The report 'Reshaping European Data Centre Market 2022 and beyond' provides an in-depth analysis of the Top 10 Trends for Data Centres in the EMEA region, with a forecast for the key Data Centre Metro Markets and Countries in the region. Forecasts are shown for the four-year period from the beginning of 2022 to the beginning of 2026 for Data Centre raised floor space, Data Centre Customer Power & Data Centre revenues.European Data Centres Are Set for a New Explosive Period of Growth - With Spain to Challenge the Established Data Centre Metros Markets Among the Top 10 Trends

This report considers the key trends that impact the third-party Data Centre segment (also referred to as the Multi-Tenant Data Centre (MTDC)). It is composed of two sections as shown below:

Section 1: This section considers the Top 10 key trends that are impacting the European Data Centre market and is mostly qualitative in approach. It draws upon a range of research sources including interviews with several Data Centre Providers in Europe.

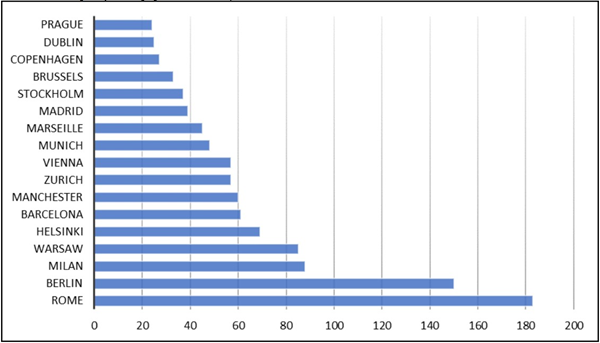

One of the findings is that the fastest growing Data Centre Metro comes from the Metros shown in the Figure below.

A chart showing the forecast growth in the Top 20 Data Centre Metros by raised floor space from the beginning of 2022 to the beginning of 2026 - as a percentage (from the lowest to the highest percentage growth rate overall):

Section 2: This section is mainly quantitative and provides a detailed analysis based on a four-year forecast from the beginning of 2022 to the beginning of 2026 for the following key EMEA region Data Centre metrics:

- Data Centre space (as measured by Data Centre raised floor space in m2)

- Data Centre power (as measured by Data Centre Customer Power - or in MW - as delivered to the customer equipment or IT load)

- Data Centre pricing (as measured by rack space rental (based on a 19” 42u rack with power supply but excluding the actual power used), m2 space rental & kW rental - shown in Euro p/m. excl. tax)

- Data Centre annual rentals - shown in Euro per annum

- Data Centre power (in kWH) in Euro without tax or VAT

Table of Contents

- About the Analyst

- Methodology

- Press Release

- Executive Summary

Executive Summary

This new report identifies the Top 10 Trends in the European third-party Data Centre market. The new research highlights the rapid increase in Data Centre capacity and revenues taking place in the aftermath of the Covid-19 pandemic.In the 'Reshaping European Data Centre Market 2022 and beyond' Report, the analyst identifies the Top 10 key trends taking place over the next 4-year period impacting Data Centres. The report provides a forecast for Data Centre raised floor space, Data Centre Customer Power (DCCP), Data Centre Pricing & Data Centre Revenues across the region and identifies the largest key Data Centre city Metro Markets.

The key findings are:

1. The largest markets are the UK, Germany, the Netherlands and France: The largest Data Centre markets are buoyed by having the largest so-called FLAP Metro Markets (including Frankfurt, London/Slough, Amsterdam and Paris) which account from 50% up to 75% of Data Centre capacity in each country market.

2. The main growth in Data Centre capacity will take place in Tier 2 Metro Markets: The Tier 2 Metro Markets - outside of the traditional FLAP markets - are set to see the fastest capacity growth from a low initial starting point. In particular, the Barcelona, Milan and Rome Metro Markets are forecast to triple the amount of Data Centre power over the next four years with a further eleven Metro Markets set to double their power capacity over the same period.

3. New Hyperscale Data Centres are being introduced that will transform the Tier 2 Metro Markets: New large campus Data Centres are being introduced into Metro Markets in the cities of Barcelona, Berlin, Madrid, Milan, Warsaw and Zurich - with Data4 Group introducing a 50 MW campus in Warsaw, Merlin Properties introducing a 20 MW facility (scalable up to 100 MW) in Barcelona and Vantage Data Centers launching a 40 MW facility at Winterthur near Zurich.

4. Data Centre supply is being boosted by new Private Equity investment: New Data Centre projects across the EMEA region are being promoted by private equity funds, attracted to previously “under-served” markets including Poland, Spain, Portugal, South Africa and Italy - where Cloud & Hyperscale investment is still at an early stage - but where the gains to the first Data Centre mover may be significant.

5. European Data Centre revenues are forecast to increase by more than 60% over the 4 year period to 2026: The growth in revenues comes from a mix of growth in new Data Centre capacity, higher utilisation levels and a moderate increase in rental pricing - along with annual price escalators and recent power price increases.

6. The impact of the demand for Data Centre Power is creating serious environmental concerns: The amount of Data Centre Power required for new Hyperscale facilities is becoming a serious concern. In Offenbach, near Frankfurt, the introduction of the proposed CloudHQ Hyperscale Data Centre alone will consume as much power as the entire Offenbach region. And in Dublin Data Centres are forecast to account for up to 27% of all power grid consumption with Irish national grid operator Eirgrid imposing a moratorium on new Dublin Data Centre power connectivity from January 2022 until 2028.

7. Spain is the Data Centre market (dominated by the Madrid Metro) which will start to challenge the established Metro markets. Spain, outside the traditional FLAP (Frankfurt, London, Amsterdam & Paris) Data Centre markets, is forecast by the analyst to have the third highest number of new Data Centre projects in Europe after the UK and Germany. The Spanish market currently has 17 x 3rd party Data Centre projects under construction - with facilities being developed in the Madrid area - followed by Barcelona and other individual cities.

As European Data Centre markets reach maturity there is less space and power available for new facility developments. One solution is to expand Data Centres in lower cost Tier II markets where land is more widely available and power more abundant.

The Metro Markets outside of the established Data Centre hubs are attracting more large-scale investment. For example, Sines, located south of Lisbon in Portugal, is attracting up to USD $4.5 billion of private equity-led Data Centre investment in a new campus of up to 495 MW of power when complete.

Finally, the new report highlights the advantages of the Nordics region as a location for power hungry applications - with abundant low-cost renewable energy available addressing environmental concerns using free cooling in a cool climate providing a reduced PUE (Power Usage Effectiveness) ratio than for the other traditional Metro Markets.

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ark

- CloudHQ Data Centre

- ClusterPower

- CyrusOne Data Centre developments in Europe

- Data4 Group

- EdgeConneX

- Eirgrid

- Equinix

- Green Datacenter

- Interxion

- Main One

- Merlin Properties

- Microsoft

- NTT Global

- Sagamu

- Sines

- SuperNap

- Teraco

- TIM

- Vantage

Methodology

The analyst researches its reports typically within a three-month period. All of its reports are based on primary and secondary research including interviews with relevant companies/operators covered in the report. The analyst also draws on its extensive in-house database and its contacts in the field of telecommunications it has established since the company was launched in 2006.

The analyst has 26-years of experience in the field of telecoms pricing both mobile and fixed. They have a network of consultants as well as a multi-lingual research team, with languages spoken French, German, Polish and Spanish.

LOADING...