Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Government Incentives and Policy Support

A primary driver of growth in the Australia air source heat pump market is the proactive support provided through government incentives and environmental policy initiatives. Programs like the Victorian Energy Upgrades (VEU) and rebates from Clean Energy Regulator schemes are encouraging both residential and commercial users to transition from outdated, high-emission systems to cleaner alternatives such as ASHPs. These financial incentives reduce upfront costs, making the systems more accessible and accelerating adoption, especially in areas with high electricity prices. Additionally, regulatory moves phasing out gas-based systems in favor of electric heating options are further stimulating demand. By supporting energy savings and emission reductions, government-backed programs have created a favorable environment for ASHPs to become an increasingly preferred choice among consumers.Key Market Challenges

High Upfront Costs and Installation Barriers

Despite offering long-term cost savings and energy efficiency, air source heat pumps face a significant barrier in their high initial purchase and installation costs. Even with rebates, the investment required for ASHP units, installation, and potential electrical upgrades remains substantial, deterring many potential users - particularly in low-income segments. Installation complexities based on property type, size, and retrofitting needs can further escalate expenses. Compounding the issue is a lack of pricing transparency and inconsistent installation practices, making it difficult for consumers to evaluate their options. Without broader financial solutions such as low-interest financing or expanded subsidies, these costs remain a key challenge to wider market adoption.Key Market Trends

Integration with Renewable Energy Systems

An emerging trend in the Australia air source heat pump market is the integration of ASHPs with solar photovoltaic (PV) systems. This combination enables homeowners to use solar energy to power their heat pumps, enhancing energy independence while reducing grid reliance and operational costs. It also aligns with national efforts to cut carbon emissions and improve residential energy efficiency. Incentive programs further support this integration, appealing to environmentally conscious consumers seeking sustainable home solutions. As investment in renewable energy infrastructure continues across Australia, the synergy between solar PV and ASHPs is expected to play a pivotal role in shaping the future of energy-efficient heating and cooling in the country.Key Market Players

- Stiebel Eltron (Aust) Pty Ltd

- Daikin Australia Pty Ltd

- Rheem Australia Pty Ltd

- Aquamax Australia Pty. Limited

- Robert Bosch (Australia) Pty Ltd

- Evo Industries Australia Pty Ltd.

- Smart Lifestyle Australia Pty Ltd

- Rinnai Australia Pty Ltd

- Solargain Pty Ltd (iStore)

- Mitsubishi Electric Australia Pty Ltd.

Report Scope:

In this report, the Australia Air Source Heat Pump Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Australia Air Source Heat Pump Market, By Technology:

- Air to Air (Ducts, Ductless)

- Air to Water (Split, Integrated)

Australia Air Source Heat Pump Market, By End Use:

- Residential

- Hotels & Resorts

- Gym & Spas

- Education

- Food Service

- Others

Australia Air Source Heat Pump Market, By Distribution Channel:

- Online

- Offline

Australia Air Source Heat Pump Market, By Region:

- New South Wales

- Victoria

- Queensland

- South Australia

- Western Australia

- Tasmania

- Northern Territory

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Australia Air Source Heat Pump Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Stiebel Eltron (Aust) Pty Ltd

- Daikin Australia Pty Ltd

- Rheem Australia Pty Ltd

- Aquamax Australia Pty. Limited

- Robert Bosch (Australia) Pty Ltd

- Evo Industries Australia Pty Ltd.

- Smart Lifestyle Australia Pty Ltd

- Rinnai Australia Pty Ltd

- Solargain Pty Ltd (iStore)

- Mitsubishi Electric Australia Pty Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | April 2025 |

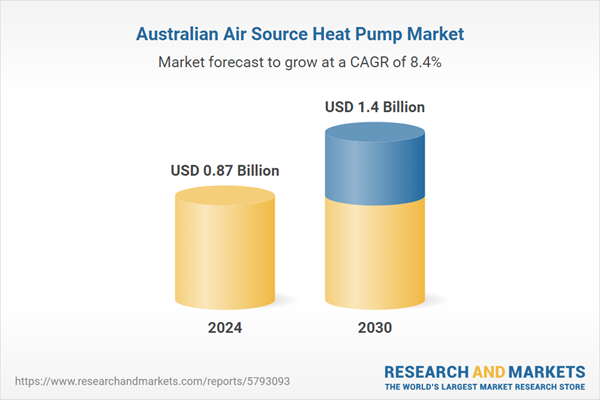

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 0.87 Billion |

| Forecasted Market Value ( USD | $ 1.4 Billion |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 10 |