Speak directly to the analyst to clarify any post sales queries you may have.

MARKET DRIVERS

Rising Frequency of Power Outages: Increasing power outages, from weather, grid issues, or maintenance, drive demand for generator rentals. Businesses prioritize reliable backup power for uninterrupted operations, fueling the need for rental services. In Japan, power utilities anticipate a reserve power supply capacity ratio of 5.8%, below the recommended 8%. A power supply deficit prompted warnings and increased demand for backup power during peak demand in February 2022. Such factors boost the market for rental power equipment in outage-prone regions and among companies facing load shedding.Energy Transition Facilitating the APAC Generator Rental Market: The energy transition to cleaner sources fuels growth in the APAC generator rental market. As countries shift to renewables, the intermittent nature of sources like solar and wind creates a need for backup power. Generator rentals offer a flexible solution, ensuring stable power during low renewable energy generation. This transition reduces ecological impact and aligns with the region's environmental goals for a greener future.

Rising Events and Temporary Power Needs: The APAC generator rental market is crucial for events, offering reliable power solutions for festivals, concerts, conferences, and more. The trend extends beyond events to industries like construction, manufacturing, and emergency response, where generator rentals provide mobile and adaptable power solutions. Businesses rely on them for uninterrupted power during emergencies, maintenance, and fluctuating demands on construction sites.

APAC GENERATOR RENTAL MARKET HIGHLIGHTS

- The diesel fuel segment accounted for the largest revenue share of the APAC generator rental market. Reliability and ease of usage alongside large-scale industries' demand push this segment. They are often used in several applications, comprising construction sites, events, and emergency backup, owing to their robust performance and ability to offer a stable power supply. In addition, uncertainty in electricity supply and low emission packages in generators fuel the segment's growth.

- Based on power rating, the < 75KVA market is the fastest-growing segment, with a CAGR of 6.75% during the forecast period. Generators with a capacity of less than 75KVA are growing significantly due to their versatility and suitability for small-scale applications. They are commonly used for events, residential backup power, and smaller construction projects across APAC, providing a reliable power source for modest energy demands.

- The continuous power application segment is growing at the highest CAGR of 5.73% during the forecast period. Continuous power generators are often deployed in industrial settings where a reliable and uninterrupted power supply is essential for constant manufacturing. These generators ensure that industrial operations run seamlessly without disruptions. As these generators provide power without disruptions, the demand for continuous power generators is increasing.

- The construction sector by end-user accounted for the largest revenue share owing to the high adoption of electric equipment for various infrastructure activities. The APAC generator rental market caters to remote and off-grid applications, including construction sites in remote locations, mining operations, and events held in areas with limited access to the main power grid.

REGIONAL ANALYSIS

The generator rentals market in India is expected to grow at the fastest CAGR of 6.96% during the forecast period. The relatively unreliable grid supply supports the growth through most parts of the country. Several residential, commercial, and industrial establishments require prime or standby power to ensure continuity in operations. Therefore, such factors are anticipated to surge the demand for generators in the country.VENDOR LANDSCAPE

The APAC generator rental market report contains exclusive data on 20 vendors. Aggreko, Atlas Copco, Cummins, Kohler, and Caterpillar are some leading players currently dominating the APAC generator rental market. The competitive landscape characterizes the APAC generator rental market, prompting key players to engage in strategic partnerships and collaborations. Companies are forming alliances to expand their regional footprint, offer a comprehensive range of services, and enhance their technological capabilities.SEGMENTATION & FORECAST

Fuel Type (Revenue)

- Diesel

- Natural Gas

- Others

Power Rating (Revenue)

- < 75KVA

- 75-375KVA

- 376-1000KVA

- >1000KVA

Application (Revenue)

- Standby Power

- Continuous Power

- Peak Shaving

End-User (Revenue)

- Construction

- Retail

- Oil & Gas

- Mining

- Events

- Utilities

- I.T. & Data Centers

- Manufacturing

- Others

LIST OF VENDORS

Key Vendors

- Aggreko

- Atlas Copco

- Caterpillar

- Cummins

- Kohler

Other Prominent Vendors

- Aksa Power Generation

- Aver Asia

- East Coast Generators

- Generac Power Systems

- Generators Australia

- HIMOINSA

- Kaltimex Energy

- Kanamoto

- Modern Energy Rental

- Nishio

- Powermak

- Sudhir

- UMAC

- Unicel Autotech

- United Rentals

KEY QUESTIONS ANSWERED

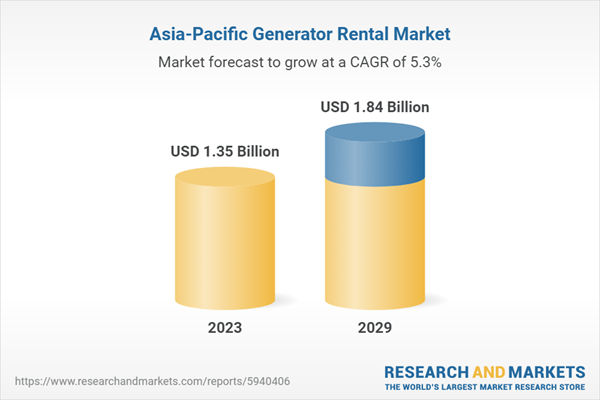

1. How big is the APAC generator rental market?2. What is the projected growth rate of the APAC generator rental market?

3. What are the rising trends in the APAC generator rental market?

4. Who are the key players in the APAC generator rental market?

Table of Contents

Companies Mentioned

- Aggreko

- Atlas Copco

- Caterpillar

- Cummins

- Kohler

- Aksa Power Generation

- Aver Asia

- East Coast Generators

- Generac Power Systems

- Generators Australia

- HIMOINSA

- Kaltimex Energy

- Kanamoto

- Modern Energy Rental

- Nishio

- Powermak

- Sudhir

- UMAC

- Unicel Autotech

- United Rentals

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | February 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 1.35 Billion |

| Forecasted Market Value ( USD | $ 1.84 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 20 |