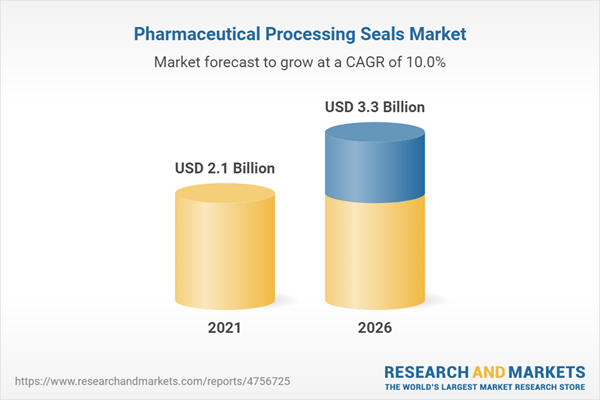

The pharmaceutical processing seals market is estimated to be USD 2.1 Billion in 2021 and is projected to reach USD 3.3 Billion by 2026, at a CAGR of 10.0%. Manufacturing equipment is the major application of pharmaceutical processing seals. Capacity expansion and constant innovation in the pharmaceutical industry are expected to drive the demand for pharmaceutical processing seals. North America is the major consumer of pharmaceutical manufacturing equipment; the presence of a strong healthcare sector in the region is driving the pharmaceutical industry and thus, boosting the market for pharmaceutical processing seals. The high demand for new and improved equipment with greater stability and performance used in pharmaceutical manufacturing is likely to generate a positive impact on the growth of the pharmaceutical processing seals market. This overall growth in the demand for pharmaceutical manufacturing equipment is expected to drive the pharmaceutical processing seals market.

O-rings accounted for the largest market share in pharmaceutical processing seals market.

O-rings accounted for the largest market share in the pharmaceutical processing seals market. O-rings are used in pharmaceutical equipment used during the manufacturing of pharmaceutical drugs. The increasing demand for pharmaceutical processing seals is driven by the growth of the pharmaceutical manufacturing sector. The factors contributing to the growth of the pharmaceutical sector, globally are increasing incidences of chronic diseases and lifestyle diseases, growing elderly population, and improved healthcare system. O-rings are used in applications such as cryogenic, bioprocessing, and others. The type of equipment, which highly consumes O-rings are agitators and hydraulic cylinders, the huge consumption of which, is expected to drive the pharmaceutical processing seals market, globally.

Silicone is the fastest-growing material for pharmaceutical processing seals.

Silicone is estimated to be the fastest-growing material for pharmaceutical processing seals between 2021 and 2026. Silicone is preferred in the pharmaceutical industry due to its properties such as flexibility and stability in extreme pressure and temperature conditions, chemical inertness, and minimal bacterial growth. Silicone is the apt material for pharmaceutical processing seals used in pharmaceutical equipment when purity and cleanliness is highly concerned. It is used in the pharmaceutical industry for manufacturing O-rings, diaphragms, elastomer seals, and gaskets. The growth in the consumption of these seals in pharmaceutical equipment is expected to drive the market for silicone-based pharmaceutical processing seals, globally.

North America is the largest market for pharmaceutical processing seals.

North America was the largest market for pharmaceutical processing seals in 2020, owing to the presence of strong and developed pharmaceutical industry in the region. North America consists of some of the major pharmaceutical markets of the world, such as the US and Mexico. The huge production of pharmaceutical drugs in the region has boosted the pharmaceutical equipment market which has increased the demand for pharmaceutical processing seals. Factors contributing to the increased pharmaceutical production in the region are huge demand for generic and biosimilar drugs, huge healthcare expenditure, increasing elderly population, and growing incidence of lifestyle diseases. The huge production and consumption of pharmaceuticals in the region is expected to drive the pharmaceutical processing seals market.

Extensive primary interviews were conducted in the process of determining and verifying sizes of the type, material, and application segments of the pharmaceutical processing seals market gathered through secondary research.

The break-up of primary interviews has been given below.

- By Company Type: Tier 1 - 30%, Tier 2 - 50%, and Tier 3 - 20%

- By Designation: C Level Executives - 40%, Director Level - 20%, Others - 40%

- By Region: North America - 10%, Europe - 40%, APAC - 30%, South America - 10%, MEA- 10%

The key companies profiled in this report for the pharmaceutical processing seals market include Trelleborg AB (Sweden), Freudenberg Group (Germany), Flowserve Corporation (US), James Walker (UK), Parker Hannifin Corporation (US), Saint-Gobain S.A. (France), Garlock (US), John Crane (US), IDEX Corporation (US), and Morgan Advanced Materials PLC (UK).

Research Coverage

The pharmaceutical processing seals market has been segmented based on type, material, application, and region. This report covers the pharmaceutical processing seals market and forecasts its market size till 2023. It also provides detailed information on company profiles and competitive strategies adopted by the key players to strengthen their position in the pharmaceutical processing seals market. The report also provides insights into the driving and restraining factors in the pharmaceutical processing seals market along with opportunities and challenges across the market. The report also includes profiles of top manufacturers in the pharmaceutical processing seals market.

Key Benefits of Buying the Report

The report is expected to help market leaders/new entrants in the following ways:

1. This report segments the pharmaceutical processing market and provides the closest approximations of revenue numbers for the overall market and its segments across different verticals and regions.

2. This report is expected to help stakeholders understand the pulse of the pharmaceutical processing seals market and provide information on key market drivers, restraints, challenges, and opportunities influencing the growth of the market.

3. This report is expected to help stakeholders obtain an in-depth understanding of the competitive landscape of the pharmaceutical processing seals market and gain insights to improve the position of their businesses. The competitive landscape section includes detailed information on strategies such as new product launch, merger & acquisition, joint venture, and expansion.

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology

2.1 Research Data

Figure 1 Pharmaceutical Processing Seals Market: Research Methodology

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

Figure 2 Market Size Estimation: Top-Down Approach

Figure 3 Market Size Estimation: Bottom-Up Approach

2.3 Data Triangulation

Figure 4 Pharmaceutical Processing Seals: Data Triangulation

2.3.1 Assumptions

3 Executive Summary

Figure 5 Metals to be Largest Type of Material for Pharmaceutical Processing Seals

Figure 6 O-Rings to be Largest Type of Pharmaceutical Processing Seals

Figure 7 Manufacturing Equipment Was Largest Application of Pharmaceutical Processing Seals in 2020

Figure 8 North America Was Largest Pharmaceutical Processing Seals Market in 2020

4 Premium Insights

4.1 Attractive Opportunities in the Pharmaceutical Processing Seals Market

Figure 9 Growing Manufacturing Equipment Application to Drive Market During Forecast Period (2021-2026)

4.2 Pharmaceutical Processing Seals Market in North America, by Country and Application, 2020

Figure 10 Manufacturing Equipment Was Largest Application of Pharmaceutical Processing Seals in North America, 2020

5 Market Overview

5.1 Introduction

Figure 11 Drivers, Restraints, Opportunities, and Challenges Governing Pharmaceutical Processing Seals Market

5.1.1 Drivers

5.1.1.1 Increasing Demand for OTC Drugs

5.1.1.2 Increasing Instances of Chronic Diseases

5.1.2 Restraints

5.1.2.1 Growing Preference for Refurbished Equipment

5.1.3 Opportunities

5.1.3.1 Growing Elderly Population

5.1.3.2 Growth of Pharmaceutical Manufacturing in the Emerging Economies

Figure 12 Percentage of Finish Dosage Forms (Fdf) Manufacturing Facilities for Human Drugs in US Market by Country or Region, 2020

5.1.4 Challenges

5.1.4.1 Increasing Overall Costs Owing to Dynamic Regulatory Measures

5.2 Porter's Five Forces Analysis

Figure 13 Pharmaceutical Processing Seals Market: Porter's Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Threat of New Entrants

5.2.3 Threat of Substitutes

5.2.4 Bargaining Power of Buyers

5.2.5 Intensity of Competitive Rivalry

5.3 Macroeconomic Indicators

5.3.1 Global GDP Outlook

Table 1 World GDP Growth Projection

6 Pharmaceutical Processing Seals Market, by Material

6.1 Introduction

Figure 14 Metals to Lead Pharmaceutical Processing Seals Market in Material Segment

Table 2 Pharmaceutical Processing Seals Market Size, by Material, 2019-2026 (USD Million)

6.2 Metals

6.2.1 Ability to Withstand High Pressure and Temperatures Makes Metals Ideal for Use in Pharmaceutical Processing Seals

Table 3 Metal-Based Pharmaceutical Processing Seals Market Size, by Region, 2019-2026 (USD Million)

6.3 Ptfe

6.3.1 Growing Markets for O-Rings and Gaskets Are Driving Demand for Ptfe in Pharmaceutical Processing Seals

Table 4 Ptfe-Based Pharmaceutical Processing Seals Market Size, by Region, 2019-2026(USD Million)

6.4 Silicone

6.4.1 Inherent Properties of Silicone Boost Its Demand for Pharmaceutical Processing Seals

Table 5 Silicone-Based Pharmaceutical Processing Seals Market Size, by Region, 2019-2026 (USD Million)

6.5 Nitrile Rubber

6.5.1 Increasing Demand for Nitrile Rubber-Based O-Rings Due to Their Low Compression Set, High Tensile Strength, and High Abrasion Resistance Properties

Table 6 Nitrile Rubber-Based Pharmaceutical Processing Seals Market Size, by Region, 2019-2026 (USD Million)

6.6 Epdm

6.6.1 Resistance to Chemicals and Thermal Reactions is One of the Major Properties of Epdm Driving Its Demand for Making Pharmaceutical Processing Seals

Table 7 Epdm-Based Pharmaceutical Processing Seals Market Size, by Region, 2019-2026(USD Million)

6.7 Fkm

6.7.1 Increasing Demand for High Performance Seals in Pharmaceutical Equipment Manufacturing to Drive Market for Fkm

Table 8 Fkm-Based Pharmaceutical Processing Seals Market Size, by Region, 2019-2026 (USD Million)

6.8 Ffkm

6.8.1 Application of Fkkm for High-End Applications to Drive Demand

Table 9 Ffkm-Based Pharmaceutical Processing Seals Market Size, by Region, 2019-2026(USD Million)

6.9 Polyurethane

6.9.1 Increasing Demand for New and Innovative Pharmaceutical Products is Driving the Market for D Seals

Table 10 Polyurethane-Based Pharmaceutical Processing Seals Market Size, by Region, 2019-2026 (USD Million)

6.10 Uhmwpe

6.10.1 Increasing Demand for New and Innovative Pharmaceutical Products is Driving Market for Uhmwpe

Table 11 Uhmwpe-Based Pharmaceutical Processing Seals Market Size, by Region, 2019-2026(USD Million)

7 Pharmaceutical Processing Seals Market, by Type

7.1 Introduction

Figure 15 O-Rings to be the Fastest-Growing Segment During the Forecast Period

7.2 O-Rings

7.2.1 Increasing Demand for O-Rings in Pharmaceutical Industry is Due to Their Cost-Effectiveness and Versatility

Table 12 O-Rings Market Size for Pharmaceutical Processing Seals, by Region, 2019-2026 (USD Million)

7.3 Gaskets

7.3.1 Increasing Demand for Pharmaceutical Manufacturing, Especially in the Developing Economies is Driving the Market for Gaskets

Table 13 Gaskets Market Size for Pharmaceutical Processing Seals, by Region, 2019-2026 (USD Million)

7.4 Lip Seals

7.4.1 Growing Pharmaceutical Industry is Driving the Market for Lip Seals

Table 14 Lip Seals Market Size for Pharmaceutical Processing Seals, by Region, 2019-2026(USD Million)

7.5 D Seals

7.5.1 Increasing Demand for New and Innovative Pharmaceutical Products is Driving the Market for D Seals

Table 15 D Seals Market Size for Pharmaceutical Processing Seals, by Region, 2019-2026(USD Million)

7.6 Others

Table 16 Other Pharmaceutical Processing Seals Market Size, by Region, 2019-2026 (USD Million)

8 Pharmaceutical Processing Seals Market, by Application

8.1 Introduction

Figure 16 Manufacturing Equipment to Dominate the Pharmaceutical Processing Seals Market

Table 17 Pharmaceutical Processing Seals Market Size, by Application, 2019-2026(USD Million)

8.2 Manufacturing Equipment

8.2.1 Growing Pharmaceutical Industry is Driving Demand in Manufacturing Equipment Segment

Table 18 Pharmaceutical Processing Seals Market Size in Manufacturing Equipment Application, by Region, 2019-2026 (USD Million)

8.3 Others

Table 19 Pharmaceutical Processing Seals Market Size in Other Applications, by Region, 2019-2026(USD Million)

9 Pharmaceutical Processing Seals Market, by Region

9.1 Introduction

Figure 17 India, China, Mexico, and South Korea to Emerge as New Strategic Destinations for Pharmaceutical Processing Seals Market

Table 20 Pharmaceutical Processing Seals Market Size, by Region, 2016-2018 (USD Million)

Table 21 Pharmaceutical Processing Seals Market Size, by Region, 2019-2026 (USD Million)

Table 22 Pharmaceutical Processing Seals Market Size, by Type, 2016-2018 (USD Million)

Table 23 Pharmaceutical Processing Seals Market Size, by Type, 2019-2026 (USD Million)

Table 24 Pharmaceutical Processing Seals Market Size, by Material, 2016-2018 (USD Million)

Table 25 Pharmaceutical Processing Seals Market Size, by Material, 2019-2026 (USD Million)

Table 26 Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 27 Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

9.2 North America

Figure 18 North America: Pharmaceutical Processing Seals Market Snapshot

Table 28 North America: Pharmaceutical Processing Seals Market Size, by Region, 2016-2018 (USD Million)

Table 29 North America: Pharmaceutical Processing Seals Market Size, by Region, 2019-2026 (USD Million)

Table 30 North America: Pharmaceutical Processing Seals Market Size, by Type, 2016-2018 (USD Million)

Table 31 North America: Pharmaceutical Processing Seals Market Size, by Type, 2019-2026 (USD Million)

Table 32 North America: Pharmaceutical Processing Seals Market Size, by Material, 2016-2018 (USD Million)

Table 33 North America: Pharmaceutical Processing Seals Market Size, by Material, 2019-2026 (USD Million)

Table 34 North America: Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 35 North America: Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

9.2.1 US

9.2.1.1 Growing Pharmaceutical Industry and Healthcare Expenditure Are Driving US Market for Pharmaceutical Processing Seals

Table 36 US: Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 37 US: Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

9.2.2 Canada

9.2.2.1 Growing Generic Drugs Market is Influencing the Pharmaceutical Processing Seals Market Positively in Canada

Table 38 Canada: Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 39 Canada: Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

9.2.3 Mexico

9.2.3.1 Growing Aging Population and Growth in Biosimilar Drugs Segment Are Expected to Drive Market for Pharmaceutical Processing Seals

Table 40 Mexico: Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 41 Mexico: Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

9.3 APAC

Figure 19 APAC: Pharmaceutical Processing Seals Market Snapshot

Table 42 APAC: Pharmaceutical Processing Seals Market Size, by Country, 2016-2018 (USD Million)

Table 43 APAC: Pharmaceutical Processing Seals Market Size, by Country, 2019-2026 (USD Million)

Table 44 APAC: Pharmaceutical Processing Seals Market Size, by Type, 2016-2018 (USD Million)

Table 45 APAC: Pharmaceutical Processing Seals Market Size, by Type, 2019-2026 (USD Million)

Table 46 APAC: Pharmaceutical Processing Seals Market Size, by Material, 2016-2018 (USD Million)

Table 47 APAC: Pharmaceutical Processing Seals Market Size, by Material, 2019-2026 (USD Million)

Table 48 APAC: Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 49 APAC: Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

9.3.1 China

9.3.1.1 Increasing Aging Population and Healthcare Spending Are Driving the Market for Pharmaceutical Processing Seals in China

Table 50 China: Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 51 China: Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

9.3.2 Japan

9.3.2.1 Growing Aging Population is Triggering the Demand for Pharmaceutical Processing Seals Indirectly in Japan

Table 52 Japan: Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 53 Japan: Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

9.3.3 India

9.3.3.1 as Largest Manufacturer of Generic Drugs, India is a Prominent Market for Pharmaceutical Processing Seals

Table 54 India: Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 55 India: Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

9.3.4 South Korea

9.3.4.1 Growing Market for Biosimilar Drugs is Contributing to Market Growth of Pharmaceutical Processing Seals

Table 56 South Korea: Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 57 South Korea: Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

9.3.5 Indonesia

9.3.5.1 Growing Middle-Class Population and Healthcare Expenditure Are Driving the Market for Pharmaceutical Processing Seals

Table 58 Indonesia: Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 59 Indonesia: Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

9.3.6 Rest of APAC

Table 60 Rest of APAC: Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 61 Rest of APAC: Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

9.4 Europe

Figure 20 Europe: Pharmaceutical Processing Seals Market Snapshot

Table 62 Europe: Pharmaceutical Processing Seals Market Size, by Country, 2016-2018 (USD Million)

Table 63 Europe: Pharmaceutical Processing Seals Market Size, by Country, 2019-2026 (USD Million)

Table 64 Europe: Pharmaceutical Processing Seals Market Size, by Type, 2016-2018 (USD Million)

Table 65 Europe: Pharmaceutical Processing Seals Market Size, by Type, 2019-2026 (USD Million)

Table 66 Europe: Pharmaceutical Processing Seals Market Size, by Material, 2016-2018 (USD Million)

Table 67 Europe: Pharmaceutical Processing Seals Market Size, by Material, 2019-2026 (USD Million)

Table 68 Europe: Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 69 Europe: Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

9.4.1 Germany

9.4.1.1 Growing Pharmaceutical Industry Due to Constant R&D Investments and Increasing Healthcare Expenditures Are Driving the Market in Germany

Table 70 Germany: Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 71 Germany: Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

9.4.2 Italy

9.4.2.1 Strong Pharmaceutical Manufacturing Base and Export Market Are Driving the Demand for Pharmaceutical Processing Seals

Table 72 Italy: Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 73 Italy: Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

9.4.3 Switzerland

9.4.3.1 Concentration of Major Pharmaceutical Companies Propels the Pharmaceutical Processing Seals Market in the Country

Table 74 Switzerland: Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 75 Switzerland: Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

9.4.4 UK

9.4.4.1 Growing Pharmaceutical Industry Due to the Increasing Elderly Population, Has Boosted the Demand for Pharmaceutical Processing Seals in the Country

Table 76 UK: Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 77 UK: Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

9.4.5 France

9.4.5.1 Strong Healthcare System and Government Support to the Healthcare Industry Are Driving the Market for Pharmaceutical Processing Seals

Table 78 France: Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 79 France: Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

9.4.6 Spain

9.4.6.1 High R&D Spending in the Pharmaceutical Industry Are Driving the Market for Pharmaceutical Processing Seals

Table 80 Spain: Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 81 Spain: Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

9.4.7 Rest of Europe

Table 82 Rest of Europe: Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 83 Rest of Europe: Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

9.5 South America

Table 84 South America: Pharmaceutical Processing Seals Market Size, by Country, 2016-2018 (USD Million)

Table 85 South America: Pharmaceutical Processing Seals Market Size, by Country, 2019-2026 (USD Million)

Table 86 South America: Pharmaceutical Processing Seals Market Size, by Type, 2016-2018 (USD Million)

Table 87 South America: Pharmaceutical Processing Seals Market Size, by Type, 2019-2026 (USD Million)

Table 88 South America: Pharmaceutical Processing Seals Market Size, by Material, 2016-2018 (USD Million)

Table 89 South America: Pharmaceutical Processing Seals Market Size, by Material, 2019-2026 (USD Million)

Table 90 South America: Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 91 South America: Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

9.5.1 Brazil

9.5.1.1 Growing Generic Drugs Market Drives the Demand for Pharmaceutical Processing Seals in the Country

Table 92 Brazil: Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 93 Brazil: Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

9.5.2 Argentina

9.5.2.1 Huge Investments in R&D Activities in the Pharmaceutical Industry and the Presence of Strong Locally-Owned Laboratories Are the Governing Factors for the Market

Table 94 Argentina: Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 95 Argentina: Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

9.5.3 Rest of South America

Table 96 Rest of South America: Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 97 Rest of South America: Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

9.6 Middle East & Africa

Table 98 Middle East & Africa: Pharmaceutical Processing Seals Market Size, by Country, 2016-2018 (USD Million)

Table 99 Middle East & Africa: Pharmaceutical Processing Seals Market Size, by Country, 2019-2026 (USD Million)

Table 100 Middle East & Africa: Pharmaceutical Processing Seals Market Size, by Type, 2016-2018 (USD Million)

Table 101 Middle East & Africa: Pharmaceutical Processing Seals Market Size, by Type, 2019-2026 (USD Million)

Table 102 Middle East & Africa: Pharmaceutical Processing Seals Market Size, by Material, 2016-2018 (USD Million)

Table 103 Middle East & Africa: Pharmaceutical Processing Seals Market Size, by Material, 2019-2026 (USD Million)

Table 104 Middle East & Africa: Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 105 Middle East & Africa: Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

9.6.1 Saudi Arabia

9.6.1.1 New Government Initiatives for the Development of the Pharmaceutical Industry is Driving the Pharmaceutical Processing Seals Market in the Country

Table 106 Saudi Arabia: Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 107 Saudi Arabia: Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

9.6.2 UAE

9.6.2.1 Growing Pharmaceutical Industry Due to the Development of Generic Drugs Market is Boosting the Market for Pharmaceutical Processing Seals in the UAE

Table 108 UAE: Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 109 UAE: Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

9.6.3 Rest of Middle East & Africa

Table 110 Rest of Middle East & Africa: Pharmaceutical Processing Seals Market Size, by Application, 2016-2018 (USD Million)

Table 111 Rest of Middle East & Africa: Pharmaceutical Processing Seals Market Size, by Application, 2019-2026 (USD Million)

10 Competitive Landscape

10.1 Introduction

Figure 21 Expansion of Facilities is a Key Strategy Adopted by Players Between 2018 and 2021

10.2 Market Share Analysis

Figure 22 Market Share, by Key Players (2020)

10.3 Key Market Development

10.3.1 Acquisitions

10.3.2 New Product Launches

11 Company Profiles

Business Overview, Products Offered, Recent Developments, Analyst's View

11.1 Trelleborg Ab

Table 112 Trelleborg Ab: Business Overview

Figure 23 Trelleborg Ab: Company Snapshot

Table 113 Trelleborg Ab: Product Offerings

Table 114 Trelleborg Ab: Acquisition

Figure 24 Trelleborg Ab's Capability in Pharmaceutical Processing Seals Market

11.2 Freudenberg Group

Table 115 Freudenberg Group: Business Overview

Figure 25 Freudenberg Group: Company Snapshot

Table 116 Freudenberg Group: Product Offerings

Table 117 Freudenberg Group: Acquisition

Figure 26 Freudenberg Group's Capability in Pharmaceutical Processing Seals Market

11.3 Flowserve Corporation

Table 118 Flowserve Corporation: Business Overview

Figure 27 Flowserve Corporation: Company Snapshot

Table 119 Flowserve Corporation: Product Offerings

Figure 28 Flowserve Corporation's Capability in Pharmaceutical Processing Seals Market

11.4 James Walker Group

Table 120 James Walker Group: Business Overview

Table 121 James Walker: Product Offerings

11.5 Parker Hannifin Corporation

Table 122 Parker Hannifin Corporation: Business Overview

Figure 29 Parker Hannifin Corporation: Company Snapshot

Table 123 Parker Hannifin Corporation: Product Offerings

Table 124 Parker Hannifin Corporation: Deals

Figure 30 Parker Hannifin Corporation's Capability in Pharmaceutical Seals Market

11.6 Saint-Gobain Sa

Table 125 Saint-Gobain Sa: Business Overview

Figure 31 Saint-Gobain Sa: Company Snapshot

Table 126 Saint-Gobain Sa: Product Offerings

Figure 32 Saint-Gobain S.A.'s Capability in Pharmaceutical Processing Seals Market

11.7 Garlock

Table 127 Garlok: Business Overview

Table 128 Garlok: Product Offerings

11.8 John Crane

Table 129 John Crane: Business Overview

Figure 33 John Crane: Company Snapshot

Table 130 John Crane: Product Offerings

Table 131 John Crane: Acquisition

Figure 34 John Crane's Capability in Pharmaceutical Processing Seals Market

11.9 Idex Corporation

Table 132 Idex Group: Business Overview

Figure 35 Idex Corporation: Company Snapshot

Table 133 Idex Corporation: Deals

Figure 36 Idex Group's Capability in Pharmaceutical Processing Seals Market

11.10 Techno Ad Ltd.

Table 134 Techno Ad Ltd: Business Overview

11.11 Precision Associates, Inc.

Table 135 Precision Associates, Inc: Business Overview

11.12 Maclellan Rubber Ltd.

Table 136 Maclellan Rubber Ltd: Business Overview

11.13 Marco Rubber and Plastic Products, Inc.

Table 137 Marco Rubber and Plastic Products, Inc: Business Overview

11.14 Seals and Design, Inc.

Table 138 Seals and Design, Inc: Business Overview

11.15 Darcoid of California

Table 139 Darcoid of California: Business Overview

11.16 American High-Performance Seals

Table 140 American High-Performance Seals: Business Overview

11.17 Vulcan Engineering Limited

Table 141 Vulcan Engineering Limited: Business Overview

11.18 Canada Rubber Group Inc.

Table 142 Canada Rubber Group: Business Overview

11.19 Etannor Sealing System

Table 143 Etannor Sealing System: Business Overview

11.20 Additional Company Profiles

11.20.1 Aesseal

11.20.2 Eagle Industry Co. Ltd.

11.20.3 Performance Sealing Inc.

11.20.4 Technetics Group

11.20.5 C. Otto Gehrckens GmbH and Co. Kg Seal Technology

11.20.6 Wika Alexander Wiegand Se and Co. Kg

11.20.7 Intec Seals

Details on Business Overview, Products Offered, Recent Developments, Analyst's View Might Not be Captured in Case of Unlisted Companies.

12 Appendix

12.1 Discussion Guide

12.2 Knowledge Store: Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

Companies Mentioned

- Aesseal

- American High-Performance Seals

- C. Otto Gehrckens GmbH and Co. Kg Seal Technology

- Canada Rubber Group Inc.

- Darcoid of California

- Eagle Industry Co. Ltd.

- Etannor Sealing System

- Flowserve Corporation

- Freudenberg Group

- Garlock

- Idex Corporation

- Intec Seals

- James Walker Group

- John Crane

- Maclellan Rubber Ltd.

- Marco Rubber and Plastic Products, Inc.

- Parker Hannifin Corporation

- Performance Sealing Inc.

- Precision Associates, Inc.

- Saint-Gobain Sa

- Seals and Design, Inc.

- Technetics Group

- Techno Ad Ltd.

- Trelleborg Ab

- Vulcan Engineering Limited

- Wika Alexander Wiegand Se and Co. Kg

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 165 |

| Published | November 2021 |

| Forecast Period | 2021 - 2026 |

| Estimated Market Value ( USD | $ 2.1 Billion |

| Forecasted Market Value ( USD | $ 3.3 Billion |

| Compound Annual Growth Rate | 10.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |