Speak directly to the analyst to clarify any post sales queries you may have.

A concise technology overview explaining how multi-axis sensing, edge analytics, and user-centric design have reshaped modern 3D pedometer capabilities

The evolution of motion-sensing technology has elevated the pedometer from a simple step counter into an advanced 3D pedometer system that integrates multi-axis sensing, real-time analytics, and contextual awareness. Modern devices harness improvements in sensor fidelity, signal processing, and embedded software to deliver accurate activity recognition across diverse user profiles and use cases. This section introduces the core capabilities of 3D pedometers, highlighting how improvements in accelerometer and gyroscope performance coupled with algorithmic enhancements enable richer motion signals and more reliable detection of walking, running, and nuanced mobility events.As healthcare providers and fitness ecosystems demand higher levels of reliability and interpretability, 3D pedometers have adapted by offering enhanced calibration routines, adaptive filtering, and edge analytics that reduce dependence on continuous cloud connectivity. At the same time, product designers are balancing power consumption, form factor, and user experience to ensure that continuous monitoring remains unobtrusive. This introduction frames the reader’s understanding of the technology stack, typical integration pathways with smartphones and wearables, and the growing expectations from end users that drive feature development and competitive differentiation.

Strategic industry transformation driven by sensor miniaturization, embedded AI, and ecosystem integration reshaping 3D pedometer value propositions

The landscape for 3D pedometers is undergoing transformative shifts driven by converging advances in sensor miniaturization, machine learning, and cross-device interoperability. Improvements in microelectromechanical systems have reduced noise and drift in accelerometers and gyroscopes, enabling algorithms to extract higher-resolution gait features and detect subtle mobility patterns previously indistinguishable from background motion. Parallel progress in on-device machine learning frameworks allows models to run efficiently on constrained processors, making real-time classification viable without constant cloud dependency.Ecosystem integration is another pivotal shift. 3D pedometers are no longer standalone gadgets; they are data sources within broader health and performance platforms. This drives demands for standardized APIs, secure data exchange, and harmonized data models that can feed clinical decision support or athlete performance analysis. At the same time, regulatory scrutiny related to medical-grade monitoring and user privacy has intensified, prompting manufacturers to embed robust data governance and validation protocols early in product development. These forces collectively push vendors to prioritize accuracy, reproducibility, and trustworthiness alongside traditional metrics like battery life and comfort.

Assessment of how 2025 tariff developments have reshaped sourcing, production footprints, and procurement strategies across the 3D pedometer value chain

Changes in trade policy and tariff measures in 2025 have created cumulative effects that ripple through supply chains supporting 3D pedometer production. Tariff actions that target electronic components, sensor modules, and certain finished wearable goods have increased input cost volatility and encouraged manufacturers to reassess sourcing geographies. As a result, procurement strategies have shifted from single-source dependencies toward diversified supplier portfolios and increased emphasis on nearshoring where feasible to mitigate lead-time and duty exposure.Manufacturers and brands have responded by redesigning bills of materials to reduce reliance on tariff-affected components and by negotiating longer-term contracts to lock in favorable terms where possible. These adaptations have also accelerated interest in vertically integrated manufacturing arrangements and regional assembly hubs that can absorb some tariff impacts while preserving time-to-market. In parallel, some enterprises have pursued dual-sourcing strategies and strategic stockpiling for critical components to buffer against episodic tariff escalations. Regulatory compliance burdens associated with origin rules and classification have compelled legal and trade specialists to play a more active role in product launch planning.

Across the value chain, distributors and retail partners have re-evaluated pricing approaches to balance competitiveness with margin preservation. For B2B buyers such as healthcare providers and sports organizations, procurement teams are weighing total cost of ownership-including tariff-driven logistics costs-when selecting devices and service contracts. The cumulative impact of tariffs in 2025 therefore manifests less as a single cost increase and more as an enduring shift in how manufacturers, suppliers, and buyers structure relationships, manage inventory, and prioritize regional manufacturing footprints.

In-depth segmentation-driven insights revealing how sensor types, application demands, end-user needs, and distribution choices determine product strategy and validation pathways

Understanding market dynamics requires a granular view of device typologies, application contexts, end-user categories, and distribution pathways. Device differentiation centers on accelerometer-based solutions that emphasize energy efficiency and cost-effectiveness, gyroscope-based systems that enhance rotational and orientation sensitivity, and hybrid sensor architectures that fuse multi-modal inputs for superior motion fidelity. Each sensor approach implies distinct trade-offs between accuracy, power consumption, and integration complexity, and these technical choices cascade into product positioning and target use cases.Applications span consumer-oriented fitness tracking where integration with smartphones and wearable fitness devices enables lifestyle insights, to medical monitoring scenarios such as cardiac monitoring and fall detection that demand clinical-grade reliability and traceability. Sports analytics covers both amateur sports, which prioritize accessibility and real-time feedback, and professional sports, which require high-resolution telemetry and integration with coaching platforms. End users range from general consumers seeking everyday activity feedback to geriatric care settings including assisted living and nursing homes, and to organized healthcare environments encompassing clinics, home care programs, and hospitals; sports and fitness centers from amateur clubs to professional training facilities also form a distinct constituency with unique performance and durability requirements. Distribution channels combine established offline retail in general electronics and specialized stores with digital routes through company websites and third-party e-commerce platforms, each delivering different expectations for product discovery, after-sales support, and warranty management.

These intersecting segmentation dimensions inform product development priorities, validation protocols, and go-to-market tactics. For example, a hybrid sensor device targeting cardiac monitoring in home care will require a different certification process, user interface design, and channel strategy than an accelerometer-based fitness band sold primarily through online retail. Recognizing these nuanced linkages enables more precise alignment between technical design, regulatory strategy, and customer acquisition plans.

Regional dynamics and regulatory nuances across the Americas, Europe, Middle East & Africa, and Asia-Pacific that affect product design, compliance, and commercialization strategies

Regional dynamics exert significant influence on product design, regulatory compliance, and commercialization approaches. In the Americas, demand patterns emphasize integrated health and wellness solutions that pair consumer convenience with clinical interoperability, prompting vendors to prioritize connectivity standards, privacy safeguards, and partnerships with digital health platforms. Regulatory frameworks in major markets emphasize data protection and device safety, which shapes the verification and documentation practices that manufacturers must adopt prior to market entry.The Europe, Middle East & Africa region presents a heterogeneous set of opportunities and constraints. In parts of Europe, stringent medical device regulations and reimbursement mechanisms reward demonstrable clinical efficacy, driving investment in validation studies and clinical collaborations. Meanwhile, rising adoption rates in select Middle Eastern and African markets are spurring demand for ruggedized, cost-effective devices and distribution models that leverage local partnerships. Across the region, multilingual support and culturally informed user experiences are necessary to achieve meaningful adoption.

Asia-Pacific is marked by a diverse manufacturing base and strong electronics supply chains, which facilitate rapid prototyping and iterative product refinement. High smartphone penetration and established mobile ecosystems create fertile ground for integrated wearable-device offerings, while varying regulatory regimes across countries require adaptable compliance strategies. Regional strengths in component manufacturing also enable strategic partnerships that can reduce lead times and support more aggressive feature roadmaps.

How firms synthesize technical expertise, supplier partnerships, and ecosystem strategies to create competitive moats in the 3D pedometer market

Competitive positioning within the 3D pedometer space is shaped by firms that combine sensor know-how, embedded software capabilities, and market channel breadth. Leading organizations invest in validation protocols, firmware optimization, and partnerships with healthcare providers and sports institutions to differentiate on reliability and domain expertise. Others focus on platform strategies that enable third-party developers to build analytics and services on top of device data, creating ecosystem lock-in and recurring revenue potential.Supply chain integration and manufacturing relationships remain critical competitive levers. Companies that secure strategic supplier agreements for high-performance sensors or that maintain flexible assembly arrangements can accelerate product refresh cycles and respond more nimbly to shifting customer needs. Moreover, investments in privacy-preserving analytics, explainable algorithms, and transparent data governance resonate with institutional buyers in healthcare and geriatric care, where traceability and auditability are prerequisites. Brands that successfully combine technical credibility with clear post-sales support models tend to capture higher trust among clinical and performance-focused buyers, while those that excel at streamlined user experiences and attractive price-performance ratios do well in the consumer and amateur sports segments.

Practical and prioritized recommendations for product validation, supply resilience, interoperability, and channel alignment to maximize commercial and clinical impact

Industry leaders should prioritize a dual approach that balances technical validation with commercial execution. First, invest in robust clinical and field validation to substantiate claims around accuracy and reliability for medical monitoring and fall detection; this includes structured validation protocols, third-party expert review, and transparent reporting that build trust with healthcare purchasers. Simultaneously, optimize sensor fusion algorithms and power management to deliver compelling battery life without sacrificing signal fidelity, as this combination is a decisive factor for both consumer adoption and institutional procurement.Second, diversify supply chains and pursue regional assembly capabilities to mitigate tariff exposure and logistics disruption. Establishing alternative suppliers and negotiating long-term component agreements will reduce volatility and support predictable production planning. Third, adopt interoperable data standards and secure APIs to facilitate integration with electronic health records, coaching platforms, and third-party analytics, thereby expanding the device’s utility across multiple buyer types. Finally, develop differentiated distribution strategies that match product complexity to channel strengths: clinical-grade devices should be accompanied by professional sales and support, while consumer-focused products benefit from streamlined e-commerce experiences and digital-first marketing campaigns. These coordinated actions will enhance resilience, speed to market, and customer trust.

Transparent, multi-source research methodology combining expert interviews, technical validation, supply chain mapping, and data triangulation for robust conclusions

The research methodology integrates a layered approach combining primary qualitative engagements with secondary evidence synthesis and technical audit. Primary inputs included structured interviews with device engineers, procurement leads, clinical users, and distribution partners to capture real-world performance expectations, procurement constraints, and adoption barriers. These conversations were triangulated with secondary sources such as company technical disclosures, patent filings, regulatory documents, and publicly accessible industry reports to validate technology assertions and historical development timelines.Technical validation included device specifications review, algorithmic architecture analysis, and, where available, independent performance summaries to evaluate claims around sensitivity, specificity, and power consumption. Supply chain mapping used customs data, supplier directories, and logistics indicators to identify concentration risks and alternative manufacturing hubs. Throughout the process, findings were cross-checked with domain experts to ensure interpretive rigour and to reconcile divergent perspectives. The methodology emphasizes transparency in source attribution, reproducibility of analytical steps, and traceability of assumptions to support confident decision-making by stakeholders.

Concluding synthesis outlining how validated technology, supply resilience, and interoperable design converge to drive adoption of 3D pedometer solutions

In closing, the trajectory of 3D pedometers reflects a convergence of sensor innovation, intelligent on-device processing, and expanding use cases that move well beyond step counting. As devices integrate more closely with healthcare workflows and sports performance systems, demands for validated accuracy, secure data handling, and seamless interoperability will determine which products achieve sustained adoption. Technological choices-between accelerometer, gyroscope, and hybrid architectures-are consequential, informing everything from battery life to suitability for clinical monitoring.Regional regulatory landscapes and trade policies add layers of complexity that require strategic planning around manufacturing and distribution. Companies that align technical excellence with agile supply chain management and clear evidence of clinical or performance utility will be best positioned to capture value. The recommendations provided herein aim to help decision-makers prioritize investments that strengthen trust, reduce operational risk, and create pathway to broader market applications. Ultimately, the most successful solutions will marry proven measurement rigor with accessible user experiences to deliver meaningful outcomes across consumer, clinical, and athletic environments.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

15. China 3D Pedometer Market

Companies Mentioned

- Apple Inc.

- Fitbit, Inc.

- Garmin Ltd.

- Huawei Technologies Co., Ltd.

- InBios International, Inc.

- Polar Electro Oy

- Pyle USA

- Samsung Electronics Co., Ltd.

- Suunto Oy

- TomTom N.V.

- Withings SA

- Xiaomi Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | January 2026 |

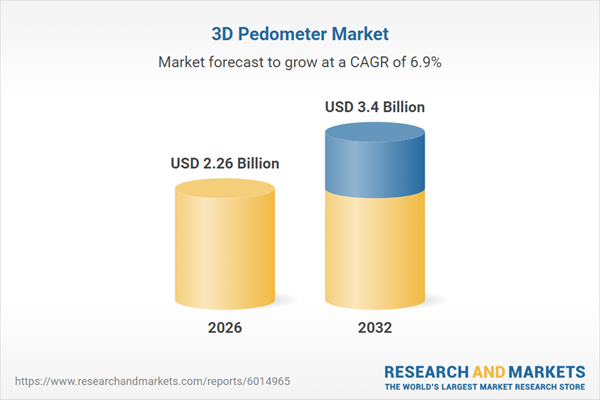

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 2.26 Billion |

| Forecasted Market Value ( USD | $ 3.4 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |