Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Market Drivers

Increased Demand for Air Travel and Aircraft Production

One of the primary drivers propelling the growth of the Aerospace Actuators market is the unprecedented increase in global air travel. The surge in demand for air travel, fueled by factors such as population growth, urbanization, and rising disposable incomes, has led to a significant expansion of commercial aviation. As more people choose air travel as their preferred mode of transportation, the aviation industry experiences a surge in demand for new aircraft, creating a robust market for aerospace actuators.The expanding global fleet of commercial and military aircraft, coupled with the replacement of aging aircraft, further contributes to the increased demand for aerospace actuators. Airlines and defense forces worldwide are modernizing their fleets to enhance operational efficiency, fuel economy, and safety. This drive for fleet modernization necessitates the incorporation of advanced actuators to meet the stringent performance and reliability requirements of modern aircraft systems.

The overall growth trajectory of the aerospace industry, including both commercial and defense sectors, is a significant driver for the Aerospace Actuators market. With an increasing number of aircraft orders and deliveries, manufacturers are ramping up production to meet the demand. This surge in aircraft production directly translates into a heightened need for actuators, which play a crucial role in controlling various aircraft systems, such as flight control surfaces, landing gear, and avionics.

Advancements in Technology and Electrification

Technological advancements and the trend toward electrification in aircraft systems are driving innovation in aerospace actuators. Traditional hydraulic actuators are being complemented and, in some cases, replaced by electro-hydraulic and electro-mechanical actuators. These advanced actuators offer benefits such as reduced weight, improved efficiency, and enhanced precision in controlling critical functions, aligning with the aerospace industry's pursuit of more electric and all-electric aircraft.The adoption of fly-by-wire systems and the digitalization of aircraft controls represent another driver influencing the Aerospace Actuators market. Fly-by-wire technology, which replaces traditional mechanical linkages with electronic systems, relies heavily on sophisticated actuators to translate pilot inputs into precise control surface movements. Digitalization enhances system reliability, reduces maintenance requirements, and allows for advanced features such as envelope protection and adaptive control, further fueling the demand for advanced actuators.

The integration of sensors and the development of smart actuators contribute to the evolving landscape of aerospace actuators. Smart actuators, equipped with sensors and embedded control algorithms, enable real-time monitoring and adaptive control. These actuators can dynamically adjust their performance based on changing conditions, enhancing overall system efficiency and responsiveness. The trend towards intelligent, sensor-equipped actuators aligns with the industry's push for more autonomous and connected aircraft systems.

Focus on Fuel Efficiency and Environmental Sustainability

With a growing emphasis on environmental sustainability and fuel efficiency, the aerospace industry is seeking ways to reduce aircraft weight and fuel consumption. Aerospace actuators play a crucial role in achieving these goals by contributing to the development of lightweight systems. Actuators made from advanced materials, such as carbon composites and titanium alloys, help reduce overall aircraft weight, leading to improved fuel efficiency and reduced environmental impact.Green aviation initiatives, backed by regulatory bodies and industry stakeholders, are driving the adoption of technologies that minimize the environmental footprint of aircraft. Aerospace actuators, particularly those used in fuel systems, landing gear, and aerodynamic control surfaces, are subject to continuous innovation to align with sustainability goals. Actuators designed for more efficient energy use, reduced emissions, and eco-friendly materials contribute to the industry's commitment to greener aviation.

Growing Complexity of Aircraft Systems

The evolving landscape of aircraft systems, marked by increasing complexity and integration of advanced technologies, is a significant driver for the Aerospace Actuators market. Modern aircraft feature a multitude of systems, from fly-by-wire controls to advanced avionics and automated safety systems. As the complexity of these systems grows, the demand for highly capable and reliable actuators rises to ensure precise and responsive control across various aircraft functions.Actuators are integral components in the integration of avionics and automation systems in modern aircraft. The integration of actuators with avionics allows for seamless communication and coordination between different systems. Automated flight control systems, auto-throttle systems, and advanced navigation systems rely on actuators for precise control and execution of commands. The increasing automation of aircraft functions reinforces the crucial role of aerospace actuators in supporting safe and efficient operations.

Stringent Regulatory Standards and Safety Requirements

Stringent regulatory standards set by aviation authorities, such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA), drive the Aerospace Actuators market. Compliance with these standards is essential for the certification and airworthiness of aircraft. Manufacturers must adhere to rigorous testing and quality control measures to ensure that their actuators meet or exceed the safety and performance requirements outlined by regulatory bodies.Aerospace actuators play a critical role in safety-critical applications, including flight control surfaces and landing gear. The need for redundancy and fail-safe features in these systems is mandated by regulatory authorities to ensure the highest level of safety in aviation. Actuators designed for safety-critical applications must undergo extensive testing and validation to achieve certification, contributing to the overall reliability and safety of aircraft operations.

Key Market Challenges

Stringent Regulatory Compliance

The global aerospace actuators market is subject to stringent regulatory standards set by aviation authorities such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA). Compliance with these regulations is non-negotiable, and failure to meet the specified standards can result in severe consequences, including grounded aircraft and financial penalties. Developing actuators that adhere to these standards involves comprehensive testing, documentation, and certification processes. The challenge lies in navigating the complex and evolving regulatory landscape, staying abreast of updates, and ensuring that actuators consistently meet or exceed the stipulated requirements to ensure the safety and reliability of aerospace systems.Technological Complexity and Innovation

The aerospace industry is characterized by rapid technological advancements and a constant drive for innovation. Actuators play a crucial role in the evolving landscape of aircraft design, automation, and control systems. However, the increasing complexity of aircraft systems, coupled with the demand for more sophisticated and efficient actuators, poses a significant challenge. Engineers and manufacturers must continually innovate to develop actuators that not only meet the current technological requirements but also anticipate and adapt to future advancements. Balancing the need for cutting-edge technology with reliability and ease of integration is a perpetual challenge in the aerospace actuators market.Weight and Size Constraints

Weight is a critical factor in aviation, directly impacting fuel efficiency and overall performance. Actuators must be designed with a keen focus on minimizing weight without compromising strength or functionality. This challenge becomes even more pronounced with the trend toward lightweight materials and the continuous drive for fuel-efficient aircraft. Additionally, the physical size of actuators is a consideration, especially in smaller aircraft or in applications where space is limited. Developing compact yet powerful actuators that adhere to stringent weight and size constraints without sacrificing performance remains an ongoing challenge for manufacturers in the aerospace industry.Harsh Environmental Conditions

Aerospace actuators operate in diverse and often harsh environmental conditions. Aircraft encounter a wide range of temperatures, humidity levels, and atmospheric pressures during flight. Actuators must withstand these conditions while maintaining precision and reliability. Additionally, factors such as exposure to contaminants, vibrations, and mechanical stresses pose challenges in ensuring the longevity and performance of actuators. Developing robust actuators that can endure extreme conditions without compromising functionality requires extensive testing and validation processes, adding complexity to the manufacturing and deployment of aerospace actuation systems.Supply Chain Disruptions and Material Selection

The aerospace industry relies on a global supply chain for critical components, including actuators. Supply chain disruptions due to geopolitical events, natural disasters, or global health crises can significantly impact the availability of essential materials and components. Manufacturers must carefully manage and diversify their supply chains to mitigate these risks. Additionally, the selection of materials for actuators is a crucial consideration. Aerospace actuators often require specialized materials with high strength-to-weight ratios and resistance to fatigue and corrosion. Ensuring a stable supply of these materials, especially in the face of geopolitical uncertainties, requires strategic planning and proactive risk management.Key Market Trends

Advancements in Material Technologies

A prominent trend in the global aerospace and defense ducting market is the continuous advancements in material technologies. Ducting systems play a critical role in ensuring the efficient and safe functioning of aircraft and defense systems. As a response to the evolving demands of modern aerospace applications, manufacturers are investing in the development of lightweight yet durable materials. Advanced composites, high-temperature alloys, and innovative polymers are increasingly being integrated into ducting systems to enhance performance, reduce weight, and withstand the harsh operating conditions encountered in both civilian and military aviation. The trend towards innovative materials aligns with the industry's overarching goals of improving fuel efficiency, reducing emissions, and enhancing overall sustainability.Integration of Smart Technologies

The integration of smart technologies is a transformative trend in the aerospace and defense ducting market. With the broader industry embracing the concept of the Internet of Things (IoT) and Industry 4.0, ducting systems are becoming more intelligent and connected. Sensors embedded within ducting components enable real-time monitoring of various parameters such as temperature, pressure, and structural integrity. This data can be utilized for predictive maintenance, performance optimization, and condition-based monitoring. The integration of smart technologies contributes to enhanced reliability, reduced downtime, and improved overall operational efficiency. Additionally, smart ducting systems align with the growing emphasis on data-driven decision-making and the digitalization of aerospace and defense operations.Focus on Additive Manufacturing (3D Printing)

Additive manufacturing, commonly known as 3D printing, is emerging as a significant trend in the aerospace and defense ducting market. This innovative production technique offers the potential to revolutionize the design and manufacturing processes of ducting components. The ability to create complex geometries and intricate structures with 3D printing allows for the development of more efficient and customized ducting solutions. Manufacturers are exploring the application of additive manufacturing for prototyping, low-volume production, and even the production of critical components within ducting systems. This trend aligns with the industry's pursuit of lightweighting, design flexibility, and cost-effective manufacturing solutions.

Rising Demand for Environmentally Sustainable Solutions

The aerospace and defense industry is experiencing a growing focus on environmentally sustainable practices, and this trend is extending to the ducting market. Governments, regulatory bodies, and industry stakeholders are increasingly emphasizing the importance of reducing the environmental impact of aviation. In response, the ducting market is witnessing a shift towards environmentally sustainable solutions. Manufacturers are exploring eco-friendly materials, implementing energy-efficient manufacturing processes, and adopting sustainable design practices. Ducting systems that contribute to overall fuel efficiency, emissions reduction, and adherence to eco-friendly standards are gaining prominence. This trend reflects the industry's commitment to addressing environmental challenges and aligning with global sustainability goals.Global Collaborations and Partnerships

Collaborations and partnerships between key players in the aerospace and defense industry are emerging as a significant trend in the ducting market. As the industry becomes more globalized, manufacturers, suppliers, and research institutions are forming strategic alliances to leverage each other's strengths. Collaborative efforts involve sharing expertise, pooling resources, and jointly developing innovative ducting solutions. These partnerships contribute to accelerated research and development, faster time-to-market for new products, and increased competitiveness. Additionally, global collaborations enable companies to navigate complex regulatory landscapes and geopolitical challenges by leveraging the insights and capabilities of partners across different regions.Segmental Insights

Actuator Type Analysis

Primary and secondary flight control actuators, landing gear, thrust reversers, engine control, utilities, seats, weapon release, missiles, and other items are the different market segments. Due to the increased emphasis on safer and lighter flight control systems as well as the use of several actuators, the primary flight control actuator is anticipated to continue to be the most common type of actuator in the market throughout the forecast period, followed by secondary flight control actuators.Regional Insights

It is expected that North America would continue to dominate the market for aerospace actuators. The USA is the market's main growth driver, possessing one of the biggest fleets of both military and commercial aircraft in the world. The majority of the leading companies in the aerospace actuators market are present in the area to support OEMs' emerging demands and work with them on prospective aircraft projects or fuel-efficient versions of current aircraft projects. Due to factors such as increased demand for commercial aircraft to handle expanding passenger traffic, rising defense spending in significant economies, the opening of Boeing and Airbus assembly plants, and the introduction of indigenous commercial aircraft, Asia-Pacific is predicted to grow at the fastest rate in the market over the next five years.Report Scope

In this report, the Global Aerospace Actuators Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Aerospace Actuators Market, By Aircraft Type:

- Commercial Aircrafts

- Regional Jets

- Business Jets

- Military Aircrafts

Aerospace Actuators Market, By Actuators Type:

- Primary Flight Control Actuators

- Secondary Flight Actuators

- Landing Gear

- Thrust Reversers

- Engine Control

- Utilities

- Seats

- Weapon Release

- Missiles

- Others

Aerospace Actuators Market, By Sales Channel:

- OEM

- Aftermarket

Aerospace Actuators Market, By Region:

- Asia-Pacific

- China

- India

- Japan

- Indonesia

- Thailand

- South Korea

- Australia

- Europe & CIS

- Germany

- Spain

- France

- Russia

- Italy

- United Kingdom

- Belgium

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Turkey

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Aerospace Actuators Market.Available Customizations:

The analyst offers customization according to specific needs, along with the already-given market data of the Global Aerospace Actuators market report.This product will be delivered within 1-3 business days.

Table of Contents

1. Introduction1.1. Product Overview

1.2. Key Highlights of the Report

1.3. Market Coverage

1.4. Market Segments Covered

1.5. Research Tenure Considered

2. Research Methodology

2.1. Methodology Landscape

2.2. Objective of the Study

2.3. Baseline Methodology

2.4. Formulation of the Scope

2.5. Assumptions and Limitations

2.6. Sources of Research

2.7. Approach for the Market Study

2.8. Methodology Followed for Calculation of Market Size & Market Shares

2.9. Forecasting Methodology

3. Executive Summary

3.1. Market Overview

3.2. Market Forecast

3.3. Key Regions

3.4. Key Segments

4. Impact of COVID-19 on Global Aerospace Actuators Market

5. Global Aerospace Actuators Market Outlook

5.1. Market Size & Forecast

5.1.1. By Value

5.2. Market Share & Forecast

5.2.1. By Aircraft Type Market Share Analysis (Commercial Aircrafts, Regional Jets, Business Jets, Military Aircrafts)

5.2.2. By Actuators Type Market Share Analysis (Primary Flight Control Actuators, Secondary Flight Actuators, Landing Gear, Thrust Reversers, Engine Control, Utilities, Seats, Weapon Release, Missiles, and Others)

5.2.3. By Sales Channel Market Share Analysis (OEM, Aftermarket)

5.2.4. By Regional Market Share Analysis

5.2.4.1. Asia-Pacific Market Share Analysis

5.2.4.2. Europe & CIS Market Share Analysis

5.2.4.3. North America Market Share Analysis

5.2.4.4. South America Market Share Analysis

5.2.4.5. Middle East & Africa Market Share Analysis

5.2.5. By Company Market Share Analysis (Top 5 Companies, Others - By Value, 2023)

5.3. Global Aerospace Actuators Market Mapping & Opportunity Assessment

5.3.1. By Aircraft Type Market Mapping & Opportunity Assessment

5.3.2. By Actuators Type Market Mapping & Opportunity Assessment

5.3.3. By Sales Channel Market Mapping & Opportunity Assessment

5.3.4. By Regional Market Mapping & Opportunity Assessment

6. Asia-Pacific Aerospace Actuators Market Outlook

6.1. Market Size & Forecast

6.1.1. By Value

6.2. Market Share & Forecast

6.2.1. By Aircraft Type Market Share Analysis

6.2.2. By Actuators Type Market Share Analysis

6.2.3. By Sales Channel Market Share Analysis

6.2.4. By Country Market Share Analysis

6.2.4.1. China Market Share Analysis

6.2.4.2. India Market Share Analysis

6.2.4.3. Japan Market Share Analysis

6.2.4.4. Indonesia Market Share Analysis

6.2.4.5. Thailand Market Share Analysis

6.2.4.6. South Korea Market Share Analysis

6.2.4.7. Australia Market Share Analysis

6.2.4.8. Rest of Asia-Pacific Market Share Analysis

6.3. Asia-Pacific: Country Analysis

6.3.1. China Aerospace Actuators Market Outlook

6.3.1.1. Market Size & Forecast

6.3.1.1.1. By Value

6.3.1.2. Market Share & Forecast

6.3.1.2.1. By Aircraft Type Market Share Analysis

6.3.1.2.2. By Actuators Type Market Share Analysis

6.3.1.2.3. By Sales Channel Market Share Analysis

6.3.2. India Aerospace Actuators Market Outlook

6.3.2.1. Market Size & Forecast

6.3.2.1.1. By Value

6.3.2.2. Market Share & Forecast

6.3.2.2.1. By Aircraft Type Market Share Analysis

6.3.2.2.2. By Actuators Type Market Share Analysis

6.3.2.2.3. By Sales Channel Market Share Analysis

6.3.3. Japan Aerospace Actuators Market Outlook

6.3.3.1. Market Size & Forecast

6.3.3.1.1. By Value

6.3.3.2. Market Share & Forecast

6.3.3.2.1. By Aircraft Type Market Share Analysis

6.3.3.2.2. By Actuators Type Market Share Analysis

6.3.3.2.3. By Sales Channel Market Share Analysis

6.3.4. Indonesia Aerospace Actuators Market Outlook

6.3.4.1. Market Size & Forecast

6.3.4.1.1. By Value

6.3.4.2. Market Share & Forecast

6.3.4.2.1. By Aircraft Type Market Share Analysis

6.3.4.2.2. By Actuators Type Market Share Analysis

6.3.4.2.3. By Sales Channel Market Share Analysis

6.3.5. Thailand Aerospace Actuators Market Outlook

6.3.5.1. Market Size & Forecast

6.3.5.1.1. By Value

6.3.5.2. Market Share & Forecast

6.3.5.2.1. By Aircraft Type Market Share Analysis

6.3.5.2.2. By Actuators Type Market Share Analysis

6.3.5.2.3. By Sales Channel Market Share Analysis

6.3.6. South Korea Aerospace Actuators Market Outlook

6.3.6.1. Market Size & Forecast

6.3.6.1.1. By Value

6.3.6.2. Market Share & Forecast

6.3.6.2.1. By Aircraft Type Market Share Analysis

6.3.6.2.2. By Actuators Type Market Share Analysis

6.3.6.2.3. By Sales Channel Market Share Analysis

6.3.7. Australia Aerospace Actuators Market Outlook

6.3.7.1. Market Size & Forecast

6.3.7.1.1. By Value

6.3.7.2. Market Share & Forecast

6.3.7.2.1. By Aircraft Type Market Share Analysis

6.3.7.2.2. By Actuators Type Market Share Analysis

6.3.7.2.3. By Sales Channel Market Share Analysis

7. Europe & CIS Aerospace Actuators Market Outlook

7.1. Market Size & Forecast

7.1.1. By Value

7.2. Market Share & Forecast

7.2.1. By Aircraft Type Market Share Analysis

7.2.2. By Actuators Type Market Share Analysis

7.2.3. By Sales Channel Market Share Analysis

7.2.4. By Country Market Share Analysis

7.2.4.1. Germany Market Share Analysis

7.2.4.2. Spain Market Share Analysis

7.2.4.3. France Market Share Analysis

7.2.4.4. Russia Market Share Analysis

7.2.4.5. Italy Market Share Analysis

7.2.4.6. United Kingdom Market Share Analysis

7.2.4.7. Belgium Market Share Analysis

7.2.4.8. Rest of Europe & CIS Market Share Analysis

7.3. Europe & CIS: Country Analysis

7.3.1. Germany Aerospace Actuators Market Outlook

7.3.1.1. Market Size & Forecast

7.3.1.1.1. By Value

7.3.1.2. Market Share & Forecast

7.3.1.2.1. By Aircraft Type Market Share Analysis

7.3.1.2.2. By Actuators Type Market Share Analysis

7.3.1.2.3. By Sales Channel Market Share Analysis

7.3.2. Spain Aerospace Actuators Market Outlook

7.3.2.1. Market Size & Forecast

7.3.2.1.1. By Value

7.3.2.2. Market Share & Forecast

7.3.2.2.1. By Aircraft Type Market Share Analysis

7.3.2.2.2. By Actuators Type Market Share Analysis

7.3.2.2.3. By Sales Channel Market Share Analysis

7.3.3. France Aerospace Actuators Market Outlook

7.3.3.1. Market Size & Forecast

7.3.3.1.1. By Value

7.3.3.2. Market Share & Forecast

7.3.3.2.1. By Aircraft Type Market Share Analysis

7.3.3.2.2. By Actuators Type Market Share Analysis

7.3.3.2.3. By Sales Channel Market Share Analysis

7.3.4. Russia Aerospace Actuators Market Outlook

7.3.4.1. Market Size & Forecast

7.3.4.1.1. By Value

7.3.4.2. Market Share & Forecast

7.3.4.2.1. By Aircraft Type Market Share Analysis

7.3.4.2.2. By Actuators Type Market Share Analysis

7.3.4.2.3. By Sales Channel Market Share Analysis

7.3.5. Italy Aerospace Actuators Market Outlook

7.3.5.1. Market Size & Forecast

7.3.5.1.1. By Value

7.3.5.2. Market Share & Forecast

7.3.5.2.1. By Aircraft Type Market Share Analysis

7.3.5.2.2. By Actuators Type Market Share Analysis

7.3.5.2.3. By Sales Channel Market Share Analysis

7.3.6. United Kingdom Aerospace Actuators Market Outlook

7.3.6.1. Market Size & Forecast

7.3.6.1.1. By Value

7.3.6.2. Market Share & Forecast

7.3.6.2.1. By Aircraft Type Market Share Analysis

7.3.6.2.2. By Actuators Type Market Share Analysis

7.3.6.2.3. By Sales Channel Market Share Analysis

7.3.7. Belgium Aerospace Actuators Market Outlook

7.3.7.1. Market Size & Forecast

7.3.7.1.1. By Value

7.3.7.2. Market Share & Forecast

7.3.7.2.1. By Aircraft Type Market Share Analysis

7.3.7.2.2. By Actuators Type Market Share Analysis

7.3.7.2.3. By Sales Channel Market Share Analysis

8. North America Aerospace Actuators Market Outlook

8.1. Market Size & Forecast

8.1.1. By Value

8.2. Market Share & Forecast

8.2.1. By Aircraft Type Market Share Analysis

8.2.2. By Actuators Type Market Share Analysis

8.2.3. By Sales Channel Market Share Analysis

8.2.4. By Country Market Share Analysis

8.2.4.1. United States Market Share Analysis

8.2.4.2. Mexico Market Share Analysis

8.2.4.3. Canada Market Share Analysis

8.3. North America: Country Analysis

8.3.1. United States Aerospace Actuators Market Outlook

8.3.1.1. Market Size & Forecast

8.3.1.1.1. By Value

8.3.1.2. Market Share & Forecast

8.3.1.2.1. By Aircraft Type Market Share Analysis

8.3.1.2.2. By Actuators Type Market Share Analysis

8.3.1.2.3. By Sales Channel Market Share Analysis

8.3.2. Mexico Aerospace Actuators Market Outlook

8.3.2.1. Market Size & Forecast

8.3.2.1.1. By Value

8.3.2.2. Market Share & Forecast

8.3.2.2.1. By Aircraft Type Market Share Analysis

8.3.2.2.2. By Actuators Type Market Share Analysis

8.3.2.2.3. By Sales Channel Market Share Analysis

8.3.3. Canada Aerospace Actuators Market Outlook

8.3.3.1. Market Size & Forecast

8.3.3.1.1. By Value

8.3.3.2. Market Share & Forecast

8.3.3.2.1. By Aircraft Type Market Share Analysis

8.3.3.2.2. By Actuators Type Market Share Analysis

8.3.3.2.3. By Sales Channel Market Share Analysis

9. South America Aerospace Actuators Market Outlook

9.1. Market Size & Forecast

9.1.1. By Value

9.2. Market Share & Forecast

9.2.1. By Aircraft Type Market Share Analysis

9.2.2. By Actuators Type Market Share Analysis

9.2.3. By Sales Channel Market Share Analysis

9.2.4. By Country Market Share Analysis

9.2.4.1. Brazil Market Share Analysis

9.2.4.2. Argentina Market Share Analysis

9.2.4.3. Colombia Market Share Analysis

9.2.4.4. Rest of South America Market Share Analysis

9.3. South America: Country Analysis

9.3.1. Brazil Aerospace Actuators Market Outlook

9.3.1.1. Market Size & Forecast

9.3.1.1.1. By Value

9.3.1.2. Market Share & Forecast

9.3.1.2.1. By Aircraft Type Market Share Analysis

9.3.1.2.2. By Actuators Type Market Share Analysis

9.3.1.2.3. By Sales Channel Market Share Analysis

9.3.2. Colombia Aerospace Actuators Market Outlook

9.3.2.1. Market Size & Forecast

9.3.2.1.1. By Value

9.3.2.2. Market Share & Forecast

9.3.2.2.1. By Aircraft Type Market Share Analysis

9.3.2.2.2. By Actuators Type Market Share Analysis

9.3.2.2.3. By Sales Channel Market Share Analysis

9.3.3. Argentina Aerospace Actuators Market Outlook

9.3.3.1. Market Size & Forecast

9.3.3.1.1. By Value

9.3.3.2. Market Share & Forecast

9.3.3.2.1. By Aircraft Type Market Share Analysis

9.3.3.2.2. By Actuators Type Market Share Analysis

9.3.3.2.3. By Sales Channel Market Share Analysis

10. Middle East & Africa Aerospace Actuators Market Outlook

10.1. Market Size & Forecast

10.1.1. By Value

10.2. Market Share & Forecast

10.2.1. By Aircraft Type Market Share Analysis

10.2.2. By Actuators Type Market Share Analysis

10.2.3. By Sales Channel Market Share Analysis

10.2.4. By Country Market Share Analysis

10.2.4.1. South Africa Market Share Analysis

10.2.4.2. Turkey Market Share Analysis

10.2.4.3. Saudi Arabia Market Share Analysis

10.2.4.4. UAE Market Share Analysis

10.2.4.5. Rest of Middle East & Africa Market Share Analysis

10.3. Middle East & Africa: Country Analysis

10.3.1. South Africa Aerospace Actuators Market Outlook

10.3.1.1. Market Size & Forecast

10.3.1.1.1. By Value

10.3.1.2. Market Share & Forecast

10.3.1.2.1. By Aircraft Type Market Share Analysis

10.3.1.2.2. By Actuators Type Market Share Analysis

10.3.1.2.3. By Sales Channel Market Share Analysis

10.3.2. Turkey Aerospace Actuators Market Outlook

10.3.2.1. Market Size & Forecast

10.3.2.1.1. By Value

10.3.2.2. Market Share & Forecast

10.3.2.2.1. By Aircraft Type Market Share Analysis

10.3.2.2.2. By Actuators Type Market Share Analysis

10.3.2.2.3. By Sales Channel Market Share Analysis

10.3.3. Saudi Arabia Aerospace Actuators Market Outlook

10.3.3.1. Market Size & Forecast

10.3.3.1.1. By Value

10.3.3.2. Market Share & Forecast

10.3.3.2.1. By Aircraft Type Market Share Analysis

10.3.3.2.2. By Actuators Type Market Share Analysis

10.3.3.2.3. By Sales Channel Market Share Analysis

10.3.4. UAE Aerospace Actuators Market Outlook

10.3.4.1. Market Size & Forecast

10.3.4.1.1. By Value

10.3.4.2. Market Share & Forecast

10.3.4.2.1. By Aircraft Type Market Share Analysis

10.3.4.2.2. By Actuators Type Market Share Analysis

10.3.4.2.3. By Sales Channel Market Share Analysis

11. SWOT Analysis

11.1. Strength

11.2. Weakness

11.3. Opportunities

11.4. Threats

12. Market Dynamics

12.1. Market Drivers

12.2. Market Challenges

13. Market Trends and Developments

14. Competitive Landscape

14.1. Company Profiles (Up to 10 Major Companies)

14.1.1. Curtiss-Wright Corporation

14.1.1.1. Company Details

14.1.1.2. Key Product Offered

14.1.1.3. Financials (As Per Availability)

14.1.1.4. Recent Developments

14.1.1.5. Key Management Personnel

14.1.2. Parker Hannifin Corporation

14.1.2.1. Company Details

14.1.2.2. Key Product Offered

14.1.2.3. Financials (As Per Availability)

14.1.2.4. Recent Developments

14.1.2.5. Key Management Personnel

14.1.3. Aero Space Controls Corporation.

14.1.3.1. Company Details

14.1.3.2. Key Product Offered

14.1.3.3. Financials (As Per Availability)

14.1.3.4. Recent Developments

14.1.3.5. Key Management Personnel

14.1.4. Moog, Inc

14.1.4.1. Company Details

14.1.4.2. Key Product Offered

14.1.4.3. Financials (As Per Availability)

14.1.4.4. Recent Developments

14.1.4.5. Key Management Personnel

14.1.5. Triumph Group, Inc.

14.1.5.1. Company Details

14.1.5.2. Key Product Offered

14.1.5.3. Financials (As Per Availability)

14.1.5.4. Recent Developments

14.1.5.5. Key Management Personnel

14.1.6. Nook Industries Inc

14.1.6.1. Company Details

14.1.6.2. Key Product Offered

14.1.6.3. Financials (As Per Availability)

14.1.6.4. Recent Developments

14.1.6.5. Key Management Personnel

14.1.7. Honeywell International Inc

14.1.7.1. Company Details

14.1.7.2. Key Product Offered

14.1.7.3. Financials (As Per Availability)

14.1.7.4. Recent Developments

14.1.7.5. Key Management Personnel

14.1.8. Collins Aerospace.

14.1.8.1. Company Details

14.1.8.2. Key Product Offered

14.1.8.3. Financials (As Per Availability)

14.1.8.4. Recent Developments

14.1.8.5. Key Management Personnel

14.1.9. UTC Aerospace Systems

14.1.9.1. Company Details

14.1.9.2. Key Product Offered

14.1.9.3. Financials (As Per Availability)

14.1.9.4. Recent Developments

14.1.9.5. Key Management Personnel

15. Strategic Recommendations

15.1. Key Focus Areas

15.1.1. Target Regions

15.1.2. Target Actuator Type

15.1.3. Target By Aircraft Type

16. About Us & Disclaimer

Companies Mentioned

- Curtiss-Wright Corporation

- Parker Hannifin Corporation

- Aero Space Controls Corporation

- Moog, Inc.

- Triumph Group, Inc.

- Nook Industries Inc

- Honeywell International Inc.

- Collins Aerospace

- UTC Aerospace Systems

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 172 |

| Published | January 2024 |

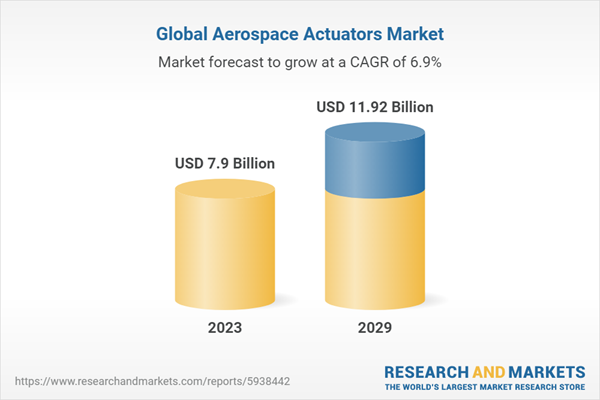

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 7.9 Billion |

| Forecasted Market Value ( USD | $ 11.92 Billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |