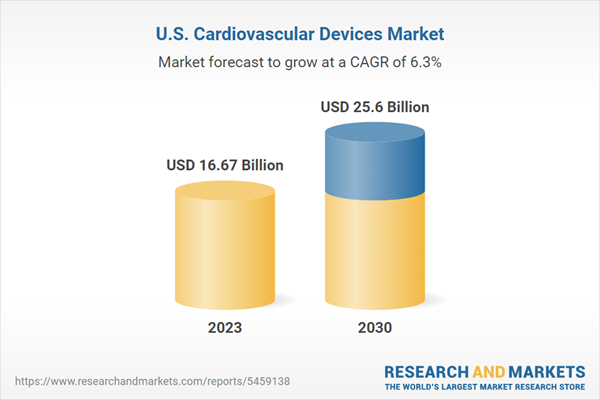

United States Cardiovascular Devices Market is anticipated to undergo a CAGR of 6.32% during the forecast years (2024 to 2030)

The market is significantly increasing because of the upward push in cardiovascular sicknesses. As per the American Heart Association, cardiovascular disease (CVD) remains the main reason for death in the United States, with 928,741 casualties attributed to it. As cardiovascular situations remain a significant purpose of mortality and morbidity in the US, there may be a growing need for superior scientific devices to diagnose, treat, and manage those illnesses. The increasing prevalence of risk factors, including weight problems, high blood pressure, and diabetes, fuels the market's growth. Consequently, producers are investing in innovation and developing new cardiovascular devices to satisfy growing healthcare wishes, expanding the increase in the United States cardiovascular devices market.

Technology is pivotal in employing growth in the United States cardiovascular devices market. Advancements, including minimally invasive methods, superior imaging techniques, and innovative materials, enhance the efficacy and protection of cardiovascular interventions. Further, trends in wearable technology and remote monitoring structures permit higher control of cardiac conditions in outdoor traditional medical settings. These technological improvements enhance patient results, lessen healing times, and increase the efficiency of cardiovascular tactics, thereby stimulating the demand and fueling growth in the market. Hence, the United States cardiovascular devices market was US$ 16.67 Billion in 2023.

Numerous market players actively enforce strategic tasks, propelling an increase in the United States cardiovascular devices market. These initiatives involve research and improvement efforts to introduce progressive technologies, collaborations for collective know-how, and strategic partnerships to enhance market presence. By fostering non-stop improvements and increasing their product portfolios, those businesses contribute to the evolving panorama of cardiovascular care within the U.S. For instance, Myocardial Solutions, Inc. And United Imaging, Inc. have partnered strategically to open the cancer care and cardiology market for speedy cardiac magnetic resonance (M.R.) imaging. These proactive engagements reflect a commitment to addressing the growing occurrence of cardiovascular diseases and the U.S.'s rising need for superior clinical solutions.

In the United States cardiovascular devices market, diagnostics and monitoring devices have a significant presence

The United States cardiovascular device market is broken up by device type into Diagnostics and Monitoring Devices and Therapeutic and Surgical Devices. Diagnostic and monitoring devices are prominent in the United States cardiovascular devices market. This is because of their crucial role in sickness control and prevention. These devices allow healthcare professionals to diagnose cardiac situations, monitor patient health, and examine treatment effectiveness. With the prevalence of cardiovascular diseases at an upward push, the demand for reliable diagnostic tools keeps developing. From electrocardiography (ECG) machines to portable heart monitors, these devices empower early detection and proactive control of cardiovascular conditions, propelling their popularity in the cardiovascular device market in the United States.Coronary artery disease is commonly treated in the United States cardiovascular device market

By application, the United States cardiovascular device market is categorized into Coronary Artery Disease (CAD), Cardiac Arrhythmia, Heart Failure, and Others. Coronary artery disease (CAD) is one of the conventional applications in the United States cardiovascular devices market due to its significant effect on public health. As a primary motive of heart-related morbidity and mortality, CAD necessitates a wide array of medical devices for analysis, treatment, and management. From stents and angioplasty balloons for revascularization to superior imaging technology like coronary angiography, the various devices cater to the complex desires of people living with CAD. The incidence of CAD underscores the continuing demand for revolutionary cardiovascular devices, solidifying its prominence in the market.Utilization of diagnostic centers is among the highest in the cardiovascular devices market of the United States

By end-user, the United States cardiovascular device market is separated into Hospitals and Clinics, Ambulatory Surgical Centers, Diagnostic Centers, Cardiac Catheterization Laboratories, and Others. Diagnostic facilities are one of the most used in the United States cardiovascular devices market. This is because of their pivotal role in cardiovascular fitness evaluation and control. These facilities house diverse diagnostic devices, including echocardiography machines, stress tests, and cardiac catheterization labs, allowing for comprehensive assessment and accurate analysis of cardiac conditions. With early detection and specific evaluation essential in cardiovascular care, diagnostic centers are important hubs for patient assessment, propelling their full-size usage in the market.California is among the major players in the United States cardiovascular devices market

By states, the United States cardiovascular device market is divided into California, Texas, New York, Florida, Illinois, Pennsylvania, Ohio, Georgia, New Jersey, Washington, North Carolina, Massachusetts, Virginia, Michigan, Maryland, Colorado, Tennessee, Indiana, Arizona, Minnesota, Wisconsin, Missouri, Connecticut, South Carolina, Oregon, Louisiana, Alabama, Kentucky, and Rest of the United States. California is one of the distinguished players in the United States cardiovascular devices market. This is due to its robust healthcare surroundings and revolutionary panorama. Home to renowned research institutions, clinical facilities, and enterprise leaders, California fosters conducive surroundings for developing and commercializing modern cardiovascular technology. The state's vibrant biotechnology zone and strategic collaborations among academia and enterprise contribute to ongoing improvements in cardiovascular care, solidifying California's recognition as a vital hub in the cardiovascular devices market.Key Players

The leading companies in the United States cardiovascular devices market are Abbott Laboratories, Boston Scientific Corporation, Edwards Lifesciences, Cardinal Health Inc., Medtronic PLC, GE Healthcare, Johnson & Johnson Services, Inc., and Siemens Healthcare GmbH.Device type - United States Cardiovascular Devices Market breakup in 2 viewpoints:

1. Diagnostic and Monitoring Devices2. Therapeutic and Surgical Devices

Application - United States Cardiovascular Devices Market breakup in 4 viewpoints:

1. Coronary Artery Disease (CAD)2. Cardiac Arrhythmia

3. Heart Failure

4. Others

End-User - United States Cardiovascular Devices Market breakup in 5 viewpoints:

1. Hospitals and Clinics2. Ambulatory Surgical Centers

3. Diagnostic Centers

4. Cardiac Catheterization Laboratories

5. Others

States - United States Cardiovascular Devices Market of 29 States Covered in the Report:

1. California2. Texas

3. New York

4. Florida

5. Illinois

6. Pennsylvania

7. Ohio

8. Georgia

9. New Jersey

10. Washington

11. North Carolina

12. Massachusetts

13. Virginia

14. Michigan

15. Maryland

16. Colorado

17. Tennessee

18. Indiana

19. Arizona

20. Minnesota

21. Wisconsin

22. Missouri

23. Connecticut

24. South Carolina

25. Oregon

26. Louisiana

27. Alabama

28. Kentucky

29. Rest of the United States

All the Key players have been covered from 3 Viewpoints:

- Overview

- Recent Development

- Revenue Analysis

Company Analysis:

1. Abbott Laboratories2. Boston Scientific Corporation

3. Edwards Lifesciences

4. Cardinal Health Inc.

5. Medtronic PLC

6. GE Healthcare

7. Johnson & Johnson Services, Inc.

8. Siemens Healthcare GmbH.

Table of Contents

Companies Mentioned

- Abbott Laboratories

- Boston Scientific Corporation

- Edwards Lifesciences

- Cardinal Health Inc.

- Medtronic PLC

- GE Healthcare

- Johnson & Johnson Services, Inc.

- Siemens Healthcare GmbH.

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 220 |

| Published | March 2024 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 16.67 Billion |

| Forecasted Market Value ( USD | $ 25.6 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | United States |

| No. of Companies Mentioned | 8 |