This lingerie, particularly in the form of bras, serves both functional and aesthetic purposes. It is designed to enhance sensuality and confidence, playing a significant role in intimate settings. These bras often feature luxurious materials such as lace, satin, and silk, and include embellishments like embroidery, sequins, and cut-outs to add allure and sophistication. The use of this lingerie can enhance intimacy, boost self-esteem, and provide a means for self-expression and empowerment. Thus, the China market registered 39.99 million units of volume in 2023.

The China market dominated the Asia Pacific Erotic Lingerie Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $3.73 billion by 2031. The Japan market is registering a CAGR of 4.9% during (2024 - 2031). Additionally, The India market would showcase a CAGR of 6.4% during (2024 - 2031).

Adoption trends in the market reflect evolving consumer behaviors, cultural shifts, and industry innovations that shape how this lingerie is perceived, purchased, and integrated into daily life. There is a growing cultural acceptance of this lingerie as a form of self-expression and empowerment. Increasingly, individuals are embracing their sexuality and using lingerie as a means to celebrate their bodies and enhance intimate experiences. This shift is accompanied by broader movements promoting body positivity and inclusivity, encouraging consumers of diverse backgrounds and body types to explore and embrace this lingerie.

The proliferation of online shopping platforms has revolutionized the accessibility and availability of this lingerie. Consumers can browse a wide range of styles, sizes, and brands from the comfort and privacy of their homes. This convenience has democratized access to erotic lingerie, appealing particularly to younger demographics who are digital-savvy and value discreet purchasing options.

India’s textile and apparel industry fosters innovation in lingerie design by integrating traditional craftsmanship with modern techniques. Designers draw inspiration from India’s rich cultural heritage, incorporating intricate embroidery, vibrant colors, and luxurious fabrics into erotic lingerie collections that appeal to domestic and international consumers. India’s diverse consumer base, spanning urban centers, semi-urban areas, and rural regions, fuels demand for a wide range of lingerie styles and sizes. The growth of the textile and apparel industry ensures that lingerie brands can cater to varying preferences and body types across different demographics within the Indian market. In conclusion, the increasing e-commerce sales and the rising textile and apparel industry in the region drive the market’s growth.

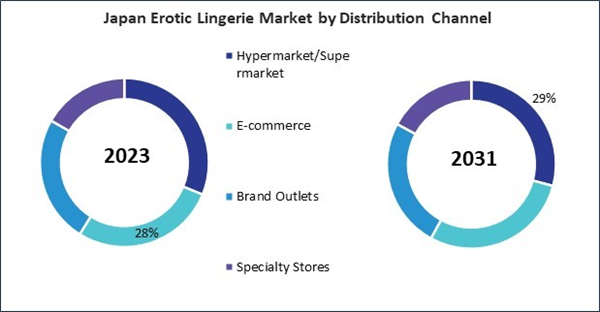

Based on Material, the market is segmented into Natural and Synthetic. Based on Product Type, the market is segmented into Bra, Brief, Camisole, Shapewear, and Others. Based on Distribution Channel, the market is segmented into Hypermarket/Supermarket, E-commerce, Brand Outlets, and Specialty Stores. Based on countries, the market is segmented into China, Japan, India, South Korea, Singapore, Malaysia, and Rest of Asia Pacific.

List of Key Companies Profiled

- Victoria’s Secret & Co.

- Agent Provocateur (Fourmarketing Limited)

- MAS Holdings Limited

- Ann Summers Ltd. (Gold Group International Ltd.)

- Bluebella Ltd.

- Felina GmbH (Lauma Lingerie.)

- Hanky Panky Ltd.

- La Perla Fashion Holding N.V.

- PVH Corp.

- Stella McCartney Limited

Market Report Segmentation

By Material (Volume, Thousand Units, USD Billion, 2020-2031)- Natural

- Synthetic

- Bra

- Brief

- Camisole

- Shapewear

- Others

- Hypermarket/Supermarket

- E-commerce

- Brand Outlets

- Specialty Stores

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

Table of Contents

Companies Mentioned

- Victoria’s Secret & Co.

- Agent Provocateur (Fourmarketing Limited)

- MAS Holdings Limited

- Ann Summers Ltd. (Gold Group International Ltd.)

- Bluebella Ltd.

- Felina GmbH (Lauma Lingerie.)

- Hanky Panky Ltd.

- La Perla Fashion Holding N.V.

- PVH Corp.

- Stella McCartney Limited