Speak directly to the analyst to clarify any post sales queries you may have.

An authoritative and practical introduction that frames acoustic louvres as multidisciplinary solutions combining acoustic control, ventilation performance, and architectural integration

Acoustic louvres represent a convergence of architectural intent and acoustic engineering, serving as both a physical barrier for airflow and a tuned solution for noise management. The introduction to this domain situates acoustic louvres within building systems where environmental control, regulatory compliance, and occupant comfort intersect. These products are increasingly specified not only for their attenuation performance but also for their integration with façade aesthetics, ventilation pathways, and maintenance regimes.Beyond basic function, stakeholders now weigh ease of installation, durability under exposure, and compatibility with HVAC and industrial ventilation systems. Consequently, procurement teams seek clarity on material performance, long-term maintenance implications, and the trade-offs between adjustable mechanisms and fixed solutions. Moreover, design teams demand options that preserve architectural intent while meeting acoustic targets, prompting closer collaboration between acousticians, façade engineers, and manufacturers.

To orient readers who make decisions about acoustic louvres, this introduction frames the technical, operational, and commercial dimensions that define product selection. It also clarifies how evolving performance expectations and integration requirements influence specification practices across commercial, industrial, and residential contexts.

How regulatory pressure, sustainability demands, and technological integration are driving systemic changes in acoustic louvre design, procurement, and specification practices

The landscape for acoustic louvres is shifting as regulatory scrutiny, sustainability priorities, and technological enhancements reshape how designers and operators specify noise-control solutions. New materials and coatings improve durability and reduce life-cycle environmental impacts, while motorization and smart controls broaden the functional envelope of adjustable systems. Consequently, the competitive dynamic now rewards manufacturers that can demonstrate not only acoustic attenuation but also energy-conscious integration and digital readiness.In parallel, procurement behavior is undergoing transformation. Buyers increasingly demand transparent supply-chain documentation, modular product architectures for easier retrofits, and lifecycle cost perspectives rather than only upfront price. These shifts encourage manufacturers to rethink product families to accommodate retrofit scenarios and to provide clearer guidance for maintenance and performance verification. Meanwhile, cross-disciplinary collaboration between acousticians, mechanical engineers, and architects is becoming standard practice, raising the bar for product data and installation guidance.

Furthermore, as specifications grow more stringent in urban and industrial environments, product differentiation arises from verified performance under real-world installation conditions and from the ability to deliver consistent results in external and internal applications. Ultimately, these transformative shifts are creating a market that prizes demonstrable performance, operational resilience, and adaptability to increasingly integrated building systems.

An informed analysis of how recent tariff movements and trade dynamics are prompting strategic supply-chain realignment, local capability building, and risk-sharing commercial models

Recent policy actions and tariff changes across global trade corridors have introduced tangible operational considerations for manufacturers, specifiers, and distributors of acoustic louvres. Tariff adjustments impact supply-chain decisions and encourage firms to reassess their sourcing footprints, vendor partnerships, and inventory strategies. As a result, many stakeholders are reevaluating the balance between cost, lead time, and supplier reliability when selecting components or complete assemblies.Consequently, manufacturers with diversified regional manufacturing capabilities or flexible supply arrangements gain a strategic advantage as they can insulate customers from abrupt cost fluctuations and delivery disruptions. In addition, specification teams respond by placing greater emphasis on material provenance, availability of local support for installation and maintenance, and the potential for standardizing interfaces to allow multiple vendors to participate in a single project without jeopardizing performance consistency.

Moreover, distributors and channel partners are adapting commercial terms and inventory management practices to maintain service levels. They are increasingly offering bundled solutions that include consultancy and post-installation verification to offset the perceived risk of procurement during periods of tariff-driven pricing variability. Therefore, the cumulative effect of tariff dynamics is a renewed focus on supply-chain resilience, local capability building, and contractual structures that distribute risk more evenly across the value chain.

Comprehensive segmentation insights revealing how product type hierarchies, end-use distinctions, distribution channels, applications, and material choices determine specification and commercial approaches

Segmentation-driven insights expose where product design choices and channel strategies intersect with end-use requirements, revealing targeted opportunities for differentiation. Based on product type, the market divides between Adjustable, Fixed, and Operable solutions; Adjustable variants include Manual and Motorized options, with Motorized systems further differentiated by Battery Powered and Wired implementations. This hierarchy affects specification choices because manual adjustable units appeal for low-complexity installations where occasional tuning suffices, while motorized battery options provide retrofit flexibility and reduced installation cabling for constrained sites.When viewed through end use industry lenses, offerings must align with Commercial, Industrial, and Residential contexts, and the Commercial segment further subdivides into Hospitality, Offices, and Retail environments. Each subsegment places unique demands on acoustics, aesthetics, and maintenance access: hospitality prioritizes occupant comfort and noise privacy; offices require predictable reverberation control and easy integration with HVAC; retail demands unobtrusive solutions that preserve visual merchandising.

Distribution channel patterns reveal that Direct Sales, Distributors, and Online pathways each require tailored commercial and after-sales support. Direct sales favor complex, project-driven engagements with specification support; distributors enable broader geographic reach and local inventory; online channels increase accessibility for standardized components. Applications split into External and Internal uses, which drives different materials, coatings, and durability requirements. Finally, material type selection among Aluminum, PVC, Steel, and Wood shapes structural performance, acoustic absorption characteristics, and life-cycle maintenance profiles. Taken together, these segmentation lenses illuminate where product families and go-to-market models can be optimized to meet distinct client priorities and installation realities.

Strategic regional insights that connect local regulatory priorities, climatic conditions, and construction practices to supply-chain strategies and product adaptation requirements

Regional dynamics shape demand drivers, compliance expectations, and supply-chain design, and an effective regional strategy must fit local regulatory frameworks, climatic conditions, and construction practices. In the Americas, regulatory emphasis on urban noise mitigation and an established construction market favor solutions that combine robust performance with straightforward installation and maintenance pathways. Consequently, vendor relationships that offer local technical support and rapid spare-parts access tend to perform well in this region.The Europe, Middle East & Africa region presents heterogeneous conditions where advanced regulatory frameworks in parts of Europe coexist with rapidly developing infrastructure needs elsewhere. This diversity creates an environment where high-performance engineered solutions sit alongside cost-conscious, rapidly deployable systems. Accordingly, manufacturers must balance certification rigor with flexible product families that can be adapted to different project specifications and climatic exposures.

In the Asia-Pacific region, rapid urbanization and an expanding industrial base drive demand for scalable and retrofit-capable products. Here, durability in the face of diverse climates and the ability to service a wide range of building typologies matter. Regional supply chains and local manufacturing partnerships can reduce lead times and enhance responsiveness, which is particularly valuable in fast-moving construction environments. Across all regions, localized technical expertise, material sourcing strategies, and channel partnerships remain decisive factors in successful market engagement.

Key competitive insights showing how engineering excellence, modular offerings, verified performance, and hybrid go-to-market approaches create durable advantages in acoustic louvre supply

Competitive dynamics in the acoustic louvre arena reward firms that combine product engineering rigor with consistent after-sales capabilities and clear documentation for installation and verification. Leading companies emphasize reproducible performance across installation contexts, invest in demonstrable durability testing, and provide comprehensive guidance for integration with HVAC and façade systems. Moreover, firms that develop modular solutions and offer field verification services create stickier customer relationships by reducing performance uncertainty at handover.In addition, successful companies often maintain diversified go-to-market routes, blending direct project engagement for complex institutional contracts with distributor partnerships to reach a broader set of dealers and installers. These firms also prioritize transparent material sourcing and offer variants that accommodate both high-end architectural projects and cost-conscious industrial applications. Investments in training for installers and specification teams further differentiate those companies that aim to be perceived as full-solution providers rather than component vendors.

Finally, strategic collaboration with acousticians and third-party testing bodies enhances credibility, while digital tools for specifying and modeling acoustic performance accelerate project cycles. Consequently, companies that align product development with service offerings and that can demonstrate consistent in-situ performance tend to command stronger client trust and repeat business.

Actionable strategic recommendations that integrate modular product design, regional supply resilience, expanded service offerings, and channel optimization to secure long-term advantage

Industry leaders should prioritize a coordinated strategy that aligns product innovation, supply-chain resilience, and service delivery to capture long-term value. First, investing in modular product architectures that support both fixed and adjustable use cases will reduce SKU complexity while enabling faster project customization. This approach should be supported by clear installation protocols and plug-and-play interfaces that simplify on-site integration and verification.Second, develop multi-source supply-chain strategies and regional manufacturing partnerships to mitigate exposure to trade dynamics and to shorten lead times. In doing so, firms can offer clients greater certainty on delivery while preserving margins. Third, expand service capabilities to include specification support, on-site performance validation, and lifecycle maintenance programs, because these services convert one-time sales into recurring relationships and demonstrably reduce operational risk for end users.

Fourth, leverage digital tools for acoustic modeling and product selection, enabling architects and engineers to evaluate solutions virtually before procurement. Fifth, tailor channel strategies so that direct sales handle large, complex projects while distributors and online platforms address standardized components; ensure each channel receives commensurate technical and commercial support. Taken together, these actions position industry leaders to deliver consistent performance, accelerate adoption across sectors, and build defensible customer relationships.

A transparent methodological overview describing how practitioner interviews, technical literature review, manufacturer documentation, and field verification were triangulated to produce practical, installation-focused insights

The research underpinning these insights combined primary engagement with practitioners and a structured review of installation and product performance evidence. Primary inputs included interviews with acousticians, façade engineers, specification managers, and procurement leads to capture real-world decision criteria, installation constraints, and maintenance expectations. These dialogues informed an understanding of how adjustable versus fixed solutions are specified and where motorization or battery options materially change installation and lifecycle considerations.Secondary analysis encompassed technical literature on acoustic attenuation principles, material weathering characteristics, and best-practice integration with ventilation systems. In addition, manufacturer technical documentation and installation guides were reviewed to reconcile stated performance with recommended installation practices. Wherever feasible, field performance notes and third-party verification summaries were used to benchmark product claims against typical site conditions.

Methodologically, the approach emphasized cross-validation of claims through multiple sources and sought to prioritize actionable, installation-focused findings over theoretical performance in lab conditions. This mixed-method approach yields pragmatic guidance for decision-makers focused on specification, procurement, and post-installation verification.

A concise and strategic conclusion highlighting the essential elements of performance, integration, and service that determine success in acoustic louvre applications

In closing, acoustic louvres are a specialized but increasingly strategic component of building and industrial noise-control systems. Their value derives from performance consistency, ease of integration, and long-term resilience in the face of environmental exposure and operational demands. As stakeholders seek both acoustic effectiveness and ease of installation, the most successful approaches marry engineered attenuation with practical installation guidance and robust after-sales support.Consequently, manufacturers and channel partners that invest in modularity, local responsiveness, and demonstrable in-situ performance will be best positioned to meet evolving specification practices. Meanwhile, project teams that emphasize multidisciplinary coordination-bringing acousticians, mechanical engineers, and façade designers into early conversations-reduce the likelihood of performance shortfalls and costly rework. Ultimately, pragmatic choices about materials, actuation mechanisms, and service offerings will determine which solutions deliver the expected performance in real-world installations and which fall short of client expectations.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Acoustic Louvres Market

Companies Mentioned

The key companies profiled in this Acoustic Louvres market report include:- Colt International Limited by Kingspan Group plc

- Construction Specialties, Inc.

- CVS Equipment Pty Ltd

- Ecotone Systems Pvt. Ltd.

- Elta-UK Ltd.

- Envirotech Systems Limited

- Flexshield Group Pty Ltd

- IAC Acoustics UK Ltd by Sound Seal

- Ikon Aluminium Ltd

- Innivate Pte Ltd

- Kinetics Noise Control, Inc.

- Lindab AB

- Louvreclad Pty Ltd.

- Nationwide Louvre Company

- Noico Ltd

- Penina Pty Ltd

- Pottorff

- Price Industries

- Ruskin By Johnson Controls, Inc.

- TEK Ltd

- Titon Hardware Limited

- TROX GmbH

- Ventuer Engineered Ventilation

- Wakefield Acoustics Ltd

- ZAK Acoustics Pvt Ltd

Table Information

| Report Attribute | Details |

|---|---|

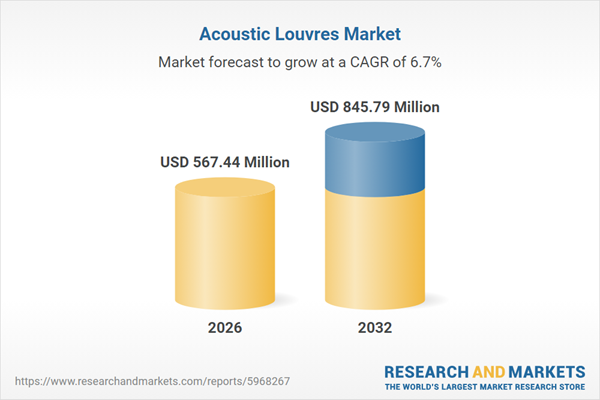

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 567.44 Million |

| Forecasted Market Value ( USD | $ 845.79 Million |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |