Market Competitive Leadership Mapping (SME)

11.5 Competitive Scenario

11.5.1 New Product Launches

Table 97 New Product Launches, August 2018-August 2021

11.5.2 Deals

Table 98 Deals, August 2018- August 2021

12 Company Profiles

Business Overview, Products Offered, Recent Developments, SWOT Analysis, Analyst's View

12.1 Introduction

12.2 Key Players

12.2.1 Bae Systems

Table 99 Bae Systems: Business Overview

Figure 46 Bae Systems: Company Snapshot

Table 100 Bae Systems: Deals

12.2.2 Boeing

Table 101 Boeing: Business Overview

Figure 47 Boeing: Company Snapshot

12.2.3 Raytheon Technologies

Table 102 Raytheon Technologies: Business Overview

Figure 48 Raytheon Technologies: Company Snapshot

Table 103 Raytheon Technologies: New Product Development

Table 104 Raytheon Technologies: Deals

12.2.4 Safran Group

Table 105 Safran Group: Business Overview

Figure 49 Safran Group: Company Snapshot

12.2.5 Northrop Grumman Corporation

Table 106 Northrop Grumman Corporation: Business Overview

Figure 50 Northrop Grumman Corporation: Company Snapshot

12.2.6 Leonardo S.P.A

Table 107 Leonardo S.P.A.: Business Overview

Figure 51 Leonardo S.P.A.: Company Snapshot

12.2.7 Thales

Table 108 Thales: Business Overview

Figure 52 Thales: Company Snapshot

12.2.8 Rafael Advanced Defense Systems Ltd.

Table 109 Rafael Advanced Defense Systems Ltd.: Business Overview

Figure 53 Rafael Advanced Defense Systems Ltd.: Company Snapshot

Table 110 Rafael Advanced Defense Systems Ltd.: New Product Development

12.2.9 Aselsan As

Table 111 Aselsan AS: Business Overview

Figure 54 Aselsan AS: Company Snapshot

12.2.10 Semiconductor Devices

Table 112 Semiconductor Devices: Business Overview

Table 113 Semiconductor Devices: Deals

12.2.11 Kongsberg Defence & Aerospace

Table 114 Kongsberg Defence & Aerospace: Business Overview

Figure 55 Kongsberg Defence & Aerospace: Company Snapshot

12.2.12 Janos Technology LLC

Table 115 Janos Technology LLC: Business Overview

12.2.13 Analog Devices

Table 116 Analog Devices: Business Overview

Figure 56 Analog Devices: Company Snapshot

12.2.14 Defence Research & Development Organisation

Table 117 Defence Research & Development Organisation: Business Overview

12.2.15 Bharat Electronics Limited

Table 118 Bharat Electronics Limited: Business Overview

12.2.16 Tata Advanced Systems

Table 119 Tata Advanced Systems: Business Overview

12.2.17 Excelitas Technologies Corp.

Table 120 Excelitas Technologies Corp.: Business Overview

12.2.18 Diehl Defence

Table 121 Diehl Defence: Business Overview

Table 122 Diehl Defence: Deals

12.2.19 Tonbo Imaging

Table 123 Tonbo Imaging: Business Overview

12.3 Other Key Players

12.3.1 Adani Aerospace & Defence

Table 124 Adani Aerospace & Defence: Business Overview

12.3.2 Mbda Missile Systems

Table 125 Mbda Missile Systems: Business Overview

12.3.3 Marotta Controls

Table 126 Marotta Controls: Business Overview

12.3.4 Koda Technologies Inc.

Table 127 Koda Technologies Inc.: Business Overview

12.3.5 Vem Technologies Pvt. Ltd.

Table 128 Vem Technologies Pvt. Ltd.: Business Overview

12.3.6 Radionix

Table 129 Radionix: Business Overview

Table 130 Radionix: New Product Development

Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, Analyst's View Might Not be Captured in Case of Unlisted Companies.

13 Appendix

13.1 Discussion Guide

13.2 Knowledge Store: the Subscription Portal

13.3 Available Customization

13.4 Related Reports

13.5 Author Details

Executive Summary

Companies Mentioned

- Adani Aerospace & Defence

- Analog Devices

- Aselsan As

- Bae Systems

- Bharat Electronics Limited

- Boeing

- Defence Research & Development Organisation

- Diehl Defence

- Excelitas Technologies Corp.

- Janos Technology LLC

- Koda Technologies Inc.

- Kongsberg Defence & Aerospace

- Leonardo S.P.A

- Marotta Controls

- Mbda Missile Systems

- Northrop Grumman Corporation

- Radionix

- Rafael Advanced Defense Systems Ltd.

- Raytheon Technologies

- Safran Group

- Semiconductor Devices

- Tata Advanced Systems

- Thales

- Tonbo Imaging

- Vem Technologies Pvt. Ltd.

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | September 2021 |

| Forecast Period | 2021 - 2026 |

| Estimated Market Value ( USD | $ 5.3 Billion |

| Forecasted Market Value ( USD | $ 6.8 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |