Seed treatment is essential in agricultural practice to enhance the quality and performance of seeds before they are planted. It involves the application of numerous treatments and coatings to seeds to protect them from diseases, pests, and environmental stressors. It consists of fungicides, insecticides, and sometimes micronutrients or growth enhancers. It creates a protective barrier around the seed, preventing potential threats from impeding germination and early plant growth. Additionally, it delivers protection precisely where required, minimizing the use of chemicals and their environmental impact. It also often exhibits improved uniformity and vigor, resulting in healthier plants and potentially higher crop yields.

The market is primarily driven by the rising population and the growing demand for food production. It helps improve crop yields and protect against pests and diseases, making it an essential component of modern agriculture. Moreover, continuous research and development (R&D) efforts led to innovative treatment products that provide better protection, enhanced nutrient uptake, and improved crop yield, attracting farmers seeking to optimize their crop production, representing another major growth-inducing factor. Besides this, the increasing awareness among farmers about the benefits of products, such as higher crop yields, reduced production costs, and improved crop quality, resulted in rising investment in treatment products, thus accelerating the sales. Furthermore, the widespread adoption of genetically modified (GM) seeds, often available with built-in resistance to pests and diseases, is also propelling the market growth.

Seed Treatment Market Trends/Drivers:

The rising demand for seed treatment among farmers to improve crop yields

The market is driven by the increasing product demand for safeguarding seeds against various diseases and pests. Farmers are aware of the essential role of healthy seeds in improving production, resulting in the widespread product adoption to provide an added layer of protection to their valuable seeds, thereby ensuring healthier and more robust plant growth. Along with this, the adoption of modern farming practices, such as precision agriculture and sustainable farming, are also contributing the market growth. These practices emphasize the importance of optimizing resource utilization and minimizing environmental impacts which aligns with these principles by reducing the need for excessive pesticide applications and lowering production costs for farmers. Furthermore, the shift toward the treatment process, due to rising food production to meet the demands of the growing population with limited arable land available, thus propelling the market growth.The emerging technological advancements in seed treatment technologies

The market is driven by advancements in seed treatment technologies such as precision application technologies, nanotechnology, and biological seed treatments. In addition, the integration of precision agriculture techniques is transforming the seed process, with automated machinery and drones employed to precisely apply treatments, minimizing waste and ensuring uniform coverage across fields, thus influencing market growth. Moreover, the introduction of nanotechnology into the treatment process to encapsulate active ingredients, allows for targeted delivery and improved efficacy which enhances the performance of seeds, representing another major growth-inducing factor. Besides this, the increasing use of biological agents, such as beneficial microorganisms and natural compounds, offer superior pest and disease protection, resulting in the escalating demand for sustainable agriculture practices, thus influencing the market growth.The implementation of favorable regulations and government support

Governments are recognizing the importance of enhancing crop productivity and food security and allocating substantial funding to support research initiatives aimed at developing advanced treatment solutions to achieve these goals. Moreover, the introduction of integrated pest management to reduce reliance on chemical pesticides, which can have adverse effects on ecosystems and human health, represents another major growth-inducing factor. Besides this, the implementation of policies and incentives to encourage the adoption of IPM practices in treatment, including financial incentives, educational programs, and regulatory frameworks that support the use of environmentally friendly pest control methods are accelerating the sales demand. These regulations often focus on the safety and efficacy of treatment products, ensuring they meet stringent quality standards to safeguard the interests of farmers and improve consumer confidence in the safety of agricultural products.Seed Treatment Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global seed treatment market report, along with forecasts at the global, and regional levels for 2024-2032. The report has categorized the market based on type, application technique, crop type, and function.Breakup by Type:

- Chemical Seed Treatment

- Non-Chemical Seed treatment

- Chemical seed treatment represents the most used type

Chemical treatment finds its primary application in the agriculture industry, where it is essential in enhancing crop yield and ensuring healthier plant growth. Farmers employ this method to protect seeds from pests, diseases, and fungal infections by coating seeds with specific chemicals, which create a protective shield that prevents potential threats during germination and early plant growth stages.

Moreover, the increasing use of chemical treatment is due to its cost-effectiveness. This affordability makes it an attractive option for small-scale and large-scale farmers, ensuring that various agricultural operations can benefit from its use.

Furthermore, the chemical product is known for its precision and efficiency which allows for targeted protection of seeds, minimizing the use of pesticides and other chemicals in the farming process which reduces the environmental impact and contributes to sustainable farming practices, aligning with modern agricultural trends, thus creating a positive market outlook.

Breakup by Application Technique:

- Seed Coating

- Seed Dressing

- Seed Pelleting

- Others

Seed dressing holds the largest share of the market

A detailed breakup and analysis of the market based on the application technique have also been provided in the report. This includes seed coating, seed dressing, seed pelleting, and others. According to the report, seed dressing accounted for the largest market share.Seed dressing is primarily employed in agriculture, specifically in the cultivation of crops. It serves several purposes, such as protection by treating seeds with fungicides, insecticides, and other protective agents. In addition, it helps protect young plants against various threats, such as soil-borne diseases, pests, and pathogens. This preventive approach significantly reduces the risk of crop loss, leading to healthier and more enhanced plant growth.

Furthermore, the seed dressing market is driven by its efficiency and cost-effectiveness. Also, the treatment is applied directly to the seeds, which ensures uniform distribution of the protective agents, eliminating the need for broader-scale chemical applications that reduces the use of chemicals and minimize environmental impact, making it an environmentally friendly choice.

Besides this, seed dressing is easy to apply resulting in its widespread adoption among farmers to treat their seeds with minimal equipment and expertise, making it accessible to numerous agricultural practices, from large-scale commercial farms to smallholders, thus propelling the market growth.

Breakup by Crop Type:

- Corn/Maize

- Soybean

- Wheat

- Rice

- Cotton

- Others

Corn/maize presently accounts for the largest market share

A detailed breakup and analysis of the market based on the crop type has also been provided in the report. This includes corn/maize, soybean, wheat, rice, cotton, and others. According to the report, corn/maize accounted for the largest market share.Corn is the most widely cultivated crop, with a vast global footprint. It is a staple food and a major source of feed for livestock. This widespread cultivation makes it a natural choice for seed treatment, as protecting the crop from diseases, pests, and environmental stressors is essential to ensure consistent yields.

Apart from this, corn serves as a primary ingredient in various industries, including food, livestock feed, and biofuel production. Consequently, ensuring the health and productivity of corn crops is essential for sustaining these industries, resulting in the widespread adoption of seed processes which is essential in achieving this goal by safeguarding the seeds against potential threats.

Moreover, corn's susceptibility to various pests and diseases makes treatment processes an indispensable practice. Along with this, farmers can mitigate the risks associated with soil-borne pathogens and insect infestations with a treatment process, that increases the chances of a successful harvest.

Breakup by Function:

- Seed Protection

- Seed Enhancement

- Others

Seed protection holds the largest share of the market

A detailed breakup and analysis of the market based on the function has also been provided in the report. This includes seed protection, seed enhancement, and others. According to the report, seed protection accounted for the largest market share.Seed protection involves the application of various protective agents to seeds before planting. These agents can include fungicides, insecticides, and nematicides. The primary purpose of seed protection is to safeguard seeds from potential threats that can hamper germination and early plant development which aims to ensure that seeds have a healthy start, leading to improved crop yields.

Moreover, seed protection is employed across several agricultural contexts. It finds extensive usage in conventional and modern farming methods. Small-scale and large-scale farmers are turning to seed protection to mitigate the risks posed by soilborne pathogens, pests, and nematodes, representing another major growth-inducing factor. Apart from this, it is widely employed to prevent diseases, control pests, and improve germination, and crop quality, thus propelling the market growth.

Breakup by Region:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

North America exhibits a clear dominance in the market

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America. According to the report, North America accounted for the largest market share.The North America market is driven by its extensive expanse of arable land, making it a prime hub for agricultural activities. It requires efficient and effective methods of seed protection, ensuring optimal crop yields. It protects seeds against pests, diseases, and adverse environmental conditions, and is employed extensively in this region to secure agricultural productivity.

Moreover, the widespread adoption of advanced treatment technologies is instrumental in elevating the region's position in the market. Also, farmers and agribusinesses in North America are investing in research and development (R&D) to enhance treatment methodologies, thus representing another major growth-inducing factor. Besides this, the implementation of stringent regulations to ensure that only high-quality, treated seeds are deployed, further propels the region's reputation for excellence in treatment practices. Furthermore, the demand for sustainable agriculture practices that can minimize the need for chemical pesticides and fertilizers is contributing to the market growth.

Competitive Landscape:

At present, key players are continually striving to strengthen their positions through numerous strategic initiatives. These efforts are pivotal in maintaining their status as thought leaders and experts in the domain of market research and consulting services. They are allocating significant resources to research and development (R&D) and investing in advanced technologies, innovative treatment formulations, and sustainable solutions that enhance the efficacy of their products. Moreover, companies are establishing a strong international presence and entering new geographical markets or strengthening their existing foothold through acquisitions, mergers, or organic growth, allowing them to tap into emerging markets with significant growth potential. Besides this, key players are emphasizing on sustainable and eco-friendly treatment solutions.The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Bayer AG

- Syngenta Group Co. Ltd

- BASF SE

- DOW Agrosciences

- Dupont de Nemours Inc

- Nufarm

- FMC Corporation

- Arysta Lifescience

- Sumitomo Chemical

- UPL Ltd

- Incotec

- Germains

- Advanced Biological Marketing Inc

Recent Developments:

In May 2022, Syngenta introduced Victrato, a seed treatment solution designed to combat nematodes and critical soil-borne fungal diseases while enhancing the quality and yield of various crops such as soybeans, cotton, corn, cereals, and rice.In May 2022, Bayer AG launched Routine Start, an innovative seed treatment solution aimed at protecting early-season rice seeds from rice blast fungus and improving crop productivity and resource efficiency for rice growers.

In August 2023, BASF, a leading chemical company, and Poncho Votivo seed treatment announced collaboration with the Field of Dreams movie site, to widen the spectrum of insect control and deliver higher yields.

Key Questions Answered in This Report

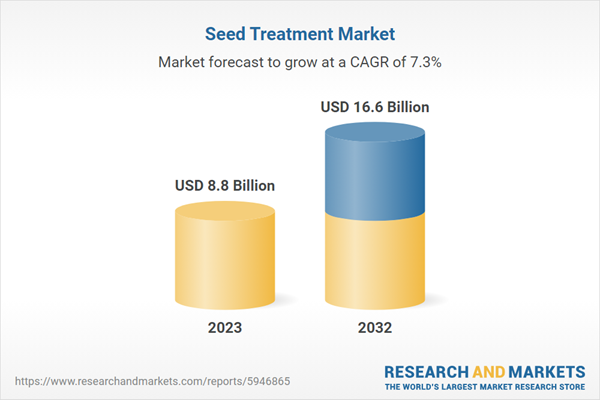

1. What was the size of the global seed treatment market in 2023?2. What is the expected growth rate of the global seed treatment market during 2024-2032?

3. What are the key factors driving the global seed treatment market?

4. What has been the impact of COVID-19 on the global seed treatment market?

5. What is the breakup of the global seed treatment market based on the type?

6. What is the breakup of the global seed treatment market based on the application technique?

7. What is the breakup of the global seed treatment market based on the crop type?

8. What is the breakup of the global seed treatment market based on the function?

9. What are the key regions in the global seed treatment market?

10. Who are the key players/companies in the global seed treatment market?

Table of Contents

Companies Mentioned

- Bayer AG

- Syngenta Group Co. Ltd

- BASF SE

- DOW Agrosciences

- Dupont de Nemours Inc

- Nufarm

- FMC Corporation

- Arysta Lifescience

- Sumitomo Chemical

- UPL Ltd Incotec

- Germains

- Advanced Biological Marketing Inc

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 142 |

| Published | March 2024 |

| Forecast Period | 2023 - 2032 |

| Estimated Market Value ( USD | $ 8.8 Billion |

| Forecasted Market Value ( USD | $ 16.6 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |