Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Seismic survey is a non-intrusive information-gathering technique used in geophysical surveys to estimate geo characteristics. Oil and gas companies use seismic surveys to examine new hydrocarbon fields, which helps to forecast the growth of seismic services market. The seismic testing is conducted using a vibroseis truck. The truck is equipped with a plate that produces an acoustic sound signal which is reflected off the earth's surface. In small vans, geophones are used to record the reflected sound. Additionally, seismic services are mostly employed in the mining and oil & gas industries for exploration purposes.

Increasing Hydrocarbons Exploration to Spur Market Opportunities for Market

Seismic administrations are searching for hydrocarbon assets underground, counting oil and characteristic gas, due to the rising requirement for oil and gas. Planning field development and production of a reservoir's oil or gas, as well as developing a reliable estimate of the volume of oil and gas already present, are the most important aspects of the process. To find natural resources to meet the growing need for energy and consumer products, seismic survey is one economically viable option. To address the rising need for oil and gas, the government and commercial organizations are heavily dividing their funds for finding undiscovered hydrocarbon sources, opening new market potential. For instance, on October 13, 2021, Russian Joint Stock Company Rosgeologia (RosGeo) and Asian Energy Services (AESL) signed a Memorandum of Understanding (MoU) that focuses on long-term cooperation in seismic and geophysical surveys in India and other nations.Increasing Adoption of New Software to Aid Market Growth

The oil and gas sector has started implementing digital technology with an emphasis on enhancing health and safety, production potential, reservoir resource understanding, and oil field operational efficiency. Additionally, a lot of businesses are using business and digital technologies, sparingly, to improve their performance, which will probably support the market's expansion. The development of new geophysical techniques, along with the capacity to process and analyze data quickly and enable decision-making and action in real-time, has caused a shift in major actors' priorities towards a future powered by sustainable energy sources. For instance, on June 8, 2021, CGG introduced GeoSoftware 11.0, a new edition of its comprehensive reservoir characterization and petrophysical interpretation software. A new Hampson Russell application called WellGen, which enables deep learning marine linkage of geological and geophysical interpretations, is one of the machine learning capabilities that are leveraged by the software solution. Due to these new technologies, Asia-Pacific seismic services market will grow in the future.Progressive Demand for Geophysical Technologies from Petroleum Industries Drive Market Growth

The demand for fossil fuels increased due to exponential economic growth and increasing urbanization. Many private entities and governmental organizations use seismic services to determine the characteristics of the geological subsurface. It measures the difference between rock types and physical discontinuities without drilling or tunnelling. For instance, as of October 2022, PXGEO awarded 3D towed streamer project in Asia Pacific. PXGEO has been awarded a project in the Asia Pacific region to acquire 3D seismic data for TGS (Energy Data & Intelligence company). The seismic vessel PXGEO 2mobilized in December 2022 and the project lasted for approximately three months.Offshore Segment to Witness Significant Growth

During the forecast period, a sizable part of the seismic service market is anticipated to come from the offshore sector. Due to various favorable factors, including reliable and constant sources, suitable coupling circumstances at sources and receivers, and the uniformity of water as amedium, offshore seismic data typically has greater quality than onshore data.Additionally, Asia-Pacific has seen a significant increase in offshore oil and gas rig activity. The number of operating offshore drilling rigs in the Asia-Pacific area increased from the previous year to 82, as of June 2022. Furthermore, as various nations concentrate on increasing their domestic oil and gas output, offshore oil and gas activities in the region are projected to increase in the years to come.

Additionally, the Chinese national oil giant China National Offshore Oil Corporation (CNOOC) intends to build a deepwater oilfield complex in the upcoming years and hopes to double its exploration effort and proved reserves, by 2025. Early in 2022, CNOOC Ltd. intended to collect around 17,000 sq km of 3D seismic data, while drilling 227 offshore exploration wells and 132 unconventional onshore exploration wells. The entire capital budget for CNOOC for 2022 is in the range of CNY 90-100 billion. About 20%, 57%, 21%, and 2% of total capital expenditures spent on exploration, development, production, and other activities, respectively, in 2022. Therefore, it is anticipated that the Offshore segment of the seismic services market would experience tremendous growth, due to rising exploration and production (E&P) activities in deepwater and ultra-deepwater reserves, as well as rising efforts by the major oil and gas companies to access undiscovered assets.

Volatility in Crude Oil and Opposition to Mining by Local Community Hinders Market Growth

The seismic services market is expanding primarily due to the oil and gas industry. However, the business is constrained by the fluctuating prices of crude oil on the global market because the production, demand, and supply of oil and gases are highly reliant on these prices. Oil prices can fluctuate significantly, with a price of about USD 115 per barrel in 2014 and USD 19 in 2020, which most likely happened as a result of changed policies and an increase in the supply of oil and gas. Numerous oil and gas firms' operations and administrations are affected by this viewpoint, which advances its administrations.The demand for oil and gas fossil fuels will also decline due to paradigm breakthroughs in clean energy technology and renewable energy sources. In Asia-Pacific, many countries have established their net-zero goals and reduced their reliance on oil, which limits market's expansion.

Market Segmentation

The Asia-Pacific Seismic Services Market is divided into Service, Technology, Location of Deployment and Country. Based on service, the market is bifurcated into Data Acquisition and Data Processing & Interpretation. Based on technology, the market is divided into 2D imaging, 3D imaging, and 4D imaging. Based on Location of Deployment, the market is bifurcated into Onshore and Offshore. Based on country, the market is segmented into China, Japan, India, Australia, Indonesia, Malaysia and rest of Asia-Pacific.Market Players

Major market players in the Asia-Pacific Seismic Services Market are Schlumberger Ltd, Halliburton Company, China Oilfield Services Limited, Fugro NV, SAExploration Holdings Inc, TGS ASA, CGG SA (CGG), Ion Geophysical Corporation.Report Scope:

In this report, the Asia-Pacific Seismic Services Market has been segmented into following categories, in addition to the industry trends which have also been detailed below:Asia-Pacific Seismic Services Market, By Service:

- Data Acquisition

- Data Processing

- Interpretation

Asia-Pacific Seismic Services Market, By Technology:

- 2D imaging

- 3D imaging

- 4D imaging

Asia-Pacific Seismic Services Market, By Location of Deployment:

- Onshore

- Offshore

Asia-Pacific Seismic Services Market, By Country:

- China

- India

- Japan

- Malaysia

- Australia

- Indonesia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Asia-Pacific Seismic Services Market.Available Customizations:

Asia-Pacific Seismic Services Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Schlumberger Ltd

- Halliburton Company

- China Oilfield Services Limited

- Fugro NV

- SAExploration Holdings Inc

- TGS ASA

- CGG SA (CGG)

- Ion Geophysical Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | October 2023 |

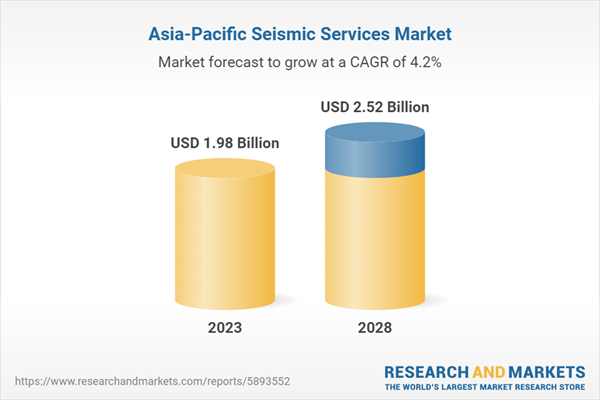

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 1.98 Billion |

| Forecasted Market Value ( USD | $ 2.52 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 8 |