Expansion Continues with 924 Million Electricity Meters to be Shipped Through 2030

Smart Metering in Asia-Pacific is the seventh consecutive market report analyzes the latest smart metering developments in this dynamic region covering both electricity and gas. The countries covered in-depth include China, Japan, South Korea, Taiwan, Bangladesh, India, Brunei, Indonesia, Malaysia, the Philippines, Singapore, Thailand, Vietnam, Australia and New Zealand. This strategic research report provides you with 240 pages of unique business intelligence, including 5-year industry forecasts, expert commentary and real-life case studies on which to base your business decisions.

Asia-Pacific now home to nearly 1.1 billion connected energy meters

Smart metering is widely regarded as the cornerstone for future smart grids and is currently being deployed all over the developed world, with a growing number of large-scale initiatives now also being launched in developing countries. Asia-Pacific constitutes the world’s largest metering market by far with more than 1.8 billion electricity and gas customers - more than North America and Europe combined. Annual demand for electricity meters in the region is in the range of 130-180 million units, of which China accounts for roughly half. The region saw a wave of massive smart metering projects being launched during the first half of the past decade and several utilities in the region are now preparing for rollouts of second-generation meters to take off, driven by new smart meter functionalities and smart energy use cases. Other markets in South and Southeast Asia are on the other hand just beginning their smart metering journeys, following in the footsteps of the leading markets in East Asia.

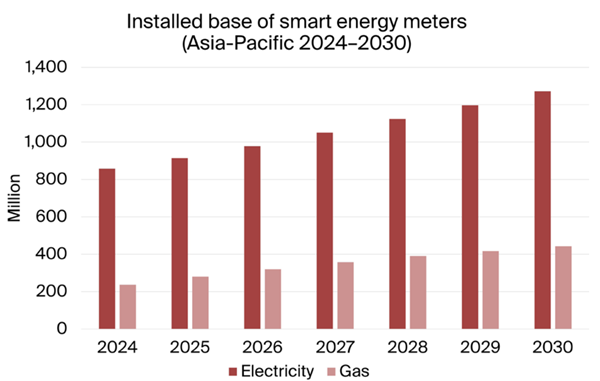

The analyst forecasts that the installed base of smart electricity meters in Asia-Pacific - defined as China, Japan, South Korea, Taiwan, Bangladesh, India, Brunei Darussalam, Indonesia, Malaysia, the Philippines, Singapore, Thailand, Vietnam, Australia and New Zealand - will grow at a compound annual growth rate (CAGR) of 6.8% throughout the forecast period, from 857.6 million in 2024 to nearly 1.3 billion in 2030. Shipments will to a large extent be driven by firstwave installations in India as well as by replacements of first-generation meters in China and Japan, while emerging markets in South and Southeast Asia will contribute with increasing volumes throughout the forecast period. In total, the analyst forecasts that around 924.7 million smart electricity meters will be shipped in Asia Pacific during 2025-2030. The installed base of smart gas metering endpoints in the region is at the same time expected to grow at a CAGR of 10.9% throughout the forecast period, from 237.1 million in 2024 to 442.2 million in 2030. China accounts for the vast majority of the market, both in terms of installed base and annual shipment volumes, although emerging markets are expected to account for a significant increase in annual shipments throughout the forecast period. India for example aims to increase the number of piped natural gas connections more than ninefold - from around 14 million in 2024 to more than 125 million in 2034.

East Asia - defined as China, Japan, South Korea and Taiwan - has led the adoption of smart metering technology in Asia-Pacific with ambitious national rollouts and today accounts for around 91% of the installed base of smart electricity meters in the region. The rollouts of smart electricity meters in China and Japan are now complete. The nationwide rollout in South Korea has suffered a number of delays and the national utility KEPCO now aims to complete the rollout by the end of 2025. Taiwan is the least mature market in East Asia and boasts an installed base of just 3.4 million smart meters. In China and Japan, replacements of first-generation smart meters have already begun and will dominate shipment volumes in the region in the coming years. East Asia also constitutes the leading adopter of smart gas metering technology in Asia-Pacific, accounting for nearly all installed devices and forecasted shipment volumes in the coming years.

South Asia - defined as India and Bangladesh - will constitute the fastest growing smart electricity metering market in Asia-Pacific throughout the forecast period with ambitious governmental initiatives now in place in both India and Bangladesh. The former has for example set a highly ambitious target of reaching 250 million installed smart prepayment meters by 2026 - a target that will however not be met. The analyst anticipates that the installed base of smart electricity meters in South Asia will grow at a CAGR of 52.4% throughout the forecast period, reaching 324.5 million units installed in 2030.

Southeast Asia - defined as Thailand, Vietnam, Indonesia, Malaysia, Singapore, Brunei Darussalam and the Philippines - on the other hand remains the most nascent smart metering market in Asia-Pacific, although some countries have made notable progress with major projects now underway. Singapore is on track to complete its nationwide rollout within the next year, while the main utility in Malayasia is in the midst of a largescale deployment. The small country of Brunei is at the same time rolling out smart prepayment meters for all electricity customers. The main utilities in Indonesia and Thailand are by contrast at the very beginning of their large-scale smart metering implementation plans while the leading utilities in the Philippines have similar ambitions. In Vietnam, the national utility has rolled out basic remote metering technologies for years with a vision to eventually transition to more advanced technologies. Australasia - defined as Australia and New Zealand - is characterised by a market-driven and retailer-led approach to smart metering. In the case of Australia, however, recent changes to the regulatory framework have strengthened the role of mandated deployment over market forces. More than half of all smart meters in Australia are now smart while New Zealand has reached a natural saturation of more than 90% with second-generation installations now about to take off.

The markets in Asia-Pacific are largely dominated by local or regional players and only a few companies such as Landis+Gyr, Itron, EDMI (Osaki Electric) and Trilliant have managed to establish a notable presence in multiple markets across the region. In terms of smart meter communications, domestic PLC technologies dominate the electricity markets in China and South Korea while RF mesh is the main option in Japan, Singapore and Malaysia. Cellular communications has meanwhile emerged as the dominant technology in Australasia as well as in India, where RF mesh also has a significant market share. The LPWA technologies NB-IoT, LTE-M, LoRa and Sigfox have at the same time emerged as the favoured options for smart gas metering projects across Asia-Pacific, although major regional differences exist.

Highlights from the report:

- In-depth market profiles of China, Japan, South Korea, Taiwan, Bangladesh, India, Brunei, Indonesia, Malaysia, the Philippines, Singapore, Thailand, Vietnam, Australia and New Zealand.

- 360-degree overview of next-generation PLC, RF and cellular technologies for smart grid communications.

- Profiles of the key players in the smart metering industry in Asia-Pacific.

- New forecasts for smart electricity and gas meters until 2030.

- Analysis of the latest market and industry developments in each of the countries.

- Case studies of smart metering projects by the leading energy groups.

The report answers the following questions:

- How are national energy policies driving the adoption of smart metering?

- What is the current deployment status of major utilities across Asia-Pacific?

- Which countries are leading the adoption of smart gas metering technology in Asia-Pacific?

- Which communications technologies are being used for smart metering across Asia-Pacific?

- Which are the leading smart metering solution providers in Asia-Pacific?

- What is the outlook for second-generation smart metering rollouts in Asia-Pacific?

- How are market-liberalising reforms changing the energy utility sector in Asia-Pacific?

- Which are the main electricity and gas utilities in each country?

Who should read this report?

Smart Metering in Asia-Pacific is the foremost source of information about the ongoing transformation of the metering sector. Whether you are a solution vendor, utility, telecom operator, investor, consultant or government agency, you will gain valuable insights from this in-depth research.

Table of Contents

Executive Summary

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Accenture

- Aichi Tokei Denki

- Allied Engineering Works

- Avon Meters

- Azbil Kimmon

- Bentec

- Bharti Airtel

- Capital Power Systems

- CHINT Instrument & Meter

- Chung-Hsin Electric & Machinery

- Chunghwa Telecom

- Clou Electronics

- CyanConnode

- Dongfang Wisdom Electric

- EDF

- EDMI (Osaki Electric)

- Esyasoft Technologies

- Fluentgrid

- Fuji Electric

- Fujitsu

- GE Vernova

- Genesis Gas Solutions

- Genus Power Infrastructures

- GoldCard Smart Group

- Gridspertise

- Hansen Technologies

- Hexing Electrical

- Holley Technology

- Honeywell

- HPL Electric & Power

- IBM

- Iljin Electric

- Innover Technology

- ITI Limited

- Itron

- KAIFA Technology

- KDDI

- Kimbal Technologies

- Landis+Gyr

- Larsen & Toubro

- Linyang Energy

- Londian Wason Holdings Group

- LS Electric

- Mitsubishi Electric

- NuriFlex

- Oculin Tech

- Omni System

- Oracle

- Osaki Electric

- PSTEC

- Reliance Jio

- Sanxing Electric

- SAP

- Schneider Electric

- Secure Meters

- Siemens

- Star Instrument

- Sunrise Technology

- Suntront Technology

- Tatung Company

- Telstra

- Toshiba Toko Meter Systems

- TOYOKEIKI

- Trilliant

- Ubiik

- UnaBiz

- Viewshine

- Vodafone

- Wasion

- Wirepas

- XJ Electric

- Yazaki Group

- ZenMeter (Enzen)

- ZENNER Metering Technology