Key Highlights

- The Mobile Phones market includes mobile phone service revenues and average minutes of use (MOU). Market values are made up of total mobile revenues containing revenues from mobile service providers and other members of the mobile service value-chain for the provision of mobile telephony services, excluding revenues from the sale of devices. Market volumes are made up of two segments: prepaid and postpaid, which consist of prepaid average monthly MOU and postpaid average monthly MOU. Minutes of use are made up from the average of voice minutes used in mobile subscriptions, including both incoming and outgoing calls, but not including M2M/IoT voice services.

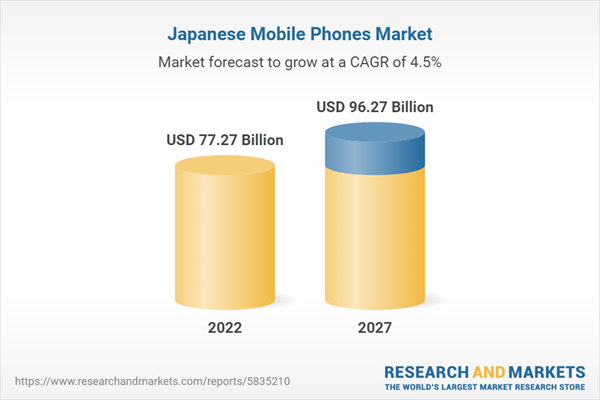

- The Japanese mobile phones market is expected to generate total revenues of $77.3 billion in 2022, representing a compound annual growth rate (CAGR) of 4.0% between 2017 and 2022.

- Market consumption volume is forecasted to increase with a CAGR of 0.2% between 2017 and 2022, to reach a total of 215.7 average MOU in 2022.

- By 2025, 68% Japanese people are estimated to adopt to 5G network with 169 million active users of the 5G network in Japan.

Scope

- Save time carrying out entry-level research by identifying the size, growth, major segments, and leading players in the mobile phones market in Japan

- Use the Five Forces analysis to determine the competitive intensity and therefore attractiveness of the mobile phones market in Japan

- Leading company profiles reveal details of key mobile phones market players’ global operations and financial performance

- Add weight to presentations and pitches by understanding the future growth prospects of the Japan mobile phones market with five year forecasts

Reasons to Buy

- What was the size of the Japan mobile phones market by value in 2022?

- What will be the size of the Japan mobile phones market in 2027?

- What factors are affecting the strength of competition in the Japan mobile phones market?

- How has the market performed over the last five years?

- What are the main segments that make up Japan's mobile phones market?

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- NTT DOCOMO Inc

- KDDI Corporation

- Rakuten Group Inc

- SoftBank Corp

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 53 |

| Published | March 2023 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 77.27 Billion |

| Forecasted Market Value ( USD | $ 96.27 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Japan |