Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Propane, usually referred to as liquefied petroleum gas, is a flammable hydrocarbon gas that is frequently utilized as a non-toxic and sulfur-free fuel. Along with butane (C4H10) and propane (C3H8), it also contains minor amounts of other hydrocarbons. Owing to its easy storage, LPG is a very adaptable source of energy for businesses located in places without access to piped gas supply. It is favored over a number of other energy fuels because it emits less carbon and sulphur during combustion, protecting the environment. In process industries, LP gas is frequently used to power the boilers that produce steam and boiled water. Due to its high flash point and clean fuel with little GHG emission, it is also employed as a residential cooking gas.

Increasing Demand for Autogas is Augmenting the LPG Market Growth

Over the past 20 years, auto gas consumption has significantly expanded and in 2019 reached a record high of 27.1 million tonnes. The COVID-19 crisis upheaval led to a considerable decline in auto gas use in 2020 as compared to other transportation fuels. With around 27.8 million operational auto gas vehicles worldwide, the auto gas fleet is still expanding rapidly. The proportion of gas in the overall amount of vehicle fuel consumed varies greatly between nations, from 0.03% in the United States to over 25% in the Ukraine. The vast discrepancy in auto gas' ability to compete successfully with gasoline, diesel, and other conventional car fuels is primarily accounted for by variations in government incentive schemes. The environment is the main justification for the government's aggressive promotion of auto gas and other alternative fuels in many nations. In the majority of comparative examinations of environmental performance carried out globally, auto gas outperforms gasoline, diesel, and certain other alternative fuels. The Asia Pacific market is expected to grow as a result of these factors.Increasing Government Initiatives and Support for LPG Adoption to Aid Market Dynamics

The use of LPG has been expanding in Asia Pacific, across several sectors as GHG emissions reduction and guaranteeing sustainable energy for everyone have come under more and more scrutiny. The government has made major contributions in the form of programs and subsidies to accelerate the adoption of LPG. The 'PAHAL' scheme, which deposits subsidies directly into the bank accounts of consumers who are entitled to them, is one of the governments of India's efforts that more effectively targets subsidies. The 'give it up' campaign that supports this program encourages consumers who can afford to buy LPG at market rates to voluntarily stop purchasing products that are subsidized. The market is expected to grow throughout the forecast period as a result of LPG potentially becoming an appealing alternative fuel for more applications.Increasing Utilization of LPG in Transportation as an Alternative Fuel to Augment Growth

Autogas is another term for automotive liquefied petroleum gas, or LPG, which is used as a fuel for automobiles. In terms of fleet size, auto gas is the non-blended alternative to conventional oil-based transport fuels such as gasoline and diesel that is most widely used. The auto gas market is well established in several nations. Over the past two decades, auto gas consumption has continuously climbed, hitting a record high of 27.1 million tonnes in 2019 with an increase of 1% over the previous year. Despite this, demand has declined recently, in part due to increased fuel efficiency and a decrease in the autogas fleet in some key regions. Countries' trends vary significantly, with some experiencing high market growth in 2019 while others had declines. In 2020, global pandemic brought due to which demand for Autogas and other transportation fuels is reduced.In 2020, the demand for Autogas and other transportation fuels was reduced due to global pandemic.

.During the period of market forecasting, all of these factors are anticipated to increase the demand for this gas.

Market Segmentation

The Asia-Pacific LPG Market is divided into source and application. Based on source, the market is divided into refinery, associated gas, and non-associated gas. Based on application, the market is further divided into residential, commercial, agriculture, industrial, transportation, and others. By Supply Mode (Packaged, Bulk, On-site)Market Players

Major market players in the Asia-Pacific LPG Market are PetroChina Company Limited, Petroliam Nasional Berhad (PETRONAS), Royal Dutch Shell, Total Energies, Reliance Industries Limited, Exxon Mobil Corporation, Chevron Corporation, China Gas Holdings Ltd, JGC HOLDINGS CORPORATION, and Bharat Petroleum Corporation Limited.Report Scope:

In this report, the Asia-Pacific LPG Market has been segmented into following categories, in addition to the industry trends which have also been detailed below:Asia-Pacific LPG Market, By Source:

- Refinery

- Associated Gas

- Non-associated Gas

Asia-Pacific LPG Market, By Application:

- Residential

- Commercial

- Agriculture

- Industrial

- Transportation

- Others

Asia-Pacific LPG Market, By Supply Mode:

- Packaged

- Bulk

- On-site

Asia-Pacific LPG Market, By Country:

- China

- Japan

- India

- South Korea

- Australia

- Vietnam

- Indonesia

- Singapore

- Philippines

- Malaysia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Asia-Pacific LPG Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- PetroChina Company Limited

- Petroliam Nasional Berhad (PETRONAS)

- Royal Dutch Shell

- Total Energies

- Reliance Industries Limited

- Exxon Mobil Corporation

- Chevron Corporation

- China Gas Holdings Ltd

- JGC HOLDINGS CORPORATION

- Bharat Petroleum Corporation Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | September 2023 |

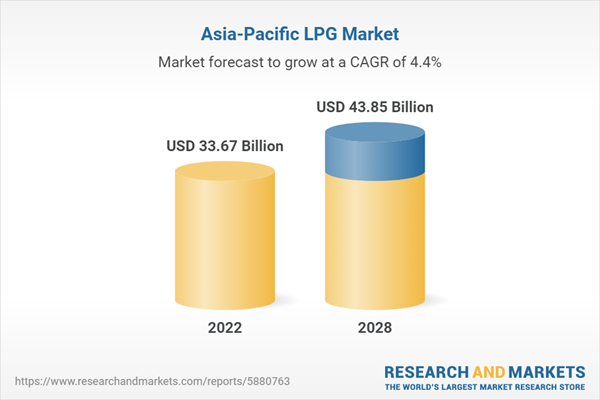

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 33.67 Billion |

| Forecasted Market Value ( USD | $ 43.85 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 10 |