Speak directly to the analyst to clarify any post sales queries you may have.

KEY HIGHLIGHTS

- Earthmoving equipment accounted for the largest market share in the Latin America construction equipment market in 2023. Construction industry end-users accounted for Latin America's most significant share of construction equipment. The sales increased due to rising infrastructure investment & transport sector across the countries in Latin America.

- Brazil is the largest market in Latin America construction equipment market. The country accounts for nearly 40% of overall construction equipment sales in the region in 2023.

- Brazil is the center of construction equipment manufacturing in the continent. All the major construction equipment OEMs have manufacturing centers in the Sao Paulo region of the country.

- Hydraulic excavators and backhoe loaders are the region's two most sold construction equipment. The demand for this equipment will grow sharply in the Latin America construction equipment market in 2024.

- Construction equipment manufacturers are introducing customized construction equipment according to the needs of the customers in the region. Liebherr introduced a harbor crane for port operations in the Latin American region.

- The construction and mining market accounts for more than 70% of construction equipment utilization in the continent.

- The demand for electric equipment is growing in the Latin America construction equipment market. Several companies are introducing electric equipment in the region. For instance, Link-Belt launched an X4S Series electric excavator.

- In a strategic move, XCMG established a new Central America region, which will help the company grow aggressively.

SEGMENTATION ANALYSIS

Segmentation by Type

- Earthmoving Equipment

- Road Construction Equipment

- Material Handling Equipment

- Other Construction Equipment

- End Users

- Region

MARKET TRENDS & DRIVERS

Water Management Projects Triggering Demand for Backhoe Loaders With Flexible Attachments

There is a rise in water management projects across the Latin American countries. CAF (Development Bank of Latin America) allocated USD 4 billion for financing water management projects and better water governance at a regional level till 2026. Further, ECLAC (Economic Commission for Latin America and the Caribbean) launched the Regional Network and Observatory for Water Sustainability (ROSA) project for managing water resources in five countries: Colombia, Bolivia, Dominican Republic, El Salvador, and Panama in 2023, to enhance construction project completion, the country needs to optimize its resources and increase efficiency. Integrating BIM in construction machinery will help reduce construction costs and make construction sites safe.The Surge in Infrastructure Investment Propelling the Latin America Construction Equipment Market

- In 2023, various infrastructure development projects were announced by the governments in Latin America. There is a diverse range of infrastructure investments and opportunities across the region.

- There will be an 11% surge in investment in infrastructure projects in Brazil in 2023. According to the National Transport and Logistics Observatory of Infra South America, Brazil invested USD 1.4 billion in transport infrastructure projects in the first seven months of 2023.

- According to Brazil's government, 172 infrastructure investment projects are in progress, ranging from airports to power distribution, mining, and urban mobility, in 2023.

Rising Demand for Electric Forklifts in the Latin American Countries

- Latin American countries are aiming to reduce their carbon footprint by 2040. Countries are planning to reduce their dependence on fossil fuels in the future.

- The demand for electric equipment is rising in the Latin America construction equipment market. The major countries in Latin America, such as Brazil and Mexico, are investing in port development projects in 2022.

- BYD has been operating in South American markets such as Brazil, Mexico, and Chile, offering green transportation solutions to support the region's transition to a low-carbon transportation sector.

Rise in Mining Activities Drives the Latin America Construction Equipment Market Growth

- There is a surge in demand for commodities such as gold, copper, iron ore, and silver across the globe. Latin America's mining sector has had ample opportunity to grow recently. The region is one of the leading producers of iron ore, copper, and gold.

- Chile, Argentina, and Bolivia, which form the lithium triangle, contain the largest lithium reserves. Lithium mining has already been started, and new licenses are being issued.

- Brazil is one of the world's largest sources of reserves and metal, including aluminum, iron ore, and nickel, and the world's largest producer of gold. The demand for these metals is expected to rise due to their use in market and construction activities.

INDUSTRY RESTRAINTS

High Inflation Rates Adversely Impact Corporate Investments & Construction Equipment Import

Latin American countries are facing the challenge of rising inflation rates. The Russian invasion of Ukraine pushed up energy prices. The disruption in the supply of raw materials such as steel, iron & rubber further worsened the condition. Moreover, Brazil’s annual inflation reached a six-year high of over 10% in 2022. The inflation rates surpassed the government targets, leading to a decrease in domestic consumption. Further, other Latin American countries such as Argentina, Colombia & others have witnessed a similar surge in inflation.Mining Project Hampered by Environmental Protest

Environmental protests often lead to social conflicts, halting industrial projects, including mining, & construction projects in the country. The growth of Argentina’s mining market is hampered due to several environmental protests, stopping some of the major mining projects in the country. Further, some mining projects, such as the USD 3.3 billion open-pit molybdenum copper alloy extraction project and the USD 2.4 billion Mara (Minera Agua Rica– Alumbrera) copper mining project, were hampered due to protests in 2023. The inhabitants of Andalgalá detected a more significant presence of iron, aluminum, and fluoride in their drinking water due to cooper mining projects in Argentina in 2023.

VENDOR LANDSCAPE

- Caterpillar, Komatsu, Hitachi, XCMG, Liebherr & Volvo Construction Equipment have a substantial market share in the Latin America construction equipment market. These manufacturers are market leaders in the market.

- LiuGong, Yanmar, CNH Industrials, and Manitou are niche players in the Latin America construction equipment industry. These manufacturers provide low product diversification and are concentrated more in the local market.

Key Vendors

- Caterpillar

- Komatsu

- Liebherr

- Xuzhou Construction Machinery Group (XCMG)

- Volvo Construction Equipment

- Hitachi Construction Machinery

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

- JCB

- SANY

- Hyundai Construction Equipment

Other Prominent Vendors

- Kobelco

- LiuGong

- John Deere

- Yanmar

- CNH Industrial

- Toyota Material Handling

- Bobcat

- Wacker Neuson

- Tadano

- SAKAI HEAVY INDUSTRIES, LTD.

- Shantui Construction Machinery

- BOMAG GmbH

- AMMANN

- Sunward

- HANGCHA

- Romanelli

- AIMIX Group

Distributor Profiles

- Grúas San Blas

- Tecmaco Integral S.A.

- Bramaq

- Centro Vial

- Cowdin

- Repas

- ZMG Argentina

- IGARRETA MAQUINAS

- Noroeste Maquinas Equipamentos LTDA

- FW Maquinas

- Mason Equipamentos

- Engepecas

- Extra Group

KEY QUESTIONS ANSWERED

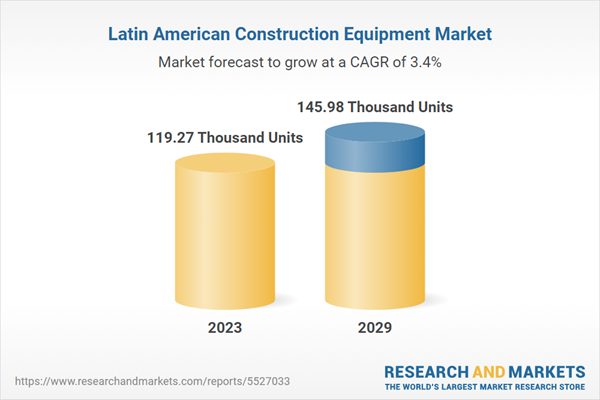

1. How big is the Latin America construction equipment market?2. What is the growth rate of the Latin America construction equipment market?

3. Who are the key players in the Latin America construction equipment market?

4. What are the trends in the Latin America construction equipment industry?

5. Which are the primary distributor companies in the Latin America construction equipment market?

Table of Contents

Companies Mentioned

- Caterpillar

- Komatsu

- Liebherr

- Xuzhou Construction Machinery Group (XCMG)

- Volvo Construction Equipment

- Hitachi Construction Machinery

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

- JCB

- SANY

- Hyundai Construction Equipment

- Kobelco

- LiuGong

- John Deere

- Yanmar

- CNH Industrial

- Toyota Material Handling

- Bobcat

- Wacker Neuson

- Tadano

- SAKAI HEAVY INDUSTRIES, LTD.

- Shantui Construction Machinery

- BOMAG GmbH

- AMMANN

- Sunward

- HANGCHA

- Romanelli

- AIMIX Group

- Grúas San Blas

- Tecmaco Integral S.A.

- Bramaq

- Centro Vial

- Cowdin

- Repas

- ZMG Argentina

- IGARRETA MAQUINAS

- Noroeste Maquinas Equipamentos LTDA

- FW Maquinas

- Mason Equipamentos

- Engepecas

- Extra Group

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 325 |

| Published | March 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value in 2023 | 119.27 Thousand Units |

| Forecasted Market Value by 2029 | 145.98 Thousand Units |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | Latin America |

| No. of Companies Mentioned | 40 |