Speak directly to the analyst to clarify any post sales queries you may have.

An authoritative orientation that clarifies the product universe, practical applications, and strategic procurement criteria for alcohol-based disinfectant decisions

The opening orientation frames alcohol-based disinfectants as a critical component of modern infection prevention strategies across clinical, industrial, and consumer contexts. This introduction clarifies the product universe, typical formulations, and primary applications while setting expectations for the analytical lens used throughout the report. It highlights why organizations should treat disinfectant selection and procurement as strategic decisions that intersect formulation efficacy, regulatory compliance, supply chain resilience, and channel economics.Readers are guided through the fundamental distinctions between hand sanitizers, industrial disinfectants, surface disinfectants, and surgical scrubs, and why those categories have different performance, regulatory, and procurement imperatives. The introduction also situates product forms such as foam, gel, spray, liquid, and wipes within practical use cases and handling considerations, explaining how dispensing systems and packaging can materially affect adoption by end users.

Finally, this orientation lays out the primary decision criteria executives and category managers should use when evaluating suppliers or designing product portfolios: efficacy against target organisms, safety and skin tolerability, regulatory documentation and labeling, supply continuity, and total cost of ownership. These criteria form the foundation for subsequent sections that analyze structural shifts, tariff impacts, segmentation intelligence, and regional dynamics.

A clear articulation of ongoing structural shifts reshaping product innovation, regulatory scrutiny, supply chain resilience, and channel dynamics across the disinfectant landscape

The landscape for alcohol-based disinfectants is undergoing several converging transformations that influence sourcing, product development, and go-to-market strategies. Rising sustained hygiene awareness has shifted demand beyond episodic spikes to more nuanced long-term purchasing patterns, prompting manufacturers to balance institutional supply contracts with evolving retail and e-commerce channels. At the same time, regulatory scrutiny has intensified around product claims, labeling, and ingredient transparency, compelling companies to strengthen documentation and compliance pathways to mitigate recall and enforcement risks.Innovation in formulation and packaging has accelerated. Manufacturers are expanding product forms and delivery systems to meet differentiated end-use requirements: rapid-evaporation gels and foams for clinical hand hygiene, robust liquids and sprays for surface decontamination, and convenience-focused wipes and pump-dispensed foams for consumer settings. Parallel to this, sustainability pressures are driving experimentation with refillable formats, reduced-plastic packaging, and solvent sourcing that lowers carbon intensity. These design decisions affect unit economics and logistical complexity, especially for companies pursuing cross-channel distribution.

Supply chain restructuring is another salient shift. Firms are diversifying raw material suppliers, investing in regional production capabilities, and reconfiguring inventory strategies to manage volatility in alcohol feedstocks and packaging components. This operational reorientation interacts with commercial strategy: channel partners increasingly demand evidence of supply continuity, while large institutional buyers prefer long-term agreements that lock in specifications and delivery performance. Taken together, these shifts redefine competitive advantage as a combination of validated efficacy, regulatory robustness, sustainable packaging, and resilient distribution.

A focused examination of how 2025 tariff adjustments have driven procurement restructuring, nearshoring choices, and contract redesign across the disinfectant value chain

The cumulative effects of tariff adjustments announced or implemented in 2025 have reverberated through procurement and manufacturing decisions for alcohol-based disinfectant stakeholders. Tariff changes on raw materials, ancillary packaging components, and finished disinfectant imports have elevated the importance of re-evaluating supplier footprints, total landed cost, and contractual terms with global vendors. Companies that depend on cross-border supply of ethanol, isopropanol, pumping systems, and preformed wipes faced immediate choices about absorb versus pass-through cost management.In response to tariff pressure, many organizations intensified nearshoring efforts and pursued dual-sourcing strategies to reduce exposure to single-country trade policy shifts. Procurement teams revisited vendor contracts, tightened lead-time buffers, and increased focus on tariff classification and duty optimization by reconfiguring product bills of materials and harmonized system coding. Operationally, some manufacturers adjusted packaging specifications to source locally available components, and others shifted assembly or final fill activities to lower-tariff jurisdictions to preserve price competitiveness for key buyers.

Commercial teams also adapted pricing and contract terms to account for tariff uncertainty, emphasizing indexation clauses and collaborative risk-sharing agreements with major institutional customers. Regulatory and customs compliance functions gained prominence as organizations sought to leverage free trade agreements and tariff relief mechanisms while ensuring conformity with labeling and safety standards. The combined effect has been a more deliberate orchestration of procurement, manufacturing, and commercial policies to mitigate the downstream impact of trade policy fluctuations.

A granular segmentation synthesis that aligns product forms, alcohol chemistries, concentrations, end-use demands, and distribution channels to strategic portfolio decisions

Segmentation analysis reveals distinct pathways for product development, channel strategy, and customer engagement that companies must calibrate to capture value across diverse use environments. Product type segmentation includes hand sanitizer, industrial disinfectant, surface disinfectant, and surgical scrub, each carrying unique formulation, dispensing, and regulatory requirements. Hand sanitizer demand further differentiates by foam, gel, and spray formats, which influence dispensing ergonomics and user acceptance. Industrial disinfectants divide into foam and liquid variations optimized for equipment and process hygiene, while surface disinfectants span liquid, spray, and wipe formats that align with differing contact-time and convenience trade-offs. Surgical scrub formulations are typically available as gel and liquid forms and must meet heightened sterility and skin-tolerance standards.End-use segmentation highlights where purchases occur and what performance attributes matter most. Food and beverage applications emphasize processing equipment and surface hygiene to protect product safety, while hospital settings separate preoperative and routine needs that drive both formulation and procurement cycles. Household users prioritize bathroom, general, and kitchen applications with convenience and odor considerations, whereas laboratories require diagnostic and research-grade solutions with traceability and compatibility with analytical systems. Pharmaceutical end uses focus on cleanrooms and equipment, demanding validated processes and documentation.

Form-based segmentation captures how physical delivery systems affect adoption and logistics. Foam products are commonly supplied in pump dispensers, gel variants are predominantly bottle-dispensed, liquid formats use both bottles and cartridges for bulk or refillable solutions, and wipes are packaged in sealed packs for controlled moisture retention. Alcohol type segmentation-ethanol, isopropanol, and n-propyl-determines efficacy spectra and regulatory labeling, and concentration bands such as sub-60 percent, 60-70 percent, and over-70 percent define use-case suitability and safety considerations. Distribution channels range from direct and institutional procurement to online and retail pathways, and channel choice influences packaging presentation, order size, and fulfillment models. These segmentation layers together inform product portfolio design, go-to-market planning, and R&D prioritization.

An incisive appraisal of how distinct regulatory regimes, supply networks, and buyer behaviors across major regions dictate tailored manufacturing and commercial strategies

Regional dynamics shape sourcing, regulatory compliance, and commercial strategy in meaningful ways across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, a mix of large institutional buyers, advanced distribution networks, and a strong retail presence creates opportunities for scale manufacturing, multi-channel fulfillment, and coordinated public-sector contracting. Manufacturers operating in this region often emphasize compliance with national regulatory frameworks and speed-to-market for product innovations that address consumer convenience and clinical performance.The Europe, Middle East & Africa region presents a heterogeneous regulatory and commercial environment where harmonization efforts coexist with country-level variations in labeling, efficacy claims, and procurement practices. Sustainability mandates and extended producer responsibility measures are increasingly prominent drivers of packaging design and end-of-life considerations. Navigating this region requires a disciplined approach to regulatory dossiers, multi-jurisdictional labeling, and localized commercial partnerships.

Asia-Pacific is characterized by rapid adoption of new delivery formats, a strong manufacturing base for both raw materials and packaging components, and diverse end-use priorities across markets. Regional supply networks can provide cost advantages for both feedstock alcohols and ancillary components, but firms must manage quality control and certification differences when exporting to other regions. Together, these regional profiles imply that manufacturers and distributors must adopt differentiated strategies for regulatory engagement, manufacturing location decisions, and channel investments to match local demand drivers and compliance regimes.

A strategic perspective on competitive advantage driven by validated efficacy, regulatory preparedness, and partnerships across formulation, packaging, and distribution

Competitive dynamics within the alcohol-based disinfectant space reflect a mix of legacy chemistry expertise, rapid product innovation, and strategic partnerships that span formulation, packaging, and distribution. Leading companies prioritize clear evidence of antimicrobial efficacy and invest in clinical or laboratory data to support differentiated claims. At the same time, nimble entrants focus on niche advantages such as novel dispensing technologies, sustainable packaging, or value-priced formulations designed for high-volume institutional buyers.Strategic alliances and channel partnerships play an important role in accelerating market access and expanding product portfolios. Manufacturers commonly collaborate with packaging specialists to develop refill systems and with logistics providers to improve cold-chain independent distribution efficiencies. Mergers, acquisitions, and licensing arrangements frequently target capabilities that close gaps in manufacturing scale, regulatory documentation, or proprietary delivery systems. Successful firms also embed regulatory intelligence and quality systems into product roadmaps to reduce time-to-market friction.

Operational excellence differentiates market leaders: optimized supply chains, robust demand-planning processes, and rigorous supplier qualification protocols reduce disruption risk for large accounts. A focus on customer service and technical support-particularly for institutional and pharmaceutical buyers-reinforces retention and enables premium positioning. Overall, competitive advantage accrues to organizations that combine validated efficacy, regulatory readiness, and a responsive supply and distribution footprint.

A pragmatic set of strategic initiatives focused on formulation validation, sourcing diversification, channel optimization, and sustainability to strengthen competitive positioning

Industry leaders should take decisive steps to convert market intelligence into durable commercial and operational advantages. First, prioritize formulation and labeling investments that substantiate efficacy claims and simplify compliance across multiple jurisdictions; this reduces time-to-market friction and builds buyer trust. Next, diversify sourcing by qualifying regional suppliers for critical feedstocks such as ethanol and isopropanol, and by securing alternative packaging vendors to avoid single-point failures in the supply chain.Commercially, refine channel strategies by tailoring SKUs and packaging to the needs of institutional purchasers, retail consumers, and e-commerce platforms. Invest in modular packaging systems that enable refill and bulk options, and test subscription or replenishment models for high-frequency institutional users. Operationally, build tariff-aware procurement playbooks that incorporate duty optimization, tariff classification audits, and scenario-based inventory buffers. These measures will mitigate cost shocks and preserve margin flexibility.

Finally, make sustainability and safety non-negotiable components of product differentiation. Implement lifecycle assessments for packaging choices, reduce volatile organic compound impacts where possible, and communicate cleanroom and clinical validation status clearly to pharmaceutical and hospital customers. By aligning R&D, procurement, and commercial functions around these priorities, leaders can both defend market positions and create pathways for profitable growth.

A transparent mixed-methods research approach combining primary expert interviews, secondary technical review, and cross-validation to underpin actionable insights

The research underpinning this executive summary combines structured primary engagements with secondary evidence synthesis and rigorous validation processes designed to ensure reliability and relevance. Primary inputs included interviews with procurement, regulatory, and technical leaders across institutional buyers and manufacturers, as well as structured discussions with packaging suppliers and distribution partners to capture operational constraints and channel dynamics. These conversations informed qualitative understanding of buyer priorities, supply risk tolerances, and innovation adoption patterns.Secondary research encompassed review of regulatory guidance, industry standards, scientific literature on alcohol antimicrobial performance, and public-facing product documentation to triangulate claims and identify market norms for formulation and labeling. Data from customs and trade publications were analyzed to understand movement patterns and tariff-relevant classifications, while sustainability frameworks and packaging guidelines were used to evaluate environmental implications of product choices.

All inputs underwent a validation phase that reconciled conflicting perspectives, cross-checked claims against documented lab or regulatory evidence, and tested scenarios with subject-matter experts. The methodology prioritized transparency in assumptions, traceability of sources, and reproducibility of key analytical steps. This layered approach ensures that strategic recommendations are grounded in both practitioner experience and documented technical evidence.

A concise synthesis emphasizing the necessity of validated formulations, supply chain resilience, and cross-functional execution to sustain competitive advantage

This executive summary synthesizes how technical performance, regulatory rigor, and supply chain integrity collectively determine success in the alcohol-based disinfectant arena. Effective products must balance demonstrated antimicrobial activity with safety, regulatory traceability, and user-friendly delivery systems that meet the needs of diverse end-use contexts. Simultaneously, manufacturers and distributors face a landscape where trade policy changes, sustainability mandates, and channel fragmentation compel more deliberate strategic planning.The cumulative message for executives is clear: investments in validated formulations and robust quality systems reduce commercial friction, while supply chain diversification and tariff-aware procurement protect margins and continuity. Product and packaging innovation should be guided by real-world use cases, regulatory expectations, and lifecycle considerations rather than short-term marketing signals. When these elements are aligned, organizations can achieve resilient operations and differentiated market positions that withstand episodic shocks.

Moving from insight to implementation requires coordinated action across R&D, procurement, regulatory, and commercial teams. The integrated approach outlined by this summary offers a roadmap for translating analytical findings into tactical plans that support both risk mitigation and growth objectives in a complex, evolving environment.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

18. China Alcohol-based Disinfectant Market

Companies Mentioned

- 3M Company

- BODE Chemie GmbH

- Dow Inc.

- DuPont

- Ecolab Inc.

- Evonik Industries AG

- GOJO Industries, Inc.

- Henkel AG & Co. KGaA

- Johnson & Johnson Services, Inc.

- Kao Corporation

- Kimberly-Clark Corporation

- Procter & Gamble

- Reckitt Benckiser Group plc

- Stepan Company

- The Clorox Company

- Unilever plc

- Zep Inc.

Table Information

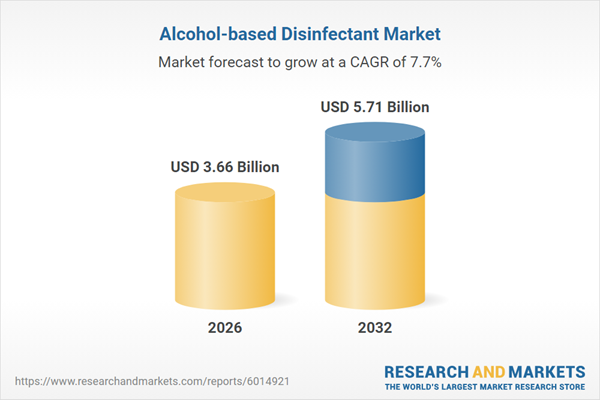

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 3.66 Billion |

| Forecasted Market Value ( USD | $ 5.71 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |