Quantum Dots Market Analysis:

- Major Market Drivers: The escalating adoption of quantum dots in the healthcare sector for applications, such as bioimaging, drug delivery, and disease diagnosis coupled with the growing use of quantum dots in the automotive industry for advanced displays and lighting systems is fueling the market demand. Moreover, the expanding applications of quantum dots in solar cells, where they improve energy conversion efficiency, are propelling the market growth.

- Key Market Trends: The rising popularity of quantum dot-based computing and burgeoning investments in research and development (R&D) activities by major players in the electronics industry are driving the quantum dots market demand. In addition, the emergence of quantum dot-based sensors for environmental monitoring and industrial applications and the surging demand for quantum dot-based photovoltaic devices and LED lighting are creating lucrative opportunities for the market.

- Competitive Landscape: Some of the leading quantum dots market companies are Altairnano, ams-OSRAM International GmbH, LG Display Co. Ltd, Nanoco Group plc., Nanosys Inc., Ocean NanoTech LLC, QD Laser, Quantum Materials Corp., Samsung Display Co. Ltd. (Samsung Electronics Co. Ltd), and Thermo Fisher Scientific Inc., among many others.

- Geographical Trends: According to the report, North America acquires the largest share of the overall market. Governments in the region are investing in research and development of quantum dot technology due to its potential to revolutionize various industries. Funding and support from government agencies are driving innovation and accelerating the commercialization of quantum dot products.

- Challenges and Opportunities: The rising cost of production, high competition from other technologies, and lack of standardization and regulations in manufacturing processes are hindering the market growth. However, continued advancements in quantum dot synthesis, such as improving efficiency, stability, and tunability, create opportunities for innovation and product development.

Quantum Dots Market Trends:

Increasing Demand for Energy-Efficient Displays

Traditional technologies used in displays and lighting often struggle to achieve accurate color reproduction and high energy efficiency simultaneously. Quantum dots offer a compelling solution to this challenge. These nanocrystals, when incorporated into displays and lighting devices, can emit highly pure and vibrant colors, resulting in enhanced color reproduction. Quantum dots also possess unique properties that allow them to convert light more efficiently, resulting in higher energy efficiency compared to conventional technologies. For instance, in August 2022, researchers from the University of Cambridge created smart, color-controllable white light devices out of quantum dots, tiny semiconductors only a few billionths of a meter in size. These devices are more efficient and have better color saturation than standard LEDs. Moreover, the demand for quantum dot displays is particularly driven by the increasing popularity of high-resolution televisions and smartphones, where consumers seek vibrant and true-to-life colors. For instance, according to a study published in Science Advances found that clustering quantum dots, which are known for their clear colors, increases their fluorescence and allows for a wider range of colors. Moreover, in February 2024, researchers at Queen's University Belfast in the United Kingdom developed quantum dots comprising methylammonium, and lead bromine. They expected that this discovery would boost the number of colors that can be displayed by more than 50%, making TVs and smartphones brighter. In addition to this, in January 2024, Samsung Electronics launched a quantum dot display TV with an AI processor that converts low-definition footage into ultra-high-definition material. These factors are further positively influencing the quantum dots market forecast.Rising Product Adoption in the Healthcare Sector

Quantum dots have demonstrated immense potential in various healthcare applications such as bioimaging, drug delivery, and disease diagnosis. In bioimaging, quantum dots act as powerful fluorescent probes that can be targeted to specific biological structures, enabling high-resolution imaging of cells, tissues, and live organisms. For instance, according to an article published by the National Library of Medicine, semiconductor quantum dots have typical optical and electrical properties, and they are developing as a new type of nanoparticle probe for bioimaging and biodiagnostics. According to research, monodispersed QDs are encapsulated in stable polymers with diverse surface chemistries. These nanocrystals are strongly fluorescent, making them useful as imaging probes both in vitro and in vivo. Furthermore, quantum dots show promise in disease diagnosis, where they can be used as sensitive probes for detecting biomarkers associated with various diseases, including cancer and infectious diseases. The ability of quantum dots to provide precise and sensitive detection contributes to early diagnosis and improved patient outcomes, further driving their adoption in the healthcare sector. For instance, in April 2024, an assistant professor in UW-Milwaukee's College of Engineering & Applied Science collaborated with the University of Illinois-Chicago and the University of Nevada-Reno in order to develop low-cost biosensors that can quickly identify foodborne bacteria using the fluorescence of quantum dots for early detection of infectious disease or even cancer. These factors are further contributing to the quantum dots market share.Expanding Application of Quantum Dots in Solar Cells

Solar energy is a clean and renewable source of power, and enhancing the efficiency of solar cells is crucial for its widespread adoption. Quantum dots offer a promising solution by improving the energy conversion efficiency of solar cells. These nanocrystals can be integrated into the structure of solar cells to capture a broader spectrum of light, including visible and infrared wavelengths. By effectively absorbing a larger portion of the solar spectrum, quantum dots enable a more efficient conversion of sunlight into electricity. For instance, in February 2024, a team of researchers at the School of Energy and Chemical Engineering at UNIST propelled the development of the efficient quantum dot (QD) solar cell. This innovative approach enabled the synthesis of organic cation-based perovskite quantum dots (PQDs), ensuring exceptional stability while suppressing internal defects in the photoactive layer of solar cells. Furthermore, quantum dots can be engineered to exhibit tunable bandgaps, allowing for the customization of absorption and emission properties to match specific solar cell designs. This tunability enables the optimization of solar cell performance and enhances overall efficiency. For instance, in May 2024, the Department of Energy Science and Engineering developed a PbS quantum dot that can rapidly enhance the electrical conductivity of solar cells. PbS quantum dots are nanoscale semiconductor materials that were investigated in next-generation solar cells. They can absorb a wide variety of sunlight wavelengths, including ultraviolet, visible light, near-infrared, and shortwave infrared while having low processing costs due to solution processing and outstanding photoelectric characteristics. These factors are further driving the quantum dots market growth.Quantum Dots Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the global quantum dots market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on processing techniques, application, material, and end-use industry.Breakup by Processing Techniques:

- Colloidal Synthesis

- Fabrication

- Lithography

- Electron Beam Lithography

- Soft Lithography

- Stencil Lithography

- Nanolithography

- Photopatternable Arrays

- Bio-Molecular Self-Assembly

- Viral Assembly

- Electrochemical Assembly

- Others

Colloidal synthesis dominate the market

The report has provided a detailed breakup and analysis of the market based on the processing techniques. This includes colloidal synthesis, fabrication (lithography, electron beam lithography, soft lithography, stencil lithography, nanolithography, and photopatternable arrays), bio-molecular self-assembly, viral assembly, electrochemical assembly, and others. According to the report, colloidal synthesis represented the largest segment.According to the quantum dots market outlook, colloidal synthesis is a commonly used technique where quantum dots are synthesized in a colloidal solution through chemical reactions. This method allows for precise control over the size and composition of the quantum dots. One of the major factors driving the market of this segment is their broad applications in various industries such as pharmaceuticals, cosmetics, food and beverage, and nanotechnology. In pharmaceuticals and cosmetics, colloids are used for their improved solubility and bioavailability, while in the food industry, they aid texture modification and stability. Additionally, advancements in nanotechnology, which heavily relies on colloidal synthesis to produce nanoparticles, fuels market expansion. The rise of green synthesis methods, employing eco-friendly substances, also contributes to market growth. Apart from this, increased research and development (R&D) activities supported by substantial funding are accelerating technological advancements in the field. Furthermore, the growing demand for efficient drug delivery systems and high-quality consumer products necessitates the application of colloids.

Breakup by Application:

- Medical Devices

- Displays

- Solar Cells

- Photodetectors Sensors

- Lasers

- LED Lights

- Batteries & Energy Storage Systems

- Transistors

- Others

Displays hold the largest share in the market

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes medical devices, displays, solar cells, photodetectors sensors, lasers, LED lights, batteries & energy storage systems, transistors, and others. According to the report, displays accounted for the largest market share.In the displays segment, quantum dots offer high-quality color reproduction and enhanced brightness, resulting in vibrant and energy-efficient displays for televisions, smartphones, and monitors. Quantum dots can emit light in very specific wavelengths determined by their size. This property enables displays to achieve a wider color gamut and more accurate colors compared to traditional display technologies like LCDs (Liquid Crystal Displays). By using quantum dots, displays can reproduce a larger portion of the color spectrum, leading to more vibrant and lifelike images. For instance, in April 2023, Nanosys, an independent quantum dot company, launched its 1000th unique quantum display product.

Breakup by Material:

- Cadmium Based QD

- Cadmium Selenide

- Cadmium Sulfide

- Cadmium Telluride

- Cadmium Free QD

- Indium Arsenide

- Silicon

- Graphene

- Lead Sulfide

Cadmium based QD hold the largest share in the market

A detailed breakup and analysis of the market based on the material has also been provided in the report. This includes cadmium based QD (cadmium selenide, cadmium sulfide, and cadmium telluride) and cadmium free QD (indium arsenide silicon, graphene, and lead sulfide). According to the report, cadmium based QD accounted for the largest market share.According to the quantum dots market overview, cadmium-based quantum dots exhibit unique optical properties due to quantum confinement effects. Their emission wavelength can be tuned by controlling the size of the quantum dot, allowing for precise control over the emitted color. This property makes them valuable for applications such as displays, lighting, and biological imaging. Moreover, cd-based QDs typically have a high quantum yield, meaning they efficiently emit light when excited by an external energy source such as UV light. This high quantum yield contributes to their brightness and color purity, making them desirable for use in display technologies where vibrant and accurate colors are essential. For instance, First Solar, a US cadmium telluride (CdTe) thin-film module producer, raised its manufacturing capacity by 6.8GW in 2023, with the majority coming from their Series 7.

Breakup by End-Use Industry:

- Healthcare

- Optoelectronics

- LED Lighting

- Solar Modules

- Others

Healthcare holds the largest share in the market

A detailed breakup and analysis of the market based on the end-use industry has also been provided in the report. This includes healthcare, optoelectronics, LED lighting, solar modules, and others. According to the report, healthcare accounted for the largest market share.Quantum dots find applications in the healthcare industry for advanced biomedical imaging techniques and diagnostics, enabling precise visualization and detection of diseases. They also play a role in targeted drug delivery systems, enhancing the effectiveness of therapies. Quantum dots are used as fluorescent probes in various imaging techniques, including fluorescence microscopy and in vivo imaging. Their tunable emission wavelengths and high quantum yields make them valuable for labeling and tracking biological molecules and cells with high sensitivity and resolution. Quantum dot imaging enables researchers and clinicians to visualize cellular and molecular processes in real-time, aiding in the diagnosis and monitoring of diseases such as cancer. For instance, in January 2024, Quantum Solutions unveiled the availability of QDot Perovskite CsPbBr3 Single Crystals for X-ray sensors. The product was released in partnership with AY Sensors. This material offers a substantial alternative to the CdTe and CdZnTe (CZT) crystals used in direct X-ray sensors. CsPbBr3 single crystals are considered the best perovskite composition for X-ray sensors in terms of performance and long-term stability.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

North America exhibits a clear dominance, accounting for the largest quantum dots market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa (Turkey, Saudi Arabia, Iran, United Arab Emirates, Others). North America holds the largest market share.One of the key factors driving the North America quantum dots market is the increasing adoption of technology in a wide array of applications, including displays, solar cells, and medical imaging. Their superior properties, like high brightness, pure color, and energy efficiency, make quantum dots a highly sought-after solution, particularly in the consumer electronics industry for next-generation display technology. Additionally, vigorous research and development (R&D) activities in the region, backed by substantial governmental and private funding, are advancing quantum dot technology. The presence of several key market players in North America also contributes to the regional market growth. Furthermore, progressive regulatory policies, combined with favorable economic conditions, are promoting the use of quantum dots. For instance, in September 2023, Shoei Chemical, Inc., a leading advanced materials manufacturer, along with its North American subsidiary, Shoei Electronic Materials, Inc. (Shoei), acquired Nanosys quantum dot business.

Competitive Landscape:

The competitive landscape of the quantum dots market is characterized by intense competition among key players. Companies are actively involved in research, development, and commercialization of quantum dot technologies. These companies are focusing on strategic partnerships, collaborations, and product innovations to gain a competitive edge in the market. Additionally, manufacturers are emphasizing improving production processes, enhancing product quality, and expanding their product portfolios to cater to diverse industry needs. Moreover, the market is witnessing the entry of new players, which further intensifies the competition. Rising investments in quantum dot technologies by both established players and startups indicate potential growth opportunities in the market.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Altairnano

- ams-OSRAM International GmbH

- LG Display Co. Ltd

- Nanoco Group plc

- Nanosys Inc.

- Ocean NanoTech LLC

- QD Laser

- Quantum Materials Corp.

- Samsung Display Co. Ltd. (Samsung Electronics Co. Ltd)

- Thermo Fisher Scientific Inc.

Key Questions Answered in This Report

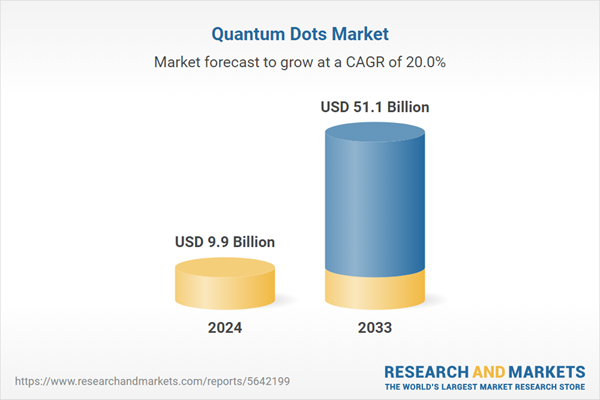

1. What was the size of the global quantum dots market in 2024?2. What is the expected growth rate of the global quantum dots market during 2025-2033?

3. What are the key factors driving the global quantum dots market?

4. What has been the impact of COVID-19 on the global quantum dots market?

5. What is the breakup of the global quantum dots market based on the processing techniques?

6. What is the breakup of the global quantum dots market based on the application?

7. What is the breakup of the global quantum dots market based on the material?

8. What is the breakup of the global quantum dots market based on the end-use industry?

9. What are the key regions in the global quantum dots market?

10. Who are the key players/companies in the global quantum dots market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Quantum Dots Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Processing Techniques

6.1 Colloidal Synthesis

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Fabrication

6.2.1 Market Trends

6.2.2 Major Types

6.2.2.1 Lithography

6.2.2.2 Electron Beam Lithography

6.2.2.3 Soft Lithography

6.2.2.4 Stencil Lithography

6.2.2.5 Nanolithography

6.2.2.6 Photopatternable Arrays

6.2.3 Market Forecast

6.3 Bio-Molecular Self-Assembly

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Viral Assembly

6.4.1 Market Trends

6.4.2 Market Forecast

6.5 Electrochemical Assembly

6.5.1 Market Trends

6.5.2 Market Forecast

6.6 Others

6.6.1 Market Trends

6.6.2 Market Forecast

7 Market Breakup by Application

7.1 Medical Devices

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Displays

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Solar Cells

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Photodetectors Sensors

7.4.1 Market Trends

7.4.2 Market Forecast

7.5 Lasers

7.5.1 Market Trends

7.5.2 Market Forecast

7.6 LED Lights

7.6.1 Market Trends

7.6.2 Market Forecast

7.7 Batteries & Energy Storage Systems

7.7.1 Market Trends

7.7.2 Market Forecast

7.8 Transistors

7.8.1 Market Trends

7.8.2 Market Forecast

7.9 Others

7.9.1 Market Trends

7.9.2 Market Forecast

8 Market Breakup by Material

8.1 Cadmium Based QD

8.1.1 Market Trends

8.1.2 Major Types

8.1.2.1 Cadmium Selenide

8.1.2.2 Cadmium Sulfide

8.1.2.3 Cadmium Telluride

8.1.3 Market Forecast

8.2 Cadmium Free QD

8.2.1 Market Trends

8.2.2 Major Types

8.2.2.1 Indium Arsenide

8.2.2.2 Silicon

8.2.2.3 Graphene

8.2.2.4 Lead Sulfide

8.2.3 Market Forecast

9 Market Breakup by End-Use Industry

9.1 Healthcare

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Optoelectronics

9.2.1 Market Trends

9.2.2 Market Forecast

9.3 LED Lighting

9.3.1 Market Trends

9.3.2 Market Forecast

9.4 Solar Modules

9.4.1 Market Trends

9.4.2 Market Forecast

9.5 Others

9.5.1 Market Trends

9.5.2 Market Forecast

10 Market Breakup by Region

10.1 North America

10.1.1 United States

10.1.1.1 Market Trends

10.1.1.2 Market Forecast

10.1.2 Canada

10.1.2.1 Market Trends

10.1.2.2 Market Forecast

10.2 Asia Pacific

10.2.1 China

10.2.1.1 Market Trends

10.2.1.2 Market Forecast

10.2.2 Japan

10.2.2.1 Market Trends

10.2.2.2 Market Forecast

10.2.3 India

10.2.3.1 Market Trends

10.2.3.2 Market Forecast

10.2.4 South Korea

10.2.4.1 Market Trends

10.2.4.2 Market Forecast

10.2.5 Australia

10.2.5.1 Market Trends

10.2.5.2 Market Forecast

10.2.6 Indonesia

10.2.6.1 Market Trends

10.2.6.2 Market Forecast

10.2.7 Others

10.2.7.1 Market Trends

10.2.7.2 Market Forecast

10.3 Europe

10.3.1 Germany

10.3.1.1 Market Trends

10.3.1.2 Market Forecast

10.3.2 France

10.3.2.1 Market Trends

10.3.2.2 Market Forecast

10.3.3 United Kingdom

10.3.3.1 Market Trends

10.3.3.2 Market Forecast

10.3.4 Italy

10.3.4.1 Market Trends

10.3.4.2 Market Forecast

10.3.5 Spain

10.3.5.1 Market Trends

10.3.5.2 Market Forecast

10.3.6 Russia

10.3.6.1 Market Trends

10.3.6.2 Market Forecast

10.3.7 Others

10.3.7.1 Market Trends

10.3.7.2 Market Forecast

10.4 Latin America

10.4.1 Brazil

10.4.1.1 Market Trends

10.4.1.2 Market Forecast

10.4.2 Mexico

10.4.2.1 Market Trends

10.4.2.2 Market Forecast

10.4.3 Argentina

10.4.3.1 Market Trends

10.4.3.2 Market Forecast

10.4.4 Colombia

10.4.4.1 Market Trends

10.4.4.2 Market Forecast

10.4.5 Chile

10.4.5.1 Market Trends

10.4.5.2 Market Forecast

10.4.6 Peru

10.4.6.1 Market Trends

10.4.6.2 Market Forecast

10.4.7 Others

10.4.7.1 Market Trends

10.4.7.2 Market Forecast

10.5 Middle East and Africa

10.5.1 Turkey

10.5.1.1 Market Trends

10.5.1.2 Market Forecast

10.5.2 Saudi Arabia

10.5.2.1 Market Trends

10.5.2.2 Market Forecast

10.5.3 Iran

10.5.3.1 Market Trends

10.5.3.2 Market Forecast

10.5.4 United Arab Emirates

10.5.4.1 Market Trends

10.5.4.2 Market Forecast

10.5.5 Others

10.5.5.1 Market Trends

10.5.5.2 Market Forecast

11 SWOT Analysis

11.1 Overview

11.2 Strengths

11.3 Weaknesses

11.4 Opportunities

11.5 Threats

12 Value Chain Analysis

13 Porters Five Forces Analysis

13.1 Overview

13.2 Bargaining Power of Buyers

13.3 Bargaining Power of Suppliers

13.4 Degree of Competition

13.5 Threat of New Entrants

13.6 Threat of Substitutes

14 Price Indicators

15 Competitive Landscape

15.1 Market Structure

15.2 Key Players

15.3 Profiles of Key Players

15.3.1 Altairnano

15.3.1.1 Company Overview

15.3.1.2 Product Portfolio

15.3.2 LG Display Co. Ltd

15.3.2.1 Company Overview

15.3.2.2 Product Portfolio

15.3.2.3 Financials

15.3.3 Nanosys Inc.

15.3.3.1 Company Overview

15.3.3.2 Product Portfolio

15.3.4 Nanoco Group plc

15.3.4.1 Company Overview

15.3.4.2 Product Portfolio

15.3.5 Ocean NanoTech LLC

15.3.5.1 Company Overview

15.3.5.2 Product Portfolio

15.3.6 ams-OSRAM International GmbH

15.3.6.1 Company Overview

15.3.6.2 Product Portfolio

15.3.6.3 Financials

15.3.6.4 SWOT Analysis

15.3.7 QD Laser

15.3.7.1 Company Overview

15.3.7.2 Product Portfolio

15.3.8 Quantum Materials Corp.

15.3.8.1 Company Overview

15.3.8.2 Product Portfolio

15.3.8.3 Financials

15.3.9 Samsung Display Co. Ltd. (Samsung Electronics Co. Ltd)

15.3.9.1 Company Overview

15.3.9.2 Product Portfolio

15.3.9.3 Financials

15.3.9.4 SWOT Analysis

15.3.10 Thermo Fisher Scientific Inc.

15.3.10.1 Company Overview

15.3.10.2 Product Portfolio

15.3.10.3 Financials

15.3.10.4 SWOT Analysis

List of Figures

Figure 1: Global: Quantum Dots Market: Major Drivers and Challenges

Figure 2: Global: Quantum Dots Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Quantum Dots Market: Breakup by Processing Techniques (in %), 2024

Figure 4: Global: Quantum Dots Market: Breakup by Application (in %), 2024

Figure 5: Global: Quantum Dots Market: Breakup by Material (in %), 2024

Figure 6: Global: Quantum Dots Market: Breakup by End-Use Industry (in %), 2024

Figure 7: Global: Quantum Dots Market: Breakup by Region (in %), 2024

Figure 8: Global: Quantum Dots Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 9: Global: Quantum Dots (Colloidal Synthesis) Market: Sales Value (in Million USD), 2019 & 2024

Figure 10: Global: Quantum Dots (Colloidal Synthesis) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 11: Global: Quantum Dots (Fabrication) Market: Sales Value (in Million USD), 2019 & 2024

Figure 12: Global: Quantum Dots (Fabrication) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 13: Global: Quantum Dots (Bio-Molecular Self-Assembly) Market: Sales Value (in Million USD), 2019 & 2024

Figure 14: Global: Quantum Dots (Bio-Molecular Self-Assembly) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 15: Global: Quantum Dots (Viral Assembly) Market: Sales Value (in Million USD), 2019 & 2024

Figure 16: Global: Quantum Dots (Viral Assembly) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 17: Global: Quantum Dots (Electrochemical Assembly) Market: Sales Value (in Million USD), 2019 & 2024

Figure 18: Global: Quantum Dots (Electrochemical Assembly) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 19: Global: Quantum Dots (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 20: Global: Quantum Dots (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 21: Global: Quantum Dots (Medical Devices) Market: Sales Value (in Million USD), 2019 & 2024

Figure 22: Global: Quantum Dots (Medical Devices) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 23: Global: Quantum Dots (Displays) Market: Sales Value (in Million USD), 2019 & 2024

Figure 24: Global: Quantum Dots (Displays) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 25: Global: Quantum Dots (Solar Cells) Market: Sales Value (in Million USD), 2019 & 2024

Figure 26: Global: Quantum Dots (Solar Cells) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 27: Global: Quantum Dots (Photodetectors Sensors) Market: Sales Value (in Million USD), 2019 & 2024

Figure 28: Global: Quantum Dots (Photodetectors Sensors) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 29: Global: Quantum Dots (Lasers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 30: Global: Quantum Dots (Lasers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 31: Global: Quantum Dots (LED Lights) Market: Sales Value (in Million USD), 2019 & 2024

Figure 32: Global: Quantum Dots (LED Lights) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 33: Global: Quantum Dots (Batteries & Energy Storage Systems) Market: Sales Value (in Million USD), 2019 & 2024

Figure 34: Global: Quantum Dots (Batteries & Energy Storage Systems) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 35: Global: Quantum Dots (Transistors) Market: Sales Value (in Million USD), 2019 & 2024

Figure 36: Global: Quantum Dots (Transistors) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 37: Global: Quantum Dots (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 38: Global: Quantum Dots (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 39: Global: Quantum Dots (Cadmium Based QD) Market: Sales Value (in Million USD), 2019 & 2024

Figure 40: Global: Quantum Dots (Cadmium Based QD) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 41: Global: Quantum Dots (Cadmium Free QD) Market: Sales Value (in Million USD), 2019 & 2024

Figure 42: Global: Quantum Dots (Cadmium Free QD) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 43: Global: Quantum Dots (Healthcare) Market: Sales Value (in Million USD), 2019 & 2024

Figure 44: Global: Quantum Dots (Healthcare) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 45: Global: Quantum Dots (Optoelectronics) Market: Sales Value (in Million USD), 2019 & 2024

Figure 46: Global: Quantum Dots (Optoelectronics) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 47: Global: Quantum Dots (LED Lighting) Market: Sales Value (in Million USD), 2019 & 2024

Figure 48: Global: Quantum Dots (LED Lighting) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 49: Global: Quantum Dots (Solar Modules) Market: Sales Value (in Million USD), 2019 & 2024

Figure 50: Global: Quantum Dots (Solar Modules) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 51: Global: Quantum Dots (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 52: Global: Quantum Dots (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 53: North America: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 54: North America: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 55: United States: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 56: United States: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 57: Canada: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 58: Canada: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 59: Asia Pacific: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 60: Asia Pacific: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 61: China: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 62: China: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 63: Japan: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 64: Japan: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 65: India: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 66: India: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 67: South Korea: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 68: South Korea: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 69: Australia: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 70: Australia: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 71: Indonesia: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 72: Indonesia: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 73: Others: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 74: Others: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 75: Europe: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 76: Europe: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 77: Germany: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 78: Germany: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 79: France: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 80: France: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 81: United Kingdom: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 82: United Kingdom: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 83: Italy: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 84: Italy: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 85: Spain: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 86: Spain: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 87: Russia: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 88: Russia: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 89: Others: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 90: Others: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 91: Latin America: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 92: Latin America: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 93: Brazil: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 94: Brazil: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 95: Mexico: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 96: Mexico: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 97: Argentina: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 98: Argentina: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 99: Colombia: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 100: Colombia: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 101: Chile: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 102: Chile: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 103: Peru: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 104: Peru: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 105: Others: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 106: Others: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 107: Middle East and Africa: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 108: Middle East and Africa: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 109: Turkey: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 110: Turkey: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 111: Saudi Arabia: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 112: Saudi Arabia: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 113: Iran: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 114: Iran: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 115: United Arab Emirates: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 116: United Arab Emirates: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 117: Others: Quantum Dots Market: Sales Value (in Million USD), 2019 & 2024

Figure 118: Others: Quantum Dots Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 119: Global: Quantum Dots Industry: SWOT Analysis

Figure 120: Global: Quantum Dots Industry: Value Chain Analysis

Figure 121: Global: Quantum Dots Industry: Porter’s Five Forces Analysis

List of Tables

Table 1: Global: Quantum Dots Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Quantum Dots Market Forecast: Breakup by Processing Techniques (in Million USD), 2025-2033

Table 3: Global: Quantum Dots Market Forecast: Breakup by Application (in Million USD), 2025-2033

Table 4: Global: Quantum Dots Market Forecast: Breakup by Material (in Million USD), 2025-2033

Table 5: Global: Quantum Dots Market Forecast: Breakup by End-Use Industry (in Million USD), 2025-2033

Table 6: Global: Quantum Dots Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 7: Global: Quantum Dots Market: Competitive Structure

Table 8: Global: Quantum Dots Market: Key Players

Companies Mentioned

- Altairnano

- ams-OSRAM International GmbH

- LG Display Co. Ltd

- Nanoco Group plc.

- Nanosys Inc.

- Ocean NanoTech LLC

- QD Laser

- Quantum Materials Corp.

- Samsung Display Co. Ltd. (Samsung Electronics Co. Ltd) and Thermo Fisher Scientific Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 142 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 9.9 Billion |

| Forecasted Market Value ( USD | $ 51.1 Billion |

| Compound Annual Growth Rate | 20.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |