1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions

1.3.3 Years Considered

1.4 Currency Considered

Table 1 USD Exchange Rates, 2022

1.5 Stakeholders

2 Research Methodology

2.1 Research Data

Figure 1 Cloud-based Quantum Computing Market: Research Design

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primaries

2.1.2.2 Key Industry Insights

2.2 Data Triangulation

Figure 2 Market: Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

Figure 3 Approach 1 (Supply-Side): Revenue from Software/Services of Cloud-based Quantum Computing Vendors

Figure 4 Approach 1 (Supply-Side) Analysis

Figure 5 Cloud-based Quantum Computing Market Estimation: Research Flow

2.4 Market Forecast

Table 2 Factor Analysis

2.5 Company Evaluation Quadrant Methodology

Figure 6 Company Evaluation Quadrant: Criteria Weightage

2.6 Company Evaluation Quadrant Methodology (Startups)

Figure 7 Company Evaluation Quadrant (Startups): Criteria Weightage

2.7 Assumptions

Table 3 Market: Assumptions

2.8 Limitations

Table 4 Market: Limitations

3 Executive Summary

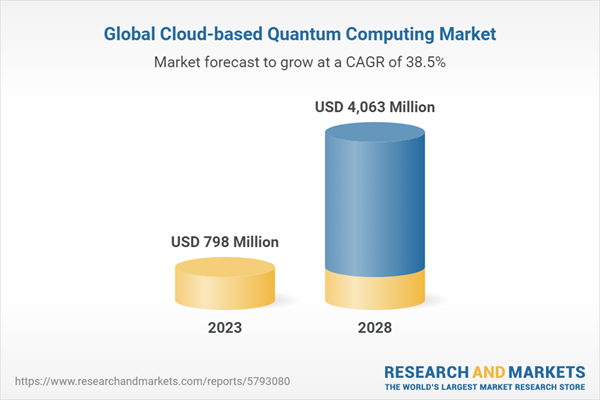

Figure 8 Cloud-based Quantum Computing Market to Witness Significant Growth During Forecast Period Globally

Figure 9 Market: Segments Snapshot

Figure 10 Market: Regional Snapshot

4 Premium Insights

4.1 Attractive Opportunities for Key Market Players

Figure 11 Increasing Investments and Innovations in Quantum Computing Technology to Fuel Market Growth

4.2 Market, by Offering

Figure 12 Cloud-based Quantum Computing Software to Hold Larger Market During Forecast Period

4.3 Market, by Service

Figure 13 Cloud-based Quantum Computing Professional Services to Hold Larger Market Share During Forecast Period

4.4 Market, by Vertical

Figure 14 Research and Academia Segment to Hold Largest Market Size During Forecast Period

4.5 Market Investment Scenario

Figure 15 Asia-Pacific to Emerge as Best Market for Investment in Next Five Years

5 Market Overview and Industry Trends

5.1 Introduction

5.2 Market Dynamics

Figure 16 Cloud-based Quantum Computing Market: Drivers, Restraints, Opportunities, and Challenges

5.2.1 Drivers

5.2.1.1 Accessibility of Quantum Computers Using Cloud Technology

5.2.1.2 Rapid Digitalization to Increase Use of Cloud-based Quantum Computing

5.2.2 Restraints

5.2.2.1 Stability and Error Correction Issues

5.2.2.2 Limited Skilled Expertise for Deployment and Usage of Cloud-based Quantum Computing Solutions

5.2.3 Opportunities

5.2.3.1 Growing Adoption of Quantum Computing Solutions Across Several Verticals

5.2.3.2 Emergence of Startups to Provide Cloud-based Quantum Computing Solutions

5.2.4 Challenges

5.2.4.1 Lack of Standardization

5.3 Ecosystem

Figure 17 Market: Ecosystem

Table 5 Cloud-based Quantum Computing Market: Ecosystem

5.4 Technology Analysis

5.4.1 High-Performance Computing (HPC)

5.4.2 Hybrid Quantum Computing

5.4.3 AI/ML

5.4.4 Cryptography

5.5 Regulatory Implications

5.5.1 P1913 - Software-Defined Quantum Communication

5.5.2 P7130 - Standard for Quantum Technologies Definitions

5.5.3 P7131 - Standard for Quantum Computing Performance Metrics and Benchmarking

5.5.4 National Quantum Initiative Act

5.5.5 OpenQKD

5.5.6 Quantum Computing Governance Principles

5.5.7 Regulatory Bodies, Government Agencies, and Other Organizations

Table 6 List of Regulatory Bodies, Government Agencies, and Other Organizations

5.6 Patent Analysis

Figure 18 Cloud-based Quantum Computing Market: Patent Analysis

5.7 Use Cases

5.7.1 Use Case 1: OTI Lumionics to Accelerate Material Design Using Microsoft Azure Quantum

5.7.2 Use Case 2: CERN Partners with IBM Quantum to Seek New Ways of Patterns in LHC Data

5.7.3 Use Case 3: Microsoft Collaborates with Willis Towers Watson to Transform Risk-Management Solutions

5.8 Pricing Analysis

5.9 Value Chain

Figure 19 Value Chain: Market

5.9.1 Quantum Computing Hardware Manufacturers

5.9.2 Quantum Computing Software Vendors

5.9.3 Cloud Infrastructure Vendors

5.9.4 Independent Software Vendors

5.9.5 System Integrators

5.9.6 End-users

5.10 Porter's Five Forces Analysis

Figure 20 Market: Porter's Five Forces Analysis

Table 7 Market: Impact of Porter's Five Forces

5.10.1 Threat of New Entrants

5.10.2 Threat of Substitutes

5.10.3 Bargaining Power of Suppliers

5.10.4 Bargaining Power of Buyers

5.10.5 Intensity of Competitive Rivalry

5.11 Trends and Disruptions Impacting Customers

Figure 21 Market: Trends and Disruptions Impacting Customers

5.12 Key Stakeholders and Buying Criteria

5.12.1 Key Stakeholders in Buying Process

Figure 22 Influence of Stakeholders on Buying Process (%)

Table 8 Influence of Stakeholders on Buying Process (%)

5.13 Key Conferences and Events in 2023-2024

Table 9 Market: List of Conferences and Events

6 Cloud-based Quantum Computing Market, by Offering

6.1 Introduction

Figure 23 Services Segment to Register Highest CAGR During Forecast Period

Table 10 Market, by Offering, 2019-2022 (USD Million)

Table 11 Market, by Offering, 2023-2028 (USD Million)

6.2 Software

6.2.1 Initiatives to be Taken by Organizations

6.2.2 Software: Market Drivers

Table 12 Software: Market, by Region, 2019-2022 (USD Million)

Table 13 Software: Market, by Region, 2023-2028 (USD Million)

6.3 Services

6.3.1 Efficient Deployment of Cloud-based Quantum Computing Software

6.3.2 Services: Market Drivers

Table 14 Services: Market, by Region, 2019-2022 (USD Million)

Table 15 Services: Market, by Region, 2023-2028 (USD Million)

Table 16 Market, by Service, 2019-2022 (USD Million)

Table 17 Market, by Service, 2023-2028 (USD Million)

6.3.3 Professional Services

6.3.4 Managed Services

7 Cloud-based Quantum Computing Market, by Technology

7.1 Introduction

7.2 Superconducting Qubit

7.2.1 Utilization of Superconducting Qubits in Quantum Processors Development

7.3 Trapped Ion

7.3.1 Adoption of Trapped Ion Technology in Cloud Quantum Computing

7.4 Quantum Annealing

7.4.1 Quantum Annealing to Solve Optimization Problems in Lesser Time

7.5 Others

8 Cloud-based Quantum Computing Market, by Application

8.1 Introduction

8.2 Optimization

8.2.1 Growing Use of Quantum Algorithms to Tackle Optimization Problems Effectively

8.3 Simulation and Modeling

8.3.1 Increasing Adoption of Quantum Computing Simulation to Understand Behavior of Quantum Systems and Develop Quantum Algorithms

8.4 Sampling

8.4.1 Efficient Generation of Results from Dataset

8.5 Encryption

8.5.1 Increasing Cyberattacks and Rising Demand for Hybrid and Fully Remote Working Models

8.6 Others

9 Cloud-based Quantum Computing Market, by Vertical

9.1 Introduction

Figure 24 BFSI Segment to Register Highest CAGR During Forecast Period

Table 18 Market, by Vertical, 2019-2022 (USD Million)

Table 19 Market, by Vertical, 2023-2028 (USD Million)

9.2 Research and Academia

9.2.1 Growing Initiatives in Quantum Research

9.2.2 Research and Academia: Market Drivers

Table 20 Research and Academia: Market, by Region, 2019-2022 (USD Million)

Table 21 Research and Academia: Market, by Region, 2023-2028 (USD Million)

9.3 BFSI

9.3.1 Cloud-based Quantum Computing to Enhance Process of Safeguarding Customer Financial Data

9.3.2 BFSI: Cloud-based Quantum Computing Market Drivers

Table 22 BFSI: Market, by Region, 2019-2022 (USD Million)

Table 23 BFSI: Market, by Region, 2023-2028 (USD Million)

9.4 Healthcare and Pharmaceuticals

9.4.1 Growing Adoption of Cloud Technology

9.4.2 Healthcare and Pharmaceuticals: Market Drivers

Table 24 Healthcare and Pharmaceuticals: Market, by Region, 2019-2022 (USD Million)

Table 25 Healthcare and Pharmaceuticals: Market, by Region, 2023-2028 (USD Million)

9.5 Aerospace and Defense

9.5.1 Cloud-based Quantum Computing to Enhance Process of Secured Communications

9.5.2 Aerospace and Defense: Market Drivers

Table 26 Aerospace and Defense: Market, by Region, 2019-2022 (USD Million)

Table 27 Aerospace and Defense: Market, by Region, 2023-2028 (USD Million)

9.6 Manufacturing

9.6.1 Manufacturing to Enable Process Optimization and Product Development

9.6.2 Manufacturing: Market Drivers

Table 28 Manufacturing: Market, by Region, 2019-2022 (USD Million)

Table 29 Manufacturing: Market, by Region, 2023-2028 (USD Million)

9.7 Transportation and Logistics

9.7.1 Cloud-based Quantum Computing to Overcome Challenges Related to Optimization Operations

9.7.2 Transportation and Logistics: Market Drivers

Table 30 Transportation and Logistics: Market, by Region, 2019-2022 (USD Million)

Table 31 Transportation and Logistics: Market, by Region, 2023-2028 (USD Million)

9.8 Chemicals

9.8.1 Cloud-based Quantum Computing to Enable Designing of Efficient Molecules, Polymers, and Solids

9.8.2 Chemicals: Market Drivers

Table 32 Chemicals: Market, by Region, 2019-2022 (USD Million)

Table 33 Chemicals: Market, by Region, 2023-2028 (USD Million)

9.9 Other Verticals

10 Cloud-based Quantum Computing Market, by Region

10.1 Introduction

Figure 25 Asia-Pacific to Grow at Highest CAGR During Forecast Period

Table 34 Market, by Region, 2019-2022 (USD Million)

Table 35 Market, by Region, 2023-2028 (USD Million)

10.2 North America

10.2.1 North America: Market Drivers

10.2.2 North America: Regulatory Landscape

Figure 26 North America: Market Snapshot

Table 36 North America: Market, by Offering, 2019-2022 (USD Million)

Table 37 North America: Market, by Offering, 2023-2028 (USD Million)

Table 38 North America: Market, by Vertical, 2019-2022 (USD Million)

Table 39 North America: Market, by Vertical, 2023-2028 (USD Million)

Table 40 North America: Market, by Country, 2019-2022 (USD Million)

Table 41 North America: Market, by Country, 2023-2028 (USD Million)

10.2.3 US

10.2.3.1 Presence of Many Cloud-based Quantum Computing Solution Vendors

Table 42 US: Cloud-based Quantum Computing Market, by Offering, 2019-2022 (USD Million)

Table 43 US: Market, by Offering, 2023-2028 (USD Million)

Table 44 US: Market, by Vertical, 2019-2022 (USD Million)

Table 45 US: Market, by Vertical, 2023-2028 (USD Million)

10.2.4 Canada

10.2.4.1 Increasing Investments by Government in Quantum Computing

Table 46 Canada: Market, by Offering, 2019-2022 (USD Million)

Table 47 Canada: Market, by Offering, 2023-2028 (USD Million)

Table 48 Canada: Market, by Vertical, 2019-2022 (USD Million)

Table 49 Canada: Market, by Vertical, 2023-2028 (USD Million)

10.3 Europe

10.3.1 Europe: Market Drivers

10.3.2 Europe: Regulatory Landscape

Table 50 Europe: Market, by Offering, 2019-2022 (USD Million)

Table 51 Europe: Market, by Offering, 2023-2028 (USD Million)

Table 52 Europe: Market, by Vertical, 2019-2022 (USD Million)

Table 53 Europe: Market, by Vertical, 2023-2028 (USD Million)

Table 54 Europe: Cloud-based Quantum Computing Market, by Country, 2019-2022 (USD Million)

Table 55 Europe: Market, by Country, 2023-2028 (USD Million)

10.3.3 UK

10.3.3.1 Organizations to Take Initiative Toward Cloud-based Quantum Computing

Table 56 UK: Market, by Offering, 2019-2022 (USD Million)

Table 57 UK: Market, by Offering, 2023-2028 (USD Million)

Table 58 UK: Market, by Vertical, 2019-2022 (USD Million)

Table 59 UK: Market, by Vertical, 2023-2028 (USD Million)

10.3.4 Germany

10.3.4.1 Investments by Federal Ministry for Economic Affairs and Energy to Develop Quantum Technology

Table 60 Germany: Cloud-based Quantum Computing Market, by Offering, 2019-2022 (USD Million)

Table 61 Germany: Market, by Offering, 2023-2028 (USD Million)

Table 62 Germany: Market, by Vertical, 2019-2022 (USD Million)

Table 63 Germany: Market, by Vertical, 2023-2028 (USD Million)

10.3.5 France

10.3.5.1 Growing Partnerships Among Cloud-based Quantum Computing Solution Provider Organizations

Table 64 France: Market, by Offering, 2019-2022 (USD Million)

Table 65 France: Market, by Offering, 2023-2028 (USD Million)

Table 66 France: Market, by Vertical, 2019-2022 (USD Million)

Table 67 France: Market, by Vertical, 2023-2028 (USD Million)

10.3.6 Rest of Europe

Table 68 Rest of Europe: Cloud-based Quantum Computing Market, by Offering, 2019-2022 (USD Million)

Table 69 Rest of Europe: Market, by Offering, 2023-2028 (USD Million)

Table 70 Rest of Europe: Market, by Vertical, 2019-2022 (USD Million)

Table 71 Rest of Europe: Market, by Vertical, 2023-2028 (USD Million)

10.4 Asia-Pacific

10.4.1 Asia-Pacific: Market Drivers

10.4.2 Asia-Pacific: Regulatory Landscape

Figure 27 Asia-Pacific: Market Snapshot

Table 72 Asia-Pacific: Market, by Offering, 2019-2022 (USD Million)

Table 73 Asia-Pacific: Market, by Offering, 2023-2028 (USD Million)

Table 74 Asia-Pacific: Market, by Vertical, 2019-2022 (USD Million)

Table 75 Asia-Pacific: Market, by Vertical, 2023-2028 (USD Million)

Table 76 Asia-Pacific: Market, by Country, 2019-2022 (USD Million)

Table 77 Asia-Pacific: Market, by Country, 2023-2028 (USD Million)

10.4.3 China

10.4.3.1 Growing Use of Cloud Technology

Table 78 China: Cloud-based Quantum Computing Market, by Offering, 2019-2022 (USD Million)

Table 79 China: Market, by Offering, 2023-2028 (USD Million)

Table 80 China: Market, by Vertical, 2019-2022 (USD Million)

Table 81 China: Market, by Vertical, 2023-2028 (USD Million)

10.4.4 Japan

10.4.4.1 Collaboration Between Universities and Organizations for Research and Development in Cloud-based Quantum Computing

Table 82 Japan: Market, by Offering, 2019-2022 (USD Million)

Table 83 Japan: Market, by Offering, 2023-2028 (USD Million)

Table 84 Japan: Market, by Vertical, 2019-2022 (USD Million)

Table 85 Japan: Market, by Vertical, 2023-2028 (USD Million)

10.4.5 India

10.4.5.1 Partnership Between Government and Cloud Service Providers to Develop Quantum Computing Applications Lab

Table 86 India: Cloud-based Quantum Computing Market, by Offering, 2019-2022 (USD Million)

Table 87 India: Market, by Offering, 2023-2028 (USD Million)

Table 88 India: Market, by Vertical, 2019-2022 (USD Million)

Table 89 India: Market, by Vertical, 2023-2028 (USD Million)

10.4.6 Rest of Asia-Pacific

Table 90 Rest of Asia-Pacific: Market, by Offering, 2019-2022 (USD Million)

Table 91 Rest of Asia-Pacific: Market, by Offering, 2023-2028 (USD Million)

Table 92 Rest of Asia-Pacific: Market, by Vertical, 2019-2022 (USD Million)

Table 93 Rest of Asia-Pacific: Market, by Vertical, 2023-2028 (USD Million)

10.5 RoW

10.5.1 RoW: Market Drivers

Table 94 RoW: Market, by Region, 2019-2022 (USD Million)

Table 95 RoW: Market, by Region, 2023-2028 (USD Million)

10.5.2 Middle East and Africa

10.5.2.1 Collaboration Between Tech-Giants and Academic Institutions to Drive Growth

10.5.3 Latin America

10.5.3.1 Rising Investment in Education Sector by Quantum Computing Companies to Drive Growth

11 Competitive Landscape

11.1 Overview

11.2 Historical Revenue Analysis

Figure 28 Historical Revenue Analysis of Key Cloud-based Quantum Computing Vendors, 2019-2022 (USD Million)

11.3 Market: Ranking of Key Players

Figure 29 Rankings of Key Players

11.4 Market Share Analysis

Figure 30 Cloud-based Quantum Computing Market Share, 2022

Table 96 Market: Degree of Competition

11.5 Company Evaluation Quadrant

11.5.1 Stars

11.5.2 Emerging Leaders

11.5.3 Pervasive Players

11.5.4 Participants

Figure 31 Market: Key Company Evaluation Quadrant (2022)

11.6 Competitive Benchmarking

11.6.1 Company Footprint: Offering

11.6.2 Company Footprint: Region

11.6.3 Overall Company Footprint

11.7 Startups/SMEs Evaluation Quadrant

11.7.1 Progressive Companies

11.7.2 Responsive Companies

11.7.3 Dynamic Companies

11.7.4 Starting Blocks

Figure 32 Market: Startup Evaluation Quadrant (2022)

11.7.5 Competitive Benchmarking for Startups

Table 97 List of Startups/SMEs and Funding

Table 98 Regional Footprint of Startups/SMEs

11.8 Competitive Scenarios and Trends

11.8.1 Product Launches & Enhancements

Table 99 Market: Product Launches & Enhancements, 2020-2023

11.8.2 Deals

Table 100 Cloud-based Quantum Computing Market: Deals, 2020-2023

12 Company Profiles

12.1 Key Players

(Business Overview, Products/Solutions/Services Offered, Recent Developments, Analyst's View, Key Strengths, Strategic Choices, and Weaknesses and Competitive Threats)*

12.1.1 IBM

Table 101 IBM: Business Overview

Figure 33 IBM: Company Snapshot

Table 102 IBM: Products/Solutions/Services Offered

Table 103 IBM: Product Launches and Enhancements

Table 104 IBM: Deals

12.1.2 Microsoft

Table 105 Microsoft: Business Overview

Figure 34 Microsoft: Company Snapshot

Table 106 Microsoft: Products/Solutions/Services Offered

Table 107 Microsoft: Product Launches and Enhancements

Table 108 Microsoft: Deals

12.1.3 Google

Table 109 Google: Business Overview

Figure 35 Google: Company Snapshot

Table 110 Google: Products/Solutions/Services Offered

Table 111 Google: Product Launches and Enhancements

12.1.4 AWS

Table 112 AWS: Business Overview

Figure 36 AWS: Company Snapshot

Table 113 AWS: Products/Solutions/Services Offered

Table 114 AWS: Product Launches and Enhancements

Table 115 AWS: Deals

12.1.5 Baidu

Table 116 Baidu: Business Overview

Figure 37 Baidu: Company Snapshot

Table 117 Baidu: Products/Solutions/Services Offered

Table 118 Baidu: Product Launches and Enhancements

12.1.6 Huawei

Table 119 Huawei: Business Overview

Figure 38 Huawei: Company Snapshot

Table 120 Huawei: Products/Solutions/Services Offered

Table 121 Huawei: Product Launches and Enhancements

Table 122 Huawei: Deals

12.2 Other Players

12.2.1 Rigetti Computing

12.2.2 Xanadu

12.2.3 D-Wave Systems

12.2.4 Oxford Quantum Circuits

12.2.5 IonQ

12.2.6 Pasqal

12.2.7 Zapata Computing

12.2.8 Quandela

12.2.9 QpiCloud

12.2.10 ColdQuanta

12.2.11 Spinq

12.2.12 Qilimanjaro

12.2.13 Arqit

12.2.14 Terra Quantum

12.2.15 Quantum Computing Inc.

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, Analyst's View, Key Strengths, Strategic Choices, and Weaknesses and Competitive Threats Might Not be Captured in Case of Unlisted Companies

13 Adjacent Markets and Appendix

13.1 Adjacent Markets

Table 123 Adjacent Markets and Forecasts

13.2 Limitations

13.2.1 Quantum Computing Market

Table 124 Quantum Computing Market, by Offering, 2019-2022 (USD Million)

Table 125 Quantum Computing Market, by Offering, 2023-2028 (USD Million)

Table 126 Quantum Computing Market, by Deployment, 2019-2022 (USD Million)

Table 127 Quantum Computing Market, by Deployment, 2023-2028 (USD Million)

Table 128 Quantum Computing Market, by Application, 2019-2022 (USD Million)

Table 129 Quantum Computing Market, by Application, 2023-2028 (USD Million)

Table 130 Quantum Computing Market, by End-user, 2019-2022 (USD Million)

Table 131 Quantum Computing Market, by End-user, 2023-2028 (USD Million)

Table 132 Quantum Computing Market, by Region, 2019-2022 (USD Million)

Table 133 Quantum Computing Market, by Region, 2023-2028 (USD Million)

13.2.2 Quantum Computing Software Market

Table 134 Quantum Computing Software Market, by Component, 2017-2019 (USD Million)

Table 135 Quantum Computing Software Market, by Component, 2020-2026 (USD Million)

Table 136 Quantum Computing Software Market, by Organization Size, 2017-2019 (USD Million)

Table 137 Quantum Computing Software Market, by Organization Size, 2020-2026 (USD Million)

Table 138 Quantum Computing Software Market, by Deployment Mode, 2017-2019 (USD Million)

Table 139 Quantum Computing Software Market, by Deployment Mode, 2020-2026 (USD Million)

Table 140 Quantum Computing Software Market, by Application, 2017-2019 (USD Million)

Table 141 Quantum Computing Software Market, by Application, 2020-2026 (USD Million)

Table 142 Quantum Computing Software Market, by Vertical, 2017-2019 (USD Million)

Table 143 Quantum Computing Software Market, by Vertical, 2020-2026 (USD Million)

Table 144 Quantum Computing Software Market, by Region, 2017-2019 (USD Million)

Table 145 Quantum Computing Software Market, by Region, 2020-2026 (USD Million)

13.3 Discussion Guide

13.4 Knowledgestore: The Subscription Portal

13.5 Customization Options