Speak directly to the analyst to clarify any post sales queries you may have.

Exploring the Evolving Role of Armrest Solutions in Modern Automotive Interiors from Comfort Considerations to Innovation Drivers

The automotive armrest has evolved from a simple comfort feature to a critical element of interior design and functionality in modern vehicles. In recent years, heightened consumer expectations around in-vehicle comfort, personalized experiences, and technological integration have driven manufacturers to rethink traditional armrest configurations. Amidst these shifts, the armrest no longer serves solely as a padding surface; it acts as a platform for connectivity, storage solutions, and enhanced ergonomics.In this context, industry stakeholders are challenged to balance cost pressures with the imperative to innovate. Technological advancements in materials science and sensor integration have opened new avenues for premiumization, while stringent safety and quality standards demand rigorous validation. As the global automotive industry transitions toward electrification and autonomous driving modes, the armrest is positioned to play a central role in passenger interaction and in-cabin comfort. Ultimately, understanding the evolving dynamics that underpin armrest design and deployment is essential for manufacturers, suppliers, and decision makers aiming to maintain a competitive edge.

Identifying Key Technological and Consumer Behavior Shifts Reshaping Automotive Armrest Design and Integration for Next Generation Vehicles

Over the past decade, the automotive armrest landscape has undergone transformative shifts driven by rapid technological progress and changing consumer behaviors. Connectivity features once limited to dashboard interfaces are now migrating into the center console, prompting the integration of wireless charging modules and haptic controls directly within armrest assemblies. At the same time, growing demand for personalization has led to modular designs that allow buyers to tailor material finishes, ambient lighting, and storage capacities to their preferences.Moreover, the push for sustainability has encouraged the adoption of recycled fabrics, vegan leathers, and bio-based polymers, reflecting broader environmental commitments across the supply chain. Coupled with the emergence of shared mobility concepts and autonomous passenger experiences, these shifts have intensified the focus on adaptable, multifunctional armrest solutions that cater to both driver and occupant needs. As a result, manufacturers are forging cross-functional partnerships with technology firms and material innovators to accelerate product development cycles and maintain agile responses to evolving market demands.

Assessing the Implications of Newly Enacted United States Tariff Measures on Automotive Armrest Components and Supply Chain Dynamics for 2025

The implementation of revised United States tariff measures for 2025 has introduced noteworthy implications for the automotive armrest supply chain. Components sourced from certain low-cost regions now attract higher import duties, prompting manufacturers to reassess their regional production footprints. In turn, this is fostering a reevaluation of near-shoring strategies to mitigate cost volatility and ensure supply continuity.Consequently, suppliers are exploring alternative sourcing corridors and enhancing local content to comply with preferential trade agreements, thereby cushioning the impact of new levies. At the same time, end-to-end visibility in logistics has become paramount, with digital tracking and advanced forecasting tools being deployed to navigate evolving tariff schedules. Although initial adjustments may increase manufacturing costs, these measures also catalyze investments in automation and process optimization, ultimately yielding more resilient and streamlined supply chains.

Deriving Actionable Insights from Comprehensive Segmentation Analysis Covering Type Material Design Vehicle and End Market Dimensions

A holistic segmentation analysis reveals distinct trends shaping the automotive armrest market. When categorizing by type, center armrests continue to dominate integration due to their multifunctional capabilities, while door armrests gain traction through ergonomic enhancements and ambient lighting features, and rear seat armrests see rising adoption in premium vehicle classes. Shifting to material type, fabric remains favored in cost-sensitive segments, with cotton offering a soft touch and polyester delivering durability; however, leather endures as a hallmark of luxury, whether in its natural hide form or through high-performance synthetic blends, and plastic components leverage polypropylene for lightweight strength alongside PVC for design flexibility. Looking at design type, adjustable armrests cater to ergonomic customization, allowing occupants to fine-tune height and angle, whereas fixed designs appeal to mainstream models with simpler mechanical requirements. Examining vehicle type, commercial vehicles such as heavy and light trucks prioritize robustness and easy-to-clean surfaces, while passenger vehicle variants ranging from convertibles and coupes to hatchbacks, sedans, and SUVs emphasize aesthetic integration and comfort. Finally, the end market is split between aftermarket channels that drive product differentiation and OEM partnerships that focus on seamless assembly line compatibility and brand alignment.Unveiling Regional Nuances in Automotive Armrest Demand and Innovation Trends across the Americas Europe Middle East Africa and Asia Pacific

Regional perspectives underscore diverse growth trajectories for automotive armrest demand and innovation. In the Americas, manufacturers benefit from an established supplier base and robust aftermarket networks, enabling rapid rollout of advanced material offerings and connectivity features. Transitioning to Europe, Middle East & Africa, stringent safety regulations and consumer emphasis on premium cabin experiences drive investments in leather and bio-based alternatives, while local content requirements influence production strategies. Conversely, the Asia-Pacific region experiences explosive vehicle production growth coupled with rising per-capita income, leading to heightened demand for customizable armrest solutions in both passenger and commercial segments. Each region presents its own set of regulatory, economic, and cultural factors that shape how armrest products are designed, manufactured, and marketed to end users.Profiling Leading Automotive Armrest Manufacturers and Component Suppliers Driving Innovation Technological Advancements and Strategic Partnerships

Leading players in the automotive armrest arena are advancing their market positions through targeted innovation and strategic partnerships. Industry stalwarts are forging alliances with technology providers to embed smart features such as wireless charging pads, touch-sensitive controls, and integrated sensors within armrest modules. Concurrently, collaborations with material science firms enable the deployment of sustainable polymers and advanced composites that meet both performance and environmental criteria. On the organizational front, vertical integration strategies are enhancing quality control and reducing lead times, while joint ventures and licensing agreements help expand geographical reach and diversify product portfolios. These endeavors highlight a competitive landscape where agility, technological prowess, and collaborative ecosystems dictate the pace of progress.Formulating Strategic Recommendations for Industry Leaders to Leverage Emerging Trends Optimize Manufacturing and Enhance Competitive Positioning

To capitalize on emerging trends and address evolving market demands, industry leaders should prioritize a multi-pronged strategic approach. First, investing in modular armrest architectures will allow for scalable customization across vehicle segments without incurring prohibitive retooling costs. Simultaneously, strengthening relationships with eco-material innovators can secure access to cutting-edge sustainable alternatives that align with global decarbonization goals. Furthermore, integrating digital capabilities such as haptic feedback and connectivity interfaces will differentiate offerings and enhance perceived value. Equally important is the establishment of regional manufacturing hubs to counteract tariff volatility and improve responsiveness to local regulations. By adopting a data-driven decision making framework and fostering cross-disciplinary collaboration, companies can streamline development cycles, optimize cost structures, and reinforce their competitive positioning in a dynamic marketplace.Detailing Rigorous Research Methodology Employed in Analyzing Automotive Armrest Markets Including Data Collection Analytical Frameworks and Validation Techniques

The research methodology underpinning this analysis combines rigorous primary engagements, extensive secondary reviews, and quantitative validation processes. Primary research encompassed in-depth interviews with key executives, design engineers, and procurement specialists across leading OEMs and tier-one suppliers. These discussions yielded firsthand insights into development priorities, material selection criteria, and emerging feature requirements. Secondary research involved the systematic examination of industry publications, regulatory databases, patent filings, and technical white papers to establish contextual baselines and identify technological inflection points. All data points were triangulated through cross-verification with publicly available information and expert commentary to ensure robustness. Additionally, advanced analytical frameworks, including scenario analysis and sensitivity testing, were employed to assess the implications of regulatory changes and supply chain disruptions, thereby reinforcing the validity of the findings.Summarizing Key Findings and Concluding Observations on the Evolution Challenges and Growth Opportunities within the Automotive Armrest Segment

In conclusion, the automotive armrest market stands at an inflection point where comfort, functionality, and sustainability converge to redefine in-vehicle experiences. Persistent consumer appetite for personalized interfaces and premium materials continues to drive innovation in modular designs and smart integrations. At the same time, external pressures such as tariff adjustments and regional regulatory mandates necessitate agile supply chain responses and strategic location planning. By synthesizing these dynamics through a segmentation lens and evaluating regional disparities, stakeholders can pinpoint high-impact opportunities and address potential risks proactively. The convergence of ergonomic excellence, material advancements, and digital capabilities heralds a new era for armrest solutions, offering a fertile ground for differentiation and value creation.Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Type

- Center Armrest

- Door Armrest

- Rear Seat Armrest

- Material Type

- Fabric

- Cotton

- Polyester

- Leather

- Natural Leather

- Synthetic Leather

- Plastic

- Polypropylene

- PVC

- Fabric

- Design Type

- Adjustable

- Fixed

- Vehicle Type

- Commercial Vehicles

- Heavy Commercial Vehicles

- Light Commercial Vehicles

- Passenger Vehicles

- Convertible

- Coupe

- Hatchback

- Sedan

- SUV

- Commercial Vehicles

- End Market

- Aftermarket

- OEM

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Adient PLC

- Covestro AG

- Bostrom Seating

- Brose Fahrzeugteile GmbH & Co. KG

- Faurecia Automotive Seating, LLC

- Magna International Inc.

- Ningbo Jifeng Auto Parts Co., Ltd

- Sydmeko Industri AB

- Matrix Car Decor

- jaguar land rover ltd

- AUDI AG

- GRAMMER AG

- Piston Group

- Windsor Machine Group

- Maruti Suzuki India Limited

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Automotive Armrest Market report include:- Adient PLC

- Covestro AG

- Bostrom Seating

- Brose Fahrzeugteile GmbH & Co. KG

- Faurecia Automotive Seating, LLC

- Magna International Inc.

- Ningbo Jifeng Auto Parts Co., Ltd

- Sydmeko Industri AB

- Matrix Car Decor

- jaguar land rover ltd

- AUDI AG

- GRAMMER AG

- Piston Group

- Windsor Machine Group

- Maruti Suzuki India Limited

Table Information

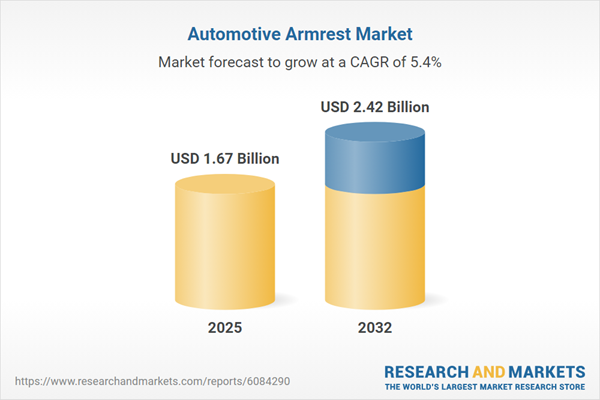

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 1.67 Billion |

| Forecasted Market Value ( USD | $ 2.42 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |