3.5 million self-driving vehicles on United States roads by 2025 and 4.5 million by 2030, according to The Insurance Institute for Highway Safety. The demand for self-driving cars in the United States has increased significantly over the past years. The collaboration between automotive companies across the United States supports the market. For example, VelodyneLidar revealed Faraday Future had chosen them as the supplier of lidar technology for Faraday's all-electric F.F. 91 vehicle. Velodyne's solid-state Velarray H800 lidar sensors will power the F.F. 91's autonomous driving system to deliver various autonomy features in April 2021. The Velarray H800 represents a solid-state lidar sensor with prolonged-variety beliefs and a wide field of view. It guarantees secure navigation and collision avoidance in ADAS and self-reliant mobility eventualities.

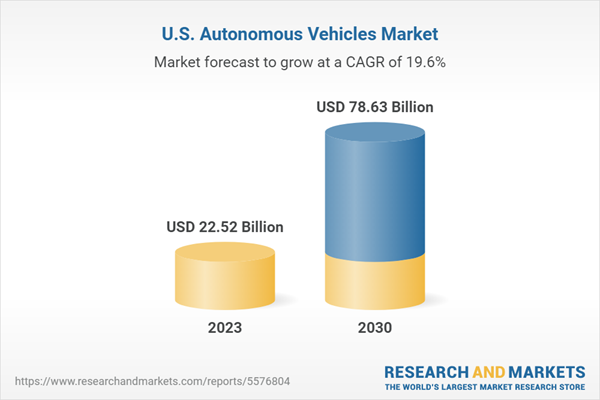

United States Autonomous Vehicle Market is expected to grow at a CAGR of 19.56% during the forecast period (2023-2030)

Mexico's new trade contract with the United States and Canada has involved opportunities for the transfer of autonomous technology and a multiplied demand for self-sufficient motors. The United States independent automobile market could be dominated by semi-autonomous vehicles, as the need for ease of riding and the growing situation for safety and protection are surging the demand for high-end technology. According to the NHTSA (National Highway Traffic Safety Administration), about 94% of the injuries on the United States roadways can be attributed to human errors, like drunken driving and speeding. These can be mitigated with a self-driving vehicle, whose functionality may observe the speed regulations in particular USA states.Contributing factors to the autonomous vehicle market share increase are the need for secure and efficient driving alternatives, the evolution of linked motor technology, increasing studies and development in the autonomous vehicle segment trends, and government assistance for those cars regarding regulations and rebates. U.S. Regulators will determine on a petition filed through General Motors (G.M.) Cruise self-riding generation unit searching for permission to deploy up to 2,500 self-riding automobiles annually without human controls, a pinnacle automobile protection concern, in July 2023.

The autonomous vehicle market growth is anticipated the rapid digitization of linked cars, which provides to their demand. The essential components of car autonomy - vehicle-to-automobile and automobile-to-infrastructure connectivity - can be more easily integrated into connected automobiles than traditional ones. United States Autonomous Vehicles Market was valued at US$ 22.52 Billion in 2023.

Expect a fast growth in Level 3 self-reliant automobiles with more extensive driver assistance systems, which include collision detection, lane departure warning, and adaptive cruise management

By Level of Driving, the United States Autonomous Vehicles Market is segmented into L1, L2, L3, L4 and L5. In the USA's self-sufficient vehicles panorama, Level 3 autonomous generation is rising as the harbinger of fast growth. L3 level of automation which combines advanced driving assistance systems with partial self-driving competencies, is witnessing substantial traction. It gives a sizeable bounce forward for each protection and convenience, with collision detection, lane-keeping, and adaptive cruise control capabilities. As the automobile industry continues to evolve, L3 technology stands out as a crucial step in the journey towards fully autonomous cars, shaping the future of transportation with its promising advancements.

In the autonomous vehicle segment in the United States, software is experiencing the speediest growth

By Hardware vs. Software, the US Autonomous Vehicle Market is segmented into Hardware and Software. Within the United States, the autonomous automobile sector is witnessing an unparalleled surge in software development. This increase is driven by software's pivotal role in shaping the upcoming of self-using cars. Advanced algorithms, device learning, and artificial intelligence enable these vehicles to perceive, navigate, and select autonomously. Companies closely invest in software solutions to enhance safety, performance, and consumer experience. As the industry advances, software innovation is at the forefront, contributing substantially to the evolution of autonomous vehicles and their integration into the transportation landscape.United States self-driving vehicle industry is poised for Lidar hardware and V2X software to dominate in the coming years

By technology, the United States Autonomous Vehicle Market is sub-divided into Hardware (Passive Components, Embedded Modem, Ultrasonic Sensors, Odometry Sensors, Other Electronics and architecture, Actuators, HMI Hardware, Mapping Hardware, Embedded Controls Hardware, V2X Hardware, Cameras, Radar and Lidar) and Software (HMI Software, Data Security Software, Mapping Software, Embedded Controls Software and V2X Software). Lidar technology is poised to take centre stage in the United States autonomous vehicle market. Its importance lies in its capacity to deliver precise, real-time 3D mapping and object detection, which is critical for safe and efficient self-riding. As this technology advances and becomes increasingly included in self-driving systems, it's predicted to play a pivotal role in enabling vehicles to navigate, perceive, and respond to their surroundings, reshaping the autonomous vehicles panorama.Meanwhile, V2X (Vehicle-to-Everything) software is experiencing exquisite growth in the ever-evolving autonomous vehicle arena. It facilitates seamless communication among vehicles and surrounding infrastructure, enhancing safety and traffic performance. As the industry focuses on comprehensive connectivity and advanced autonomous abilities, the V2X software program supports data exchange among vehicles, traffic signals, pedestrians, and more, reflecting the industry's commitment to a connected future.

Passenger vehicles maintain the most prominent market proportion in the United States

By Vehicle Type, the United States Autonomous Vehicle Market is classified into Passenger Vehicles and Commercial Vehicle. Passenger automobiles take the lead with a significant market share in the vast expanse of the US autonomous vehicle industry. This dominance results from the growing embrace of autonomous technology in daily commutes and personal transportation. The appeal of improved safety, convenience, and reduced traffic congestion fuels the desire for self-using passenger motors. This prominent position in the market highlights how autonomous technology is profoundly altering regular transportation experiences, paving the way for a future wherein self-riding passenger automobiles are a common sight on roads.Civil segment is experiencing fast growth in the USA autonomous automobile industry

By Application, the United States Autonomous Vehicle Market is split into Civil, Defence, Transportation logistics, and Construction. Within the USA, the civil area is undergoing remarkable growth in the autonomous vehicle industry. This expansion signifies the increasing adoption of autonomous technology in various factors of civil infrastructure and public offerings. This growth is driven by applications like autonomous buses, smart traffic control, and autonomous vehicles for municipal services. Integrating autonomous vehicles within the civil area guarantees more robust transportation performance, decreased congestion, and improved urban planning. It reflects a transformative shift towards more sustainable and technology-driven solutions to address the evolving needs of modern towns and communities.Internal Combustion Engines dominate the United States autonomous vehicle market

Propulsion subdivides the United States Autonomous Vehicle Market into Battery Electric Vehicle, Fuel Cell Electric Vehicles, Hybrid Electric Vehicle, Internal Combustion Engine, and Plug-in Hybrid Electric Vehicle. Internal Combustion Engines reign supreme in the United States autonomous vehicle market. ICE automobiles hold a significant presence regardless of the growing adoption of electric and hybrid options. This dominance is attributed to a combination of factors, including the existing infrastructure, well-established automotive manufacturing base, and enormous refuelling station network favouring ICE technology. Additionally, ICE vehicles often offer a more extended range, making them appealing for specific applications. While electric and alternative powertrains are gaining momentum, ICE automobiles remain a key participant in the evolving landscape of autonomous transportation in the United States.Key Players

Prominent players in the United States Autonomous vehicle market encompass Apple Inc., Alphabet Inc., Mercedes-Benz Group AG, Amazon.com, Inc., Aptiv, Baidu, Inc., Ford Motor Company, BayerischeMotorenWerke AG (BMW), DidiChuxing Technology Co., and General Motors.This research report provides a detailed and comprehensive insight of the United States Autonomous Vehicles Industry.

Level of Driving - Market breakup from 5 viewpoints:

- L1

- L2

- L3

- L4

- L5

Hardware - Market breakup from 13 viewpoints:

- Passive Components

- Embedded Modem

- Ultrasonic Sensors

- Odometry Sensors

- Other Electronics & Architecture

- Actuators

- HMI Hardware

- Mapping Hardware

- Embedded Controls Hardware

- V2X Hardware

- Cameras

- Radar

- Lidar

Software - Market breakup from 5 viewpoints:

- HMI Software

- Data Security Software

- Mapping Software

- Embedded Controls Software

- V2X Software

Vehicle Type - Market breakup from 2 viewpoints:

- Passenger Vehicle

- Commercial Vehicle

Application - Market breakup from 4 viewpoints:

- Civil

- Defense

- Transportation & Logistics

- Construction

Propulsion - Market breakup from 5 viewpoints:

- Battery Electric Vehicle

- Fuel Cell Electric Vehicles

- Hybrid Electric Vehicle

- Internal Combustion Engine

- Plug-in Hybrid Electric Vehicle

All companies have been covered from 3 viewpoints:

- Overview

- Recent Developments

- Revenue

Company Analysis

- Alphabet Inc.

- Amazon.com, Inc.

- Apple Inc.

- Aptiv

- Baidu, Inc.

- BayerischeMotorenWerke AG (BMW)

- Mercedes-Benz Group AG

- DidiChuxing Technology Co.

- Ford Motor Company

- General Motors

Table of Contents

Companies Mentioned

- Alphabet Inc.

- Amazon.com, Inc.

- Apple Inc.

- Aptiv

- Baidu, Inc.

- BayerischeMotorenWerke AG (BMW)

- Mercedes-Benz Group AG

- DidiChuxing Technology Co.

- Ford Motor Company

- General Motors

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 220 |

| Published | January 2024 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 22.52 Billion |

| Forecasted Market Value ( USD | $ 78.63 Billion |

| Compound Annual Growth Rate | 19.5% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |