Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

- For instance, India has to enhance its infrastructure to reach its 2025 economic growth target of USD 5 trillion.

- In March 2024, the Minister of Civil Aviation and Steel had announced the inauguration of 15 airport projects valued at USD 12.1 billion, with completion targeted by 2028.

- Under the Interim Budget 2024-25, the capital investment outlay for infrastructure had been increased by 11.1% to USD 133.86 billion, accounting for 3.4% of GDP.

- Infrastructure is a key enabler in helping India become a USD 26 trillion economy. Investments in building and upgrading physical infrastructure, especially in synergy with the ease of doing business initiatives, remain pivotal to increase efficiency and costs. Prime Minister Mr. Narendra Modi also recently reiterated that infrastructure is a crucial pillar to ensure good governance across sectors.

Key Market Drivers

Urbanization and Infrastructure Development

Urbanization and infrastructure development serve as significant catalysts for the Asia Pacific construction glass market. The region is currently witnessing a rapid surge in urbanization, as a growing population migrates from rural areas to cities in pursuit of enhanced economic prospects and improved living standards. This urbanization trend has resulted in a notable upswing in construction activities, encompassing the construction of residential buildings, commercial complexes, transportation networks, and various other infrastructure projects.Construction glass assumes a pivotal role in contemporary urban architecture and infrastructure. It finds extensive application in the construction of skyscrapers, office buildings, residential apartments, as well as diverse infrastructure projects such as airports, bridges, and public transportation systems. The demand for energy-efficient, visually appealing, and long-lasting glass solutions in construction projects has witnessed a significant upturn.

One key driver within this realm is the imperative for sustainable construction practices. As cities within the Asia Pacific region grapple with environmental challenges, there is an escalating emphasis on sustainable building design and energy efficiency. In response to this demand, construction glass manufacturers are actively developing innovative glass products that enhance insulation, reduce energy consumption, and minimize the carbon footprint of buildings. These sustainable solutions have gained considerable popularity among architects, builders, and developers, thereby further propelling the growth of the construction glass market.

Another driver within this category is the mounting investment in smart cities and infrastructure projects. Numerous countries in the Asia Pacific region are making substantial investments in the development of smart cities and advanced transportation systems. Smart buildings and infrastructure frequently incorporate cutting-edge glass solutions, such as switchable glass for light and heat control, or glass panels embedded with sensors for data collection and energy management. These technological advancements are driving the adoption of advanced glass technologies in construction projects, thus bolstering the growth of the construction glass market.

Key Market Challenges

Intense Market Competition and Price Sensitivity

One of the primary challenges confronting the Asia Pacific Construction Glass Market is the intense competition within the industry, combined with price sensitivity. This challenge arises from the presence of numerous local and international glass manufacturers vying for market share. The construction glass market is characterized by a high level of commoditization, where products are perceived as relatively similar by customers in terms of quality and functionality. Consequently, manufacturers often engage in price wars to gain a competitive advantage, which can result in narrow profit margins and financial strain.Local manufacturers, in particular, may encounter difficulties in competing with larger international companies that benefit from economies of scale and possess established distribution networks. This competition-driven price pressure can impede the profitability and growth prospects of companies operating in the Asia Pacific construction glass market.

Furthermore, fluctuations in raw material prices, such as soda ash, silica, and energy, can impact production costs. Manufacturers may find it challenging to maintain competitive prices while contending with volatile input costs, potentially affecting their profit margins. Striking a balance between price competitiveness and maintaining a sustainable business model remains a persistent challenge for industry players.

Key Market Trends

Growing Demand for Energy-Efficient and Sustainable Glass Solutions

A prominent trend observed in the Asia Pacific Construction Glass Market is the escalating demand for energy-efficient and sustainable glass solutions. In light of mounting concerns regarding climate change and energy conservation, architects, builders, and developers are prioritizing the utilization of environmentally friendly building materials. Construction glass plays a pivotal role in accomplishing energy efficiency and sustainability objectives in contemporary construction projects.Energy-efficient glass products, such as low-emissivity (low-E) coatings and double-glazed or triple-glazed windows, are gaining significant traction. These advanced technologies facilitate heat transfer reduction, insulation enhancement, and solar heat gain control, thereby resulting in decreased energy consumption for heating, cooling, and lighting purposes within buildings. Additionally, these glass solutions contribute to enhanced indoor comfort and reduced greenhouse gas emissions.

Moreover, sustainable glass manufacturing practices are increasingly prevalent in the Asia Pacific region. Manufacturers are integrating recycled glass and eco-friendly production processes into their operations to minimize their environmental impact. Green building certification programs, like LEED (Leadership in Energy and Environmental Design), incentivize the utilization of sustainable construction materials, including eco-friendly glass products.

Furthermore, the adoption of smart glass technologies is on the rise. Smart glass can dynamically adjust its transparency or opacity, offering privacy and glare control while allowing natural light to penetrate. These innovative glass solutions contribute to energy savings and occupant comfort. As the smart building trends continue to evolve, the Asia Pacific Construction Glass Market is expected to witness sustained growth in the demand for energy-efficient and sustainable glass products.

Key Market Players

- Asahi Glass Co., Ltd.

- Nippon Sheet Glass Co., Ltd.

- China Glass Holdings Limited

- Xinyi Glass Holdings Limited

- Sisecam Group

- Central Glass Co., Ltd.

- Taiwan Glass Industry Corporation

- Saint-Gobain S.A.

- Guardian Industries

- PT Asahimas Flat Glass Tbk

Report Scope:

In this report, the Asia Pacific Construction Glass Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Asia Pacific Construction Glass Market, By Type:

- Low-Emissivity

- Special

Asia Pacific Construction Glass Market, By Application:

- Residential

- Commercial

- Others

Asia Pacific Construction Glass Market, By Manufacturing Process:

- Float

- Rolled/Sheet

Asia Pacific Construction Glass Market, By Chemical Composition:

- Soda-Lime

- Potash-Lime

- Potash-Lead

Asia Pacific Construction Glass Market, By Country:

- China

- Japan

- India

- South Korea

- Australia

- Vietnam

- Indonesia

- Malaysia

- Singapore

- Philippines

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Asia Pacific Construction Glass Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Asahi Glass Co., Ltd.

- Nippon Sheet Glass Co., Ltd.

- China Glass Holdings Limited

- Xinyi Glass Holdings Limited

- Sisecam Group

- Central Glass Co., Ltd.

- Taiwan Glass Industry Corporation

- Saint-Gobain S.A.

- Guardian Industries

- PT Asahimas Flat Glass Tbk

Table Information

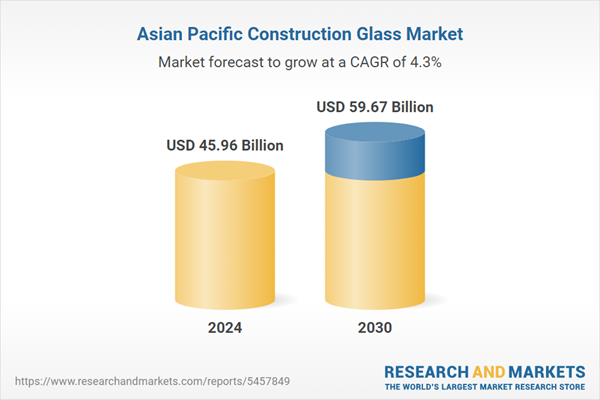

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 45.96 Billion |

| Forecasted Market Value ( USD | $ 59.67 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 10 |