Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Urbanization and Changing Lifestyles

Urbanization is one of the primary drivers of growth in the India Built-in Kitchen Appliances Market. As more people move to urban areas for better job opportunities, the demand for modern, space-efficient appliances increases. Urban living often involves smaller homes with limited kitchen space, leading consumers to prefer built-in kitchen appliances that offer sleek designs and optimize space usage. Built-in solutions like ovens, refrigerators, dishwashers, and cooktops are seamlessly integrated into the kitchen, providing both functionality and aesthetic appeal. This trend aligns with the growing preference for smart homes, where convenience and efficiency are prioritized.Along with urbanization, changing consumer lifestyles also play a significant role in the market's expansion. As middle-class incomes rise and more people embrace busy, professional lives, there is a shift towards convenience. Built-in kitchen appliances allow for easier cooking, cleaning, and maintenance, saving both time and effort. India is witnessing a swift rise in urbanization, with urban areas currently comprising about one-third of the total population, a figure expected to reach 40% by 2036.

This shift from rural to urban living is driven by factors like job opportunities and economic growth. As a result, significant investments in urban infrastructure are essential to accommodate the expanding urban population. By 2036, India’s towns and cities will house 600 million people, up from 31% of the population in 2011, with urban areas contributing nearly 70% to the GDP. To support this growth, India will need to invest USD840 billion in infrastructure, averaging $55 billion or 1.2% of GDP annually.

Increasing Disposable Income

The rising disposable income of the Indian middle class is another major driver of the built-in kitchen appliances market. With greater purchasing power, more consumers are able to invest in high-quality, premium home appliances. The increasing affordability of advanced built-in appliances, combined with attractive financing options and easy availability, encourages consumers to upgrade their kitchens.As the Indian economy grows and the middle class expands, there is a notable shift toward luxury and convenience in household products. Built-in kitchen appliances, known for their modernity, functionality, and space-saving designs, appeal to the growing number of affluent consumers who are seeking to enhance their lifestyles. This demographic is more inclined to invest in long-lasting, high-performance appliances that improve both the look and function of their kitchens. As a result, the market for premium built-in kitchen appliances, including ovens, dishwashers, and built-in refrigerators, is set to grow significantly.

Technological Advancements and Rising Awareness

Advancements in technology are playing a crucial role in the growth of the India Built-in Kitchen Appliances Market. The introduction of energy-efficient appliances, smart connectivity features, and cutting-edge innovations such as touch-control panels, voice-command integration, and AI-powered cooking functions are making built-in appliances more attractive to Indian consumers. These appliances not only offer improved performance but also help reduce energy consumption, which appeals to environmentally conscious and cost-savvy buyers.Moreover, increased awareness about the benefits of modern kitchen appliances is driving their adoption. Consumers are becoming more knowledgeable about energy efficiency, convenience, and the long-term savings that come with high-quality, built-in appliances. Social media, influencers, and the rise of home improvement content have played a significant role in promoting the benefits of upgrading to built-in solutions. As awareness grows, consumers are more inclined to invest in appliances that make their cooking and home management easier, smarter, and more efficient.

Key Market Challenges

High Initial Cost and Affordability Issues

One of the primary challenges facing the India Built-in Kitchen Appliances Market is the high initial cost of these appliances. Built-in kitchen appliances, such as ovens, dishwashers, and refrigerators, are typically more expensive than freestanding alternatives due to their advanced features, premium design, and installation requirements. The cost factor makes these appliances less accessible to a large portion of India’s population, particularly in lower and middle-income groups. While disposable income is rising in India, the affordability of built-in appliances remains a significant barrier for many consumers. Most of these appliances are considered a luxury, and many consumers may prefer to spend their money on other immediate needs rather than invest in high-end kitchen solutions. Additionally, installation costs, which often involve professional services to integrate the appliances into existing kitchen spaces, can add to the total expenditure.Limited Awareness and Lack of Consumer Education

Another major challenge is the limited awareness and understanding of built-in kitchen appliances among Indian consumers. While urban areas are witnessing increased adoption of these appliances, many consumers, especially in smaller towns and rural regions, are still unfamiliar with the benefits and availability of built-in solutions. Traditional cooking methods and standalone kitchen appliances continue to dominate many Indian households, and the concept of built-in kitchens may seem complex and unfamiliar to them. Consumers may not fully understand the advantages of built-in appliances, such as better space optimization, enhanced aesthetics, and more efficient cooking. In addition, many are unaware of the potential for long-term savings in energy costs and time saved through the convenience of built-in solutions like dishwashers or smart cooking systems.Infrastructure and Installation Challenges

The infrastructure and installation process for built-in kitchen appliances in India presents a significant challenge. Unlike freestanding appliances that can be easily moved or installed in various kitchen settings, built-in appliances require specific kitchen layouts and professional installation to ensure they function properly. In many cases, existing kitchens may need to be redesigned or renovated to accommodate these appliances, which can be costly and time-consuming. In addition, there is a shortage of skilled technicians and installers in India who are qualified to install built-in kitchen appliances. This lack of trained professionals can lead to improper installations, which might result in malfunctioning or suboptimal performance of the appliances. The inconvenience and potential for errors during installation can deter consumers from opting for built-in appliances.Key Market Trends

Shift Towards Smart and Connected Appliances

One of the most prominent trends in the India Built-in Kitchen Appliances Market is the increasing adoption of smart and connected appliances. As technology continues to evolve, more consumers are looking for appliances that offer convenience, efficiency, and control at their fingertips. Smart built-in appliances, such as refrigerators, ovens, dishwashers, and cooktops, are becoming more popular as they offer features like remote control, energy monitoring, voice assistance, and integration with other smart home systems.For example, smart refrigerators can allow users to monitor their groceries and manage inventory, while smart ovens can be controlled remotely through mobile apps, allowing users to preheat or adjust cooking settings from anywhere. These appliances offer not only convenience but also energy efficiency, as many of them are designed to optimize power usage and reduce wastage.

This trend is largely driven by the increasing penetration of internet and smartphone use in India. As more consumers get connected to the internet and smart home ecosystems, they seek appliances that can integrate seamlessly into their digital lifestyles. Furthermore, the younger, tech-savvy population is more inclined to invest in such appliances, particularly in urban areas where smart homes are becoming more prevalent. This shift towards smart appliances also reflects a growing desire for automation and control, making kitchen tasks easier and more efficient.

Increasing Demand for Energy-Efficient Appliances

Another significant trend in the India Built-in Kitchen Appliances Market is the rising demand for energy-efficient products. With energy costs steadily increasing and environmental concerns becoming more prominent, consumers are increasingly prioritizing appliances that consume less power and have lower environmental footprints. Energy-efficient built-in kitchen appliances, such as induction cooktops, dishwashers, and refrigerators, are seen as both cost-saving and environmentally friendly. The Indian government’s initiatives to promote energy efficiency, such as the Bureau of Energy Efficiency (BEE) ratings, have also played a key role in driving consumer demand for energy-efficient appliances.These appliances are designed to reduce energy consumption while still providing optimal performance, which is an attractive feature for Indian households looking to save on utility bills. For instance, energy-efficient refrigerators and dishwashers not only consume less electricity but also help in reducing the carbon footprint of households. As awareness of sustainability grows, consumers are increasingly interested in appliances that use less energy and contribute to reducing their overall environmental impact. In urban centers where electricity costs are higher, energy-efficient appliances are seen as a smart investment that can lead to long-term savings. Additionally, with the rising popularity of eco-friendly lifestyles, energy-efficient built-in appliances are gaining traction among affluent consumers who want to incorporate sustainability into every aspect of their homes, including their kitchens.

Segmental Insights

Product Type Insights

In the India Built-in Kitchen Appliances Market, built-in hobs represent the dominant segment by product type. Built-in hobs, also known as cooktops, have gained significant popularity due to their modern, sleek design, space-saving capabilities, and enhanced cooking performance. These appliances are integrated seamlessly into kitchen countertops, providing a more aesthetically appealing and functional solution compared to traditional standalone stoves. One of the primary reasons for the dominance of built-in hobs in India is the increasing demand for modular kitchens. As urbanization rises and more consumers prefer modern kitchen designs, built-in hobs fit perfectly into the evolving trend of compact, organized kitchens.These hobs come in various configurations, such as gas, electric, and induction, catering to different consumer preferences and needs. Induction hobs, in particular, are gaining traction due to their energy efficiency and quicker cooking times, aligning with the growing demand for energy-saving and advanced appliances. Moreover, the growing inclination toward cooking convenience and safety features, such as auto-shutoff and flame failure protection, further drives the adoption of built-in hobs. As disposable income rises and consumers in urban centers seek premium kitchen solutions, the built-in hob segment is expected to maintain its dominant position in the Indian market. Their ability to deliver a combination of design, functionality, and innovation makes them a top choice for modern kitchens.

Regional Insights

The North region of India was the dominant segment in the Built-in Kitchen Appliances Market, primarily driven by the rapid urbanization, increasing disposable income, and the growing trend of modern home renovations in cities like Delhi, Gurgaon, and Chandigarh. This region, with its affluent consumer base, shows a higher adoption rate of premium kitchen solutions such as built-in appliances, including hobs, ovens, dishwashers, and refrigerators. The growing awareness of the benefits of modular and built-in kitchens, which offer space optimization and sleek aesthetics, is a key factor contributing to the dominance of the North region.As urban populations grow and consumers increasingly prioritize modern, high-end kitchen designs, there is a rising demand for built-in appliances. The preference for premium, stylish, and high-performance appliances is particularly evident in tier-1 cities in the North, where consumers have higher purchasing power. Additionally, the North region's infrastructure development and the increasing number of residential and commercial projects further boost the demand for built-in kitchen appliances. The trend of improving lifestyle and home aesthetics, coupled with the growing influence of global kitchen trends, makes this region the largest contributor to the market.

- In 2024, Havells India revealed plans to launch a series of premium kitchen products, emphasizing advanced, energy-efficient, and visually appealing solutions. The company’s entry into the kitchen appliances market, offering cooktops, hobs, chimneys, and other built-in appliances, is set to intensify competition in this sector.

- In 2024, Electrolux has introduced a new range of built-in kitchen appliances in India. This expanded collection includes microwaves, ovens, hobs, cooker hoods, dishwashers, and coffee machines.

- In 2024, Hafele unveiled a new line of innovative premium appliances. Among the new products is the Midora Full Steam Oven, a versatile appliance that allows users to bake, grill, roast, and steam their food. Hafele has introduced the Renata Cookerhoods from the Essentia Series, combining style and convenience in the kitchen. These cookerhoods feature a filter-free design, a powerful motor, and intelligent auto-clean technology for effortless maintenance.

Key Market Players

- Whirlpool of India Ltd.

- BSH Household Appliances Manufacturing Private Limited

- Franke Faber India Private Limited

- Hafele India Private Limited

- Miele India Pvt. Ltd.

- Samsung India Electronics Private Limited

- Haier Smart Home Co., Ltd

- Kaff Appliances (India) Private Limited

- IFB Appliances LTD

- BlowHot Kitchen Appliances Pvt. Ltd.

Report Scope:

In this report, the India Built-in Kitchen Appliances Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Built-in Kitchen Appliances Market, By Product Type:

- Built-in Hobs

- Built-in Hoods

- Built-in Ovens & Microwaves

- Built-in Dishwashers

- Built-in Refrigerators

- Others

India Built-in Kitchen Appliances Market, By Distribution Channel:

- Contract Sales

- Multi-Branded Stores

- Exclusive Stores

- Online

India Built-in Kitchen Appliances Market, By Region:

- North

- West

- South

- East

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Built-in Kitchen Appliances Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Whirlpool of India Ltd.

- BSH Household Appliances Manufacturing Private Limited

- Franke Faber India Private Limited

- Hafele India Private Limited

- Miele India Pvt. Ltd.

- Samsung India Electronics Private Limited

- Haier Smart Home Co., Ltd

- Kaff Appliances (India) Private Limited

- IFB Appliances LTD

- BlowHot Kitchen Appliances Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 88 |

| Published | February 2025 |

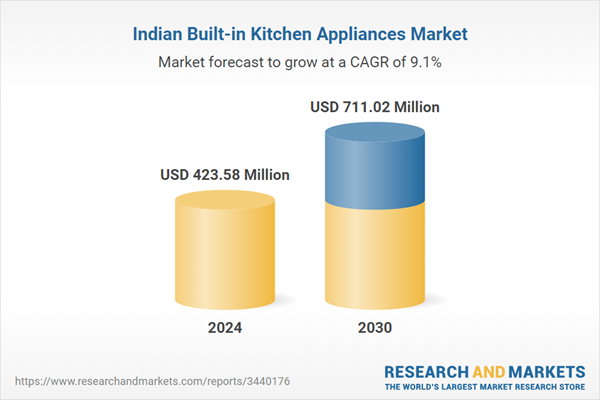

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 423.58 Million |

| Forecasted Market Value ( USD | $ 711.02 Million |

| Compound Annual Growth Rate | 9.0% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |