Technological Advancements Boost Asia Pacific Upstream Bioprocessing Market.

The upstream bioprocessing market is experiencing a wave of technological advancements, presenting considerable industry opportunities. These advancements include innovative developments in cell culture systems, bioreactor design, process monitoring, and control, as well as the integration of automation and digitalization. In September 2023, Repligen Corporation and Sartorius introduced an integrated bioreactor system. Repligen's XCell Alternating Tangential Flow (ATF) upstream intensification technology has been integrated into the Sartorius Biostat stirred-tank reactor (STR). This bioreactor technology is designed to make the application of N perfusion and intensified seed train easier for biopharmaceutical firms.

An embedded XCell ATF hardware and software module that combines integrated process analytical technologies with predefined advanced control recipes is incorporated into Biostat STR. This module is intended to simplify the management of cell growth and enhance cell retention in perfusion procedures, eliminating the need for a separate cell retention control tower. Such modern products feature enhanced process efficiency, scalability, and adaptability, which are crucial for meeting the evolving demands of biopharmaceutical production.

Advanced cell culture media formulations and next-generation bioreactor technologies are contributing to the optimization of upstream bioprocessing, in turn, enabling higher product yields, improved product quality, and the efficient production of complex biologics. The ongoing integration of advanced analytics and real-time process monitoring is revolutionizing data-driven decision-making in bioprocessing, driving precision and process optimization opportunities. Progress in biotechnology also fosters the development of flexible and modular manufacturing platforms.

Additionally, the convergence of machine learning, artificial intelligence, and predictive analytics is paving the way for predictive bioprocessing, thereby unlocking proactive process control, quality assurance, and cost optimization opportunities. Thus, technological advancements in upstream bioprocessing are reshaping the industry, presenting new avenues for innovation, efficiency, and adaptability.

Asia Pacific Upstream Bioprocessing Market Overview

The Asia Pacific upstream bioprocessing market is segmented into China, Japan, Australia, India, South Korea, and the Rest of Asia Pacific. The market in this region is expected to grow at the highest CAGR during 2022-2030. China, India, and Japan are three major contributors to the growth of the market in Asia Pacific, which is mainly driven by rising demand for bioreactors as well as an increase in research centers and government funding. Moreover, many international market players are focusing on countries in Asia Pacific for geographic expansion and other strategies.Asia Pacific Upstream Bioprocessing Market Segmentation

- The Asia Pacific upstream bioprocessing market is segmented based on product type, workflow, usage type, mode, and country. Based on product type, the Asia Pacific upstream bioprocessing market is segmented into bioreactors/fermenters, cell culture, filters, bags and containers, and others. The bioreactors/fermenters services held the largest market share in 2022.

- Based on workflow, the Asia Pacific upstream bioprocessing market is categorized into media preparation, cell culture, and cell separation. The cell separation held the largest market share in 2022.

- Based on usage type, the Asia Pacific upstream bioprocessing market is bifurcated into single-use and multi-use. The single-use held a larger market share in 2022.

- Based on mode, the Asia Pacific upstream bioprocessing market is bifurcated into In-house and outsourced. The In-house held a larger market share in 2022.

- Based on country, the Asia Pacific upstream bioprocessing market is segmented into China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific upstream bioprocessing market share in 2022.

- Thermo Fisher Scientific Inc, Esco Micro Pte Ltd, Sartorius AG, Danaher Corp, Getinge AB, Merck KGaA, Corning Inc, and Entegris Inc are some of the leading companies operating in the Asia Pacific upstream bioprocessing market.

Market Highlights

- Based on product type, the Asia Pacific upstream bioprocessing market is segmented into bioreactors/fermenters, cell culture, filters, bags and containers, and others. The bioreactors/fermenters segment held 35.3% market share in 2022, amassing US$ 697.06 million. It is projected to garner US$ 1.98 billion by 2030 to expand at 14.0% CAGR during 2022-2030.

- The cell separation segment held 41.3% share of Asia Pacific upstream bioprocessing market in 2022, amassing US$ 816.67 million. It is projected to garner US$ 2.42 billion by 2030 to expand at 14.6% CAGR during 2022-2030.

- The single-use segment held 54.8% share of Asia Pacific upstream bioprocessing market in 2022, amassing US$ 1.08 billion. It is projected to garner US$ 3.16 billion by 2030 to expand at 14.4% CAGR during 2022-2030.

- In terms of mode, the Asia Pacific upstream bioprocessing market is bifurcated into In-house and outsourced. The In-house segment held 57.8% share of Asia Pacific upstream bioprocessing market in 2022, amassing US$ 1.14 billion. It is projected to garner US$ 3.22 billion by 2030 to expand at 13.8% CAGR during 2022-2030.

- This analysis states that China captured 30.0% share of Asia Pacific upstream bioprocessing market in 2022. It was assessed at US$ 592.83 million in 2022 and is likely to hit US$ 1.69 billion by 2030, exhibiting a CAGR of 14.1% during 2022-2030.

- In March 2021, HyPerforma DynaDrive S.U.B. in different volumes, 3,000 L and 5,000 L models. Thermo Fisher Scientific's largest commercially accessible S.U.B., the first-of-its-size 5,000 L S.U.B., allows biopharmaceutical businesses to incorporate single-use technologies into large-scale bioprocesses, such as cGMP manufacture at very high cell density and perfusion cell culture.

- In December 2023, Merck has acquired Erbi Biosystems, a Massachusetts-based company that developed the "Breez" 2 ml micro-bioreactor platform technology. Merck's upstream therapeutic protein portfolio is boosted by the purchase, enabling it to promptly develop lab-scale protocols for scalable cell-based perfusion bioreactor processes with capacities ranging from 2 ml to 2000 l. Additionally, it offers opportunities for further study and advancement in cutting-edge modality applications, like cell therapies.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Asia Pacific upstream bioprocessing market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in Asia Pacific upstream bioprocessing market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth Asia Pacific market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the Asia Pacific Upstream Bioprocessing market include:- Thermo Fisher Scientific Inc

- Esco Micro Pte Ltd

- Sartorius AG

- Danaher Corp

- Getinge AB

- Merck KGaA

- Corning Inc

- Entegris Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | August 2024 |

| Forecast Period | 2022 - 2030 |

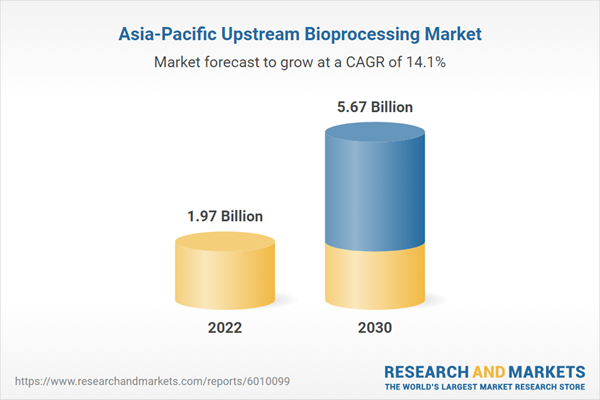

| Estimated Market Value ( USD | $ 1.97 Billion |

| Forecasted Market Value ( USD | $ 5.67 Billion |

| Compound Annual Growth Rate | 14.1% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 9 |

![Single-use Bioprocessing Market by Product (Equipment [Bioreactors, Filtration, Chromatography], Consumables [Filters, Bags, Assemblies, Sensors]), Application (Storage, Mixing), Workflow (Upstream), Molecule Type (mAbs, Vaccines) - Global Forecast to 2030 - Product Image](http://www.researchandmarkets.com/product_images/12020/12020910_60px_jpg/singleuse_bioprocessing_market.jpg)