Speak directly to the analyst to clarify any post sales queries you may have.

Concise overview of almitrine’s clinical relevance, distributional considerations, and strategic implications for healthcare delivery and procurement

Almitrine occupies a distinct position within respiratory therapeutics, carrying implications for clinicians, procurement professionals, and strategic planners alike. The compound’s pharmacologic profile and clinical utility in supporting respiratory drive have sustained interest across acute and chronic care settings, motivating renewed evaluation of its role as healthcare systems contend with evolving patient needs and constrained resources. Consequently, stakeholders are reassessing therapeutic portfolios, supply arrangements, and pathway integration to ensure preparedness across care continuums.Against this backdrop, the executive summary synthesizes current clinical relevance, regulatory headwinds, and operational considerations that influence adoption decisions. It highlights the interplay between clinical evidence and real-world delivery models, emphasizing how distribution routes and care settings shape access. The analysis foregrounds how formulation preferences and prescribing practices converge with procurement priorities, thereby informing practical recommendations for product teams, hospital pharmacists, and health system leaders.

In addition, the introduction delineates the principal dynamics that the subsequent sections explore in greater depth: regulatory shifts influencing access, tariff-driven cost pressures, segmentation nuances across distribution, dosage form, and end-user contexts, and regional patterns that affect supply and demand. Taken together, these dimensions provide a framework for translating clinical potential into sustainable, system-aligned deployment.

Critical analysis of how clinical practice evolution, regulatory tightening, and care decentralization are reshaping access and supply dynamics for respiratory therapeutics

The landscape for respiratory therapeutics is undergoing transformative shifts driven by converging clinical innovation, evolving care delivery models, and heightened scrutiny of supply-chain resilience. Advances in supportive care protocols and a stronger emphasis on early intervention have altered the context in which agents that modulate respiratory drive are considered. Simultaneously, regulatory authorities are refining guidance on safety monitoring and post-market surveillance, prompting manufacturers and providers to strengthen pharmacovigilance and real-world evidence capabilities.Moreover, care decentralization has reshaped access pathways: hospitals are expanding step-down facilities, clinics are integrating more acute care capabilities, and home-based therapies are gaining traction where feasible. These shifts necessitate adaptable dosage forms and packaging strategies, while procurement teams increasingly prioritize suppliers that can demonstrate consistent delivery and compliance with evolving regulatory expectations. Commercially, payers and health systems are pressing for clearer value narratives tied to patient outcomes and total cost of care, challenging manufacturers to substantiate comparative benefits within diverse care pathways.

Taken together, these structural changes require coordinated responses across clinical, regulatory, and commercial functions to translate therapeutic promise into durable, patient-centered outcomes.

Examination of the 2025 U.S. tariff environment and its cumulative operational, procurement, and strategic effects on pharmaceutical supply chains and access pathways

Recent tariff measures introduced by the United States in 2025 have created a cumulative set of operational and strategic implications for international supply chains, procurement strategies, and price negotiations that affect stakeholders across the therapeutic value chain. At an operational level, manufacturers and distributors have confronted increased complexity in routing and customs processing, which in turn has elevated the importance of multi-origin sourcing and contingency logistics. Consequently, supply-chain leaders are prioritizing redundancy and agility to maintain uninterrupted availability in high-acuity settings.From a commercial perspective, tariffs have intensified pressure on procurement negotiations and contractual terms, incentivizing buyers to seek longer-term agreements or to explore local manufacturing partnerships where regulatory and capacity conditions permit. In parallel, payers and hospital systems have become more circumspect about formulary inclusions where cost increments are not demonstrably offset by operational or clinical advantages. Therefore, organizations are reassessing their supplier mixes, contracting strategies, and inventory buffers to reconcile access objectives with cost containment mandates.

Furthermore, the cumulative impact extends to R&D prioritization and market entry planning, as development teams weigh the relative attractiveness of markets subject to heightened trade friction. The net effect is a heightened premium on supply-chain transparency, robust scenario planning, and cross-functional coordination to sustain product accessibility under shifting trade conditions.

In-depth segmentation intelligence linking distribution channels, dosage forms, end-user needs, and clinical applications to actionable deployment strategies

Understanding segmentation nuance is essential to align product strategies with clinical practice and distribution realities. Distribution channel patterns influence how therapies reach patients: Hospital Pharmacy environments prioritize immediate availability for critical interventions and often require product presentations optimized for inpatient administration, while Online Pharmacy channels necessitate packaging and labeling that support remote dispensing and adherence support, and Retail Pharmacy outlets emphasize shelf visibility, pharmacist engagement, and transactional convenience. Dosage form considerations further shape adoption; Capsules serve outpatient adherence needs, Injection Solution formulations respond to acute, clinician-administered scenarios, and Tablet presentations can bridge inpatient and outpatient continuity depending on formulation and labeling.Equally important are end-user dynamics: Clinics often require streamlined protocols for episodic care delivery, Homecare Settings prioritize ease of administration and caregiver education to ensure safety outside institutional environments, and Hospitals demand robust supply assurances and compatibility with existing critical care workflows. Application-driven differentiation remains pivotal, as therapeutic use in Acute Respiratory Failure places a premium on rapid onset, monitoring integration, and staff training, whereas Chronic Respiratory Insufficiency emphasizes tolerability, long-term adherence, and quality-of-life outcomes. Together, these segmentation lenses inform targeted clinical positioning, commercialization tactics, and supply-chain configurations to meet specific stakeholder expectations across care pathways.

Comparative regional insights highlighting how differing healthcare systems, regulatory frameworks, and delivery models shape access strategies for respiratory therapeutics

Regional dynamics materially shape access, regulatory engagement, and commercial approaches, demanding nuanced strategies across geographies. In the Americas, health systems display a heterogeneous payer mix and a strong emphasis on hospital-centric procurement for high-acuity care, which elevates the importance of formulary evidence and supplier reliability. Consequently, manufacturers engaging in this geography often focus on close collaboration with tertiary centers, integrated clinical education programs, and streamlined logistics to meet time-sensitive inpatient needs.By contrast, Europe, Middle East & Africa encompass varied regulatory frameworks and procurement mechanisms, where centralized reimbursement decisions in some markets coexist with decentralized hospital procurement in others. This diversity requires adaptable regulatory dossiers, localized evidence generation, and region-specific pricing strategies that account for divergent reimbursement pathways and procurement cycles. Meanwhile, the Asia-Pacific region exhibits rapidly evolving healthcare delivery models, expanding outpatient and homecare capabilities, and increasing local manufacturing capacity. These conditions favor strategies that emphasize scalable production, tailored packaging for distributed care, and partnerships that expedite regulatory approvals and distribution expansion.

Across all regions, cross-border trade policies, local clinical guidelines, and healthcare infrastructure maturity inform the tactical choices that determine whether a product is positioned primarily for acute hospital use, chronic outpatient management, or integrated care pathways that traverse multiple settings.

Strategic company-level assessment emphasizing integrated evidence generation, supply-chain resilience, and commercial alignment to secure clinical adoption

Competitive dynamics are shaped by companies that can integrate clinical evidence generation with reliable manufacturing and distribution capabilities while demonstrating operational resilience. Leading organizations increasingly differentiate through investments in pharmacovigilance systems and real-world evidence platforms that substantiate safety and effectiveness across diverse patient populations and care settings. These capabilities support dialogues with payers and hospital formulary committees and are particularly valuable when seeking to position products for both acute and chronic respiratory indications.Operationally, manufacturers that maintain diversified sourcing strategies and transparent supply-chain practices are better positioned to navigate trade frictions and procurement scrutiny. In addition, alliances with contract manufacturing and logistics partners enable scale-up and geographic reach without compromising quality or compliance. Commercially, the most effective companies align clinical education, patient support programs, and distribution partnerships to ensure continuity between inpatient initiation and outpatient or home-based continuation of therapy.

Strategically, firms that adopt flexible pricing models and risk-sharing constructs with large health systems are more likely to secure long-term inclusion in therapeutic pathways. Moreover, those that proactively engage with regulatory agencies and health technology assessment entities to address safety monitoring expectations and evidence requirements tend to accelerate adoption within institutional settings.

Action-oriented recommendations for aligning clinical evidence, supply-chain contingency planning, and payer engagement to secure durable therapeutic access

Industry leaders should prioritize an integrated approach that aligns clinical positioning, supply-chain resiliency, and payer engagement to preserve access and drive therapeutic adoption. First, strengthen evidence generation by investing in pragmatic real-world studies and post-market safety monitoring that address both acute and chronic use cases; this will support formulary discussions and clinical guideline inclusion. Concurrently, operational teams should implement multi-source procurement strategies and invest in logistical redundancies to mitigate disruptions arising from trade policy shifts and to ensure uninterrupted availability across hospitals, clinics, and homecare environments.Next, optimize product presentations and packaging to meet the practical needs of different distribution channels; for example, formats that facilitate clinician administration in hospitals as well as user-friendly options for homecare use will broaden applicability. Additionally, engage payers and procurement stakeholders early with value narratives that connect clinical outcomes to total cost of care, thereby supporting uptake within constrained budgetary contexts. Finally, establish targeted regional strategies that account for local regulatory expectations and healthcare delivery maturities, leveraging partnerships to accelerate approvals and scale distribution while maintaining compliance and quality standards.

Taken together, these steps will enable companies to move from reactive risk management to proactive value delivery, increasing the probability of sustained clinical integration across diverse care pathways.

Transparent mixed-methods research approach combining expert interviews, regulatory review, and supply-chain assessment to generate actionable and validated insights

The research underpinning this executive analysis employed a mixed-methods approach that combined qualitative interviews with subject-matter experts, a structured review of regulatory guidance documents and clinical literature, and a detailed assessment of distribution and procurement practices across care settings. Primary insights were validated through discussions with clinicians from critical care and pulmonary specialties, hospital pharmacy leaders, and supply-chain executives to ensure practical relevance and to surface real-world constraints that influence adoption.In addition, regulatory and policy materials were systematically reviewed to identify recent changes and their implications for safety monitoring, labeling, and post-market obligations. Supply-chain evaluations drew on procurement cycle analyses and logistics performance indicators to assess vulnerability points and mitigation strategies under varied trade environments. Throughout the process, triangulation techniques were applied to reconcile divergent perspectives and enhance the robustness of conclusions, while transparency in methodological choices enabled replication and contextual interpretation of findings.

Finally, the methodology emphasized actionable synthesis, focusing on implications that translate into operational decisions for clinicians, manufacturers, and procurement organizations rather than on numeric forecasting. This orientation ensures that recommendations are grounded in observable trends and stakeholder-validated priorities.

Synthesis of strategic imperatives emphasizing cross-functional alignment, evidence-driven positioning, and supply-chain robustness to sustain clinical integration

In conclusion, almitrine’s clinical profile retains relevance across acute and chronic respiratory care, yet its future adoption hinges on coordinated strategies that reconcile clinical utility with logistical, regulatory, and commercial realities. The interplay of distribution channel requirements, dosage form preferences, end-user workflows, and application-specific demands dictates that therapeutic positioning must be both clinically credible and operationally pragmatic. As trade policies and regional healthcare architectures evolve, organizations that proactively address supply-chain resilience, targeted evidence generation, and payer engagement will be best placed to sustain access across care continuums.Moreover, achieving alignment between inpatient initiation and outpatient or home-based continuation of therapy is central to delivering consistent patient outcomes. Therefore, cross-functional collaboration among clinical affairs, regulatory, manufacturing, and commercial teams is essential to translate therapeutic advantages into routine clinical practice. Ultimately, the strategic choices made today regarding evidence strategies, supply contingencies, and regional approaches will determine how effectively almitrine can be integrated into contemporary respiratory care pathways.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Almitrine Market

Companies Mentioned

- Apotex Inc.

- Enomark Pharma

- Fengchen Group Co.,Ltd

- Hangzhou Huisheng Biotech Pharmaceutical Co., Ltd

- Manus Aktteva Biopharma LLP

- Merck KGaA

- NINGBO INNO PHARMCHEM CO.,LTD.

- Selleck Chemicals

- Toronto Research Chemicals

- Xinxiang Yuda Chemical Co., Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | January 2026 |

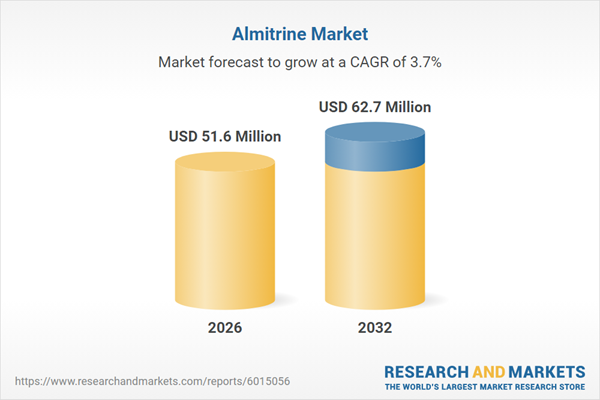

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 51.6 Million |

| Forecasted Market Value ( USD | $ 62.7 Million |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |