Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Governments in the region are heavily investing in road, rail, and smart city developments, driving demand for heavy-duty vehicles like tipper trucks. Additionally, the rise in industrialization and commercial construction has further boosted market expansion. Manufacturers are increasingly focusing on enhancing vehicle performance, fuel efficiency, and safety through technological innovations. The shift toward electric and hybrid tipper trucks is also gaining momentum, aligned with the region’s growing emphasis on sustainability and reduced carbon emissions.

Market Drivers

Rapid Urbanization and Infrastructure Development

One of the most significant drivers of the Asia-Pacific tipper truck market is the region’s rapid urbanization and large-scale infrastructure development. Countries like China, India, Indonesia, and Vietnam are witnessing rapid population growth and rural-to-urban migration, leading to an urgent need for expanded urban infrastructure. For instance, China's fixed asset investment rose by 3.2% year-on-year in 2024, with industrial investment growing by 12%, reflecting strong infrastructure momentum (National Bureau of Statistics of China, 2025). In India, the government continues to invest heavily in highway and logistics development under initiatives like Bharatmala Pariyojana, which aims to construct 83,677 km of roads by 2027.China's Belt and Road Initiative further supported USD 70.7 billion worth of construction contracts in 2024 across the Asia-Pacific region (Green Finance & Development Center, 2025). Additionally, Southeast Asia is witnessing robust transit infrastructure expansion, including metro rail and airport development in countries such as Indonesia and Vietnam. These projects demand the extensive use of heavy-duty vehicles. Tipper trucks play a vital role in hauling sand, gravel, debris, and other construction materials to and from construction sites efficiently. These development efforts not only stimulate the construction sector but also generate long-term growth opportunities for manufacturers and suppliers of tipper trucks across the region.

Key Market Challenges

High Initial Costs and Maintenance Expenses

One of the primary challenges in the Asia-Pacific tipper truck market is the high capital investment required to purchase and operate these heavy-duty vehicles. Tipper trucks are expensive due to their robust build, load-bearing capacities, and integrated hydraulic systems. For many small and medium-sized contractors, especially in developing economies, the upfront cost of acquiring new tipper trucks can be prohibitive. This is further compounded by high import duties, taxes, and limited access to affordable financing in certain countries.Additionally, the operational costs including regular maintenance, spare parts, fuel consumption, and labor significantly affect overall profitability. Tipper trucks operating in demanding environments like construction sites or mines are subject to frequent wear and tear, which necessitates timely maintenance and replacement of parts. In regions with underdeveloped service infrastructure or a shortage of skilled technicians, maintaining vehicle efficiency becomes a critical bottleneck. These costs often deter companies from expanding or modernizing their fleets, limiting market growth potential.

Key Market Trends

Shift Toward Electrification and Sustainable Mobility

One of the most prominent trends in the Asia-Pacific tipper truck market is the growing shift toward electrification and sustainable mobility. As governments across the region intensify efforts to reduce greenhouse gas emissions and combat climate change, there is increasing pressure on the commercial vehicle sector to transition to cleaner alternatives. Electric and hybrid tipper trucks are gaining popularity in countries such as China, Japan, South Korea, and India. These trucks offer reduced emissions, lower fuel costs, and quieter operations, making them particularly attractive for urban construction and municipal waste management.China's electric heavy truck sales surged by 175% year-on-year in the first half of 2025, reaching approximately 76,100 units, driven by state subsidies ands stricter emission policies (Reuters, July 2025). The Chinese government is also investing in EV infrastructure, with plans to add more than 1.2 million charging stations nationwide by 2025 (China EV100, 2024). In India, the Ministry of Heavy Industries has extended the FAME-II scheme to support electric commercial vehicles, and several local manufacturers have begun launching battery-powered light and medium-duty trucks tailored for construction logistics (Press Information Bureau, Government of India, 2024). While challenges related to battery range, payload capacity, and charging infrastructure persist, the overall trend indicates a gradual but steady movement toward sustainable and energy-efficient solutions across the Asia-Pacific tipper truck segment.

Key Market Players

- AB Volvo

- Tata Motors Limited

- Caterpillar Inc.

- OJSC Belaz

- Hitachi Construction Machinery Co. Ltd.

- MAN Truck & Bus AG

- PACCAR Inc.

- BEML Limited

- Komatsu Limited

- Scania AB

Report Scope:

In this report, the Asia-Pacific Tipper Truck Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Asia-Pacific Tipper Truck Market, By Type:

- Small (Less than 30 Tons)

- Medium (31 Tons - 70 Tons)

- Large (Above 70 Tons)

Asia-Pacific Tipper Truck Market, By Size:

- 6-Wheeler Rigid Tipper

- 4-Wheeler Rigid Tipper

- 8-Wheler Rigid Tipper

- Articulated Wheeler Rigid Tipper

Asia-Pacific Tipper Truck Market, By Application:

- Construction

- Mining

- Others

Asia-Pacific Tipper Truck Market, By Country:

- China

- Japan

- India

- Indonesia

- Thailand

- South Korea

- Australia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Asia-Pacific Tipper Truck Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- AB Volvo

- Tata Motors Limited

- Caterpillar Inc.

- OJSC Belaz

- Hitachi Construction Machinery Co. Ltd.

- MAN Truck & Bus AG

- PACCAR Inc.

- BEML Limited

- Komatsu Limited

- Scania AB

Table Information

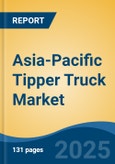

| Report Attribute | Details |

|---|---|

| No. of Pages | 131 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 21.55 Billion |

| Forecasted Market Value ( USD | $ 30.75 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 10 |