Increasing Government Spending on Space Capabilities

This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

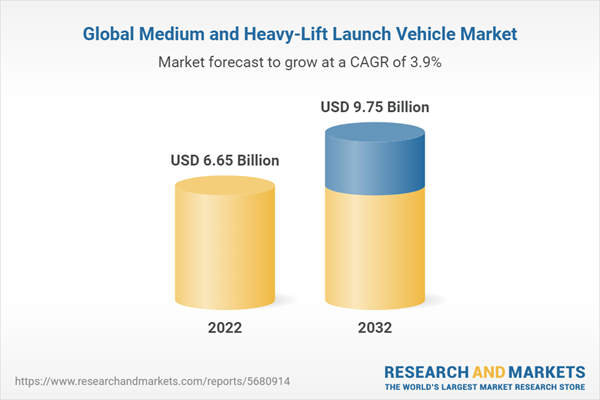

The global medium and heavy-lift launch vehicle market is estimated to reach $9.75 billion in 2032 from $6.45 billion in 2021, at a growth rate of 3.90% during the forecast period 2022-2032. The growth in the global medium and heavy-lift launch vehicle market is expected to be driven by increasing space budgets of countries across the globe. The governments of the U.S., Russia, France, Germany, Italy, China, Japan, South Korea, and India are among the top spenders in the global space sector. In 2021, global government expenditure for space programs was over $92 billion, a 10.7% increase in Y-o-Y from 2020. The U.S. is the highest spender across the globe, followed by China. With an increase in space spending, the spending on launch vehicle manufacturing is expected to rise.

Market Lifecycle Stage

The market demand for launch vehicles is expected to propel over the forecast period 2022-2032, owing to an increase in the number of proposed satellites. Growing demand to form large constellations of communications satellites bringing broadband to everyone, commercial human spaceflight, position navigation and timing, and greater space exploration and monitoring are prominent factors proliferating the global medium and heavy-lift launch vehicle market.

The commercial satellite industry has a long track record of responsible operations in space and counts on a safe environment to undertake ongoing and future space business. Solidifying the participation and support of the commercial industry to ensure the widespread adoption of space safety practices is critical and might reduce the need for unnecessary and often burdensome regulations and is an action that can be taken now.

The ongoing commercial innovations across space debris tracking, fusion and analytics, space data collection, launch vehicle design, and space weather are anticipated to enhance the current space safety regime and ensure that the safety of flight products is comprehensive, timely, accurate, and highly available. Key market players, including established and new entrants, focus on reusable small launch vehicles (SLVs) to reduce cost. For instance, Falcon 9, manufactured and launched by SpaceX, is a partially re-useable, medium-lift launch vehicle that can carry cargo and humans into Earth orbit, even reaching the International Space Station (ISS). As of September 2022, Falcon 9 had the most launches among the medium and heavy-lift launch vehicles in the U.S.

Impact

The global medium and heavy-lift launch vehicle market is expected to cater to the growing demand for satellite launches. Government and commercial end users are awarding multi-year contracts with the launch vehicle manufacturers and launch service providers, driving the demand for medium and heavy-lift launch vehicles. New upgraded launch vehicles are replacing older launch vehicles and are securing launch contracts in advance. For instance, the project cost of Ariane 6 is estimated to be about $3.6 billion. The launch cost for Ariane 62 is expected to be $75 million, while the cost for Ariane 64 might soar up to $115 million. In December 2021, VA256, a variant of Ariane 5, launched the James Webb Space Telescope toward the Sun-Earth L2 halo orbit.

North America is a prominent region in terms of medium and heavy-lift launch vehicle manufacturing due to key launch vehicle manufacturers, suppliers, and launch service providers such as SpaceX, United Launch Alliance, and Northrop Grumman Corporation. SpaceX's Falcon Heavy and Delta IV Heavy of the United Launch Alliance (ULA) are the top two heavy lift launch vehicles in the region and also across the globe. ULA will retire the Delta IV Heavy in 2024. In December 2020, for the final five missions (12-16), including modifications, ULA was awarded $2.2 billion or $440 million per launch. Comparatively, the Falcon Heavy launch price is estimated to be between $90 million and $150 million per launch.

Market Segmentation

Segmentation 1: by End User

- Commercial

- Government

Based on end user, the global medium and heavy-lift launch vehicle market is expected to be dominated by the government segment.

Segmentation 2: by Subsystem

- Structure

- Avionics

- Propulsion

- Control System

- Electrical System

- Stage Separation

- Thermal System

Based on subsystem, the global medium and heavy-lift launch vehicle market is dominated by the propulsion segment.

Segmentation 3: by Launch Vehicle Class

- Medium Lift Launch Vehicle

- Heavy Lift Launch Vehicle

- Super Heavy Lift Launch Vehicle

Based on the launch vehicle class, the global medium and heavy-lift launch vehicle market is dominated by the medium lift launch vehicle segment.

Segmentation 4: by Payload

- Satellite

- Cargo

- Human

Segmentation 5: by Region

- North America - U.S.

- Europe - France, Russia, Italy, and Rest-of-Europe

- Asia-Pacific - China, Japan, India, and Rest-of-Asia-Pacific

Asia-Pacific is the prominent region that is expected to generate considerable revenue from the medium and heavy-lift launch vehicle market.

Recent Developments in the Global Medium and Heavy-Lift Launch Vehicle Market

- In September 2022, OneWeb and Arianespace signed an agreement following the suspension of the launches. OneWeb and Arianespace are determined to examine future opportunities together, especially on the Ariane 6 Launch Vehicle for the second generation of the constellation.

- In July 2022, NASA awarded SpaceX a $255 million contract to launch the next space telescope, which will study dark energy and exoplanets. The Nancy Grace Roman Space Telescope, which is 2.4 meters in diameter, is slated to be launched in October 2026.

- In 2020, NASA awarded contracts worth $256.1 million to Eta Space, Lockheed Martin, SpaceX, and United Launch Alliance, with the collective objective to build, test, and validate the in-orbit fuel collection, storage, and distribution capability of these players.

- In December 2021, NASA signed an agreement with three U.S. companies to develop designs for space stations and other commercial destinations in space. The agreements are part of the agency’s efforts to enable a robust, U.S.-led commercial economy in the low Earth orbit (LEO). The total estimated award amount for all three funded Space Act Agreements is $415.6 million.

- In September 2021, Arianespace, a subsidiary of ArianeGroup, signed a contract with Skyloom. Arianespace would launch Skyloom’s first geostationary lasercom relay node using a heavy-lift vehicle, Ariane 64.

Demand - Drivers and Limitations

The following are the drivers for the global medium and heavy-lift launch vehicle market:

- Increasing Government Spending on Space Capabilities

- Steadily Growing Number of Satellite Operators in the Space Industry

- Emergence of New Market Segment in the Space Industry

- Growing Demand for Dedicated Launch Services

- Emergence of Spaceport-Based Business Model

Following are the challenges for the global medium and heavy-lift launch vehicle market:

- Long Development Timelines for New Launch Vehicles

- Lack of Access to Launch Infrastructure

Following are the opportunities for the global medium and heavy-lift launch vehicle market:

- Commercial Space Stations

- Deep Space Missions

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of medium and heavy-lift launch vehicles and their potential globally. Moreover, the study provides the reader a detailed understanding of the different medium and heavy-lift launch vehicles based on end user, subsystem, payload, and launch vehicle class.

Growth/Marketing Strategy: The global medium and heavy-lift launch vehicle market has seen major development by key players operating in the market, such as business expansion, contracts, mergers, partnerships, collaborations, and joint ventures. The favored strategy for the companies has been contracts, enabling them to strengthen their positions in the global medium and heavy-lift launch vehicle market. For instance, in August 2021, Rocket Lab USA, Inc. completed a merger with Vector Acquisition Corporation. The combined company will retain Rocket Lab USA, Inc. The proceeds are expected to accelerate organic and inorganic growth in Rocket Lab's space systems business, drive the development of the company’s reusable 8-ton payload class Neutron rocket, and support potential expansion into space applications, enabling Rocket Lab to deliver data and services from space.

Competitive Strategy: The key players in the global medium and heavy-lift launch vehicle market analyzed and profiled in the study involve medium and heavy-lift launch vehicle manufacturers that provide components and subsystems. Moreover, a detailed competitive benchmarking of the players operating in the global medium and heavy-lift launch vehicle market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as contracts, partnerships, agreements, acquisitions, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analysis of the companies’ coverage, product portfolio, and market penetration.

In 2021, the top segment players leading the market included established players providing medium and heavy-lift launch vehicles, which constituted 90% of the presence in the market. Emerging market participants included startup entities that accounted for approximately 10% of the presence in the market.

Some of the prominent established names in this market are:

- ArianeGroup

- Blue Origin, LLC

- China Aerospace Science and Technology Corporation (CASC)

- Interorbital System

- Indian Space Research Organization

- Mitsubishi Heavy Industries, Ltd.

- Northrop Grumman Corporation

- Rocket Lab USA, Inc.

- ROSCOSMOS

- Space Exploration Technologies Corporation

- United Launch Alliance, LLC

Table of Contents

Companies Mentioned

- ArianeGroup

- Blue Origin, LLC

- China Aerospace Science and Technology Corporation (CASC)

- Interorbital System

- Indian Space Research Organization

- Mitsubishi Heavy Industries, Ltd.

- Northrop Grumman Corporation

- Rocket Lab USA, Inc.

- ROSCOSMOS

- Space Exploration Technologies Corporation

- United Launch Alliance, LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 149 |

| Published | October 2022 |

| Forecast Period | 2022 - 2032 |

| Estimated Market Value ( USD | $ 6.65 Billion |

| Forecasted Market Value ( USD | $ 9.75 Billion |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |