Global Meat (Fresh and Processed) Market - Key Trends and Drivers Summarized

Meat, both fresh and processed, plays a pivotal role in the global diet, providing essential nutrients such as protein, vitamins, and minerals. Fresh meat includes beef, pork, lamb, poultry, and seafood, typically sold in its raw state and known for its rich flavors and textures. Processed meats, on the other hand, include products like sausages, bacon, ham, and deli meats, which undergo various preservation techniques such as curing, smoking, and fermenting to enhance flavor, shelf life, and convenience. The meat industry is a substantial sector of the global economy, employing millions and supporting ancillary industries such as feed production, veterinary services, and food processing equipment. Major meat-producing countries include the United States, Brazil, China, and Australia, each contributing significantly to both domestic consumption and international trade. The industry's complexity extends from farming and slaughtering to processing, packaging, and distribution, ensuring that meat products are readily available to consumers worldwide.Recent trends in the meat industry reflect changing consumer preferences and advancements in technology. There is a growing demand for organic and grass-fed meats as consumers become more health-conscious and environmentally aware. These products are perceived as healthier and more sustainable, prompting producers to adopt more humane and eco-friendly farming practices. Additionally, the rise of alternative proteins, such as plant-based and lab-grown meats, is reshaping the market. Companies like Beyond Meat and Impossible Foods have gained significant market share by offering products that mimic the taste and texture of traditional meats while catering to vegetarians, vegans, and flexitarians. Technological advancements in meat processing have also led to improved safety, efficiency, and product innovation. Innovations such as high-pressure processing (HPP) and advanced packaging technologies help extend the shelf life of meat products while maintaining their quality and safety. Moreover, digitalization in supply chain management enhances traceability and transparency, ensuring that consumers have access to information about the origin and processing of their meat products.

The growth in the meat market is driven by several factors. Increasing global population and rising incomes, particularly in developing countries, have led to higher meat consumption as people can afford more protein-rich diets. Urbanization and busy lifestyles are propelling the demand for convenient and ready-to-eat meat products. Health trends emphasizing high-protein diets are also fueling the consumption of both fresh and processed meats. Moreover, advancements in meat processing technologies enhance product variety and quality, attracting more consumers. Sustainability concerns are driving innovations in both traditional meat production and alternative proteins, with companies investing in more sustainable practices and products to meet consumer demand. The impact of regulatory standards on food safety and quality is another crucial driver, as stringent regulations ensure that meat products meet high safety standards, thereby boosting consumer confidence. Additionally, the expansion of e-commerce and online grocery shopping provides consumers with easier access to a wide range of meat products, further propelling market growth. These factors, combined with continuous innovation and evolving consumer preferences, are shaping the dynamic and robust growth of the global meat market.

Report Scope

The report analyzes the Meat (Fresh and Processed) market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Segment (Pork, Poultry, Beef & Veal, Lamb & Goat).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Pork segment, which is expected to reach 146.8 Million Metric Tons by 2030 with a CAGR of a 2.4%. The Poultry segment is also set to grow at 3.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at 83.3 Million Metric Tons in 2024, and China, forecasted to grow at an impressive 3.9% CAGR to reach 69.1 Million Metric Tons by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Meat (Fresh and Processed) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Meat (Fresh and Processed) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Meat (Fresh and Processed) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BRF S.A., Conagra Brands, Inc., Cremonini S.p.A., Dawn Farm Foods Limited, Elpozo Alimentación, S.A. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 207 companies featured in this Meat (Fresh and Processed) market report include:

- BRF S.A.

- Conagra Brands, Inc.

- Cremonini S.p.A.

- Dawn Farm Foods Limited

- Elpozo Alimentación, S.A.

- Foyle Food Group Ltd.

- Hormel Foods Corporation

- Itoham Foods, Inc.

- JBS S.A.

- Kepak Group Limited

- Marfrig Global Foods S.A.

- Perdue Farms Inc.

- San Miguel Pure Foods Company Inc.

- Smithfield Foods, Inc.

- Tyson Foods, Inc.

- VION Holding N.V.

- WH Group Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BRF S.A.

- Conagra Brands, Inc.

- Cremonini S.p.A.

- Dawn Farm Foods Limited

- Elpozo Alimentación, S.A.

- Foyle Food Group Ltd.

- Hormel Foods Corporation

- Itoham Foods, Inc.

- JBS S.A.

- Kepak Group Limited

- Marfrig Global Foods S.A.

- Perdue Farms Inc.

- San Miguel Pure Foods Company Inc.

- Smithfield Foods, Inc.

- Tyson Foods, Inc.

- VION Holding N.V.

- WH Group Limited

Table Information

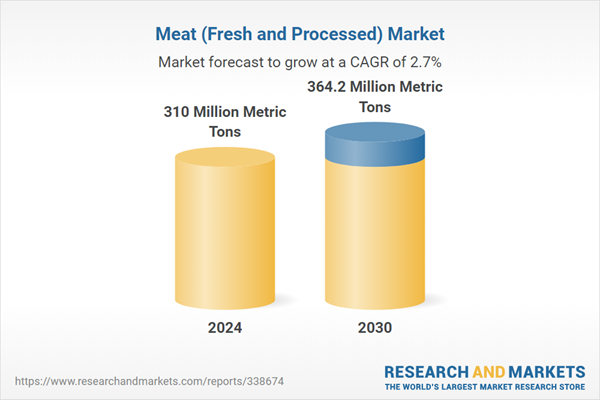

| Report Attribute | Details |

|---|---|

| No. of Pages | 351 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value in 2024 | 310 Million Metric Tons |

| Forecasted Market Value by 2030 | 364.2 Million Metric Tons |

| Compound Annual Growth Rate | 2.7% |

| Regions Covered | Global |