Worldwide Active Optical Cable Revenues Will Reach About $4.2 Billion by 2027

The publisher has been providing coverage of the Active Optical Cables market for about 15 years. Unlike other recent reports on this topic this one is rooted in accurate information on the evolution of the data center and a realistic view on where video AOCs can find a market.

AI, ML, VR and AR will both eat up bandwidth in the data center, and demand low latency to a degree that we have never seen before. AOCs that support 400G have started to become mainstream in large data centers and 800G AOCs seem likely to be with us in a few years.

Here are some of the key features of this report:

- In this Active Optical Cables Market report, we are adding coverage of Direct Attach Cable (DACs) as a measure of what potential there still is for copper in the data center.

- AOCs are sometimes considered merely commodity products. There have always been some specialist segments of the AOC market (notably ruggedized AOCs) but in the past year or so AOC vendors have found new ways to distinguish their products in the marketplace. These revolve around 400/800G AOCs, which require special design considerations.

- This report examines how re-shoring from China will impact the AOC market going forward. US and European data centers have relied heavily on AOCs manufactured in China for many years. Originally, Chinese AOCs only supported data rates up to 100G, but in the past two-to-three years China has become a primary source of 400/800G AOCs. How will supply chain for high-speed AOCs evolve in a post-globalized world?

- Throughout the Active Optical Cables market report we discuss the strategies of leading providers of AOCs and related products in data and video connectivity markets over the next decade. Two issues, in particular, are covered. We discuss the strategies that AOC vendors plan for when new kinds of optoelectronics (notably co-packed optics - CPO) will find their way into data centers. We also examine how the players in the AOC space are rethinking their branding and moving slowly away from the old brands that have dominated the data connectivity

The centerpiece of this report is the ten-year forecast of video and data AOCs/DACs. This forecast is provided to the purchaser of this report in a spreadsheet so that it can be easily read and manipulated. For the data center AOCs, we include breakouts by speed, reach, type of media, connector MSA, type of data center, and video application. Data center types considered separately in this report comprise, hyperscale, enterprise, edge and telephone center.

Who should read this report?

Whether you are an optical component manufacturer, optical equipment manufacturer, large end-user, or investor, you will gain valuable insights from this in-depth research.

Table of Contents

Samples

LOADING...

Executive Summary

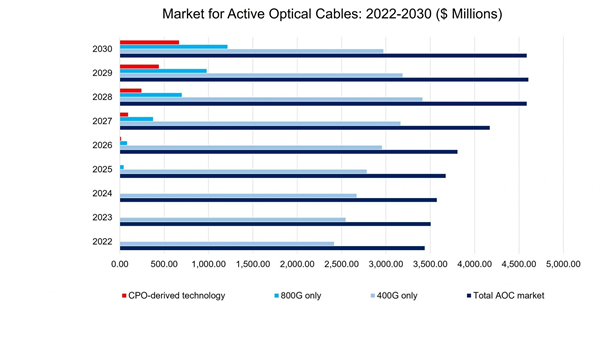

The report Active Optical Cables Market Forecasts: 2022-2031 has stated that active optical cable revenues will reach approximately $4.2 billion by 2027. This reflects an expected surge in 400G AOC deployments, soon to be followed by rapid growth 800G AOCs deployment. On the supply side, the use of 400/800G AOCs will be spurred by the latest switching technology.

According to Lawrence Gasman, author of this new study, Active Optical Cables Market Forecasts: 2022-2031, “AI, ML, VR and AR will both eat up bandwidth in the data center, and demand low latency to a degree that we have never seen before. AOCs that support 400G have started to become mainstream in large data centers and 800G AOCs seem likely to be with us in a few years.”

About the report:

This report provides the latest assessment of worldwide active optical cable revenue potential. While it follows the author’s long-established forecasting methodology, the 2022 AOC report includes new coverage including a forecast of DAC products, breakout by type of data center (hyperscale, enterprise, edge and service provider), and cost per GB for each AOC data rate. As with previous AOC projections, this one includes breakout by data rate, MSA, data center segment (intermachine/interbuilding, rack), type of fiber and country/region where the end user is located The analysis in this report is shipped with a spreadsheet containing ten-year forecasts in volume and value terms.

The report also contains separately a forecast of video AOCs, which the publisher increasingly sees as marginal to the Ethernet/IB-dominated AOC market. In addition, the report surveys the activities of such leading AOC suppliers as NVIDIA, Cisco, Intel, Coherent, Molex, etc., along with the role of third-party suppliers.

From the report:

- For many years, the AOC market has been dominated by Chinese manufacturers. But Current geopolitical events seem certain to disrupt this situation. AOC firms will move AOC manufacturing to low labor cost nations such as India and Vietnam. Some high-end AOC products (e.g. 800G AOC) might even be re-shored to the US.

- On the demand side, the factors driving the 400/800G AOC market are the need (1) the need for data center managers to reduce the cost per bit and (2) the need to provide sufficient bandwidth and latency to support new kinds of traffic that growing rapidly in the data center: AI, Machine Learning, Augmented Reality and Virtual Reality/Metaverse traffic. The value of 400/800G AOCs will total $3.5 billion by 2027

- The story has yet to be written as to how the latest co-packaged optics (CPO) can be blended into an AOC. The publisher anticipates that there is an opportunity here for optical networking firms to produce high-value added products that combine the advantages of both AOCs and CPO (or at least CPO-derived) technology. We think that by the end of the forecast period CPO-derived AOCs will generate well over $650 million in revenues

Companies Mentioned

- Cisco

- Intel