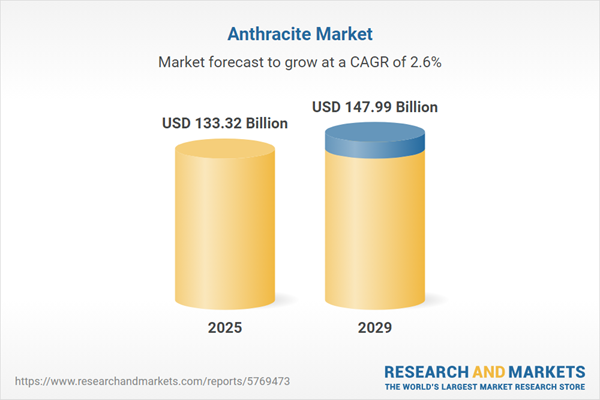

The anthracite market size is expected to see steady growth in the next few years. It will grow to $147.99 billion in 2029 at a compound annual growth rate (CAGR) of 2.6%. The growth in the forecast period can be attributed to environmental regulations, emerging markets demand, renewable energy integration challenges, residential heating trends, infrastructure development. Major trends in the forecast period include replacement for coke in steelmaking, technological advancements in mining, market expansion in Asia-pacific, strategic partnerships and investments, carbon capture and utilization (CCU).

The forecast of 2.6% growth over the next five years reflects a modest reduction of 0.3% from the previous estimate for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. Tariffs on imported anthracite could strain steel and energy production processes, especially where high-grade coal is required but domestic substitutes are limited, leading to cost pressures. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The growth of the anthracite market is expected to be driven by an increase in domestic fuel and power generation. Domestic fuel and power generation involves the production and utilization of energy specifically within households or local communities for everyday needs. This sector is expanding due to rising energy costs, environmental considerations, technological progress, government incentives, and a push for energy self-sufficiency. Anthracite, a high-grade coal, is used in power generation by burning it in coal-fired power plants, its high carbon content and low impurities allow it to produce intense heat, creating steam to drive turbines for electricity production. For example, in October 2024, the International Energy Agency, an autonomous intergovernmental organization based in France, reported that in July 2024, total net electricity production reached 996.1 TWh, reflecting a 2.6% increase from July 2023. Thus, the rise in domestic fuel and power generation is supporting the growth of the anthracite market.

Anticipated growth in the anthracite market is also driven by the increasing demand for clean energy. Clean energy, characterized by minimal environmental impact, includes sources such as solar, tidal, and geothermal energy. Anthracite, recognized as a high-quality, clean-burning coal, is versatile in environmentally friendly power generation due to its low sulfur levels and significant carbon content. For instance, in March 2023, the Energy Information Administration reported a rise in the combined percentage of total power from wind and solar, increasing from 12% in 2021 to 14% in 2022, underscoring the demand for clean energy and its positive impact on the anthracite market.

Leading companies in the anthracite market are prioritizing the development of innovative solutions, such as sustainable methods in steel production, to strengthen their competitive position. Steel production involves creating steel, an alloy primarily made of iron and carbon, with other elements like manganese, chromium, and nickel. For example, in October 2022, Liberty Steel UK, a steel manufacturer based in the UK, introduced Ecoke, a sustainable raw material aimed at reducing CO2 emissions in steel production by up to 30%. Ecoke, which contains at least 30% renewable biomass, is intended as an alternative to anthracite, the conventional charge carbon used in electric arc furnaces. Initial trials indicate that Ecoke can be integrated into current production processes without affecting efficiency. This initiative supports LIBERTY's broader GREENSTEEL strategy to achieve carbon neutrality by 2030, positioning the company as a leader in sustainable steel production while potentially reducing costs associated with carbon credits.

Major players in the anthracite market are concentrating on advanced mining operation solutions to meet increasing demand while ensuring sustainable extraction practices. An example is Coal India's Project Digicoal and Digital War Room launched in April 2023, aiming for a digital transformation in mining operations. This initiative incorporates innovative technologies such as drones for surveying, digitizing land records for streamlined land acquisition, and preventive asset maintenance under Industry 4.0 principles to enhance efficiency.

In October 2022, the State Assets Ministry of Poland acquired undisclosed stakes in Polska Grupa Górnicza S.A., separating coal assets from energy firms and aligning with social compact requirements on coal mining. The acquisition involves the purchase of shares from public utilities Energa SA, Polskie Górnictwo Naftowe i Gazownictwo S.A., PGE Polska Grupa Energetyczna SA, and Enea SA, each divesting their interests in Polska Grupa Górnicza S.A., a Poland-based anthracite mining operator.

Major companies operating in the anthracite market include Blaschak Coal Corporation, Atlantic Coal plc, Lehigh Anthracite, Reading Anthracite Company, Xcoal Energy & Resources, Jeddo Coal Company, Carbon Sales Inc., Summit Anthracite, Atrum Coal, Siberian Anthracite, Celtic Energy Ltd, China Coal Energy Company, Robindale Energy & Associated Companies, VostokCoal, Kimmel's Coal & Packaging Inc., Jincheng Anthracite Mining Group, Sibanthracite Group, Ural Mining Company, Yangquan Coal Industry Group, Keystone Anthracite Co., Glencore plc, Sadovaya Group, United Coal Company, Coal India Limited, Zibulo Colliery.

Asia-Pacific was the largest region in the anthracite mining market in 2024. The regions covered in the anthracite market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the anthracite market report are Australia, China, India, Indonesia, Japan, South Korea, Bangladesh, Thailand, Vietnam, Malaysia, Singapore, Philippines, Hong Kong, New Zealand, USA, Canada, Mexico, Brazil, Chile, Argentina, Colombia, Peru, France, Germany, UK, Austria, Belgium, Denmark, Finland, Ireland, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, Russia, Czech Republic, Poland, Romania, Ukraine, Saudi Arabia, Israel, Iran, Turkey, UAE, Egypt, Nigeria, South Africa.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The rapid escalation of U.S. tariffs and the ensuing trade tensions in spring 2025 are heavily affecting the mining sector, especially in areas such as equipment acquisition, export flows, and supply chain stability. Increased tariffs on imported heavy machinery, drilling tools, and specialized parts have driven up both capital and operational expenditures, leading to delays in project development and reduced production efficiency. Simultaneously, retaliatory tariffs from major trading partners have diminished global demand for U.S. sourced minerals particularly critical resources like lithium, copper, and rare earth elements intensifying revenue challenges. These impacts are hitting mid-sized and niche mining companies the hardest due to their reliance on international markets. In response, the industry is focusing on building domestic equipment supply chains, scaling up mineral recycling programs, and lobbying for tariff relief to regain competitiveness and safeguard long-term resource availability.

The anthracite market research report is one of a series of new reports that provides anthracite market statistics, including anthracite global industry, anthracite global market size, regional shares, competitors with a anthracite global market share, detailed anthracite market segments, market trends and opportunities, and any further data you may need to thrive in the anthracite industry. This anthracite market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Anthracite mining employs various mining techniques to extract bituminous coal, anthracite, and lignite coal, contributing to the development of anthracite mine sites. The process involves enhancing the quality of anthracite through cleaning, washing, screening, and sizing.

The primary categories of anthracite mining include standard-grade anthracite, high-grade anthracite, and ultra-high-grade anthracite. Standard grade finds use as a domestic fuel and in the generation of industrial power. The mining methods encompass both underground mining and surface mining.

The anthracite mining market includes revenues earned by entities by providing mining services such as strip mining, and culm bank mining. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Anthracite Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on anthracite market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for anthracite? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The anthracite market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Standard Grade Anthracite; High Grade Anthracite and Ultra-High Grade Anthracite2) By Mining Type: Underground Mining; Surface Mining

Subsegments:

1) By Standard Grade Anthracite: Commercial Grade Anthracite; Industrial Grade Anthracite2) By High Grade Anthracite: Metallurgical Grade Anthracite; Specialty Grade Anthracite; Ultra-High-Grade Anthracite

3) By Carbon Content Above 90%: Applications in Specialized Industries

Companies Mentioned: Blaschak Coal Corporation; Atlantic Coal plc; Lehigh Anthracite; Reading Anthracite Company; Xcoal Energy & Resources; Jeddo Coal Company; Carbon Sales Inc.; Summit Anthracite; Atrum Coal; Siberian Anthracite; Celtic Energy Ltd; China Coal Energy Company; Robindale Energy & Associated Companies; VostokCoal; Kimmel's Coal & Packaging Inc.; Jincheng Anthracite Mining Group; Sibanthracite Group; Ural Mining Company; Yangquan Coal Industry Group; Keystone Anthracite Co.; Glencore plc; Sadovaya Group; United Coal Company; Coal India Limited; Zibulo Colliery

Countries: Australia; China; India; Indonesia; Japan; South Korea; Bangladesh; Thailand; Vietnam; Malaysia; Singapore; Philippines; Hong Kong; New Zealand; USA; Canada; Mexico; Brazil; Chile; Argentina; Colombia; Peru; France; Germany; UK; Austria; Belgium; Denmark; Finland; Ireland; Italy; Netherlands; Norway; Portugal; Spain; Sweden; Switzerland; Russia; Czech Republic; Poland; Romania; Ukraine; Saudi Arabia; Israel; Iran; Turkey; UAE; Egypt; Nigeria; South Africa

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Anthracite market report include:- Blaschak Coal Corporation

- Atlantic Coal plc

- Lehigh Anthracite

- Reading Anthracite Company

- Xcoal Energy & Resources

- Jeddo Coal Company

- Carbon Sales Inc.

- Summit Anthracite

- Atrum Coal

- Siberian Anthracite

- Celtic Energy Ltd

- China Coal Energy Company

- Robindale Energy & Associated Companies

- VostokCoal

- Kimmel's Coal & Packaging Inc.

- Jincheng Anthracite Mining Group

- Sibanthracite Group

- Ural Mining Company

- Yangquan Coal Industry Group

- Keystone Anthracite Co.

- Glencore plc

- Sadovaya Group

- United Coal Company

- Coal India Limited

- Zibulo Colliery

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 133.32 Billion |

| Forecasted Market Value ( USD | $ 147.99 Billion |

| Compound Annual Growth Rate | 2.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |