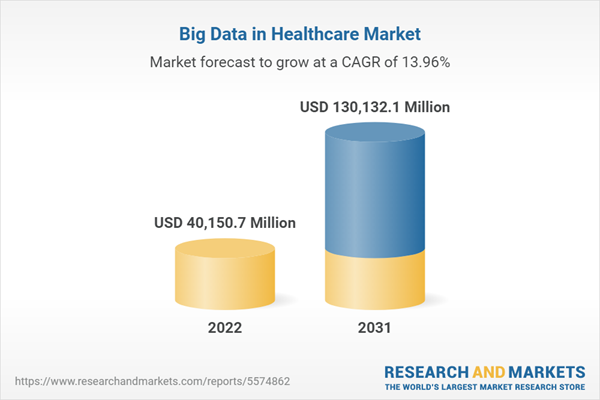

Global Big Data in Healthcare Market to Reach $130,132.1 Million by 2031

This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The global big data in healthcare market was valued at $32,925.1 million in 2021 and is anticipated to reach $130,132.1 million by the end of 2031, registering a CAGR of 13.96% during the forecast period 2022-2031.

Market Report Coverage - Big Data in Healthcare

Market Segmentation

- By Components and Services - Hardware, Software, and Analytics Services

- By Use Case - Clinical Data Analytics, Financial Analytics, and Operational Analytics

- By End Users - Professional Healthcare Settings, Healthcare Companies and Consultancies, Government Agencies/Bodies, Finance and Insurance Agencies, and Academic and Research Institutes

- By Mode of Deployment - On-Premise and Cloud-and Web-Based

Regional Segmentation

- North America - U.S. and Canada

- Europe - Germany, U.K., France, Italy, Spain, and Rest-of-Europe

- Asia-Pacific - Japan, China, India, Australia, and New Zealand, and Rest-of-Asia-Pacific

- Rest-of-the-World - Latin America, Middle East, and Africa

Market Growth Drivers

- Rise in the Adoption of Wearables, Mobile Health, and Internet of Medical Things (IoMT)

- Urgent Need to Reduce Healthcare Costs

- Dedicated Initiatives for Healthcare Digitalization

- Growing Importance of Digital Healthcare and Interoperability

Market Challenges

- Concerns Regarding Data Security

- Presence of Large Volumes of Unstructured Data

Market Opportunities

- Blockchain for Health Information Exchange

- Achieving Complete Interoperability of Healthcare Data for Clinical Decision Support

Key Companies Profiled

Active Health Management, Allscripts Healthcare Solutions, Inc., Cerner Corporation, Epic Systems Corporation, eClinicalWorks, General Electric Company, Siemens Healthineers AG, JLL Partners, Abacus Insights, ConcertAI, Clarify Health Solutions, Datavant, Lynxcare Inc., MilagroAI, Verana Health

How This Report Can Add Value

Assuming that the reader is a vendor in big data in healthcare market, the report will assist them in the following ways:

- Understand their position compared to other key players in the market

- Stay updated with the latest developments in the market

- Understand the impact of COVID-19 on big data in healthcare and the entry barriers for new companies

- Gain insights into end-user perception concerning the big data in healthcare market

- Identify key players in the market and understand their valuable contribution

- Understand the key growth areas and regions to target for market expansion

Key Questions Answered in the Report

- How has COVID-19 impacted the growth of the global big data in healthcare market?

- What are the key regulations governing the big data in healthcare market in key regions?

- Which technological developments are projected to have the maximum influence on the global big data in healthcare market?

- Who are the leading players holding significant dominance in the global big data in healthcare market?

- What are some of the growth opportunities which market players can capitalize on?

- What are the drivers and restraints for the global big data in healthcare market?

- Which region has the highest growth rate in the big data in healthcare market?

- Which are the fastest growing countries in terms of the global big data in healthcare market?

- What are the key strategies being adopted by market players in the global big data in healthcare market?

- Which are the emerging companies in the global big data in healthcare market?

Global Big Data in Healthcare Market Industry Overview

Big data is one of the subjects of interest since it has the potential to transform modern healthcare. The technology has grown substantially over the last two decades. Many healthcare companies have begun to leverage big data for a variety of applications, such as developing products, improving patient outcomes, and driving innovation, among others.

The use of big data in healthcare for areas such as cardiovascular health can lead to savings worth billions of U.S. dollars every year. The data generated on a regular basis contain mostly unstructured formats, i.e., they are not arranged or curated according to a pre-existing data model and, therefore, pose challenges during analysis. The industry perception is that nearly 80% of the big data in healthcare is unstructured, rendering only about 20% eligible for analysis.

The adoption of big data in healthcare is still at a nascent stage despite being a large market. The growth of the market is expected to be significantly boosted by the growing demand for evidence-based clinical care in developing countries. Technological advancements anticipated from 2022 to 2031 are expected to play a crucial role in deciding the future of the big data in healthcare market and the level of adoption.

The global big data in healthcare market report highlights that the market was valued at $32,925.1 million in 2021 and is expected to reach $130,132.1 million by the end of 2031. The market is expected to grow at a CAGR of 13.96% during the forecast period 2022-2031.

Global Big Data in Healthcare Market Drivers

The factors driving the growth of the market include the rise in the adoption of wearables, mobile health, and IoMT, the urgent need to reduce healthcare costs, dedicated initiatives of healthcare digitalization, and the growing importance of digital healthcare and interoperability. The rising adoption of wearables and connected devices has become a prominent driving factor for the big data in healthcare market globally. The increasing adoption has added to the pool of data sources. Additionally, several governments, including those in emerging countries such as India and China, are focusing on bringing digitalization to healthcare for the masses.

More importantly, as the prevalence and incidence of chronic diseases continue to rise, so will technological adoption. As a result, the growth of disease diagnosis and the global market for big data in healthcare will accelerate.

Governments invest a significant amount of money in healthcare insurance so that the overall healthcare costs can be reduced, and the quality of life and affordability of the treatment can be enhanced.

Global Big Data in Healthcare Market Restraints

The factors restraining the growth of the global big data in healthcare market include concerns regarding data security and the presence of large volumes of unstructured data. There are significant privacy concerns surrounding the use of big data analytics in healthcare due to the sensitivity and critical nature of a large amount of personal information (PI) and protected health information (PHI) that healthcare providers are required to maintain. Hence, the concerns regarding data security and presence of large volumes of unstructured data are restraining the digital big data in healthcare market.

Global Big Data in Healthcare Market Opportunities

High growth opportunities in emerging economies and the emergence of local companies in Asia-Pacific, the Middle East, and Africa hold immense potential for the big data in healthcare market growth.

Furthermore, organizations are increasingly turning to clinical informatics in order to reduce medical errors. Since there are multiple electronic health record (EHR) vendors in the market and each product is built on a different platform, the process to make these systems interoperable is quite complex and expensive. Companies can focus on making the healthcare data interoperable to streamline insights extraction and care delivery.

Impact of COVID-19 on the Global Big Data in Healthcare Market

The global big data in healthcare market has been a growing market before the COVID-19 pandemic began. The big data volume increased due to the demand for easy inter-organizational data sharing. Furthermore, the fast growth in hospital information systems led to an influx of a host of variations in terminology, use of non-standard terms, and incorrect descriptions, making it difficult to reconcile data across different systems data. The pandemic, however, aided in accelerating the demand for data-driven decision-making. It also led to an increase in the pool of data sources as the demand for connected devices and wearables also increased due to the growth in the number of health-conscious individuals.

Market Segmentation

Global Big Data in Healthcare Market (Components and Services)

The global big data in healthcare market, based on components and services, has been segmented into hardware, software, and analytics services. Hardware in big data refers to components whose aim is to provide security and storage to protected health information (PIH) of the patients through compliance with data protection regulations. The healthcare industry is evolving, and therefore, more treatments will depend on networks, more devices will be connected, more information will be transferred, collected, and analyzed.

Healthcare organizations expect that big data analytics will help them minimize costs and improve the quality of care. Big data analytics in healthcare helps to detect diseases at earlier stages and healthcare frauds rapidly.

Global Big Data in Healthcare Market (by Use Case)

The global big data in healthcare market, based on use case, has been segmented into clinical data analytics, financial analytics and operational analytics. Clinical data analytics extracts data from EHRs and health information exchange to analyze patient populations and proactively provide quality care to them. The importance of clinical data analytics is increasing as healthcare systems are capturing bigger and better data sets. Clinical analytics primarily uses retrospective analysis rather than real-time clinical decision support.

Global Big Data in Healthcare Market (by End User)

The global big data in healthcare market, based on end user, has been segmented into professional healthcare settings, healthcare companies and consultancies, government agencies/bodies, finance and insurance agencies, and academic and research institutes.

The increase in focus on evidence-based care has been one of the strongest drivers of the adoption of big data in healthcare. Big data analytics allows hospitals and healthcare providers to identify the risk before any major complication occurs and reduces the cost of care. Some of the factors that hinder the adoption of these digital solutions are patient privacy, as there have been some complications in sharing patient information with healthcare professionals.

Furthermore, many industries such as finance and insurance agencies are making a shift toward the use of big data for analyzing the data. Finance and insurance agencies are also shifting toward digital platforms. The adoption of big data in healthcare insurance companies has been subject to digitizing the information and understanding the complex behavioral patterns of the customer.

Global Big Data in Healthcare Market (by Mode of Deployment)

The global big data in healthcare market, based on the mode of deployment, has been segmented into on-premises and cloud-and web-based. On-premises mode of deployment refers to the model built natively into the electronic health records (EHRs) of hospitals and other professional healthcare facilities. On-premises models are currently more preferred over their cloud-based counterparts.

In addition, the cloud-and web-based systems are more flexible and secure and allow users to have control over the data center. The data encryption techniques isolate and protect sensitive data to prevent leaks during data transmission.

Global Big Data in Healthcare Market (by Region)

The different regions covered under the global big data in healthcare market include North America, Europe, Asia-Pacific, and Rest-of-the-World.

The U.S is the dominant market in North America, considering its well-developed healthcare infrastructure and healthcare reforms such as the Affordable Care Act (ACA) and HITECH Act. The Asia-Pacific big data in healthcare market is one of the lucrative markets with immense potential for expansion by key players in the global big data in healthcare market. The healthcare sector is getting more attention than in the past. Countries such as India and China have several digital health initiatives which have witnessed accelerated implementation during the COVID-19 pandemic.

Key Market Players and Competition Synopsis

Some key players operating in the market include Active Health Management, Allscripts Healthcare Solutions, Inc., Cerner Corporation, Epic Systems Corporation, eClinical Works, General Electric Company, Siemens Healthineers AG, JLL Partners, Verana Health, ConcertAI, LynxCare, Abacus Insights, Milagro AI, Datavant, and Clarify Health Solutions.

Some strategies covered in this segment are funding activities, mergers and acquisitions (M&As), partnerships, alliances, business expansion, and new offerings.

Table of Contents

Samples

LOADING...

Companies Mentioned

- Active Health Management

- Allscripts Healthcare Solutions, Inc.

- Cerner Corporation

- Epic Systems Corporation

- eClinicalWorks

- General Electric Company

- Siemens Healthineers AG

- JLL Partners

- Abacus Insights

- ConcertAI

- Clarify Health Solutions

- Datavant

- Lynxcare Inc.

- MilagroAI

- Verana Health

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 210 |

| Published | April 2022 |

| Forecast Period | 2022 - 2031 |

| Estimated Market Value ( USD | $ 40150.7 Million |

| Forecasted Market Value ( USD | $ 130132.1 Million |

| Compound Annual Growth Rate | 14.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |