This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

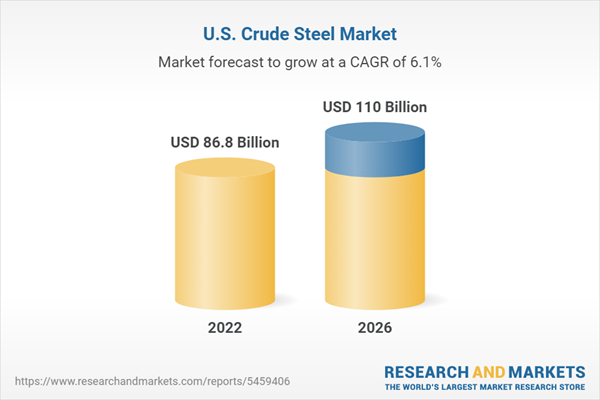

The US crude steel market is forecasted to reach US$110.0 billion in 2026, experiencing growth at a CAGR of 6.12% during the period spanning from 2022 to 2026. Growth in the US crude steel market has been supported by factors such as booming automobile industry and accelerating urban population. The United States-Mexico-Canada Agreement (USMCA) is likely to have a positive impact on US crude steel market. However, the market growth is expected to be restrained by increasing problem of excess crude steelmaking capacity.

The US crude steel market by production process can be segmented into the following segments: electric arc furnace and basic oxygen furnace. In 2021, the dominant share of US crude steel market was held by: electric arc furnace, followed by basic oxygen furnace. The US crude steel market by chemical composition can be segmented as follows: carbon steel, alloy steel, stainless steel and tool steel. The largest share of the market was held by carbon steel, followed by alloy steel, stainless steel and tool steel. The US crude steel market by steel mill products can be segmented as follows: flat steel products and long steel products. The largest share of the market is held by flat steel products, followed by long steel products.

The US crude steel market by end user industry can be segmented into the following segments: construction, automotive, machinery/ equipment, energy, appliances and other applications. In 2021, the dominant share of market was held by construction industry, followed by automotive, machinery/ equipment industry. Factors such increased construction and infrastructure projects and booming oil and gas industry helped in boosting market growth of the US crude steel market.

Scope of the report

- The report provides a comprehensive analysis of the US crude steel market with potential impact of COVID-19

- The market dynamics such as growth drivers, market trends and challenges are analyzed in-depth.

- The company profiles of leading players (Cleveland Cliffs, Inc., Commercial Metals Company, Nucor Corporation, Steel Dynamics Inc., United States Steel Corporation and Reliance Steel and Aluminum Co.) are also presented in detail.

Key Target Audience

- Steel Manufacturers

- Raw Material Providers

- End Users (Businesses/ Consumers)

- Investment Banks

- Government Bodies & Regulating Authorities

Please note: 10% free customization equates to up to 3 hours of analyst time.

Table of Contents

Companies Mentioned

- Cleveland Cliffs, Inc.

- Commercial Metals Company

- Nucor Corporation

- Steel Dynamics, Inc.

- United States Steel Corporation

- Reliance Steel and Aluminum Co.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 77 |

| Published | November 2022 |

| Forecast Period | 2022 - 2026 |

| Estimated Market Value ( USD | $ 86.8 Billion |

| Forecasted Market Value ( USD | $ 110 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | United States |

| No. of Companies Mentioned | 6 |