Speak directly to the analyst to clarify any post sales queries you may have.

Comprehensive introduction outlining adipic acid’s role in polymer supply chains, sustainability priorities, and strategic decision-making across industrial value chains

Adipic acid occupies a foundational role across multiple industrial value chains, underpinning the production of nylon intermediates, plasticizers, coatings, adhesives, and a diverse set of specialty applications. Its functional properties as a dicarboxylic acid make it central to polymer synthesis, providing both performance and processing characteristics that manufacturers rely on for high-strength fibers, engineering plastics, and versatile formulation chemistries. Over the past decade, the compound has transitioned from a largely commoditized commodity to a focus point for strategic investment, driven by shifts in feedstock economics, regulatory pressure on greenhouse gas emissions, and the growing premium placed on circularity and bio-based alternatives.

This report frames adipic acid not merely as an input chemical but as an inflection point for chemical supply chain resilience and near-term decarbonization pathways. It maps how demand patterns in automotive lightweighting, advanced textiles, and flexible packaging influence procurement choices, and how production technology-whether traditional petrochemical routes or emerging bio-based processes-shapes competitive advantage. Stakeholders across supply, conversion, and end-use sectors increasingly evaluate adipic acid through a lens that integrates cost, regulatory compliance, and sustainability credentials. The introduction that follows sets the stage for deeper analysis by establishing common terminology, scope boundaries, and the principal drivers that inform strategic decision-making across manufacturing, procurement, and R&D functions.

Analysis of fundamental transformative forces reshaping adipic acid production, procurement, and end-use preferences driven by sustainability and technological advances

The landscape for adipic acid is undergoing transformative shifts that extend beyond incremental capacity changes to structural changes in production technology, feedstock sourcing, and demand composition. Sustainability-driven innovation stands at the forefront: manufacturers and converters are accelerating adoption of lower-emission production routes, including catalytic hydrogenation pathways, electrochemical methods, and fermentation-based bio-processes. These technological shifts are not isolated R&D experiments but are being integrated into capex plans and pilot-to-commercial transition strategies, creating first-mover advantages for firms that can demonstrate credible lifecycle improvements.

Concurrently, feedstock and utility volatility have prompted procurement teams to rethink hedging strategies and supplier diversification. Natural gas and petrochemical feedstock price swings have increased interest in vertical integration and offtake agreements with producers operating closer to end markets. Demand-side transitions are equally consequential: the push for lighter, stronger materials in automotive and the premium placed on circular packaging materials are driving differentiated demand for specific adipic acid grades and derivative chemistries. Regulatory environments, especially those focused on methane, nitrous oxide, and scope 3 emissions, are accelerating capital allocation to low-emission processes and to traceability systems that can segregate and certify greener product streams. Taken together, these shifts are recasting competitive dynamics, encouraging collaboration across value chain partners, and elevating adipic acid as both a performance input and a sustainability differentiator.

Examination of the cumulative impacts of 2025 tariff measures on adipic acid supply chains, cost structures, and strategic sourcing decisions across industries

The imposition of tariffs and trade measures in 2025 has the potential to produce a cumulative set of effects that extend across manufacturing cost structures, sourcing patterns, and downstream pricing strategies for nylon and other derivatives. Tariffs can create immediate cost inflation for industries reliant on imported adipic acid or intermediates, which in turn incentivizes regional sourcing, accelerated investment in domestic capacity, and longer-term contracts to insulate converters from spot-market volatility. In practice, tariffs tend to accelerate nearshoring tendencies and increase the strategic value of integrated producers located within tariff-protected jurisdictions.

Beyond immediate cost impacts, tariffs reshuffle supply-chain architecture and supplier relationships. Global traders and distributors may reallocate stock and prioritize customers with established contractual terms, while producers in tariff-exempt regions may seek to extend their market reach by locking in favorable long-term agreements. The administrative burden associated with tariff compliance, including documentation and rules-of-origin verification, also exerts a non-negligible operational cost that favors larger suppliers with robust trade compliance functions. Importantly, the tariff-induced repricing of feedstocks encourages capital deployment into alternative production routes, including bio-based processes, as buyers seek to manage total cost of ownership and reputational risk tied to sustainability commitments.

Finally, the implications for innovation are subtle but material. Tariffs can change the calculus for investments in recycling technologies, polymer substitution, or formulation optimization if they materially alter relative input costs. Firms facing tariff-driven input inflation may accelerate product reformulation, adopt higher-value derivatives that capture more margin, or diversify into adjacent chemistries less exposed to trade measures. The net effect is a reordering of competitive priorities where supply security, regulatory agility, and process innovation become decisive factors in maintaining market position amid evolving trade regimes.

Strategic segmentation insights that reveal differentiated demand, regulatory constraints, and value chain priorities across applications, grades, processes, and channels

Segmentation provides the analytical scaffolding required to translate macro trends into actionable insights across product, process, and customer dimensions. Based on Application, the market is studied across Adhesives And Sealants, Coatings, Food And Beverage, Lubricants, Nylon, Plasticizers, and Polyurethane, with additional granularity under Nylon that distinguishes Engineering Plastics and Fiber; the Engineering Plastics segment is further analyzed across Films and Monofilaments, while the Fiber segment is separated into Industrial Fiber and Textile Fiber. This layered approach reveals that demand drivers differ significantly not only by primary application but by downstream conversion pathways, with nylon-engineering plastic demand exhibiting different sensitivity to feedstock cost and performance specifications than textile fiber demand.

Based on End Use Industry, the market is studied across Agriculture, Automotive, Construction, Electronics, Footwear, Packaging, and Textiles, which highlights how sector-specific trends-such as automotive lightweighting or sustainable packaging mandates-translate into differentiated requirements for adipic acid grade, consistency, and certification. Based on Grade, the market is studied across Food, Industrial, and Personal Care, pointing to the critical importance of regulatory compliance, purity profiles, and traceability for food- and personal-care-grade materials compared with industrial grades used in polymerization. Based on Production Process, the market is studied across Bio Based and Petrochemical, underscoring the strategic divergence between traditional feedstock-dependent producers and entrants leveraging fermentation or catalytic innovations to reduce carbon intensity. Finally, based on Distribution Channel, the market is studied across Direct Sales, Distributors, and E Commerce, which illuminates the evolving go-to-market strategies, service level expectations, and digital enablement requirements that shape buyer-supplier interactions across different customer segments. By integrating these segmentation lenses, stakeholders can identify pockets of premiumization, vulnerability to feedstock volatility, and pathways for product differentiation or cost optimization.

Regional intelligence highlighting how Americas, Europe Middle East & Africa, and Asia-Pacific dynamics shape supply resilience, investments, and regulatory responses

Regional dynamics are central to understanding supply resilience, investment incentives, and demand composition for adipic acid. The Americas exhibit strong integration between feedstock supply and downstream nylon conversion, and policy signals around energy transition and domestic manufacturing can stimulate capacity expansion or refurbishment activity. Within this region, procurement strategies emphasize reliability, logistics optimization, and supplier partnerships that reduce exposure to ocean freight disruptions.

Europe, Middle East & Africa presents a patchwork of regulatory drivers and end-use demand where aggressive climate targets and extended producer responsibility frameworks increase the premium for lower-carbon and traceable chemical inputs. Industrial clusters in Western Europe often prioritize certification and circularity, while emerging markets within the region display rising consumption tied to construction and automotive manufacturing. Regulatory complexity and carbon-price considerations make strategic alliances and technology licensing important levers for securing market access.

Asia-Pacific remains the production and consumption epicenter for many polymer and textile value chains, with integrated petrochemical complexes and large-scale derivative manufacturing. Rapid urbanization and packaging demand growth sustain consumption, while national strategies that support domestic chemical manufacturing influence capacity trajectories. Export-oriented manufacturers in this region navigate both global demand signals and localized policy incentives, making the region pivotal for global supply continuity and innovation diffusion. Across all regions, logistics, trade policy, and sustainability reporting requirements frame investment decisions and supplier selection criteria.

Insights into competitive dynamics, technology leadership, and partnership models that determine which producers gain advantage in a sustainability-driven market

Competitive dynamics among adipic acid producers are being redefined by capital allocation to low-emission processes, vertical integration strategies, and differentiated service models that emphasize reliability and technical support. Larger integrated producers benefit from scale advantages, supply chain control, and the ability to offer long-term offtake arrangements, while specialized producers and technology licensors compete on innovation, faster transition to bio-based routes, and niche grade purity. Strategic collaborations between upstream producers and downstream converters are increasing, driven by mutual interest in securing feedstock, demonstrating lifecycle improvements, and accelerating commercialization of greener chemistries.

Mergers, joint ventures, and capacity rationalization play a role in reshaping the competitive landscape, as do investments in digitalization that enhance demand forecasting, order fulfillment, and traceability. Service differentiation-such as technical support for polymer formulators, custom packaging for specialty grades, and flexible logistics solutions-has emerged as a meaningful source of competitive advantage, particularly for suppliers targeting high-value end markets like medical textiles and specialty coatings. Intellectual property around catalytic processes, bio-fermentation strains, and nitrous oxide abatement systems also informs strategic positioning, as firms with proprietary low-emission technologies can command favorable partnerships and premium pricing for certified low-carbon product streams. Overall, the interplay of scale, technology, and service orientation determines which firms can capture long-term value amid shifting customer expectations and tighter regulatory scrutiny.

Actionable recommendations for procurement, R&D, and commercial leaders to secure supply, accelerate decarbonization, and capture premium value in changing markets

Industry leaders should prioritize a set of coordinated actions that align procurement, R&D, and commercial strategy to both mitigate near-term disruptions and capture long-term value opportunities. First, accelerate evaluation and staged investment in low-emission production routes, including pilot programs that can be scaled in step with confirmed offtake agreements and regulatory incentives. This reduces exposure to potential trade measures and positions firms to meet tightening sustainability requirements while preserving margin through process efficiency improvements.

Second, strengthen supply security through diversified sourcing and strategic partnerships that combine long-term contracts with flexible spot arrangements and regional inventory hubs. This hybrid approach reduces single-source exposure and provides the agility needed to respond to tariff-driven supply reallocation or logistical constraints. Third, invest in product differentiation through grade certification and traceability systems that allow premiuming for low-carbon or bio-based adipic acid, especially in food, personal care, and high-performance textile segments where buyers demonstrate willingness to pay for verified sustainability credentials.

Fourth, deploy targeted commercial strategies that link technical service and formulation support to customer outcomes, enabling suppliers to move from transactional sales to value-based partnerships. Finally, embed scenario planning and trade compliance capabilities into strategic planning to rapidly assess the implications of evolving tariff regimes, carbon pricing, and regulatory shifts, ensuring capital and procurement decisions remain resilient in multiple possible futures.

Methodological overview describing primary research, secondary evidence synthesis, scenario analysis, and quality assurance practices that underpin the study’s findings

The research underpinning this report combines systematic primary engagement with industry participants and rigorous secondary evidence synthesis to ensure robust, defensible conclusions. Primary research included structured interviews with producers, converters, procurement executives, and technology providers, allowing for triangulation of capital investment intentions, operational constraints, and customer requirements. Secondary sources encompassed regulatory filings, technical literature, patent landscapes, and publicly disclosed company presentations to corroborate technology readiness levels, announced partnerships, and sustainability claims.

Analytical methods included value chain mapping to identify critical nodes of vulnerability, sensitivity analysis to explore the implications of tariff and feedstock volatility scenarios, and process lifecycle assessment frameworks to compare relative carbon intensity across production routes. Data quality was assured through cross-validation of interview inputs against multiple independent datasets and through iterative review cycles with sector experts. Where appropriate, scenario planning techniques were applied to stress-test strategic recommendations against a range of policy and market outcomes. The methodological approach prioritized transparency, reproducibility, and a balanced synthesis of qualitative insight and quantitative analysis to inform pragmatic decision-making by corporate and investment stakeholders.

Concluding synthesis that integrates supply chain resilience, technological innovation, and commercial strategies to inform executive decision-making on adipic acid

Adipic acid sits at a strategic intersection of performance chemistry and sustainability transformation, and the choices made by producers, converters, and buyers over the next several years will determine who captures the upside of lower-carbon production and resilient supply chains. Industry participants that combine investments in cleaner production technology with agile commercial strategies and rigorous trade compliance will be better positioned to navigate both tariff disruptions and evolving regulatory expectations. Simultaneously, end-use sectors that prioritize certified low-carbon inputs and supplier collaboration will accelerate demand for differentiated adipic acid offerings and create pathways for premiumization.

The coming period will be defined by a blend of consolidation and innovation: consolidation in logistics and distribution as firms seek scale efficiencies, and innovation in chemistry and process engineering as companies pursue lifecycle improvements. Firms that proactively engage in cross-sector partnerships, secure strategic offtakes, and adopt transparent verification frameworks for sustainability claims will reduce exposure to both cost shocks and reputational risk. In short, the future of adipic acid is not predetermined by feedstock alone but by strategic decisions around technology, sourcing, and value creation that forward-looking organizations are already beginning to make.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Adipic Acid Market

Companies Mentioned

The key companies profiled in this Adipic Acid market report include:- Asahi Kasei Corporation

- Ascend Performance Materials Holdings Inc.

- BASF SE

- Central Drug House (P) Ltd.

- Domo Chemicals GmbH

- Evonik Industries AG

- Huafon Group

- Koch, Inc.

- Lanxess AG

- LG Corporation

- Liaoyang Tianhua Chemical Co.,Ltd.

- Merck KGaA

- Mitsubishi Chemical Corporation

- Pon Pure Chemicals Group

- Radici Partecipazioni SpA

- Shanghai Guanru Chemical Co., Ltd

- Shenma Industrial Co. Ltd

- Solvay S.A.

- Spectrum Chemical Mfg. Corp.

- Sumitomo Chemical Co., Ltd

- Tangshan Zhonghao Chemical Co. Ltd

- Tokyo Chemical Industry Co., Ltd.

- Toray Industries, Inc.

- Vizag Chemical International

- Zhengzhou Meiya Chemical Products Co.,Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | January 2026 |

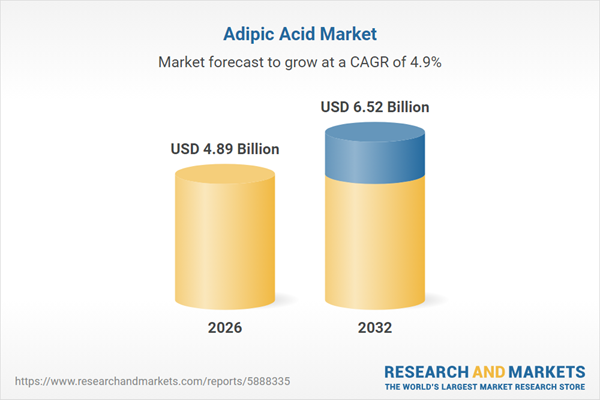

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 4.89 Billion |

| Forecasted Market Value ( USD | $ 6.52 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |