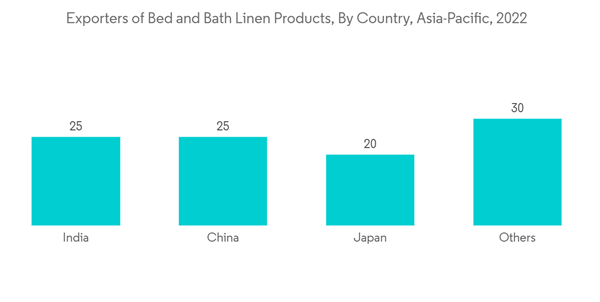

The rising export of bed and bath linen by Asia Pacific to developed countries is leading to increased market revenues. Over the previous years, India observed the rise of 5.5% in its bed & bath linen export to the United States with China observing an increase of 11% in export. Increasing domestic demand with the increase in the number of home furnishing in the commercial and residential building construction in Asia-Pcific is enhancing competition among the countries. The hand made linen products from India, China, and Bangladesh are observing an increased demand from region of United States, Latin America.

With the temporary halt of international trade and the closure of international borders during Covid, disruptions in logistics affected the export of bed and bath linen and the extended closure of physical retail stores due to lockdown measures resulted in customers shifted to online mode of purchase.

Innovations and adoption of organic dies for environment-friendly textiles is resulting in a growth and export of bed and bath linen market of Asia-Pacific. Asia had observed a continuous increase in bedding over the years with a revenue of USD 8 billion last year signalling a positive market trend for bed linen.

Asia-Pacific Bed And Bath Linen Market Trends

Growing E-Commerce is Driving the Market

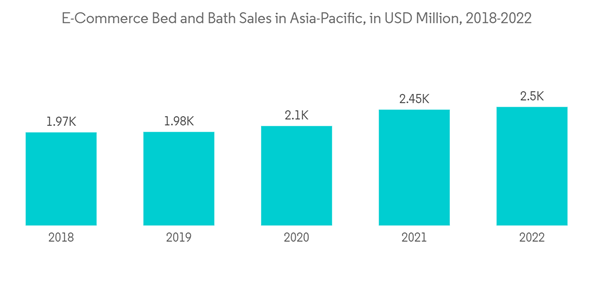

Internet connectivity and penetration have surged across the Asia Pacific region throughout recent years, which has resulted in the subsequent digitalization of the region. The emergence of a growing middle-class teamed with increased levels of disposable income has propelled internet penetration and smartphone ownership across the region.With this Bed and Bath linen industry also underwent digital transformations for keeping up with the new technology design and increasing e-Commerce business. Over the last years China, South Korea, and Japan were among the leading regions with a share of E-commerce in total retail in the Asia Pacific region.

China and India emerging as Leading Exporter in Asia Bed and Bath Linen Market

India has been proven the largest exporter of Bed and Bath Linen Products to the United States, United Kingdom, Italy, and Germany in over the years. China exhibits the potential to grow over the next couple of years and create large opportunities for the linen industry by aspiring businesses. With this late countries, such as Pakistan, Vietnam, and Bangladesh, have emerged as export competitors to China and India.China's revenue for the bedding segment had observed a sharp increase over the years signifying an increase in sales of beds which will be having a positive externality on the bed linen market of China. Last year revenue for the bedding industry in China was existing at USD 3 Billion.

Asia-Pacific Bed And Bath Linen Industry Overview

The Asia-Pacific Bed and Bath Linen market is observing continuous entry of new players. With technological advancements and eco-friendly product innovations, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets. Among the major players in Bed and Bath Linen Market include Welpsun Global, Trident, Nantong, Sidefu Company, and other players.In India the market growth has been stimulated by low-priced labor and raw material, advances in textile technology, and the 'Make in India' policy. However, in Japan, the market is struggling against countries like China and Bangladesh which offer more competitively priced goods.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Welspun Global

- Nantong Kelin Textiles Co. Ltd.

- Bombay dyeing

- Indo Count Industries

- Sidefu

- Trident limited

- Raymond group

- Shangai Trend-home Co.

- Vardhman textiles limited

- Hangzhou Yintex Co.