Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Passive optical networks (PONs) are designed to take advantage of the inherent diversity of traffic in network communications. These fiber-optic access technology can be used for residential and commercial access, data communications, and specific backhaul applications. Customers can access broadband networks via passive optical networks (PON), which employ fibre optic technology. Passive indicates that the transmit and receive points introduce electrical power, leaving the fibre and other components unpowered. PON networks employ optical splitters and point-to-multipoint architecture to simultaneously send signals upstream and downstream from a single transmission point to several user terminals. An optical line terminal (OLT) is located at the central office of the communications business, and multiple optical network units (ONUs) are placed close to the end consumers. Due to its high bandwidth and stability with an economical deployment due to their sharing of bandwidth amongst users, PONs are often utilized in residential, commercial, and enterprise settings. In addition, one of the key advantages of adopting a PON is that, when dealing with large-scale network installations, it is less expensive to deploy than other types of networks. In this method, numerous subscribers are connected by a single fiber-optic cable and is distributed closer to the user via passive splitters. Moreover, PONs is becoming increasingly popular due to their numerous benefits such as faster speed, cost effective, scalable, uses existing fiber-optic, plenty of upgrade paths and low latency for the growing number of applications.

Increasing Need for Green Network Solution Attributing Growth

The Indian telecom industry is continuously trying to embrace green energy alternatives to overcome the demand of energy consumption. The era of digitalization and adoption of smart technologies has surged the requirement for high-speed internet services with high bandwidth in various region now a days. In addition, to uphold the quality criteria established by Telecom Regulatory Authority of India (TRAI), telecom towers have successfully began deploying diesel-free sites and have started seeking for solutions for more profound grid power supply. Base stations account for the bulk of energy usage, thereby network operators place a high focus on network infrastructure energy efficiency. It provides a special challenge to deliver dependable and clean energy to telcos & tower cos.With a large rise in the volume of data traffic following the debut of 5G in the year 2022. There is no requirement for rack mount switches which in turn reduces the usage of non-renewable electrical equipment and lowers power consumption. Moreover, environmentally friendly passive optical local area network options outperform traditional copper-based Ethernet local area networks. These solutions remove the use of workgroup switches and instead uses optical splitters. As a result of this, it complies with heating, ventilation, and air-conditioning (HVAC) standards.

Since it eradicates the usage of thousands of KW energy and acts as a more-cost effective option, the need for green network solutions to build low-carbon optical networks is in great demand. Passive optical network (PON) uses a single fiber and single type optic to the work group terminal (WGT). Furthermore, PON uses small passive optical splitters, which are in the enclosures in a building, usually on every floor. Therefore, PON requires no power, produces no heat, and can even be mounted in electrical closets. Thus, increasing need for green network solution has anticipated the demand of Passive Optical Network Equipment in the Indian market.

Increasing Government Initiatives to Promote Broadband Penetration

The proliferation of internet, and advanced computer technologies has become an instrument for several underdeveloped countries such as India to walk on the path of developed economies. The demand for broadband services in India is continuously on the rise as the product providers are increasingly focusing on offering innovative broadband services. The government of India has established agencies or special offices specifically to oversee broadband development issues. In addition, the launch of 'Digital India' initiative and the implementation of 5G infrastructure by the Indian government to improve online infrastructure and increase internet accessibility among citizens has proliferated the broadband services which has enabled various enterprises to adopt passive optical network equipment.Passive optical network on the contrary aids in delivering broadband network access to end-customers. Therefore, the increasing broadband services are simultaneously enabling enterprises to depend on passive optical network equipment. Several policy measures have been initiated over the years to improve the state of internet connectivity in rural areas of the country. For instance, the government of India under the National Broadband Mission (NBM) program is emphasizing on providing internet connectivity to all the villages. Moreover, according to the Telecom Regulatory Authority of India (TRAI) report “The Indian Telecom Services Performance Indicators”, there were 336.60 million and 497.69 million internet subscribers in India’s rural and urban areas 2021. By the end of January 2023, the total number of internet subscribers increased to 839.18 million narrowband and broadband subscribers, out of which 44.25% of the internet subscribers belonged to the rural areas. Furthermore, the Government of India, Department of Telecommunications (DoT) by 2024 is planning for 70% fiberization of towers, increasing average broadband speeds of 50 Mbps and enhancing the 50 lakh kms of optic fibre rollouts at a pan-India level. Hence, increasing government initiatives to promote broadband penetration are attributing the growth of India Passive Optical Network Equipment Market.

Market Segmentation

India passive optical network equipment market is segmented based on component, type, application, end-user, and region. Based on component, the market is bifurcated into wavelength division multiplexer/de-multiplexer, optical filters, optical power splitters, optical cables, optical line terminal (OLT), optical network terminals (ONT), and others. Based on type, the market is segmented into gigabit passive optical network (GPON), ethernet passive optical network (EPON), next generation passive optical network (NG PON), and others. Based on application, the market is segmented into FTTH (fiber to the home), FTTx (fiber to the x), and mobile backhaul. Based on end-user, the market is bifurcated into residential, commercial, and industrial. Based on region, the market is segmented into east, south, west, and north.Market Player

Major players in the India passive optical network equipment market are Ericsson India Pvt. Ltd, Alphion India Pvt. Ltd., Genexis India Pvt. Ltd., Huawei Telecommunications (India) Company Private Limited, Tejas Networks Limited, ZTE Telecom India Private Limited, Mitsubishi Electric India Private Limited, Nokia India Private Limited, Cisco Systems India Pvt. Ltd, Adtran Networks India Private Limited, and others.Report Scope:

In this report, the India passive optical network equipment market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Passive Optical Network Equipment Market, By Component:

- Wavelength Division Multiplexer/De-Multiplexer

- Optical Filters

- Optical Power Splitters

- Optical Cables

- Optical Line Terminal (OLT)

- Optical Network Terminals (ONT)

- Others

India Passive Optical Network Equipment Market, By Type:

- Gigabit Passive Optical Network (GPON)

- Ethernet Passive Optical Network (EPON)

- Next Generation Passive Optical Network (NG PON)

- Others

India Passive Optical Network Equipment Market, By Application:

- FTTH (Fiber to the Home)

- FTTx (Fiber to the X)

- Mobile Backhaul

India Passive Optical Network Equipment Market, By End User:

- Residential

- Commercial

- Industrial

India Passive Optical Network Equipment Market, By Region:

- East India

- West India

- North India

- South India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Passive Optical Network Equipment market.Available Customizations:

India Passive Optical Network Equipment market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ericsson India Pvt. Ltd

- Alphion India Pvt. Ltd.

- Genexis India Pvt. Ltd.

- Huawei Telecommunications (India) Company Private Limited

- Tejas Networks Limited

- ZTE Telecom India Private Limited

- Mitsubishi Electric India Private Limited

- Nokia India Private Limited

- Cisco Systems India Pvt. Ltd

- Adtran Networks India Private Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 90 |

| Published | October 2023 |

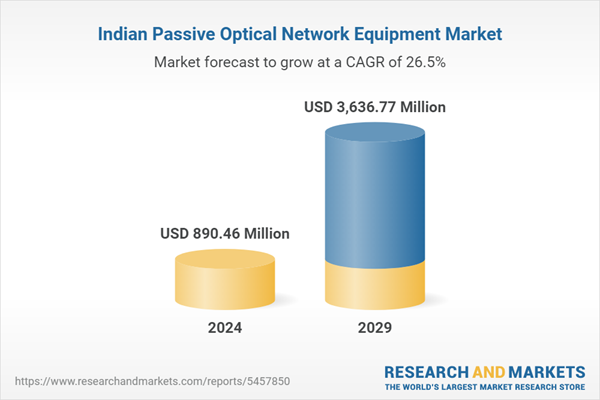

| Forecast Period | 2024 - 2029 |

| Estimated Market Value ( USD | $ 890.46 Million |

| Forecasted Market Value ( USD | $ 3636.77 Million |

| Compound Annual Growth Rate | 26.4% |

| Regions Covered | India |