In the market, the utilization of natural ingredients has gained significant attention due to their perceived safety, efficacy, and appeal to consumers seeking more sustainable and environmentally friendly options. Natural sources of ceramides, such as plant-based oils like sunflower, rice bran, and hemp seed oil, offer rich reservoirs of these lipid molecules that closely mimic those naturally found in the skin. Therefore, the China market make use of 32.53 tonnes of natural ceramide in 2022.

The China market dominated the Asia Pacific Ceramide Market, By Country in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $14,373.5 Thousands by 2030. The Japan market is registering a CAGR of 5.3% during (2023 - 2030). Additionally, The India market would showcase a CAGR of 6.7% during (2023 - 2030).

It can be incorporated into oral supplements or nutraceuticals for systemic benefits, supporting skin health from within. Oral supplements improve skin hydration, elasticity, and barrier function, complementing external skincare regimens. Its supplements contain bioavailable forms of ceramides that are orally ingested and absorbed into the bloodstream. These supplements aim to replenish its levels in the skin, enhancing barrier function and moisture retention from the inside out.

Furthermore, as disposable incomes rise, consumers are often willing to spend more on high-quality skincare products. As per the data from the Government of China, in 2023, the median of the nationwide per capita disposable income was 33,036 yuan, an increase of 5.3 percent. Likewise, as per the data published by the Office for National Statistics, the median disposable income of households in the United Kingdom increased by 2% annually to £31,400 in the fiscal year ending (FYE) 2021.

South Korea has a culture that places a strong emphasis on beauty and skincare. As a result, consumers in the country are highly knowledgeable about skincare ingredients and are willing to invest in high-quality products to achieve flawless skin. As per the data from the International Trade Administration, for 2021, the total value of cosmetics produced in South Korea was $14.5 billion, and cosmetics exports hit a record high, growing 21.3 percent from the previous year to $9.2 billion. South Korea’s trade surplus in the cosmetics sector grew by 28.6 percent to $7.8 billion. Thus, the rising cosmetics and pharmaceutical sectors in Asia Pacific will help in the expansion of the regional market.

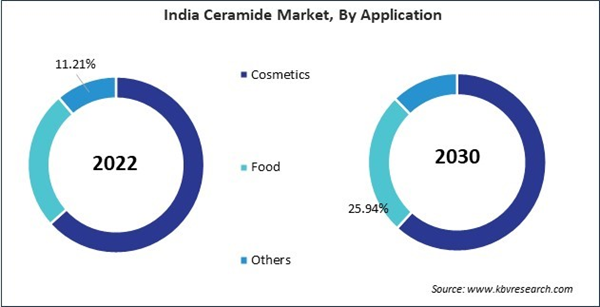

Based on Application, the market is segmented into Cosmetics, Food, and Others. Based on Process, the market is segmented into Plant Extract, and Fermentation. Based on Type, the market is segmented into Natural, and Synthetic. Based on countries, the market is segmented into China, Japan, India, South Korea, Singapore, Malaysia, and Rest of Asia Pacific.

List of Key Companies Profiled

- Ashland Inc.

- Toyobo Co., Ltd.

- Doosan Corporation

- Arkema S.A.

- Evonik Industries AG (RAG-Stiftung)

- Cayman Chemical Company, Inc.

- Kao Corporation

- Croda International PLC

- Vantage Specialty Chemicals (H.I.G. Capital, LLC)

- Incospam Co., Ltd.

Market Report Segmentation

By Application (Volume, Tonnes, USD Million, 2019-2030)- Cosmetics

- Food

- Others

- Plant Extract

- Fermentation

- Natural

- Synthetic

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

Table of Contents

Companies Mentioned

- Ashland Inc.

- Toyobo Co., Ltd.

- Doosan Corporation

- Arkema S.A.

- Evonik Industries AG (RAG-Stiftung)

- Cayman Chemical Company, Inc.

- Kao Corporation

- Croda International PLC

- Vantage Specialty Chemicals (H.I.G. Capital, LLC)

- Incospam Co., Ltd.