Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Rapid urbanization and infrastructural development are fueling the demand for stainless steel in construction projects, including high-rise buildings, bridges, and transportation systems. The region's booming automotive industry, coupled with the shift towards electric vehicles, has led to increased usage of stainless steel in automotive manufacturing. The thriving industrial sector and growing focus on energy efficiency have expanded the application scope of stainless steel. Furthermore, technological advancements and material innovations are making stainless steel more accessible and cost-effective.

Key Market Drivers

Rapid Urbanization and Infrastructural Development

The Asia-Pacific region is currently experiencing unprecedented urbanization, driven by population growth, rural-to-urban migration, and economic development. This rapid urbanization has spurred a massive demand for infrastructure, including commercial and residential buildings, transportation systems, and energy infrastructure. Stainless steel, with its exceptional properties such as corrosion resistance, strength, and aesthetic appeal, is increasingly becoming the material of choice in modern construction projects.In particular, stainless steel is utilized in various structural applications, architectural elements, and decorative finishes. In large metropolitan cities across the Asia-Pacific, skyscrapers, bridges, airports, and public transportation facilities prominently feature stainless steel. The extensive use of stainless steel in these projects is a significant market driver, and this trend is expected to persist as urbanization continues to shape the region's landscape.

Key Market Challenges

Volatile Raw Material Prices and Supply Chain Disruptions

One of the foremost challenges facing the Asia-Pacific Flat Stainless Steel Market is the volatility in raw material prices and the susceptibility of supply chains to disruptions. Stainless steel production relies heavily on raw materials such as iron ore, nickel, chromium, and molybdenum. Fluctuations in the prices of these commodities, often influenced by geopolitical tensions and economic factors, can significantly impact production costs and pricing strategies. This volatility can pose challenges for stainless steel manufacturers, making it challenging to maintain stable pricing and profitability.Additionally, the COVID-19 pandemic exposed vulnerabilities in global supply chains, causing disruptions in the availability of raw materials and affecting production schedules. This unpredictability in supply chain operations further complicates planning and procurement for stainless steel manufacturers in the Asia-Pacific region.

Key Market Trends

Rising Infrastructure Development Drives Stainless Steel Demand in the Asia-Pacific

The Asia-Pacific region has been witnessing a robust trend of infrastructure development, fueled by rapid urbanization, population growth, and economic expansion. Governments across the region are investing heavily in building modern transportation systems, energy infrastructure, and smart cities. Stainless steel, with its durability, resistance to corrosion, and strength, is a key material in these large-scale construction projects. In particular, stainless steel is used in bridges, railway systems, subway stations, and architectural elements of modern buildings.One notable example is China's Belt and Road Initiative (BRI), which involves massive infrastructure projects across Asia, the Middle East, and Europe. This initiative has significantly boosted the demand for stainless steel in the construction sector, driving market growth.

Key Market Players

- Jindal Stainless Limited

- Bahru Stainless Sdn. Bhd

- Steel Authority of India Limited (SAIL)

- K. Seng Seng Corporation Berhad

- Mitsui & Co. (Asia Pacific) Pte. Ltd.

- Nippon Steel Stainless Steel Corporation

- Baosteel Co., Ltd.

- Wanzhi Steel

- Tisco Steel Group Co., Ltd

- Stainless Structurals LLC

- Tianzhu Special Steel Co.

- Tsingshan Holding Group Co., Ltd.

- Metline Industries

- Aperam S. A

- Outokumpu Group

- Nippon Yakin Kogyo Co. Ltd

- Acerinox Group

- JFE Steel Corporation

- SIJ Group (Acroni)

- ArcelorMittal

Report Scope:

In this report, the Asia Pacific Flat Stainless Steel Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Asia Pacific Flat Stainless Steel Market, By Grade:

- Austenitic

- Ferritic

- Duplex

- Martensitic

- Super Duplex

- Precipitation Hardening

Asia Pacific Flat Stainless Steel Market, By Application:

- Building and Construction

- Heavy Industries

- Automotive and Transportation

- Consumer Goods

- Others

Asia Pacific Flat Stainless Steel Market, By Country:

- China

- India,

- Japan

- South Korea

- Australia

- Indonesia

- Vietnam

- Malaysia

- Singapore

- Thailand

- Rest of Asia-Pacific

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Asia Pacific Flat Stainless Steel Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Jindal Stainless Limited

- Bahru Stainless Sdn. Bhd

- Steel Authority of India Limited (SAIL)

- K. Seng Seng Corporation Berhad

- Mitsui & Co. (Asia Pacific) Pte. Ltd.

- Nippon Steel Stainless Steel Corporation

- Baosteel Co., Ltd.

- Wanzhi Steel

- Tisco Steel Group Co., Ltd

- Stainless Structurals LLC

- Tianzhu Special Steel Co.

- Tsingshan Holding Group Co., Ltd.

- Metline Industries

- Aperam S. A

- Outokumpu Group

- Nippon Yakin Kogyo Co. Ltd

- Acerinox Group

- JFE Steel Corporation

- SIJ Group (Acroni)

- ArcelorMittal

Table Information

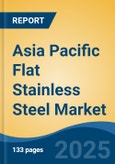

| Report Attribute | Details |

|---|---|

| No. of Pages | 133 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 38.65 Billion |

| Forecasted Market Value ( USD | $ 56.2 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 20 |