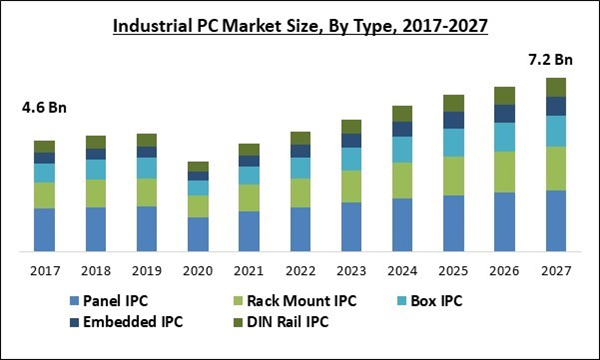

The Global Industrial PC Market size is expected to reach $7,207.4 million by 2027, rising at a market growth of 8.3% CAGR during the forecast period.

Industrial PC is defined as a computing platform developed to work in extreme environments like high-temperature fluctuation, moisture, humidity, and heavy dust. These industrial PCs are just like desktop PCs that are utilized for storage, processing, and communications, and provide a flexible interface to the personal and commercial environment. In comparison to other PCs, industrial PCs are more efficient, reliable, costly, and consume less power, as well as have a long service life.

As compared to the standard PCs, industrial PCs are suppler since they support legacy applications, which require flawless work conditions for five or even ten or more years. It is due to the fact that components utilized to make industrial PCs are industrial-grade instead of commercial-grade.

COVID-19 Impact Analysis

The outbreak of the COVID-19 pandemic has negatively impacted the demand and growth of the industrial PC market initially. It is due to the imposition of various restrictions, such as lockdown, ban on imports & exports, and shutdown of manufacturing units, across different nations of the world. Since the manufacturing of various non-essential goods was stopped in the initial phase of the pandemic, the demand for industrial PCs was declined.

In the recovery phase, governments across the world have permitted the re-opening of manufacturing units with limited capacity. Due to these technologies, production staff can safely supervise production in real-time, while working from remote places. In addition, companies have also begun to adopt various emerging technologies like machine learning and big data analytics to take well-informed data.

Market Growth Factors:

Increasing demand for industrial IoT

There are several manufacturing enterprises across different sectors that are widely adopting the Industrial Internet of Things (IIoT) for their facilities to optimize their resources and reduce costs. This is expected to allow them to link via a broad network of intelligent devices to add automation to their manufacturing plants and produce a huge amount of manufacturing data utilizing industrial PCs for data accumulation and process control. By using advanced industrial PCs, enterprises can get high productivity, better efficiency, and uptime.

Improved asset tracking and simulation

There is an increase in the applications of industrial PCs across various industries since they help manufacturers better manage and track their assets. Healthcare and retail industries are increasingly deploying industrial PC hardware into their operations remotely as well as on-site, which helps them in keeping an organized track of their assets and procedures. These PCs provide high accuracy and efficiency than the human workforce.

Market Restraining Factor:

The huge cost of deployment

Since industrial PCs are highly used in various segments of the business environment, they are made in a way to provide more visibility of the operations, supply, and distribution tasks and enable well-informed decisions on the basis of customers’ demand patterns. However, the cost of installation of these industrial PCs is high, which is not affordable for startups and SMEs. The materials used in the making of industrial PCs should be tough enough to survive in extreme environments but the cost of these raw materials is comparatively high, which ultimately increases the cost of industrial PC.

Type Outlook

Based on Type, the market is segmented into Panel IPC, Rack Mount IPC, Box IPC, Embedded IPC and DIN Rail IPC. DIN rail IPC showcases a compact design along with flexible display options and numerous I/O modules, and thus, enabling a space-saving industrial controller in the control cabinet. In addition, such IPCs emerge as high-performing computing solutions that can be customized based on the complications of the manufacturing control activities.

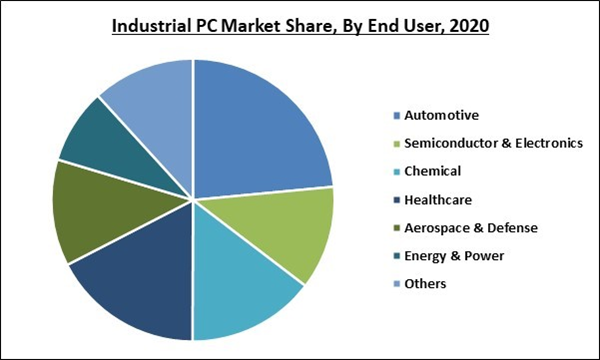

End User Outlook

Based on End User, the market is segmented into Automotive, Semiconductor & Electronics, Chemical, Healthcare, Aerospace & Defense, Energy & Power, and Others. The Semiconductor & Electronics segment is projected to showcase the high growth rate over the forecast period. Factors rising demand for enhanced process flexibility and improved efficiency, widespread integration of quality & regulatory needs, and the consistent pressure of minimizing maintenance & operation costs in the discrete industries are anticipated to spur the demand for the industrial PCs

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. The Asia Pacific is anticipated to exhibit the high growth rate in the industrial PC market over the forecast period. This growth is attributed to the swift industrialization, supportive government policies, and rising infrastructural investments in the energy & power industry.

Cardinal Matrix - Industrial PC Market Competition Analysis

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Siemens AG is the major forerunners in the Industrial PC Market. Companies such as Schneider Electric SE, Mitsubishi Electric Corporation, Panasonic Corporation are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Advantech Co., Ltd., Emerson Electric Co., Mitsubishi Electric Corporation, Siemens AG, Omron Corporation, Panasonic Corporation, Schneider Electric SE, Rockwell Automation, Inc., Beckhoff Automation GmbH & Co. KG, and Nexcom International Co., Ltd.

Recent Strategies Deployed in Onion Oil Market

Partnerships, Collaborations and Agreements:

- Sep-2021: Rockwell Automation entered into a partnership with Ansys, an American company based in Canonsburg. Through this partnership, the company aimed to expand digital twin connectivity into industrial control systems to allow the users to leverage the implementation, design, and performance of industrial operations.

- Aug-2021: Advantech partnered with Lynx Software, a software company based in California. Through this partnership, the company aimed to offer numerous software companies mission-critical edge starter kit options to allow the conjunction of IT (information technology) and OT (operational technology). In addition, Advantech hardware devices is expected to work on Level 1 operational hierarchy for direct control and Level 2 supervisory control including MIC-770 modular industrial PC along with UNO-137 embedded automation computer.

- Oct-2020: Rockwell extended its partnership with PTC, an American computer software and services company. This extended partnership now includes PTC's software-as-a-service (SaaS) and product life-cycle management (PLM). Following this, PTC is expected to provide Rockwell's virtual machinery simulation and testing software to its consumers and partners.

- Oct-2020: Rockwell Automation extended its partnership for the period of five-year with Microsoft, an American multinational technology corporation. The extended partnership is aimed to bring combined, market-ready solutions that assist industrial consumers to enhance digital agility with cloud technology.

- Aug-2020: Emerson teamed up with Mitsubishi Hitachi Power Systems, an energy solutions company. Through this collaboration, the companies aimed to build digital technologies, software, and services to assist utility customers in attaining efficiency in operation in North America. In addition, the companies is expected to develop digital solutions to enhance performance and trust, allow AI-driven and predictive maintenance strategies, and bring automation in operational decision-making.

Product Launches and Product Expansions:

- Jun-2021: Advantech rolled out the TPC-300 series, a new version of its broadly deployed TPC industrial panel PC. This new series is expected to fulfill the demand for machine automation and IoT applications.

- May-2021: Advantech unveiled EPC-U3233 compact fanless embedded PC. The new PC is built on an 8th Gen Intel Core I series processor along with the ability to accelerate data-intensive computing in IoT edge applications. EPC-U3233 offers a variety of I/O ports and 3 x M.2 expansion slots to speed up the installation of various multi-functional IoT applications. Moreover, this PC is CE (RED) and IEC EMC certified.

- May-2021: Emerson launched PACEdge, an industrial edge platform. PACEdge is aimed to assist manufacturers in boosting digital transformation tasks by allowing the user to rapidly develop and scale-up performance-improving applications. In addition, PACEdge is a simple way to develop an application by integrating the currently leading open-source tools into a flexible, combined, and safe platform for leveraging machine data and analytics.

- Apr-2021: Panasonic unveiled Toughbook FZ-55 laptop in India. Through the release, the company aimed to offer this laptop to professionals in the fields of utilities, federal & public safety, defense, automotive industry, and pharmaceutical.

- Feb-2021: Panasonic System Solutions, a subsidiary of Panasonic, released improvements in its fully rugged 2-in-1 TOUGHBOOK 33. Through these improvements, the company is expected to offer high performance, improved functionality, increased security, and more flexibility. In addition, the updates are based on the emerging requirements of remote workers in immense conditions of the ground every day.

- Nov-2020: NEXCOM rolled out xx80P (Intel Core i5/i3) and xx50P (Intel® Celeron®), its latest IPPC (industrial panel PC) range. The new multifunctional fanless computers work as edge servers and IoT gateways simultaneously as well as offer custom-made 10-PCAP touch screens with IP65 and shock/vibration protection.

- Nov-2020: Rockwell Automation rolled out VersaView 6300 industrial PCs and software. Through the launch, the company aimed to enhance the reliability and safety of visualization applications. In addition, the new PCs and thin clients enable the users to develop a single, dependable and safe visualization system.

- Jan-2020: Emerson launched the latest range of RXi industrial display and panel PC products. Through this launch, the company aimed to simplify the monitoring, visualizing, and improving daily production processes in life sciences, power, and water, metals, and mining as well as manufacturing and machinery.

Acquisitions and Mergers:

- Sep-2021: Rockwell Automation acquired Plex Systems, a leader in cloud-native smart manufacturing platforms. Following the acquisition, Rockwell is expected to boost its automation position to revive Connected Enterprise, providing rapid time for its customers as they highly embrace cloud solutions to enhance flexibility, agility, and sustainability in their operations.

- Oct-2020: Emerson acquired Progea Group, a leading vendor of industrial internet of things (IIoT), supervisory control, human-machine interface (HMI), and data acquisition (SCADA) technologies. Following this acquisition, the company aimed to integrate Progea’s capabilities in industrial visualization, analytics, and IIoT into its portfolio of embedded software and control for manufacturing, infrastructure, and building automation applications and allow the customers to simplify plant control and comprehensive machine control system to a single partner.

- Aug-2020: Schneider Electric completed the acquisition of ProLeiT, a vendor of energy and automation digital solutions. Through this acquisition, the company aimed to expand its offering of comprehensive and software-supported automation.

Scope of the Study

Market Segments Covered in the Report:

By Type

- Panel IPC

- Rack Mount IPC

- Box IPC

- Embedded IPC

- DIN Rail IPC

By End User

- Automotive

- Semiconductor & Electronics

- Chemical

- Healthcare

- Aerospace & Defense

- Energy & Power

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Advantech Co., Ltd.

- Emerson Electric Co.

- Mitsubishi Electric Corporation

- Siemens AG

- Omron Corporation

- Panasonic Corporation

- Schneider Electric SE

- Rockwell Automation, Inc.

- Beckhoff Automation GmbH & Co. KG

- Nexcom International Co., Ltd.

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Advantech Co., Ltd.

- Emerson Electric Co.

- Mitsubishi Electric Corporation

- Siemens AG

- Omron Corporation

- Panasonic Corporation

- Schneider Electric SE

- Rockwell Automation, Inc.

- Beckhoff Automation GmbH & Co. KG

- Nexcom International Co., Ltd.

Methodology

LOADING...