Rising Investments by Social Media Companies in Cloud Security Services

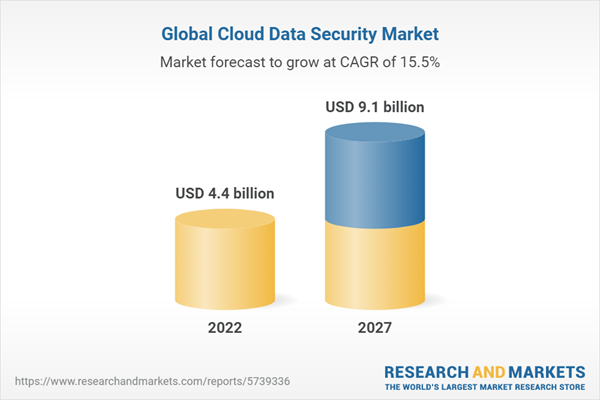

The global cloud data security market size is projected to grow from USD 4.4 billion in 2022 to USD 9.1 billion by 2027 at a Compound Annual Growth Rate (CAGR) of 15.5% during the forecast period.

The market has promising growth potential due to several factors, including security-related breaches, expanding dangers of cyberattacks, and increased adoption of cloud services among businesses. However, the greatest level of complexity in the deployment and management of cloud data security solutions, as well as a lack of cooperation and mistrust between enterprises and cloud security services providers, are projected to impede market expansion.

By organization size, the SMEs segment is to grow at a higher CAGR during the forecast period

Based on the organization’s size, the cloud data security market is divided into large enterprises and SMEs. The public, private, and hybrid cloud usage gives SMEs the freedom to do business from any location. This anticipates the popularity of cloud security solutions among SMEs. Additionally, the expansion of this market sector would also be fueled by SMEs' increased attention to adhering to different regulatory compliances and data protection legislation, such as EU data protection rules. Moreover, organizations such as Check Point unveiled brand-new technologies for SMEs to provide defense against "fifth generation" widespread attacks on various IT infrastructure systems, such as the cloud, virtual machines, networks, and endpoints. Thus, it can be concluded that SMEs are anticipated to grow at the highest CAGR during the forecast period.

By vertical, BFSI segment accounts for the largest market size during the forecast period

Regulators for the financial services industry anticipate that financial institutions will keep a high level of security. Therefore, the BFSI sector's cloud security market is anticipated to expand as a result of these heightened security regulations and demand for a safe and compliant cloud. Additionally, the rise in data breaches and cloud-native threats is pushing banks and insurance firms to switch to cloud security solutions, which is anticipated to propel market expansion. The PCI DSS regulatory standards are constantly being pressed onto financial organizations encouraging the BFSI sector to use cloud security platforms to ensure compliance with internal stakeholders and external authorities through efficient vulnerability and configuration management. Furthermore, governments worldwide are making strong efforts to ensure the cloud platform's security among financial institutions. Thus, it can be concluded that the BFSI vertical accounts for the largest market size during the forecast period.

By offering type, fully managed segment to grow at higher CAGR during the forecast period

The offering type for the cloud data security market includes fully managed and co-managed security. A fully managed IT service proves to be the best choice for businesses having trouble finding and keeping IT workers and lacking access to highly skilled IT personnel internally. It not only saves the hassle of recruiting but also have access to the talent required whenever needed. Additionally, with fully managed security, businesses eliminate the need to manage an on-site data center, maintain their gear, or keep an eye out for any network problems. Furthermore, businesses can get complete assistance by using a fully managed IT solution. Thus, fully managed security offerings are anticipated to have the highest CAGR during the forecast period.

Breakdown of primaries:

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the cloud data security market.

- By company type: Tier 1: 40%, Tier 2: 35%, and Tier 3: 25%

- By designation: C-level: 45%, Directors: 30%, and others: 25%

- By region: North America: 35%, APAC: 30%, Europe: 20%, Rest of the World (RoW): 15%

Major vendors in the global cloud data security market include CrowdStrike (US), Check Point (US), Palo Alto Networks (US), Zscaler (US), IBM (US), Imperva (US), Veritas (US), Digital Guardian (US), VMware (US), Thales (France), Sophos (UK), Polar (Israel), Netwrix (US), Informatica (US), Commvault (US), Orca Security (US), Radware (US), Rubrik (US), Veeam (US), Infrascale (US), Druva (US), Faction (US), Cohesity (US), Netskope (US), and Cloudian (US).

The study includes an in-depth competitive analysis of the key players in the cloud data security market, their company profiles, recent developments, and key market strategies.

Research Coverage

The report segments the cloud data security market and forecasts its size by offering (solutions and services), organization size (large enterprises and SMEs), offering type (fully managed and co-managed), vertical (BFSI, retail and eCommerce, government and defense, healthcare and life sciences, IT and ITeS, telecom, and others), and region (North America, Europe, Middle East & Africa, Asia Pacific, and Latin America).

The study also includes an in-depth competitive analysis of the market's key players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key benefits of buying report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall cloud data security market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Table of Contents

1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Study Scope

1.3.1 Cloud Data Security Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered

1.4 Currency Considered

Table 1 USD Exchange Rates, 2018-2021

1.5 Stakeholders

2 Research Methodology

2.1 Research Data

Figure 1 Market: Research Design

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primaries

2.1.2.2 Key Industry Insights

2.2 Data Triangulation

Figure 2 Cloud Data Security Market: Research Flow

2.3 Market Size Estimation

Figure 3 Market Size Estimation Methodology - Approach 1 (Supply Side): Revenue from Solutions/Services of Cloud Data Security Vendors

Figure 4 Market Size Estimation Methodology - Approach 3 (Demand Side), Top-Down Approach

2.4 Market Forecast

Table 2 Factor Analysis

2.5 Recession Impact and Research Assumptions

2.5.1 Recession Impact

2.5.2 Research Assumptions

2.6 Limitations

Figure 5 Limitations of Market

3 Executive Summary

Table 3 Cloud Data Security Market and Growth Rate, 2018-2021 (USD Million, Y-O-Y %)

Table 4 Market and Growth Rate, 2022-2027 (USD Million, Y-O-Y %)

Figure 6 Global Market Size and Y-O-Y Growth Rate

Figure 7 Market Share of Segments with High Growth Rates During Forecast Period

Figure 8 North America to Account for Largest Share in 2022

4 Premium Insights

4.1 Attractive Opportunities in Cloud Data Security Market

Figure 9 Security Breaches, Stringent Regulations, and Adoption of IoT and Cloud Trends to Drive Market Growth

4.2 Market, by Offering, 2022

Figure 10 Solutions Segment to Account for Larger Market Share During Forecast Period

4.3 Market, by Organization Size, 2022

Figure 11 Large Enterprises Segment to Account for Largest Market Share

4.4 Market, by Offering Type, 2022

Figure 12 Co-Managed Segment to Account for Larger Market Share

4.5 Market Share of Top Three Verticals and Regions

Figure 13 Bfsi and North America to Account for Largest Market Shares

4.6 Market Investment Scenario, by Region

Figure 14 Asia-Pacific to Emerge as Best Market for Investments in the Next Five Years

5 Market Overview and Industry Trends

5.1 Introduction

5.2 Market Dynamics

Figure 15 Cloud Data Security Market: Drivers, Restraints, Opportunities, and Challenges

5.2.1 Drivers

5.2.1.1 Rising Adoption of Cloud Services by Enterprises

5.2.1.2 Increasing Number of Cyberattacks

5.2.2 Restraints

5.2.2.1 Lack of Cooperation and Distrust Between Businesses and Cloud Security Service Providers

5.2.2.2 Complexities Associated with Deployment and Operations of Cloud Data Security Solutions

5.2.3 Opportunities

5.2.3.1 Rising Investments by Social Media Companies in Cloud Security Services

5.2.3.2 Government Initiatives Encouraging Smart Infrastructure Projects

5.2.4 Challenges

5.2.4.1 Timely Delivery of Products and Security-Related Issues with Devops, Devsecops, and Automation

5.2.4.2 Cloud Compliance and Governance

5.2.4.3 Complex Environments and Constantly Changing Workloads

5.3 Case Study Analysis

5.3.1 Case Study 1: Lookout's Solution to Improve Security and Compliance for Leading Financial Technology

5.3.2 Case Study 2: 360Learning to Improve Its Cloud Security Posture with Orca Cloud Security Platform

5.3.3 Case Study 3: Varonis Edge to Fortify Cloud Data Security

5.4 Value Chain Analysis

Figure 16 Value Chain Analysis: Cloud Data Security Market

5.5 Ecosystem Analysis

Figure 17 Market: Ecosystem

5.6 Porter's Five Forces Analysis

Figure 18 Porter's Five Forces Analysis

Table 5 Porter's Five Forces Analysis

5.6.1 Threat of New Entrants

5.6.2 Threat of Substitutes

5.6.3 Bargaining Power of Suppliers

5.6.4 Bargaining Power of Buyers

5.6.5 Intensity of Competitive Rivalry

5.7 Pricing Analysis

Table 6 Cloud Data Security Market: Pricing Levels

5.8 Technology Analysis

5.8.1 Increased Usage of AI and ML

5.8.2 Cloud Security Posture Management

5.8.3 Encryption

5.8.4 Identity and Access Management

5.8.5 Blockchain in Cloud Computing

5.8.6 Virtual Private Cloud and Security Groups

5.9 Patent Analysis

Table 7 Cloud Data Security Market: Patents

Figure 19 Top 10 Companies with the Highest Number of Patents

Figure 20 Patents Published, Year-Wise

Figure 21 Top Patents by Jurisdiction

5.10 Trends and Disruptions Impacting Buyers

Figure 22 Changes and Trends Affecting Buyers

5.11 Tariff and Regulatory Landscape

5.11.1 Introduction

5.11.2 Payment Card Industry Data Security Standard

5.11.3 California Consumer Privacy Act

5.11.4 Payment Services Directive 2

5.11.5 Personal Information Protection and Electronic Documents Act

5.11.6 Electronic Identification, Authentication, and Trust Services

5.11.7 International Organization for Standardization Standard 27001

5.11.8 Federal Information Processing Standards

5.11.9 Gramm-Leach-Bliley Act of 1999

5.11.10 European Union General Data Protection Regulation

5.11.11 Service Organization Control 2 Compliance

5.11.12 Hipaa Compliance

Table 8 Regulatory Bodies, Government Agencies, and Other Organizations

5.12 Key Stakeholders and Buying Criteria

5.12.1 Key Stakeholders in Buying Process

Figure 23 Influence of Stakeholders on Buying Process (%)

Table 9 Influence of Stakeholders on Buying Process (%)

5.13 Key Conferences and Events, 2023

Table 10 Conferences and Events, 2023

6 Cloud Data Security Market, by Offering

6.1 Introduction

Figure 24 Solutions Segment Projected to Have Larger Market Share During Forecast Period

Table 11 Market, by Offering, 2018-2021 (USD Million)

Table 12 Market, by Offering, 2022-2027 (USD Million)

6.1.1 Offering: Market Drivers

6.2 Solutions

6.2.1 Advanced Cloud Data Security Solutions to Boost Market

Table 13 Solutions: Market, by Region, 2018-2021 (USD Million)

Table 14 Solutions: Market, by Region, 2022-2027 (USD Million)

6.3 Services

6.3.1 Significant Growth in Cloud Data Monitoring to Generate Demand for Security Services

Table 15 Services: Market, by Region, 2018-2021 (USD Million)

Table 16 Services: Market, by Region, 2022-2027 (USD Million)

7 Cloud Data Security Market, by Organization Size

7.1 Introduction

Figure 25 Large Enterprises to Have Larger Market Size During Forecast Period

Table 17 Market, by Organization Size, 2018-2021 (USD Million)

Table 18 Market, by Organization Size, 2022-2027 (USD Million)

7.1.1 Organization Size: Market Drivers

7.2 Large Enterprises

7.2.1 Rising Concerns About Regulatory Compliance to Fuel Adoption of Cloud Data Security

Table 19 Large Enterprises: Market, by Region, 2018-2021 (USD Million)

Table 20 Large Enterprises: Market, by Region, 2022-2027 (USD Million)

7.3 Small and Medium-Sized Enterprises (SMEs)

7.3.1 Flexibility and Affordability to Boost Sales of Security Solutions

Table 21 Small and Medium-Sized Enterprises: Market, by Region, 2018-2021 (USD Million)

Table 22 Small and Medium-Sized Enterprises: Market, by Region, 2022-2027 (USD Million)

8 Cloud Data Security Market, by Offering Type

8.1 Introduction

Figure 26 Co-Managed Segment to Dominate During Forecast Period

Table 23 Market, by Offering Type, 2018-2021 (USD Million)

Table 24 Market, by Offering Type, 2022-2027 (USD Million)

8.1.1 Offering Type: Market Drivers

8.2 Fully Managed

8.2.1 Customization of Fully Managed Offering Type to Fuel Demand for Security Operations

Table 25 Fully Managed: Market, by Region, 2018-2021 (USD Million)

Table 26 Fully Managed: Market, by Region, 2022-2027 (USD Million)

8.3 Co-Managed

8.3.1 Cost Optimization, Scalability, and Flexibility to Drive Demand for Internal Security

Table 27 Co-Managed: Market, by Region, 2018-2021 (USD Million)

Table 28 Co-Managed: Market, by Region, 2022-2027 (USD Million)

9 Cloud Data Security Market, by Vertical

9.1 Introduction

Figure 27 Banking, Financial Services, and Insurance Vertical to Account for Largest Market Size During Forecast Period

Table 29 Market, by Vertical, 2018-2021 (USD Million)

Table 30 Market, by Vertical, 2022-2027 (USD Million)

9.1.1 Vertical: Market Drivers

9.2 Banking, Financial Services, and Insurance

9.2.1 Rising Demand for Data Protection Services in Banking Companies to Drive Market

Table 31 Banking, Financial Services, and Insurance: Market, by Region, 2018-2021 (USD Million)

Table 32 Banking, Financial Services, and Insurance: Market, by Region, 2022-2027 (USD Million)

9.3 Retail & E-Commerce

9.3.1 Automation Across Retail Channels for Curbing Data Theft to Propel Market

Table 33 Retail & E-Commerce: Cloud Data Security Market, by Region, 2018-2021 (USD Million)

Table 34 Retail & E-Commerce: Market, by Region, 2022-2027 (USD Million)

9.4 Government & Defense

9.4.1 Rising Concerns About Identity Theft and Business Fraud to Fuel Market Growth

Table 35 Government & Defense: Market, by Region, 2018-2021 (USD Million)

Table 36 Government & Defense: Market, by Region, 2022-2027 (USD Million)

9.5 Healthcare & Life Sciences

9.5.1 Need to Secure Critical Patient Data Across Cloud Environment to Boost Segment Growth

Table 37 Healthcare & Life Sciences: Market, by Region, 2018-2021 (USD Million)

Table 38 Healthcare & Life Sciences: Market, by Region, 2022-2027 (USD Million)

9.6 Information Technology & Information Technology-Enabled Services

9.6.1 Growing Concerns of Fraud and Compliance to Propel Market

Table 39 Information Technology & Information Technology-Enabled Services: Market, by Region, 2018-2021 (USD Million)

Table 40 Information Technology & Information Technology-Enabled Services: Market, by Region, 2022-2027 (USD Million)

9.7 Telecom

9.7.1 Need to Secure Cloud Telecom Infrastructure to Fuel Segment Growth

Table 41 Telecom: Cloud Data Security Market, by Region, 2018-2021 (USD Million)

Table 42 Telecom: Market, by Region, 2022-2027 (USD Million)

9.8 Other Verticals

Table 43 Other Verticals: Market, by Region, 2018-2021 (USD Million)

Table 44 Other Verticals: Market, by Region, 2022-2027 (USD Million)

10 Market, by Region

10.1 Introduction

Figure 28 Asia-Pacific to Grow at Highest CAGR by 2027

Table 45 Market, by Region, 2018-2021 (USD Million)

Table 46 Market, by Region, 2022-2027 (USD Million)

10.2 North America

10.2.1 North America: Market Drivers

10.2.2 North America: Recession Impact

10.2.3 North America: Regulatory Landscape

Figure 29 North America: Market Snapshot

Table 47 North America: Cloud Data Security Market, by Offering, 2018-2021 (USD Million)

Table 48 North America: Market, by Offering, 2022-2027 (USD Million)

Table 49 North America: Market, by Organization Size, 2018-2021 (USD Million)

Table 50 North America: Market, by Organization Size, 2022-2027 (USD Million)

Table 51 North America: Market, by Offering Type, 2018-2021 (USD Million)

Table 52 North America: Market, by Offering Type, 2022-2027 (USD Million)

Table 53 North America: Market, by Vertical, 2018-2021 (USD Million)

Table 54 North America: Market, by Vertical, 2022-2027 (USD Million)

Table 55 North America: Market, by Country, 2018-2021 (USD Million)

Table 56 North America: Market, by Country, 2022-2027 (USD Million)

10.2.4 US

10.2.4.1 Stringent Regulations and Technological Advancements

Table 57 US: Cloud Data Security Market, by Offering, 2018-2021 (USD Million)

Table 58 US: Market, by Offering, 2022-2027 (USD Million)

Table 59 US: Market, by Organization Size, 2018-2021 (USD Million)

Table 60 US: Market, by Organization Size, 2022-2027 (USD Million)

Table 61 US: Market, by Offering Type, 2018-2021 (USD Million)

Table 62 US: Market, by Offering Type, 2022-2027 (USD Million)

Table 63 US: Market, by Vertical, 2018-2021 (USD Million)

Table 64 US: Market, by Vertical, 2022-2027 (USD Million)

10.2.5 Canada

10.2.5.1 Increased Data Breaches and Government Efforts

Table 65 Canada: Cloud Data Security Market, by Offering, 2018-2021 (USD Million)

Table 66 Canada: Market, by Offering, 2022-2027 (USD Million)

Table 67 Canada: Market, by Organization Size, 2018-2021 (USD Million)

Table 68 Canada: Market, by Organization Size, 2022-2027 (USD Million)

Table 69 Canada: Market, by Offering Type, 2018-2021 (USD Million)

Table 70 Canada: Market, by Offering Type, 2022-2027 (USD Million)

Table 71 Canada: Market, by Vertical, 2018-2021 (USD Million)

Table 72 Canada: Market, by Vertical, 2022-2027 (USD Million)

10.3 Europe

10.3.1 Europe: Cloud Security Market Drivers

10.3.2 Europe: Recession Impact

10.3.3 Europe: Regulatory Landscape

Table 73 Europe: Cloud Data Security Market, by Offering, 2018-2021 (USD Million)

Table 74 Europe: Market, by Offering, 2022-2027 (USD Million)

Table 75 Europe: Market, by Organization Size, 2018-2021 (USD Million)

Table 76 Europe: Market, by Organization Size, 2022-2027 (USD Million)

Table 77 Europe: Market, by Offering Type, 2018-2021 (USD Million)

Table 78 Europe: Market, by Offering Type, 2022-2027 (USD Million)

Table 79 Europe: Market, by Vertical, 2018-2021 (USD Million)

Table 80 Europe: Market, by Vertical, 2022-2027 (USD Million)

Table 81 Europe: Market, by Country, 2018-2021 (USD Million)

Table 82 Europe: Market, by Country, 2022-2027 (USD Million)

10.3.4 UK

10.3.4.1 Increasing Adoption of Cloud Services and Strict Regulations

Table 83 UK: Cloud Data Security Market, by Offering, 2018-2021 (USD Million)

Table 84 UK: Market, by Offering, 2022-2027 (USD Million)

Table 85 UK: Market Size, by Organization Size, 2018-2021 (USD Million)

Table 86 UK: Market, by Organization Size, 2022-2027 (USD Million)

Table 87 UK: Market, by Offering Type, 2018-2021 (USD Million)

Table 88 UK: Market, by Offering Type, 2022-2027 (USD Million)

Table 89 UK: Market, by Vertical, 2018-2021 (USD Million)

Table 90 UK: Market, by Vertical, 2022-2027 (USD Million)

10.3.5 Germany

10.3.5.1 Robust Economy and Increased Demand for Compliance Solutions

Table 91 Germany: Cloud Data Security Market, by Offering, 2018-2021 (USD Million)

Table 92 Germany: Market, by Offering, 2022-2027 (USD Million)

Table 93 Germany: Market, by Organization Size, 2018-2021 (USD Million)

Table 94 Germany: Market, by Organization Size, 2022-2027 (USD Million)

Table 95 Germany: Market, by Offering Type, 2018-2021 (USD Million)

Table 96 Germany: Market, by Offering Type, 2022-2027 (USD Million)

Table 97 Germany: Market, by Vertical, 2018-2021 (USD Million)

Table 98 Germany: Market, by Vertical, 2022-2027 (USD Million)

10.3.6 Rest of Europe

Table 99 Rest of Europe: Cloud Data Security Market, by Offering, 2018-2021 (USD Million)

Table 100 Rest of Europe: Market, by Offering, 2022-2027 (USD Million)

Table 101 Rest of Europe: Market, by Organization Size, 2018-2021 (USD Million)

Table 102 Rest of Europe: Market, by Organization Size, 2022-2027 (USD Million)

Table 103 Rest of Europe: Market, by Offering Type, 2018-2021 (USD Million)

Table 104 Rest of Europe: Market, by Offering Type, 2022-2027 (USD Million)

Table 105 Rest of Europe: Market, by Vertical, 2018-2021 (USD Million)

Table 106 Rest of Europe: Market, by Vertical, 2022-2027 (USD Million)

10.4 Asia-Pacific

10.4.1 Asia-Pacific: Market Drivers

10.4.2 Asia-Pacific: Recession Impact

10.4.3 Asia-Pacific: Regulatory Landscape

Figure 30 Asia-Pacific: Cloud Data Security Market Snapshot

Table 107 Asia-Pacific: Market, by Offering, 2018-2021 (USD Million)

Table 108 Asia-Pacific: Market, by Offering, 2022-2027 (USD Million)

Table 109 Asia-Pacific: Market, by Organization Size, 2018-2021 (USD Million)

Table 110 Asia-Pacific: Market, by Organization Size, 2022-2027 (USD Million)

Table 111 Asia-Pacific: Market, by Offering Type, 2018-2021 (USD Million)

Table 112 Asia-Pacific: Market, by Offering Type, 2022-2027 (USD Million)

Table 113 Asia-Pacific: Market, by Vertical, 2018-2021 (USD Million)

Table 114 Asia-Pacific: Market, by Vertical, 2022-2027 (USD Million)

Table 115 Asia-Pacific: Market, by Country, 2018-2021 (USD Million)

Table 116 Asia-Pacific: Market, by Country, 2022-2027 (USD Million)

10.4.4 China

10.4.4.1 Growing Cloud Computing Market and Increasing Use of Smart Technology

Table 117 China: Cloud Data Security Market, by Offering, 2018-2021 (USD Million)

Table 118 China: Market, by Offering, 2022-2027 (USD Million)

Table 119 China: Market, by Organization Size, 2018-2021 (USD Million)

Table 120 China: Market, by Organization Size, 2022-2027 (USD Million)

Table 121 China: Market, by Offering Type, 2018-2021 (USD Million)

Table 122 China: Market, by Offering Type, 2022-2027 (USD Million)

Table 123 China: Market, by Vertical, 2018-2021 (USD Million)

Table 124 China: Market, by Vertical, 2022-2027 (USD Million)

10.4.5 Japan

10.4.5.1 High Internet Penetration and Digitally Connected Country

Table 125 Japan: Cloud Data Security Market, by Offering, 2018-2021 (USD Million)

Table 126 Japan: Market, by Offering, 2022-2027 (USD Million)

Table 127 Japan: Market, by Organization Size, 2018-2021 (USD Million)

Table 128 Japan: Market, by Organization Size, 2022-2027 (USD Million)

Table 130 Japan: Market, by Offering Type, 2018-2021 (USD Million)

Table 131 Japan: Market, by Offering Type, 2022-2027 (USD Million)

Table 132 Japan: Market, by Vertical, 2018-2021 (USD Million)

Table 133 Japan: Market, by Vertical, 2022-2027 (USD Million)

10.4.6 India

10.4.6.1 Fastest Developing Country and Highly Prone to Security Attacks

Table 134 India: Cloud Data Security Market, by Offering, 2018-2021 (USD Million)

Table 135 India: Market, by Offering, 2022-2027 (USD Million)

Table 136 India: Market, by Organization Size, 2018-2021 (USD Million)

Table 137 India: Market, by Organization Size, 2022-2027 (USD Million)

Table 138 India: Market, by Offering Type, 2018-2021 (USD Million)

Table 139 India: Market, by Offering Type, 2022-2027 (USD Million)

Table 140 India: Market, by Vertical, 2018-2021 (USD Million)

Table 141 India: Market, by Vertical, 2022-2027 (USD Million)

10.4.7 Rest of Asia-Pacific

Table 142 Rest of Asia-Pacific: Cloud Data Security Market, by Offering, 2018-2021 (USD Million)

Table 143 Rest of Asia-Pacific: Market, by Offering, 2022-2027 (USD Million)

Table 144 Rest of Asia-Pacific: Market, by Organization Size, 2018-2021 (USD Million)

Table 145 Rest of Asia-Pacific: Market, by Organization Size, 2022-2027 (USD Million)

Table 146 Rest of Asia-Pacific: Market, by Offering Type, 2018-2021 (USD Million)

Table 147 Rest of Asia-Pacific: Market, by Offering Type, 2022-2027 (USD Million)

Table 148 Rest of Asia-Pacific: Market, by Vertical, 2018-2021 (USD Million)

Table 149 Rest of Asia-Pacific: Market, by Vertical, 2022-2027 (USD Million)

10.5 Middle East & Africa

10.5.1 Middle East & Africa: Cloud Data Security Drivers

10.5.2 Middle East & Africa: Recession Impact

10.5.3 Middle East & Africa: Regulatory Landscape

Table 150 Middle East & Africa: Cloud Data Security Market, by Offering, 2018-2021 (USD Million)

Table 151 Middle East & Africa: Market, by Offering, 2022-2027 (USD Million)

Table 152 Middle East & Africa: Market, by Organization Size, 2018-2021 (USD Million)

Table 153 Middle East & Africa: Market, by Organization Size, 2022-2027 (USD Million)

Table 154 Middle East & Africa: Market, by Offering Type, 2018-2021 (USD Million)

Table 155 Middle East & Africa: Market, by Offering Type, 2022-2027 (USD Million)

Table 156 Middle East & Africa: Market, by Vertical, 2018-2021 (USD Million)

Table 157 Middle East & Africa: Market, by Vertical, 2022-2027 (USD Million)

Table 158 Middle East & Africa: Market, by Country, 2018-2021 (USD Million)

Table 159 Middle East & Africa: Market, by Country, 2022-2027 (USD Million)

10.5.4 Middle East

10.5.4.1 Growing Adoption of Cloud-based Security and Digital Transformation

Table 160 Middle East: Cloud Data Security Market, by Offering, 2018-2021 (USD Million)

Table 161 Middle East: Market, by Offering, 2022-2027 (USD Million)

Table 162 Middle East: Market, by Organization Size, 2018-2021 (USD Million)

Table 163 Middle East: Market, by Organization Size, 2022-2027 (USD Million)

Table 164 Middle East: Market, by Offering Type, 2018-2021 (USD Million)

Table 165 Middle East: Market, by Offering Type, 2022-2027 (USD Million)

Table 166 Middle East: Market, by Vertical, 2018-2021 (USD Million)

Table 167 Middle East: Market, by Vertical, 2022-2027 (USD Million)

10.5.5 Africa

10.5.5.1 Adoption of Cloud Technology to Tackle Rising Cases of Cybercrimes

Table 168 Africa: Cloud Data Security Market, by Offering, 2018-2021 (USD Million)

Table 169 Africa: Market, by Offering, 2022-2027 (USD Million)

Table 170 Africa: Market, by Organization Size, 2018-2021 (USD Million)

Table 171 Africa: Market, by Organization Size, 2022-2027 (USD Million)

Table 172 Africa: Market, by Offering Type, 2018-2021 (USD Million)

Table 173 Africa: Market, by Offering Type, 2022-2027 (USD Million)

Table 174 Africa: Market, by Vertical, 2018-2021 (USD Million)

Table 175 Africa: Market, by Vertical, 2022-2027 (USD Million)

10.6 Latin America

10.6.1 Latin America: Market Drivers

10.6.2 Latin America: Recession Impact

10.6.3 Latin America: Regulatory Landscape

Table 176 Latin America: Cloud Data Security Market, by Offering, 2018-2021 (USD Million)

Table 177 Latin America: Market, by Offering, 2022-2027 (USD Million)

Table 178 Latin America: Market, by Organization Size, 2018-2021 (USD Million)

Table 179 Latin America: Market, by Organization Size, 2022-2027 (USD Million)

Table 180 Latin America: Market, by Offering Type, 2018-2021 (USD Million)

Table 181 Latin America: Market, by Offering Type, 2022-2027 (USD Million)

Table 182 Latin America: Market, by Vertical, 2018-2021 (USD Million)

Table 183 Latin America: Market, by Vertical, 2022-2027 (USD Million)

Table 184 Latin America: Market, by Country, 2018-2021 (USD Million)

Table 185 Latin America: Market, by Country, 2022-2027 (USD Million)

10.6.4 Brazil

10.6.4.1 Deployment of Private and Hybrid Cloud and Investment by Cloud Service Vendors

Table 186 Brazil: Cloud Data Security Market, by Offering, 2018-2021 (USD Million)

Table 187 Brazil: Market, by Offering, 2022-2027 (USD Million)

Table 188 Brazil: Market, by Organization Size, 2018-2021 (USD Million)

Table 189 Brazil: Market, by Organization Size, 2022-2027 (USD Million)

Table 190 Brazil: Market, by Offering Type, 2018-2021 (USD Million)

Table 191 Brazil: Market, by Offering Type, 2022-2027 (USD Million)

Table 192 Brazil: Market, by Vertical, 2018-2021 (USD Million)

Table 193 Brazil: Market, by Vertical, 2022-2027 (USD Million)

10.6.5 Mexico

10.6.5.1 Rise in Digitization and Investments by Key Organizations

Table 194 Mexico: Cloud Data Security Market, by Offering, 2018-2021 (USD Million)

Table 195 Mexico: Market, by Offering, 2022-2027 (USD Million)

Table 196 Mexico: Market, by Organization Size, 2018-2021 (USD Million)

Table 197 Mexico: Market, by Organization Size, 2022-2027 (USD Million)

Table 198 Mexico: Market, by Offering Type, 2018-2021 (USD Million)

Table 199 Mexico: Market, by Offering Type, 2022-2027 (USD Million)

Table 200 Mexico: Market, by Vertical, 2018-2021 (USD Million)

Table 201 Mexico: Market, by Vertical, 2022-2027 (USD Million)

10.6.6 Rest of Latin America

Table 202 Rest of Latin America: Cloud Data Security Market, by Offering, 2018-2021 (USD Million)

Table 203 Rest of Latin America: Market, by Offering, 2022-2027 (USD Million)

Table 204 Rest of Latin America: Market, by Organization Size, 2018-2021 (USD Million)

Table 205 Rest of Latin America: Market, by Organization Size, 2022-2027 (USD Million)

Table 206 Rest of Latin America: Market, by Offering Type, 2018-2021 (USD Million)

Table 207 Rest of Latin America: Market, by Offering Type, 2022-2027 (USD Million)

Table 208 Rest of Latin America: Market, by Vertical, 2018-2021 (USD Million)

Table 209 Rest of Latin America: Market, by Vertical, 2022-2027 (USD Million)

11 Competitive Landscape

11.1 Introduction

11.2 Revenue Share Analysis of Leading Players, 2022

Figure 31 Revenue Share Analysis of Market, 2022

11.3 Cloud Data Security Market Share Analysis of Top Market Players

Table 210 Market: Degree of Competition

11.4 Historical Revenue Analysis

Figure 32 Segmental Revenue Analysis of Top Five Market

Players (USD Million) 177

11.5 Ranking of Key Players

Figure 33 Ranking of Top Five Cloud Data Security Players, 2022

11.6 Evaluation Matrix for Key Players

11.6.1 Definitions and Methodology

Figure 34 Evaluation Quadrant for Key Players: Criteria Weightage

Figure 35 Evaluation Matrix for Key Players, 2022

11.6.2 Stars

11.6.3 Emerging Leaders

11.6.4 Pervasive Players

11.6.5 Participants

11.7 Competitive Benchmarking

11.7.1 Evaluation Criteria for Key Companies

Table 211 Company Vertical Footprint

11.7.2 Evaluation Criteria for Startups/SMEs

Table 212 Key Startups

11.8 Evaluation Matrix for Startups/SMEs

11.8.1 Definitions and Methodology

Figure 36 Evaluation Quadrant for Startups/SMEs: Criteria Weightage

Figure 37 Evaluation Matrix for Startups/SMEs, 2022

11.8.2 Progressive Companies

11.8.3 Responsive Companies

11.8.4 Dynamic Companies

11.8.5 Starting Blocks

11.9 Competitive Scenario

11.9.1 Product/Solution Launches

Table 213 Market: Product/Solution Launches, 2020-2022

11.9.2 Deals

Table 214 Cloud Data Security Market: Deals, 2020-2022

12 Company Profiles

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and Analyst's View (Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1 Key Players

12.1.1 Crowdstrike

Table 215 Crowdstrike: Business Overview

Figure 38 Crowdstrike: Company Snapshot

Table 216 Crowdstrike: Products/Solutions/Services Offered

Table 217 Crowdstrike: Product Launches

Table 218 Crowdstrike: Deals

12.1.2 Check Point

Table 219 Check Point: Business Overview

Figure 39 Check Point: Company Snapshot

Table 220 Check Point: Products/Solutions/Services Offered

Table 221 Check Point: Product Launches

Table 222 Check Point: Deals

12.1.3 Palo Alto Networks

Table 223 Palo Alto Networks: Business Overview

Figure 40 Palo Alto Networks: Company Snapshot

Table 224 Palo Alto Networks: Products/Solutions/Services Offered

Table 225 Palo Alto Networks: Product Launches

Table 226 Palo Alto Networks: Deals

12.1.4 Zscaler

Table 227 Zscaler: Business Overview

Figure 41 Zscaler: Company Snapshot

Table 228 Zscaler: Products/Solutions/Services Offered

Table 229 Zscaler: Product Launches

Table 230 Zscaler: Deals

12.1.5 IBM

Table 231 IBM: Business Overview

Figure 42 IBM: Company Snapshot

Table 232 IBM: Products/Solutions/Services Offered

Table 233 IBM: Product Launches

Table 234 IBM: Deals

12.1.6 Imperva

Table 235 Imperva: Business Overview

Table 236 Imperva: Products/Solutions/Services Offered

Table 237 Imperva: Product Launches

Table 238 Imperva: Deals

12.1.7 Veritas

Table 239 Veritas: Business Overview

Table 240 Veritas: Products/Solutions/Services Offered

Table 241 Veritas: Product Launches

Table 242 Veritas: Deals

12.1.8 Digital Guardian

Table 243 Digital Guardian: Business Overview

Table 244 Digital Guardian: Products/Solutions/Services Offered

Table 245 Digital Guardian: Deals

12.1.9 Vmware

Table 246 Vmware: Business Overview

Figure 43 Vmware: Company Snapshot

Table 247 Vmware: Products/Solutions/Services Offered

Table 248 Vmware: Product Launches

Table 249 Vmware: Deals

12.1.10 Thales

Table 250 Thales: Business Overview

Figure 44 Thales: Company Snapshot

Table 251 Thales: Products/Solutions/Services Offered

Table 252 Thales: Product Launches

Table 253 Thales: Deals

12.2 Other Players

12.2.1 Sophos

12.2.2 Polar

12.2.3 Netwrix

12.2.4 Informatica

12.2.5 Commvault

12.2.6 Orca Security

12.2.7 Radware

12.2.8 Rubrik

12.2.9 Veeam

12.2.10 Infrascale

12.2.11 Druva

12.2.12 Faction

12.2.13 Cohesity

12.2.14 Netskope

12.2.15 Cloudian

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and Analyst's View (Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) Might Not be Captured in Case of Unlisted Companies.

13 Adjacent Markets

13.1 Introduction to Adjacent Markets

Table 254 Adjacent Markets and Forecasts

13.2 Limitations

13.3 Cloud Data Security Market Ecosystem and Adjacent Markets

13.3.1 Data-Centric Security Market

Table 255 Data-Centric Security Market, by Deployment Mode, 2016-2021 (USD Million)

Table 256 Data-Centric Security Market, by Deployment Mode, 2022-2027 (USD Million)

Table 257 On-Premises: Data-Centric Security Market, by Region, 2016-2021 (USD Million)

Table 258 On-Premises: Data-Centric Security Market, by Region, 2022-2027 (USD Million)

Table 259 Cloud: Data-Centric Security Market, by Region, 2016-2021 (USD Million)

Table 260 Cloud: Data-Centric Security Market, by Region, 2022-2027 (USD Million)

13.3.2 Cloud Security Posture Management Market

Table 261 Cloud Security Posture Management Market, by Organization Size, 2016-2021 (USD Million)

Table 262 Cloud Security Posture Management Market, by Organization Size, 2022-2027 (USD Million)

Table 263 Cloud Security Posture Management Market in Small & Medium Enterprises, by Region, 2016-2021 (USD Million)

Table 264 Cloud Security Posture Management Market in Small & Medium Enterprises, by Region, 2022-2027 (USD Million)

Table 265 Cloud Security Posture Management Market in Large Enterprises, by Region, 2016-2021 (USD Million)

Table 266 Cloud Security Posture Management Market in Large Enterprises, by Region, 2022-2027 (USD Million)

13.3.3 Container Security Market

Table 267 Container Security Market, by Deployment Mode, 2015-2020 (USD Million)

Table 268 Container Security Market, by Deployment Mode, 2021-2026 (USD Million)

Table 269 Cloud: Container Security Market, by Region, 2015-2020 (USD Million)

Table 270 Cloud: Container Security Market, by Region, 2021-2026 (USD Million)

Table 271 On-Premises: Container Security Market, by Region, 2015-2020 (USD Million)

Table 272 On-Premises: Container Security Market, by Region, 2021-2026 (USD Million)

14 Appendix

14.1 Discussion Guide

Executive Summary

Companies Mentioned

- Check Point

- Cloudian

- Cohesity

- Commvault

- Crowdstrike

- Digital Guardian

- Druva

- Faction

- IBM

- Imperva

- Informatica

- Infrascale

- Netskope

- Netwrix

- Orca Security

- Palo Alto Networks

- Polar

- Radware

- Rubrik

- Sophos

- Thales

- Veeam

- Veritas

- Vmware

- Zscaler

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 273 |

| Published | February 2023 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 4.4 billion |

| Forecasted Market Value ( USD | $ 9.1 billion |

| Compound Annual Growth Rate | 15.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |