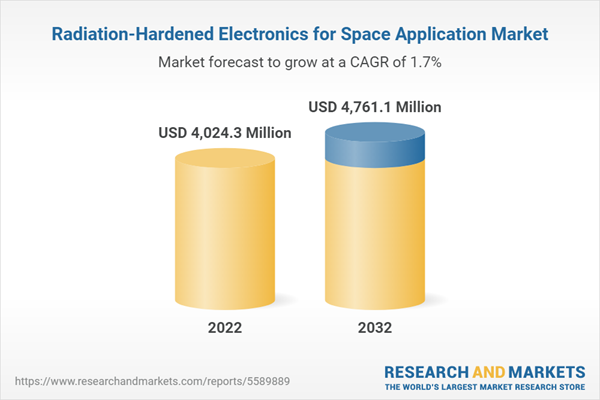

Global Radiation-Hardened Electronics for Space Application Market to Reach $4,761.1 Million by 2032

This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Global Radiation-Hardened Electronics for Space Applications Market Overview

The global radiation-hardened electronics for space applications market is estimated to reach $4,761.1 million in 2032 from $2,348.0 million in 2021, at a growth rate of 1.70% during the forecast period. The growth in the global radiation-hardened electronics for space applications market is expected to be driven by increasing demand for communication and Earth observation satellites.

Market Lifecycle Stage

Over the past few years, there has been a drastic shift toward adopting small satellites over conventional ones. Moreover, the market has been witnessing a drift in the trend from using small satellites for one-time stints toward their regular use in satellite constellations. With the rapid growth in small satellite constellations for various applications such as Earth observation, remote sensing, and space-based broadband services, the demand for radiation-hardened electronic components has also significantly increased.

Several projects are currently in progress to produce advanced radiation-hardened electronics with enhanced capability to shield space perturbations at low cost, which are expected to increase with the launch of upcoming mega-constellations as well as with the rising interest of companies in satellite components that can sustain in the harsh space environment for longer period of time.

Various radiation-hardened electronics that are currently used are onboard computers, microprocessors and microcontrollers, power sources, memory (solid-state recorder), field-programmable gate array, transmitter, and receiver (antennas), application-specific integrated circuit, and sensors. Space is a huge market with unlimited opportunities, and radiation-hardened components are required across all platforms to function. As a result, the market for radiation-hardened electronics for space applications is well-established.

Impact

- The increasing number of satellites in low Earth orbit (LEO) with the upcoming mega-constellation has placed a high demand for the production of space-based radiation-hardened components that are capable of withstanding high radiation effects caused due to solar flares.

- Furthermore, rising interest among space agencies for long-term missions has resulted in the need for radiation-hardened components that can survive severe environments while also being compressed or miniaturized to support complex missions for significantly longer periods.

Market Segmentation

by Platform (Satellite, Launch Vehicle, Deep Space Probe)

Based on platforms, the global radiation-hardened electronics for space applications market in the platform segment is expected to be dominated by the satellite platform.

by Manufacturing Technique (Rad-Hard by Design, Rad-Hard by Process, Rad-Hard by Software)

Based on manufacturing techniques, the global radiation-hardened electronics for space applications market is slightly more dominated by the rad-hard by design segment. Rad-hard by design manufacturing technique is expensive to manufacture, but the components provide extremely robust solutions and the highest radiation hardness rating that can be used for extreme space applications such as deep space missions and satellites.

by Material Type (Silicon, Gallium Nitride, Silicon Carbide, Others)

The majority of the radiation-hardened components is made out of silicon because it helps in reducing the size and weight and improves the computation performance from medium to high speed.

by Component (Onboard Computer, Microprocessor, and Controller, Power Source, Memory (Solid-State Recorder), Field-Programmable Gate Array, Transmitter and Receiver (Antennas), Application-Specific Integrated Circuit, Sensor)

Due to technological advancements, onboard computers, microprocessors, and controllers are expected to be used for new applications requiring increased efficiency, robust, and capable microprocessor technology, resulting in the deployment of highly sophisticated, demanding applications in smaller spaces.

by Region

- North America - U.S., and Canada

- Europe - France, Germany, Russia, U.K, and Rest-of-Europe

- Asia-Pacific - China, Japan, India, and Rest-of-Asia-Pacific

- Rest-of-the-World - Middle East and Africa, and South America

Recent Developments in Global Radiation-Hardened Electronics for Space Applications Market

- In June 2020, GSI Technology partnered with NSF Center for space to build cost-effective radiation-hardened and modular computer systems for space-related efforts, from ground-based high-performance computing data centers to deep space missions.

- In March 2021, Mercury systems signed a contract with NASA’s Jet Propulsion Laboratory to provide solid-state data recorders for the science mission. The device would be installed in an Earth-imaging spectrometer instrument, which is scheduled to launch in 2022.

- In August 2021, STMicroelectronics collaborated with Xilinx, Inc. to build a power solution for Xilinx radiation-tolerant field-programmable gate arrays (FPGA) with QML-V qualified voltage regulator.

- In April 2021, Exxelia launched a high-performance space-graded resistor that meets the requirements of weapons platforms, modern electronic warfare, and a wide range of space applications.

Demand - Drivers, Challenges, and Opportunities

Following are the drivers for the radiation-hardened electronics for space applications market:

- Rising Demand for Radiation-Hardened Electronics Components in the Communication Satellite Segment

- Technological Advancements in Microprocessors and FPGAs

Following are the challenges for the radiation-hardened electronics for space applications market:

- High-Cost Development and Designing Associated with Radiation-Hardened Electronic Components

- Impact of Electronics Components Shortage on the Global Space Industry

Following are the opportunities for the radiation-hardened electronics for the space applications market:

- Adoption of New Materials to Manufacture Space Electronics

How Can This Report Add Value to an Organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of radiation-hardened electronics available for deployment in the industries for space platforms, and their potential globally. Moreover, the study provides the reader a detailed understanding of the different radiation-hardened electronics by application (satellite, launch vehicle, deep space probe, and others), manufacturing technique (rad-hard by design, rad-hard by process, and rad-hard by software), material type (silicon, gallium nitride, silicon carbide, and others), and component (onboard, microprocessor and controller, power source, memory (solid-state recorder), field-programmable gate array, transmitter and receiver (antennas), application-specific integrated circuit, and sensor).

Growth/Marketing Strategy: The global radiation-hardened electronics for space application market has seen major development by key players operating in the market, such as business expansion, contracts, mergers, partnerships, collaborations, and joint ventures. The favored strategy for the companies has been contracts to strengthen their position in the radiation-hardened electronics for space applications market. For instance, in January 2022, Cobham Plc signed a contract with Lattice Semiconductor Corporation to qualify and sell radiation-tolerant field-programmable gate arrays (FPGAs) for satellite and space applications. The collaboration would allow Cobham to address the growing demand for an on-orbit reconfigurable payload system for upcoming satellites.

Competitive Strategy: Key players in the global radiation-hardened electronics for space applications market analyzed and profiled in the study involve radiation-hardened electronic product manufacturers that provide solar cells/arrays, microprocessors, memory, batteries, and power modules. Moreover, a detailed competitive benchmarking of the players operating in the global space radiation-hardened electronics for the space applications market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as contracts, partnerships, agreements, acquisitions, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analysis of the company’s coverage, product portfolio, and market penetration.

The top segment players that lead the market include established players providing radiation-hardened electronics for space applications and constitute 80% of the presence in the market. Other players include start-up entities that account for approximately 20% of the presence in the market.

Some of the prominent names established in this market are:

- 3D Plus

- Analog Devices, Inc.

- Apogee Semiconductor

- Cobham Plc

- Data Device Corporation

- Exxelia

- General Dynamics

- GSI Technology, Inc.

- Infineon Technologies

- Mercury Systems, Inc.

- Microchip Technology, Inc.

- Micropac Industries

- Renesas Electronics Corporation

- Solid State Devices, Inc.

- STMicroelectronics N.V.

- Teledyne Technologies

- Texas Instruments

- Vorago Technologies

- Xilinx, Inc.

Companies that are not a part of the previously mentioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Companies Mentioned

- 3D Plus

- Analog Devices, Inc.

- Apogee Semiconductor

- Cobham Plc

- Data Device Corporation

- Exxelia

- General Dynamics

- GSI Technology, Inc.

- Infineon Technologies

- Mercury Systems, Inc.

- Microchip Technology, Inc.

- Micropac Industries

- ON Semiconductor

- Renesas Electronics Corporation

- Solid State Devices, Inc.

- STMicroelectronics N.V.

- TE Connectivity

- Teledyne Technologies

- Texas Instruments

- Vorago Technologies

- Xilinx, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | May 2022 |

| Forecast Period | 2022 - 2032 |

| Estimated Market Value ( USD | $ 4024.3 Million |

| Forecasted Market Value ( USD | $ 4761.1 Million |

| Compound Annual Growth Rate | 1.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |