Speak directly to the analyst to clarify any post sales queries you may have.

Concise framing of clinical priorities, technological evolution, and procurement considerations that are reshaping arthroscopic hand instrument development and adoption

This executive summary introduces the contemporary landscape of arthroscopic hand instruments, framing the clinical, technological, and operational vectors that shape development and adoption across healthcare settings. Advances in minimally invasive surgery, coupled with rising expectations for procedural efficiency and patient outcomes, have focused attention on instrument ergonomics, material science, and single-use versus reprocessing trade-offs. Clinicians seek reliable tools that maintain tactile feedback and precision in constrained anatomical spaces, while procurement leaders prioritize lifecycle cost, sterilization protocols, and supplier resilience.As device designers iterate on slender profiles, modular interfaces, and hybrid material constructions, hospitals and ambulatory surgical centers evaluate instruments not only on clinical performance but also on integration with existing procedural workflows and inventory systems. Simultaneously, regulatory vigilance and infection prevention imperatives are shaping adoption pathways; institutions increasingly demand clear reprocessing instructions, validated single-use claims, and traceability. In this context, stakeholders from product development to clinical engineering must reconcile competing priorities: minimizing surgical time and patient morbidity, ensuring staff safety, and controlling total cost of ownership. The synthesis below examines transformative shifts, tariff-driven supply chain impacts, segmentation-level insights, and regionally differentiated dynamics to inform strategic choices and operational planning.

Overview of converging clinical, technological, and commercial dynamics that are redefining product design priorities and market approaches within arthroscopic hand instruments

The arthroscopic hand instrument landscape is undergoing transformative shifts driven by converging clinical, technological, and commercial forces that are reshaping product priorities and go-to-market strategies. On the clinical front, the proliferation of minimally invasive orthopedic and hand-specific procedures has increased demand for instruments that enable precision in constrained joint spaces, prompting iterative refinements in tip geometry, shaft flexibility, and tactile responsiveness. Concurrently, technology advances such as novel coatings, hybrid alloys, and additive manufacturing are enabling lighter, stronger instruments with improved corrosion resistance and customizability, allowing manufacturers to differentiate through performance attributes that matter in high-skill procedures.Commercial models are shifting as hospitals and ambulatory surgical centers reevaluate procurement pathways, balancing the economies of reusable instruments against infection control, staff workload, and sterilization costs associated with reprocessing. This dynamic has accelerated interest in disposable instrument platforms and single-use components for specific indications. Additionally, supply chain resilience has become a strategic priority; manufacturers are diversifying supplier bases and exploring nearshoring and multi-sourcing strategies to mitigate disruptions. Regulatory expectations and payer-driven demands for value-based care are further incentivizing evidence generation around device safety and comparative outcomes, encouraging closer collaboration between clinicians and manufacturers to produce real-world performance data. Taken together, these shifts are reorienting investment toward materials science, procedural ergonomics, and integrated lifecycle services that support long-term clinical and economic value.

Analysis of how United States tariff adjustments are reshaping sourcing strategies, inventory resilience, and commercial contracts across the arthroscopic hand instrument value chain

The cumulative impact of tariff changes and trade policy adjustments in the United States has materially influenced strategic behavior across the arthroscopic hand instrument ecosystem, affecting sourcing decisions, contract negotiations, and pricing strategies without necessarily altering clinical performance expectations. Tariff adjustments have prompted manufacturers to reassess cost structures tied to imported inputs such as specialty alloys, precision components, and packaging materials. In response, several suppliers have accelerated supplier diversification efforts, relocating certain production stages or qualifying alternate vendors to preserve margin and delivery rhythm. For healthcare providers, procurement teams have had to re-evaluate tender specifications to ensure continuity while managing potential cost pass-through effects.Beyond sourcing, tariff-driven uncertainty has influenced inventory policies and lead-time buffers; supply chain managers have increased visibility into upstream tiers and introduced strategic inventory positions to blunt volatility. The need to maintain regulatory compliance and device traceability has encouraged closer coordination between quality, procurement, and supply chain functions, ensuring that any supplier shifts meet sterilization validation, material certification, and labeling standards. Additionally, distributors and direct sellers have revisited contractual terms and service offerings to provide greater price transparency and flexible fulfillment options. In the medium term, policy-induced cost pressures are accelerating innovation around material substitution and process efficiency, while also incentivizing collaborative commercial models that share risk and align incentives between manufacturers and provider systems.

Segment-driven analysis that correlates instrument types, clinical applications, end-user environments, technology choices, sales channels, and material selections to operational and clinical priorities

Segmentation-driven insight reveals where clinical demand, purchasing behavior, and design innovations intersect across the arthroscopic hand instrument continuum. Based on Instrument Type, the market is studied across Ablators, Cannulas, Graspers, Probes, Punches, Retractors, and Scissors, each category presenting distinct clinical performance expectations and durability requirements that influence material choice and manufacturing tolerances. Instruments with fine tip geometries such as probes and graspers prioritize tactile feedback and corrosion resistance, while cannulas and retractors emphasize structural rigidity and ease of insertion. Product teams must therefore calibrate design trade-offs between flexibility, strength, and surface finish to meet specific intraoperative use profiles.Based on Application, the market is studied across Elbow, Hip, Knee, Shoulder, and Wrist, with wrist and elbow procedures often demanding specialized small-profile instruments optimized for constrained joint spaces and microsurgical maneuvers. Application-specific requirements drive procurement preferences and clinical training needs, influencing adoption curves across institutions. Based on End User, the market is studied across Ambulatory Surgical Centers, Clinics, and Hospitals; the Ambulatory Surgical Centers segment is further studied across Hospital Owned and Independent, the Clinics segment across General Clinics and Orthopedic Clinics, and the Hospitals segment across Large Hospitals, Medium Hospitals, and Small Hospitals, each end-user type presenting unique purchasing cycles, budgetary constraints, and reprocessing capabilities that shape product selection and service expectations. Based on Technology, the market is studied across Disposable and Reusable solutions, creating clear trade-offs between one-time use convenience and ongoing lifecycle costs associated with reprocessing and sterilization. Based on Sales Channel, the market is studied across Direct and Distributor pathways, with channel choice affecting clinical training, after-sales service, and contractual terms. Finally, based on Material, the market is studied across Stainless Steel and Titanium, with Stainless Steel further studied across Coated Stainless Steel and Standard Stainless Steel, and Titanium further studied across Alloy Titanium and Pure Titanium; material selection both defines instrument longevity and influences sterilization protocols, tactile properties, and cost dynamics. Understanding these segmentation lenses together enables manufacturers and providers to align product portfolios with clinical needs, operational capacities, and commercial channels to optimize adoption and lifecycle value.

Comparative regional perspectives highlighting how provider models, procurement practices, and regulatory regimes across major geographies influence product strategy and commercialization

Regional dynamics exert differentiated pressures on product design choices, supply chain arrangements, and commercialization strategies across the Americas, Europe, Middle East & Africa, and Asia-Pacific, shaping how stakeholders prioritize investments and partnerships. In the Americas, healthcare delivery models and reimbursement structures emphasize efficiency and evidence of clinical benefit, encouraging adoption of instruments that reduce procedure time and support outpatient transition while meeting rigorous regulatory expectations. The region's mature ambulatory surgical center infrastructure also creates opportunities for instruments designed for high-throughput settings that minimize turnover time.Europe, Middle East & Africa presents a heterogeneous landscape where regulatory harmonization efforts coexist with variable procurement practices across public and private providers. In this region, cost-containment pressures and centralized purchasing mechanisms incentivize durable, reusable instrument solutions, but growing infection control mandates and emerging private-sector demand are creating openings for single-use innovations in targeted indications. Asia-Pacific is characterized by rapid procedural volume growth and investments in surgical capacity, driving demand for scalable manufacturing, local regulatory engagement, and cost-efficient designs. Manufacturers active in the Asia-Pacific region increasingly pursue strategic partnerships, localized production, and modular product designs to meet diverse clinical and price-sensitive market needs. Across regions, successful market entry requires tailored value propositions, regulatory navigation strategies, and supply chain architectures that reflect local provider workflows and procurement mechanisms.

Insight into competitive positioning that highlights how manufacturers and channel partners differentiate through materials innovation, service integration, and clinician collaboration

Competitive dynamics in the arthroscopic hand instrument space continue to evolve as established device manufacturers, specialized instrument producers, and agile entrants compete on innovation, service models, and supply chain responsiveness. Leading companies are differentiating through investment in materials research, validated single-use platforms, and modular instrument architectures that support both reusable cores and disposable tips. These firms are also extending service portfolios with sterilization validation support, clinical training programs, and managed inventory solutions that align with provider operational needs and help lock in integrated product-service relationships.Smaller specialized manufacturers often focus on niche design excellence and close clinician collaboration, enabling rapid iteration on ergonomics and procedure-specific functionality. Partnerships between clinical centers and manufacturers increasingly inform product roadmaps, providing early-stage validation and helping accelerate adoption. Distributors and direct-sales organizations compete by bundling products with training and maintenance services, aiming to reduce switching friction for hospitals and ambulatory centers. Strategic priorities across the competitive set include strengthening regulatory pathways through robust clinical evidence, optimizing cost-to-produce via material and process innovations, and enhancing digital integration for inventory traceability and post-market surveillance. Overall, differentiation is less about singular product superiority and more about delivering comprehensive value propositions that combine clinical performance, operational efficiency, and predictable supply reliability.

Actionable strategic directives that align product modularity, material innovation, supply chain resilience, and evidence generation to accelerate adoption across clinical settings

Industry leaders can act decisively to capture clinical preference and procurement mindshare by aligning product design, supply chain strategy, and commercial engagement with evolving provider priorities. Prioritize modularity and clinician-centered ergonomics to enable a single base instrument to serve multiple applications while maintaining the tactile fidelity needed for small-joint arthroscopy. This reduces inventory complexity for purchasers and accelerates surgeon familiarity across procedure types. Concurrently, invest in material science to provide validated corrosion resistance and sterilization resilience; consider hybrid material approaches that balance cost and performance while communicating lifecycle benefits to hospital procurement and sterile processing teams.Strengthen supply chain resilience through multi-sourcing, nearshoring of critical components, and transparent supplier qualification processes that reduce exposure to policy or logistics shocks. Augment commercial propositions with service-level guarantees, sterilization validation packages, and training programs tailored to different end users, including hospital-owned and independent ambulatory surgical centers as well as general and orthopedic clinics. For channel strategy, balance direct engagement with high-volume systems and distributor partnerships for broader reach, ensuring consistent after-sales support and inventory management capabilities. Finally, generate robust real-world evidence in partnership with clinical centers to demonstrate comparative procedural outcomes and economic benefits; this documentation will be instrumental for convincing value-oriented purchasers and for navigating procurement committees in diverse institutional settings.

Description of a layered primary and secondary research approach combining clinician interviews, supply chain inquiries, regulatory review, and source-triangulation techniques

The research methodology underpinning this executive summary combined a layered approach to acquire, validate, and synthesize primary and secondary insights relevant to arthroscopic hand instruments. Primary inputs included structured interviews with practicing orthopedic and hand surgeons, sterile processing leaders, procurement officers, and distributor account managers to capture real-world clinical preferences, sterilization workflows, and contracting dynamics. These qualitative engagements were augmented by targeted discussions with supply chain and quality leads at manufacturing organizations to understand material sourcing, production challenges, and validation protocols.Secondary research entailed a systematic review of regulatory guidance, published clinical literature on arthroscopic techniques and instrument performance, patent filings, and publicly available company disclosures to triangulate technology trends and competitive moves. Data triangulation and cross-validation techniques were applied to reconcile differing perspectives and to surface consensus themes rather than isolated anecdotes. Segmentation frameworks were developed and stress-tested against user feedback to ensure relevance across instrument types, applications, end users, technologies, sales channels, and materials. Where appropriate, scenario analysis was used to assess sensitivity to supply chain disruptions and policy shifts, and methodological rigor was maintained by documenting assumptions, interview protocols, and source provenance for transparency and reproducibility.

Synthesis of clinical, technological, and commercial insights that clarify strategic priorities and decision criteria for stakeholders across the arthroscopic hand instrument ecosystem

In conclusion, arthroscopic hand instruments occupy a dynamic intersection of clinical demand for precision, evolving material and manufacturing capabilities, and shifting commercial imperatives related to sterilization and cost management. The interplay between reusable and disposable technologies creates a market dynamic where clinical performance, economic considerations, and infection prevention concerns must be balanced through thoughtful product design and comprehensive service support. Regional and end-user heterogeneity underscores the necessity for tailored value propositions that address specific procurement structures and procedural profiles.Manufacturers and providers that succeed will integrate clinician-informed design, validated sterilization and traceability protocols, and resilient supply chain strategies. They will also craft commercialization approaches that blend direct engagement with high-volume systems and distributor models that expand reach while maintaining high-quality after-sales support. Ultimately, decisions grounded in cross-functional evidence-combining clinical outcomes, operational workflow impact, and lifecycle cost implications-will determine which instruments become standard of care in various settings and applications. This executive summary provides the strategic context to guide those decisions, highlighting the areas where targeted investment and collaborative partnerships can produce disproportionate clinical and operational returns.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

18. China Arthroscopic Hand Instrument Market

Companies Mentioned

- Aesculap

- Anika Therapeutics

- Arthrex, Inc.

- B. Braun Melsungen AG

- CONMED Corporation

- DePuy Synthes, Inc.

- Integra LifeSciences Holdings Corporation

- Karl Storz SE & Co. KG

- Medtronic plc

- MicroPort Scientific Corporation

- Olympus Corporation

- Richard Wolf GmbH

- Smith & Nephew plc

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

Table Information

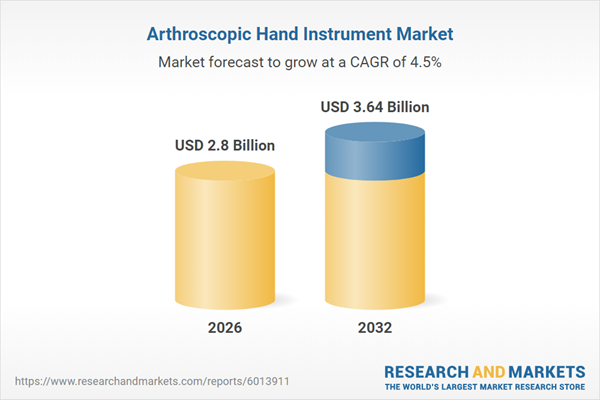

| Report Attribute | Details |

|---|---|

| No. of Pages | 195 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 2.8 Billion |

| Forecasted Market Value ( USD | $ 3.64 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |