The COVID-19 pandemic impacted the overall aluminum ingots industry growth. However, the post-pandemic, increasing residential and commercial construction propelled the demand for aluminum ingots mortar.

Key Highlights

- The surging construction activities and rising application of aluminum ingots in the automotive industry are significant factors driving the industry's growth.

- Fluctuating prices of raw materials and the availability of various alternatives will likely hinder the aluminum ingots market shortly.

- Upsurge in applying aluminum ingots in the aerospace and packaging industry will offer new growth opportunities during the forecast period.

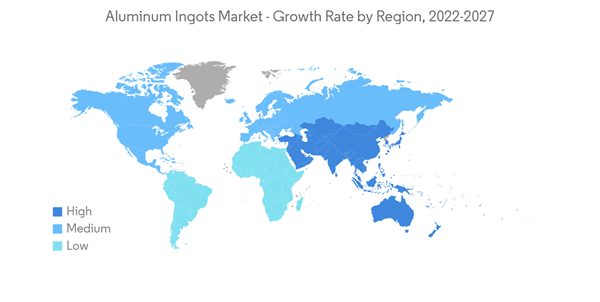

- Asia-Pacific dominated the industry owing to increasing residential and commercial construction activities in China and India.

Aluminum Ingots Market Trends

Significant Growth in Building and Construction Segment

- The rising demand for aluminum as a material in the construction industry is one of the major factors driving the segment's growth. Aluminum ingots are primarily used in civil engineering. The construction industry processes it into doors, windows, curtain walls, stairs, wall panels, floating ceilings, roof sheets, and many more uses.

- The surging construction activities in emerging countries such as China, India, Indonesia, Brazil, and several others are likely to boost the consumption of aluminum ingots. The rising demand for stylish and unique windows, doors, and curtain walls also propelled product demand.

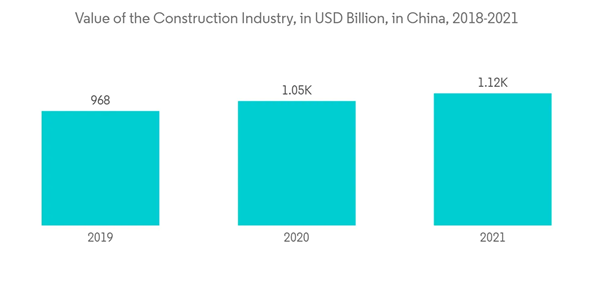

- China became the most significant construction market in the world. As the government planned to focus on improving the infrastructure in small and medium-sized cities, the construction industry is booming in the country. The construction industry in China was valued at around USD 1.2 trillion in 2021.

- The growth of the construction industry was primarily driven by infrastructure works in 2022, with the Chinese government accelerating results on infrastructure construction to drive economic growth. Investment in infrastructure increased by 7.4% Y-o-Y between January and July 2022, predominantly driven by a 14.5% YoY increase in water conservancy infrastructure investment.

- Furthermore, the United States also observed strong growth in the construction industry owing to the rising population and increasing need for residential buildings. In 2021, 1,337,800 housing units were built, constituting an increase of 4% compared to 2020. The construction sector in the United States is expected to grow at 8.8 %, and by 2026, the country's construction production is predicted to exceed USD 1.65 trillion.

- These factors above likely drive the demand for aluminum ingots in the construction industry.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is the largest consumer of aluminum ingots owing to the increased demand for aluminum in the construction, automotive, and semiconductor industry. China and India are significant markets for aluminum ingots within the region. The upsurge in construction activities in these countries propelled the consumption of aluminum ingots.

- In fiscal 2021, India exported approximately 1.08 million tons of aluminum alloy ingots, and these exports were major to countries such as China, Japan, Taiwan, Mexico, Korea, etc. Also, during the same period, aluminum extrusions were mainly exported to the United States, UAE, Canada, etc.

- The Chinese government is majorly focusing on infrastructural development in the country. In the first seven months of 2022, the National Development and Reform Commission (NDRC) approved 65 fixed asset investment projects worth CNY 6.6 trillion (USD 1 trillion).

- India is expected to become the third-largest construction market in the world by 2025. 11.5 million homes are expected to be added annually, making it a USD 1 trillion market. In FY21, infrastructure activities accounted for a 13% share of the total FDI inflows of USD 81.72 billion. Moreover, infrastructure development is essential for India to achieve its goal of having a USD 5 trillion economy by 2025. The government launched the National Infrastructure Pipeline (NIP), along with other initiatives like 'Make In India' and the production-linked incentives (PLI) scheme, to foster the expansion of the infrastructure industry.

- Furthermore, by both annual sales and manufacturing output, China remains the largest market for vehicles in the world. By 2025, domestic production is anticipated to surpass 35 million vehicles. Annual vehicle production in China accounted for more than 32% of global vehicle production, exceeding that of the European Union, the United States, and Japan combined. In 2021, China produced around 26.08 million vehicles, up from 25.22 million units in 2020. According to the China Passenger Car Association, passenger EV sales surged 123.7% in a year to around 564,000 vehicles in July 2022.

- Therefore, the above factors are expected to impact the market in the coming years significantly.

Aluminum Ingots Market Competitor Analysis

The aluminum ingots market is partially fragmented, with a few major players dominating a significant portion of the market. Some major companies are Alcoa Inc., Rio Tinto Group, Aluminum Corporation of China Limited, RUSAL Plc, and Norsk Hydro ASA, among others (not in any particular order).Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION1.1 Study Assumptions and Market Definition

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Market Drivers

4.1.1 Surging Construction Activities in Developing Countries

4.1.2 Rising Application of Aluminum Ingots in the Automotive Industry

4.2 Market Restraints

4.2.1 Fluctuating Prices of Raw Materials

4.2.2 Other Market Restraints

4.3 Industry Value-Chain Analysis

4.4 Porter's Five Forces Analysis

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Power of Consumers

4.4.3 Threat of New Entrants

4.4.4 Threat of Substitute Products and Services

4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

5.1 End-user Industry

5.1.1 Automotive

5.1.2 Aerospace

5.1.3 Building and Construction

5.1.4 Semiconductor

5.1.5 Electrical and Electronics

5.1.6 Other End-user Industries

5.2 Geography

5.2.1 Asia-Pacific

5.2.1.1 China

5.2.1.2 India

5.2.1.3 Japan

5.2.1.4 South Korea

5.2.1.5 Rest of Asia-Pacific

5.2.2 North America

5.2.2.1 United States

5.2.2.2 Canada

5.2.2.3 Mexico

5.2.3 Europe

5.2.3.1 Germany

5.2.3.2 United Kingdom

5.2.3.3 Italy

5.2.3.4 France

5.2.3.5 Rest of Europe

5.2.4 South America

5.2.4.1 Brazil

5.2.4.2 Argentina

5.2.4.3 Rest of South America

5.2.5 Middle-East and Africa

5.2.5.1 Saudi Arabia

5.2.5.2 South Africa

5.2.5.3 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

6.2 Market Share(%)**/Ranking Analysis

6.3 Strategies Adopted by Leading Players

6.4 Company Profiles

6.4.1 Alcoa Inc.

6.4.2 Aluminum Corporation of China Limited (Chalco)

6.4.3 Aluminium Bahrain

6.4.4 BHP Billiton

6.4.5 CHINA ZHONGWANG HOLDINGS LIMITED

6.4.6 Dubai Aluminium Company

6.4.7 Hindalco Industries Ltd.

6.4.8 JBMI

6.4.9 Norsk Hydro ASA

6.4.10 Rio Tinto Group

6.4.11 RUSAL Plc

6.4.12 SPIC, Inc.

6.4.13 United Company

6.4.14 Xinfa Group Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

7.1 Growing Application of Aluminum Ingots in the Aerospace and Packaging Industry

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alcoa Inc.

- Aluminum Corporation of China Limited (Chalco)

- Aluminium Bahrain

- BHP Billiton

- CHINA ZHONGWANG HOLDINGS LIMITED

- Dubai Aluminium Company

- Hindalco Industries Ltd.

- JBMI

- Norsk Hydro ASA

- Rio Tinto Group

- RUSAL Plc

- SPIC, Inc.

- United Company

- Xinfa Group Co., Ltd.